Unilever NV

Latest Unilever NV News and Updates

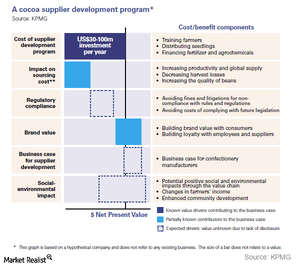

Hershey’s Steps to Improve Suppliers Productivity and Conscious Sourcing

Hershey has set a goal of sourcing 100% cocoa from certified cocoa farms. In fiscal 2014, it sourced 30% certified cocoa.

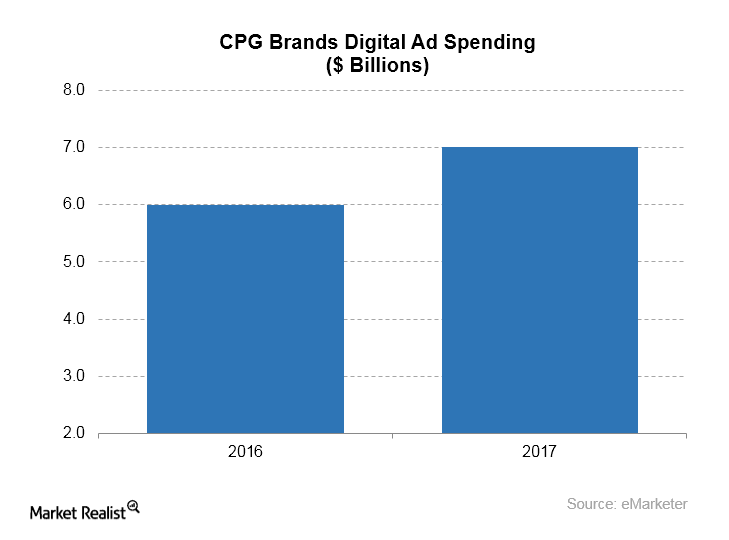

What Are the Trends in Facebook’s Largest Advertising Category?

Business intelligence firm eMarketer estimates that CPG brands spent more than $7.0 billion on digital advertising in 2017, compared with $6.0 billion in 2016.

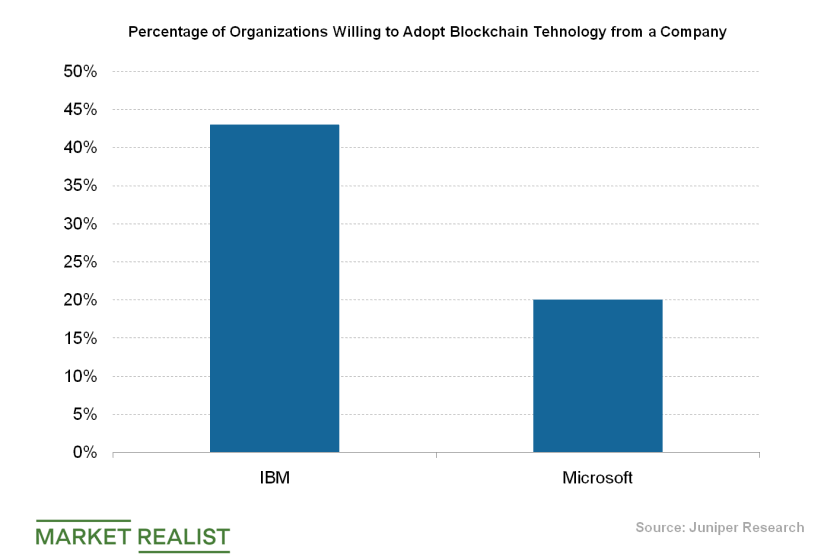

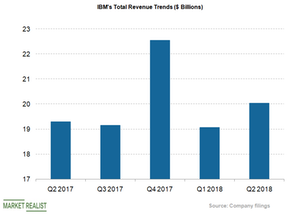

IBM Continues to Win Contracts for Its Blockchain Solutions

In July, IBM launched a blockchain solution specifically for the financial service industry, LedgerConnect.

Can IBM’s Blockchain Retain Its Market Share?

According to a report by the IDC, total spending on the blockchain platform is expected to climb by 122% to $2.1 billion.

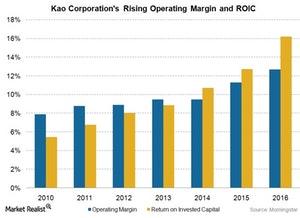

Kao Corporation: What’s Sharpening Its Competitive Edge?

Kao Corporation has become the largest branded and packaged goods company in Japan and the second-largest company in the cosmetics category.

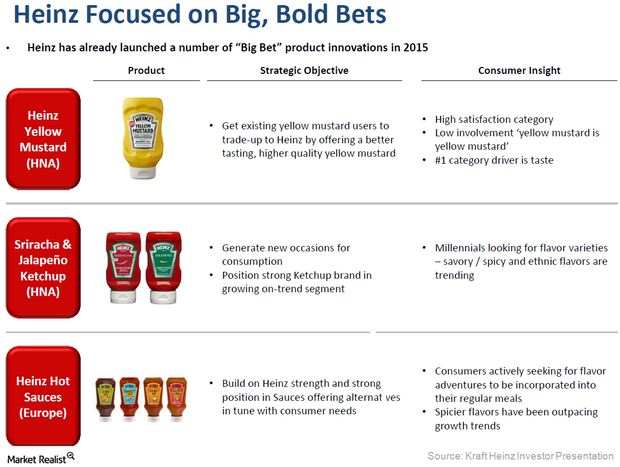

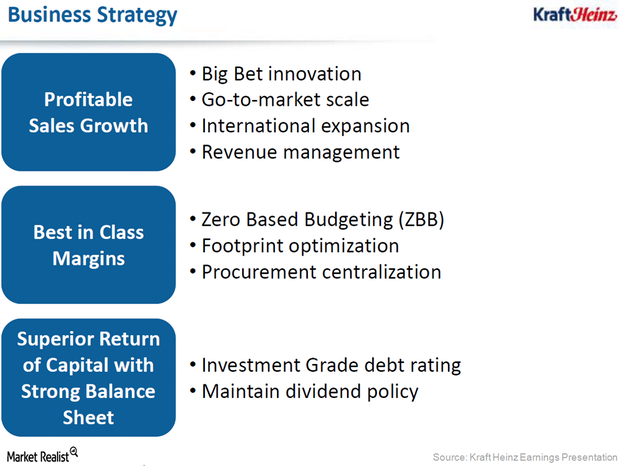

Analyzing Kraft Heinz’s Great Brands Strategy

Kraft Heinz is shifting its focus on advertising spending from non-working media to working media.

Analyzing Kraft Heinz’s Objective of Profitable Sales Growth

Kraft Heinz plans to reinvest savings from cost initiatives into its brands and to refocus its strategic vision on innovation.