VelocityShares 3x Long Natural Gas ETN

Latest VelocityShares 3x Long Natural Gas ETN News and Updates

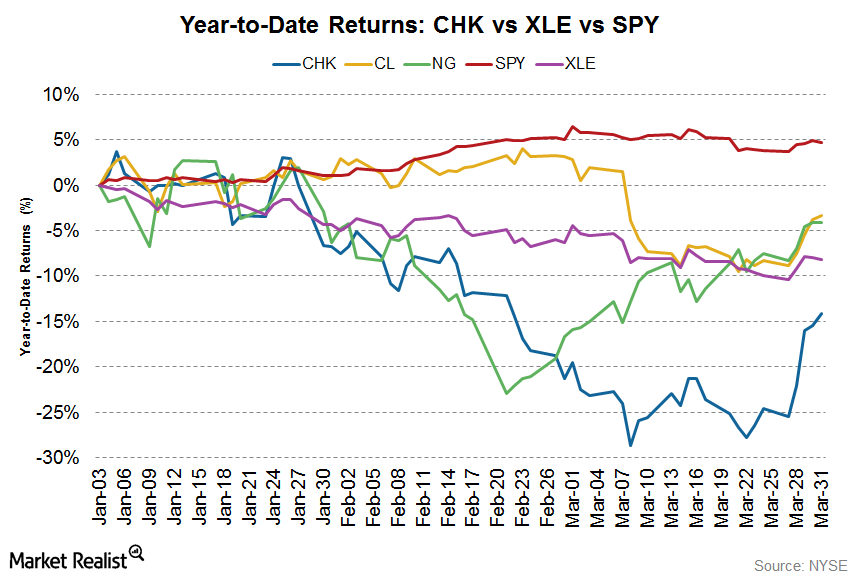

Natural Gas Prices Driving Chesapeake Energy Stock in 2017

Chesapeake Energy’s (CHK) 2016 debt management efforts included a combination of debt exchanges, open market repurchases, and equity-for-debt exchanges.

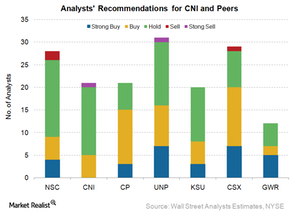

Why Analysts Have a ‘Hold’ Rating for Canadian National Railway

There are 21 analysts covering CNI. Of those, only five, or 24.0%, have a “buy” rating for the stock.

How Natural Gas Prices Have Supported Chesapeake Energy

2016 has been good for natural gas prices (UGAZ). Prices have risen ~34% year-over-year.

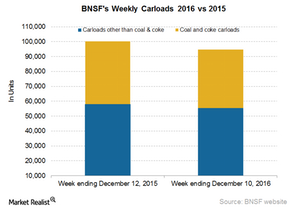

How BNSF’s Carloads Compared to Rival Union Pacific

BNSF Railway’s (BRK-B) total railcars for the week ended December 10, 2016, fell 5.5% to ~95,000 units, compared to ~100,000 units on a year-over-year basis.

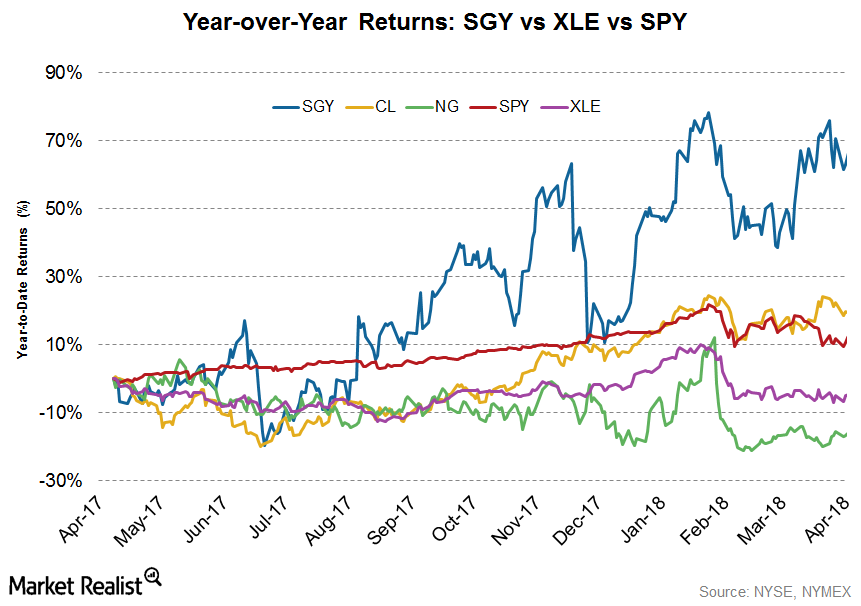

Stone Energy’s Stock Performance in 2018

Stone Energy stock has increased the most among our top five companies. Stone Energy stock has risen 60% YoY (year-over-year).

How Hedge Funds Feel about Natural Gas Right Now

On September 29, the CFTC (U.S. Commodity Futures Trading Commission) is slated to release its weekly “Commitment of Traders” report.

Energy Calendar: Analyzing Key Oil and Gas Drivers

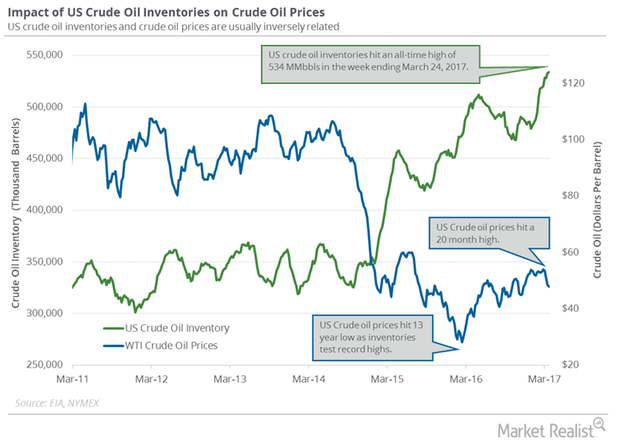

The energy sector contributed to ~6.6% of the S&P 500 on March 31, 2017. Oil and gas producers’ earnings depend on crude oil and natural gas prices.

Will US Natural Gas Futures End 2017 on a Low Note?

January US natural gas (UGAZ) futures contracts were below their 100-day, 50-day, and 20-day moving averages on December 21, 2017.

US Crude Oil Prices Could Pressure Natural Gas Futures

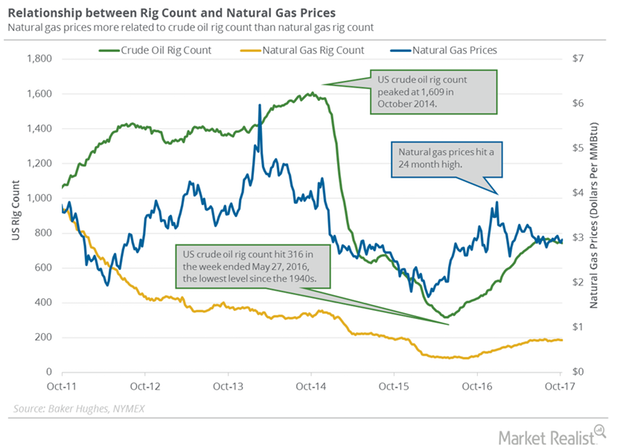

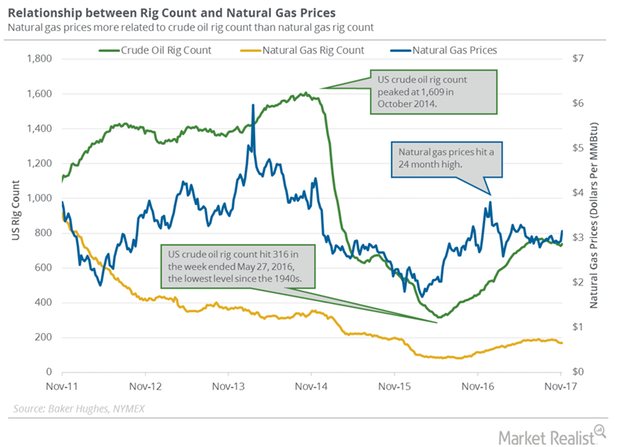

Baker Hughes is scheduled to release its US crude oil and natural gas rig count report on November 11, 2017.

US Natural Gas Futures Could Continue to Fall

Hedge funds’ net long positions in US natural gas futures (UGAZ) (UNG) and options contracts were at 5,318 for the week ending January 2, 2018.

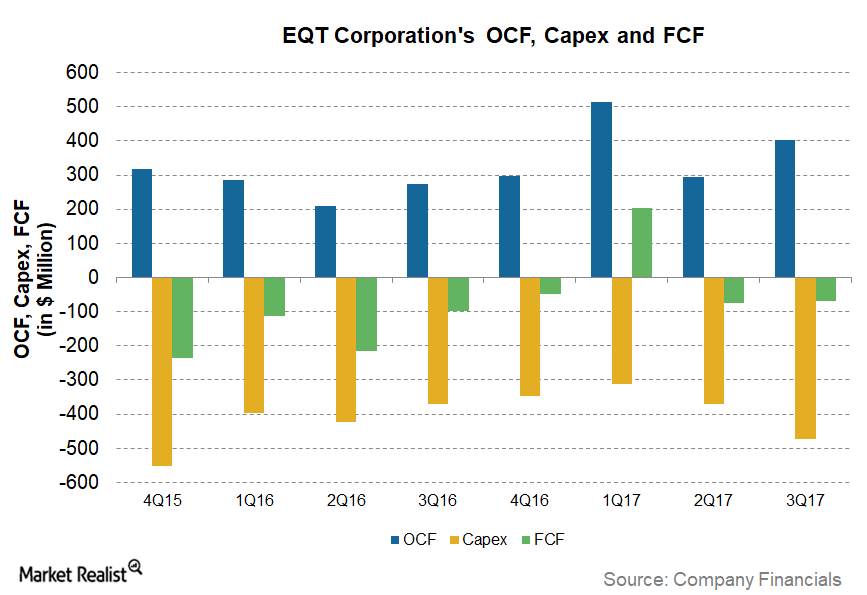

Why EQT’s Normalized Free Cash Flow Is Improving

As we saw in part one of this series, EQT (EQT) had normalized free cash flows of ~5% in the first nine months of 2017, the fifth highest among crude oil (USO) and natural gas (UNG) (UGAZ) producers we have been tracking.

Production Cut Extension Could Influence US Natural Gas Rigs

Baker Hughes, a GE company, is scheduled to release its US crude oil and natural gas rig count report on December 1, 2017.

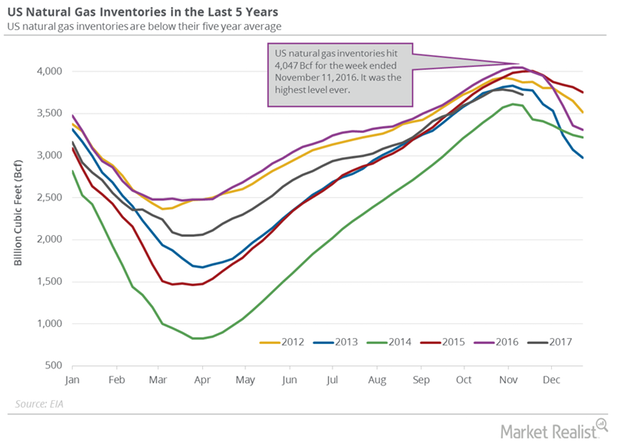

US Natural Gas Inventories Have Fallen 8% from Last Year

The EIA estimated that US natural gas inventories fell by 46 Bcf (billion cubic feet) or 1.2% to 3,726 Bcf on November 10–17, 2017.

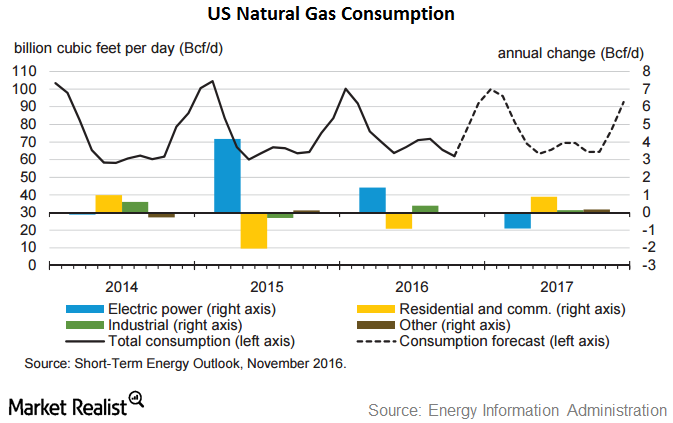

How Is US Natural Gas Production and Consumption Trending?

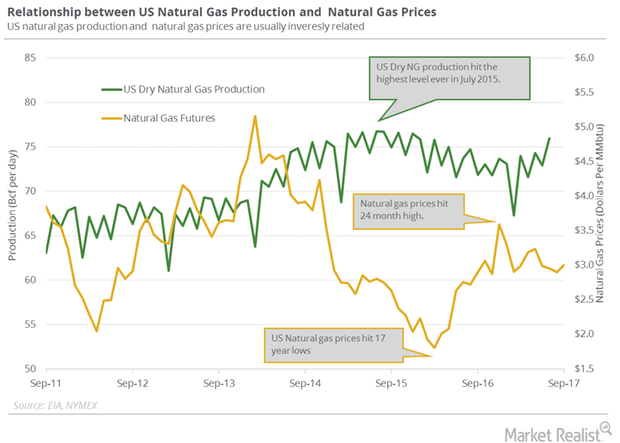

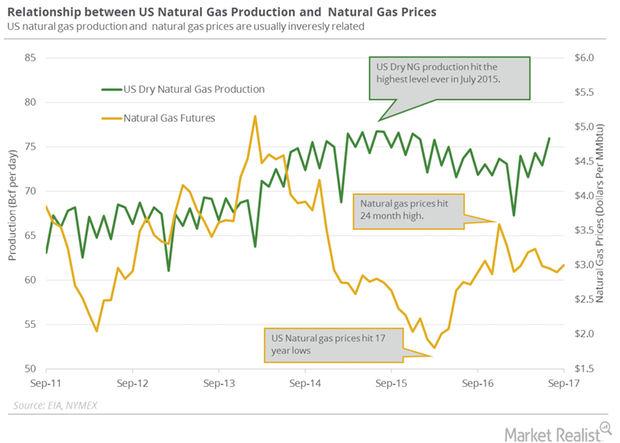

PointLogic estimates that weekly US dry natural gas production rose by 0.9 Bcf (billion cubic feet) per day to 74.6 Bcf per day between October 19 and October 25, 2017.

Is US Natural Gas Production Bearish for Natural Gas?

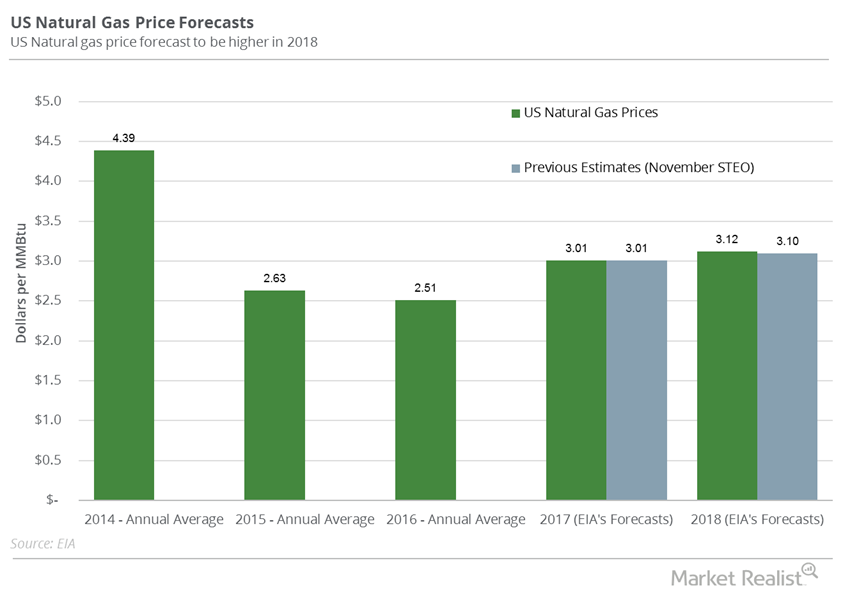

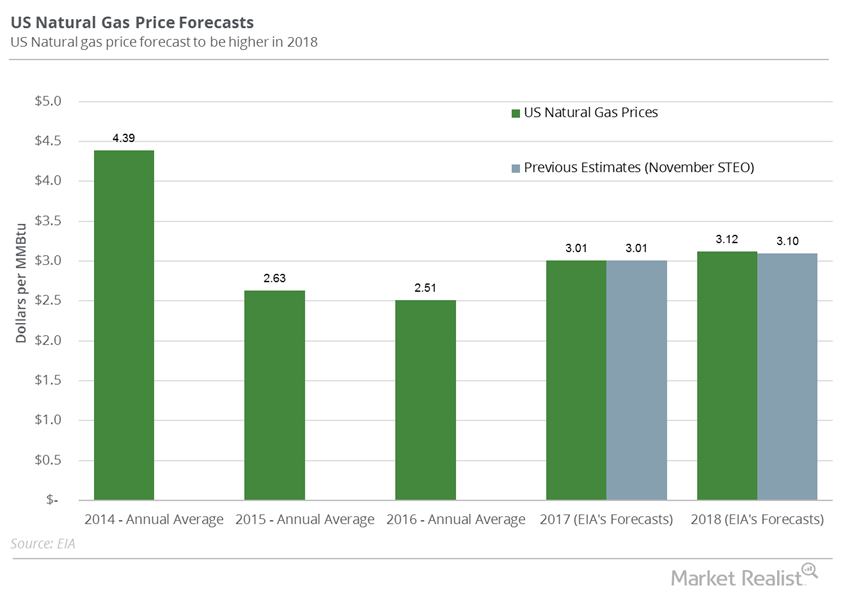

US dry natural gas production will likely average ~73.6 Bcf/d in 2017. It will likely rise by 4.9 Bcf/d or 6.6% to 78.5 Bcf/d in 2018.

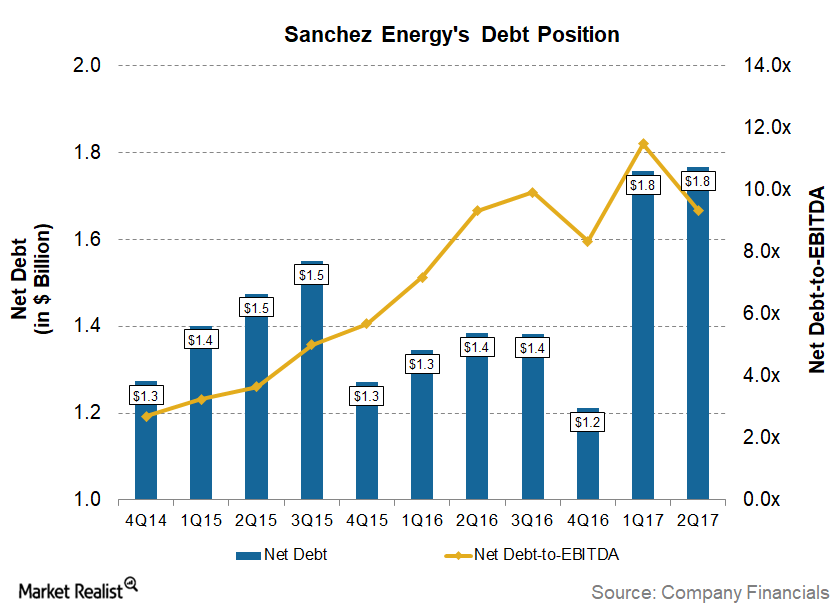

Is Sanchez Energy Repeating an Old Debt Mistake?

Since 1Q16, crude oil (USO)(SCO) prices have risen from lows of $26.05 per barrel to $49.30 per barrel as of September 13.

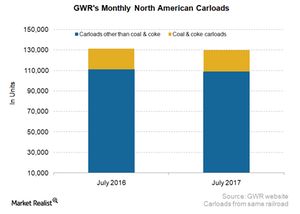

How Genesee and Wyoming’s Volumes Trended in July 2017

In July 2017, Genesee and Wyoming recorded a slight decline in its North American traffic YoY (year-over-year).

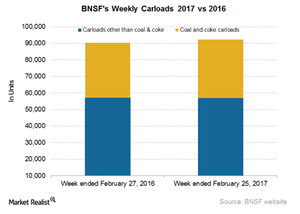

Your Guide to BNSF Railway’s Latest Carload Data

BNSF’s total railcars for the week ended February 25, 2017, rose 2.3% YoY to more than 92,000 units.

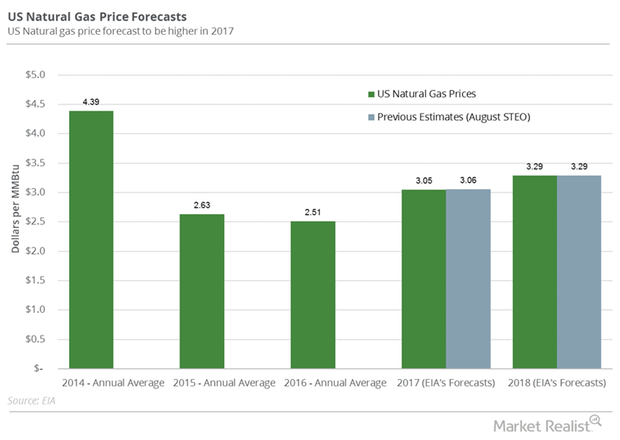

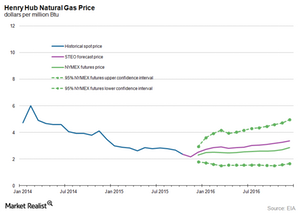

What’s the Long-Term Forecast for Natural Gas Prices?

US natural gas prices have fallen for the third time in the last five trading sessions. Prices are following the long-term bearish trend and trading close to 16-year lows.