Take-Two Interactive Software Inc

Latest Take-Two Interactive Software Inc News and Updates

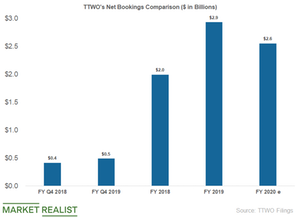

Take-Two Interactive Missed Out on Codemasters, Investors Should Be Patient

Take-Two Interactive stock (TTWO) is up almost 55 percent YTD. Is the stock a buy even though it missed out on Codemasters?

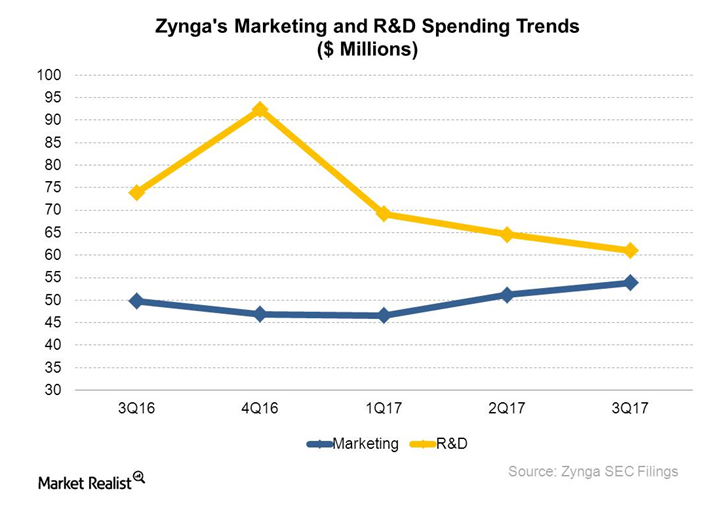

How Zynga Is Spending Its Cash

With Zynga (ZNGA) hitting profitability milestones in its recent quarters, its cash holdings have grown.

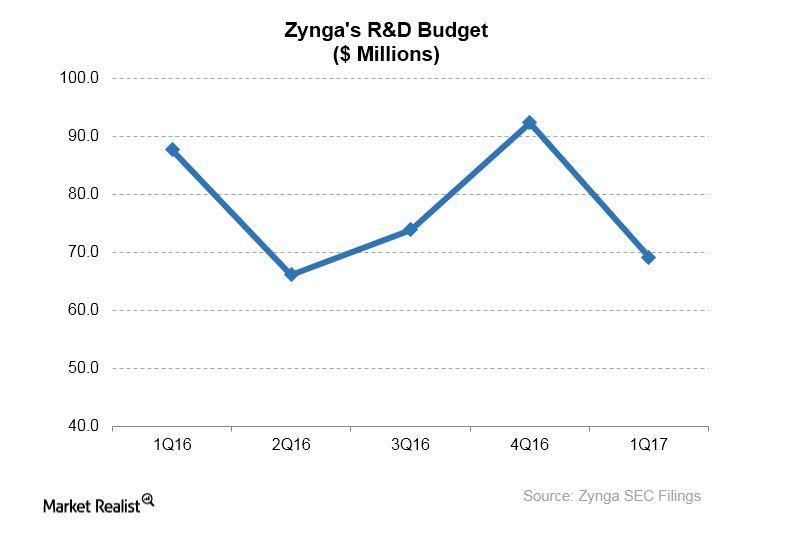

Why Zynga Is Prioritizing Its Research and Development Budget

Zynga (ZNGA) funneled $69.2 million into R&D (research and development) in 1Q17. It turns out the company is tweaking how it spends its R&D budget.

What Games Could Drive Take-Two’s Sales in 2020 and Beyond?

Take-Two’s 2K and Gearbox Software also released Borderlands: Game of the Year Edition for PC, PlayStation 4 (SNE), and Xbox One (MSFT).

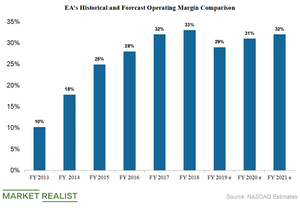

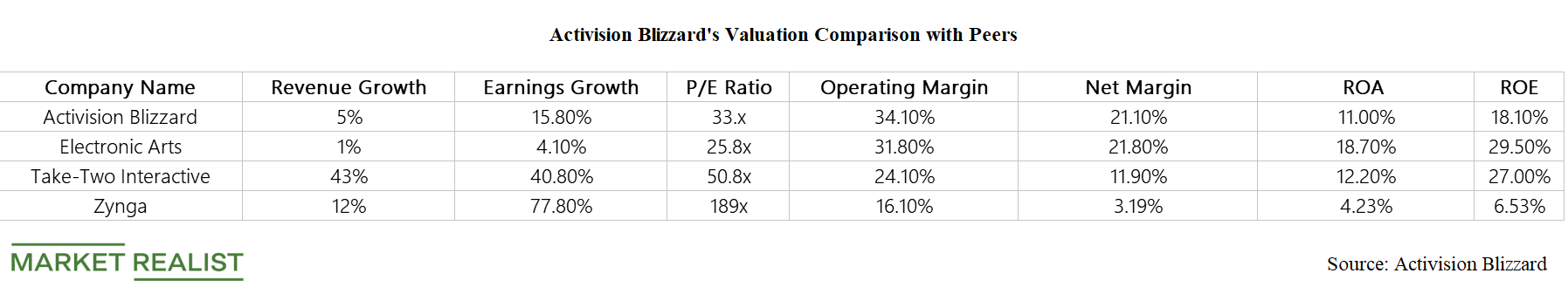

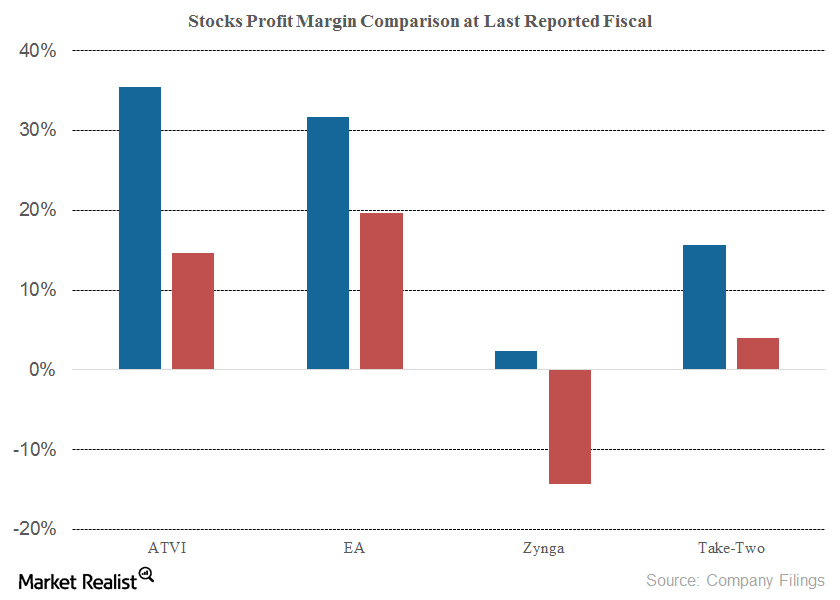

Electronic Arts: What to Expect from the Earnings Growth

The shift to digital gaming has driven the profit margins higher for Electronic Arts (EA) and its peers over the last few years.

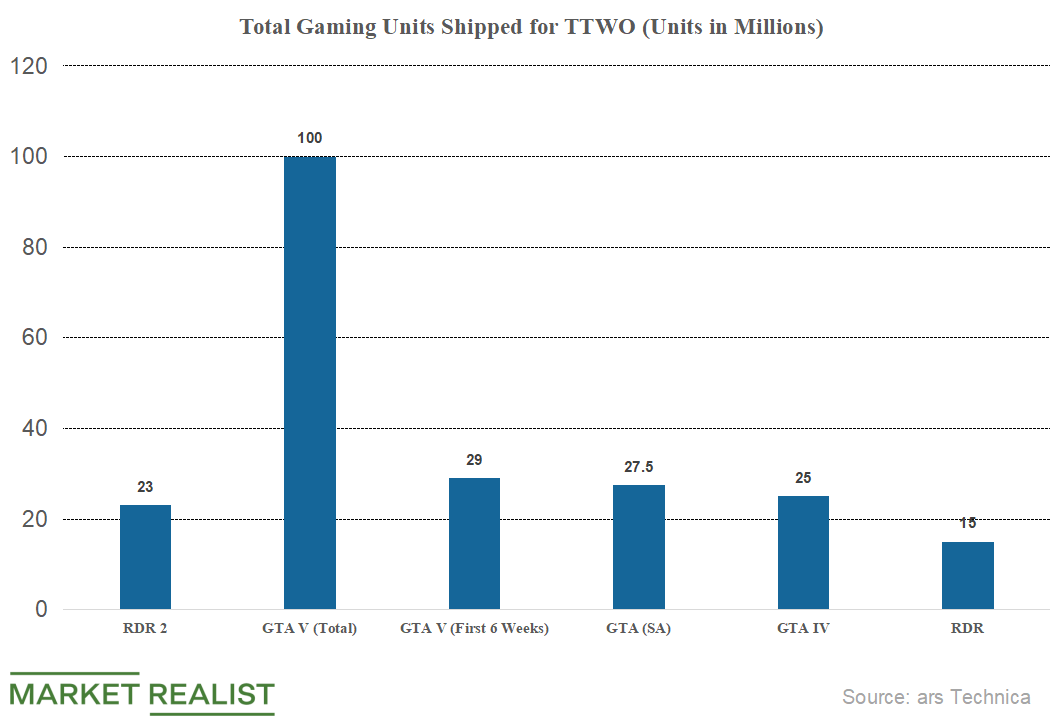

Red Dead Redemption 2 Is a Key Revenue Growth Driver for Take-Two

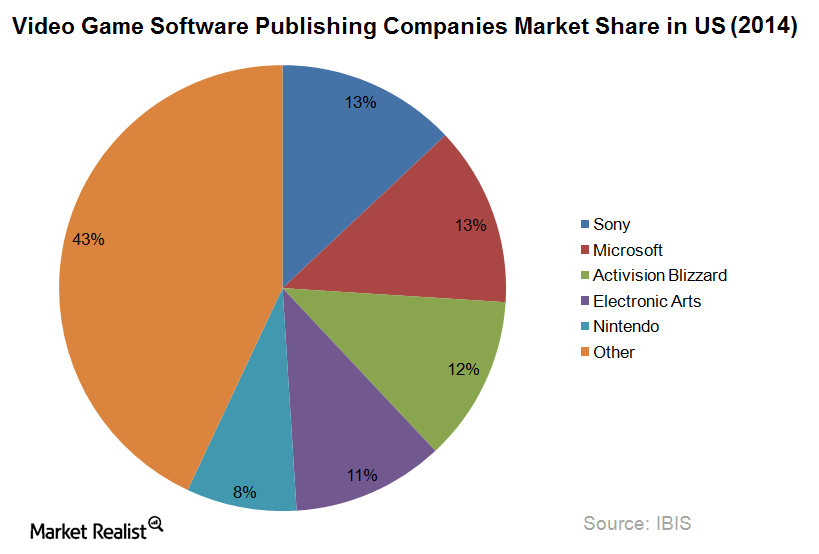

Gaming companies such as Take-Two Interactive (TTWO), Electronic Arts (EA), and Activision Blizzard (ATVI) are highly dependent on popular franchises to drive sales.

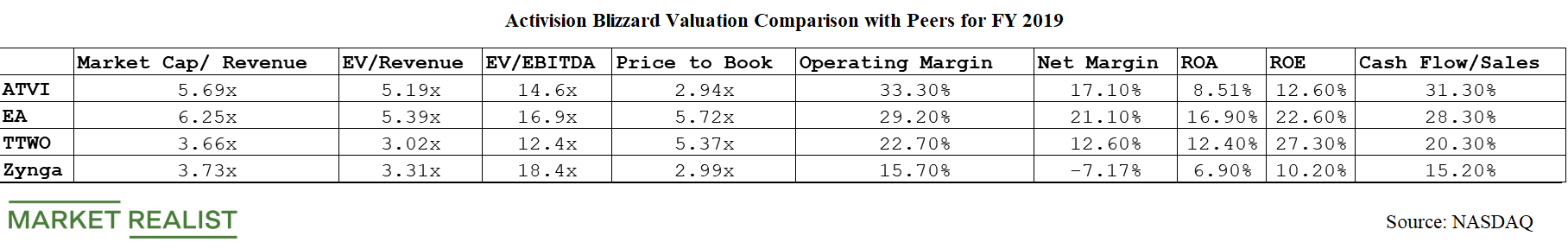

A Look at Activision Blizzard’s Valuation

Activision Blizzard (ATVI) has a forward PE ratio of 35.9x for 2019.

Why Wall Street Fell in Love with Electronic Arts Stock

Electronic Arts (EA) gained 6.8% today as of 10:45 AM EST.

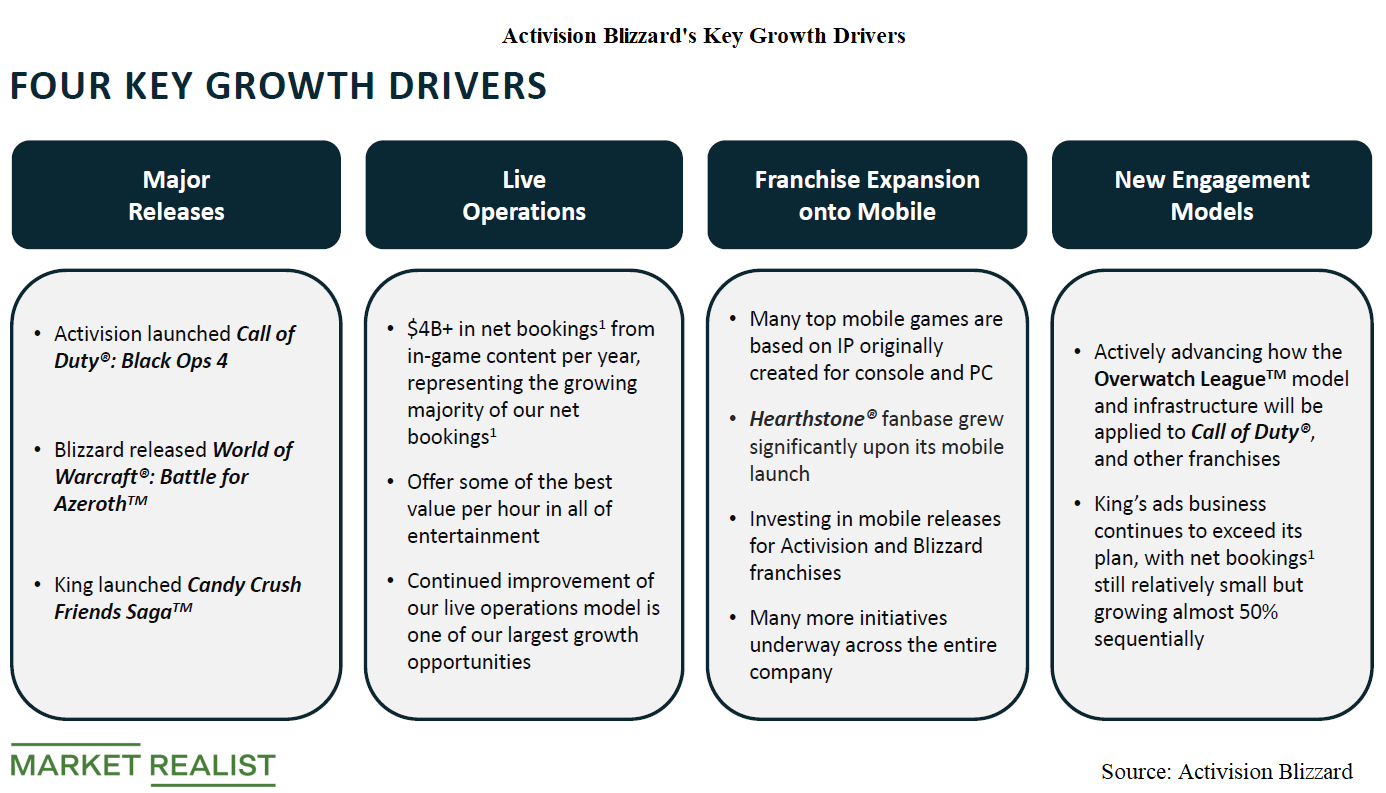

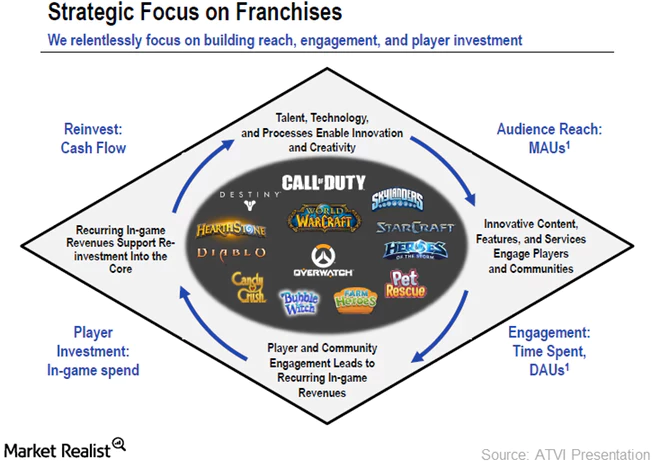

What Are Activision Blizzard’s Key Revenue Growth Drivers?

Activision Blizzard’s (ATVI) Call of Duty, World of Warcraft, and Candy Crush continue to be major drivers of its revenue growth.

Activision Blizzard’s Valuation Compared to Its Peers’

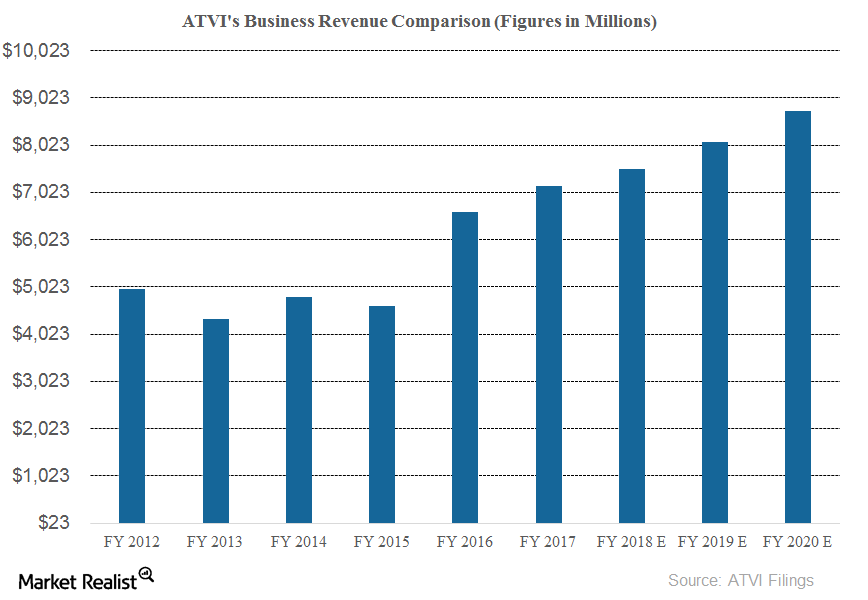

We’ve already seen that Activision Blizzard’s’ (ATVI) revenues are expected to rise 4.6% in 2018 and 6.3% in 2019.

Why Activision Blizzard Aims to Target the Battle Royale Gaming Segment

In March, the stock prices of gaming companies Activision Blizzard (ATVI), Take-Two Interactive (TTWO), and Electronic Arts (EA) fell, driven by concerns over the tremendous success of Epic Games’ Fortnite.

Why Activision Blizzard’s Revenues Are Expected to Rise in Fiscal 2018

Analysts expect Activision Blizzard’s (ATVI) revenues to rise 10.8% YoY (year-over-year) to $1.33 billion in 1Q18.

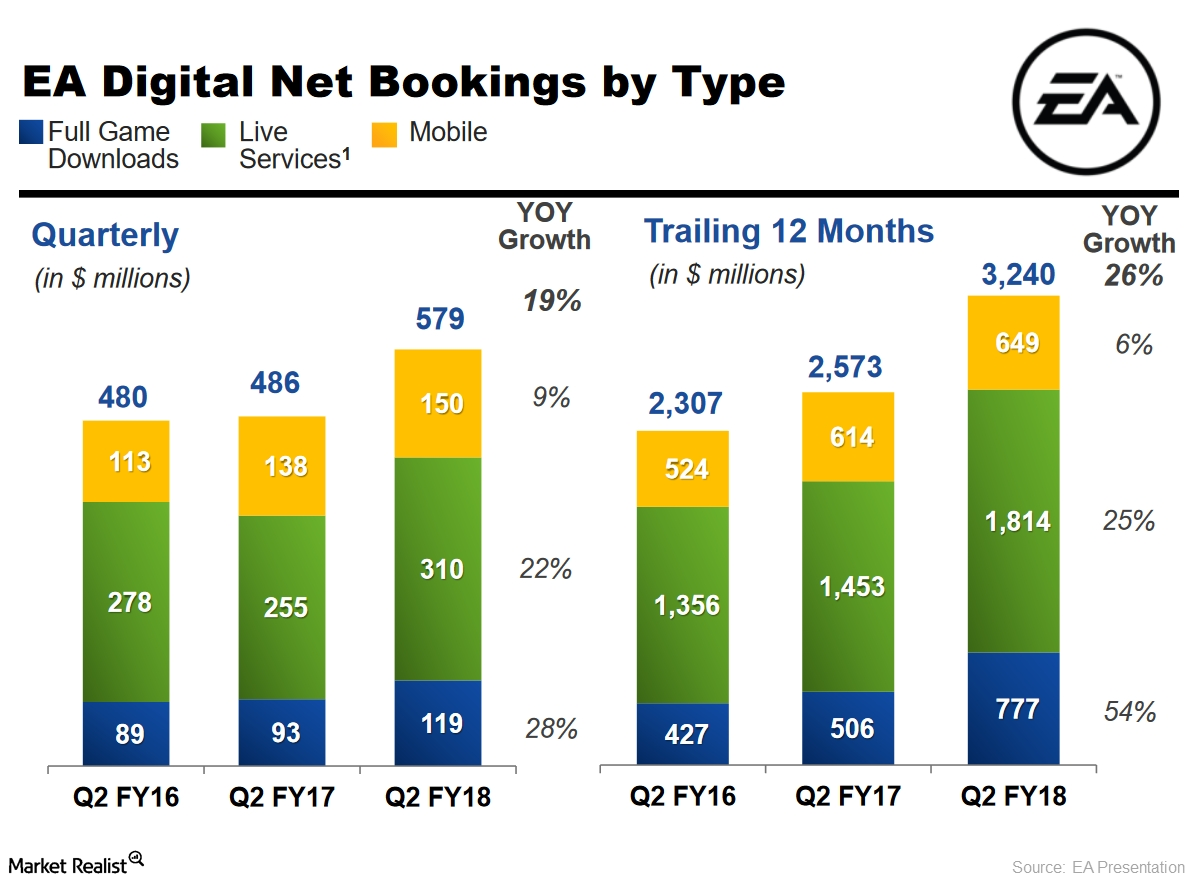

Which Games Are Driving Digital Downloads for Electronic Arts?

Management at Electronic Arts was surprised at the data released for full game downloads with respect to its games such as FIFA and Madden in fiscal 2Q18.

Inside the Profit Margins of the 4 Biggest Gaming Companies

Analysts expect Activision to post a net margin of 14.4% in fiscal 2017, 16.9% in fiscal 2018, and 19.5% in fiscal 2019.

Can Electronic Arts Improve Its Profit Margins in Fiscal 2018?

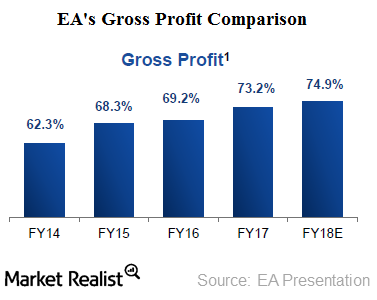

Electronic Arts (EA) expects its gross margin to be 74.9% by the end of fiscal 2018. It was 73.2% in fiscal 2017, 69.2% in fiscal 2016, and 68.3% in fiscal 2015.

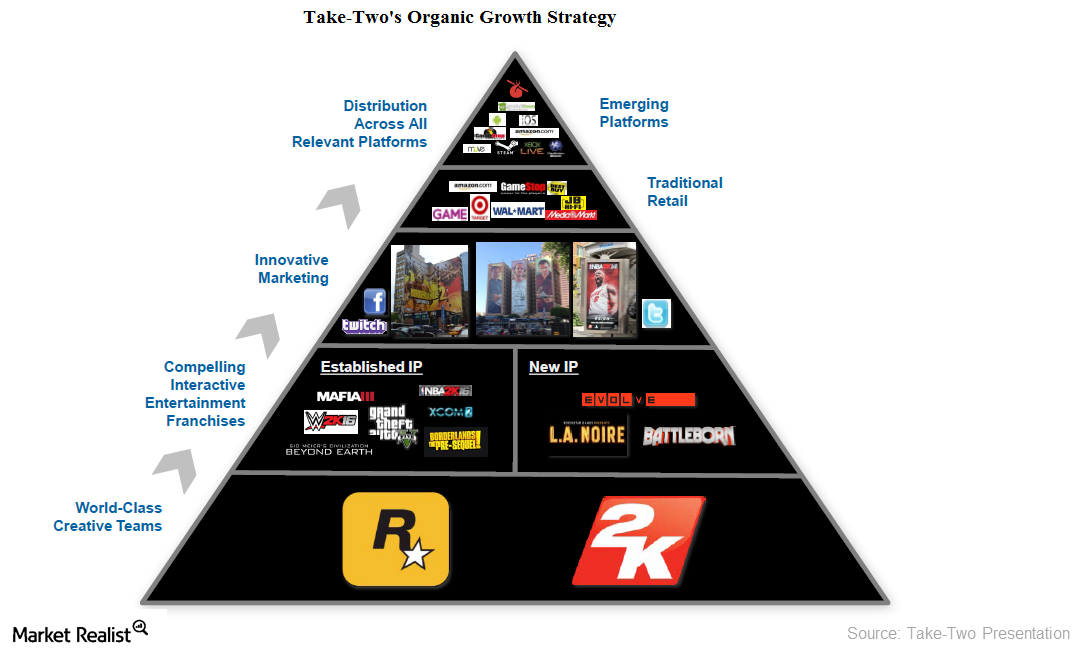

Take-Two Interactive Software Banks on Diverse Portfolio for Revenue Growth

Take-Two Interactive Software (TTWO) has seen its revenues increase from $825 million in fiscal 2012 to ~$1.4 billion in fiscal 2016.

Why EA’s Trading below Moving Averages after Q3 Earnings

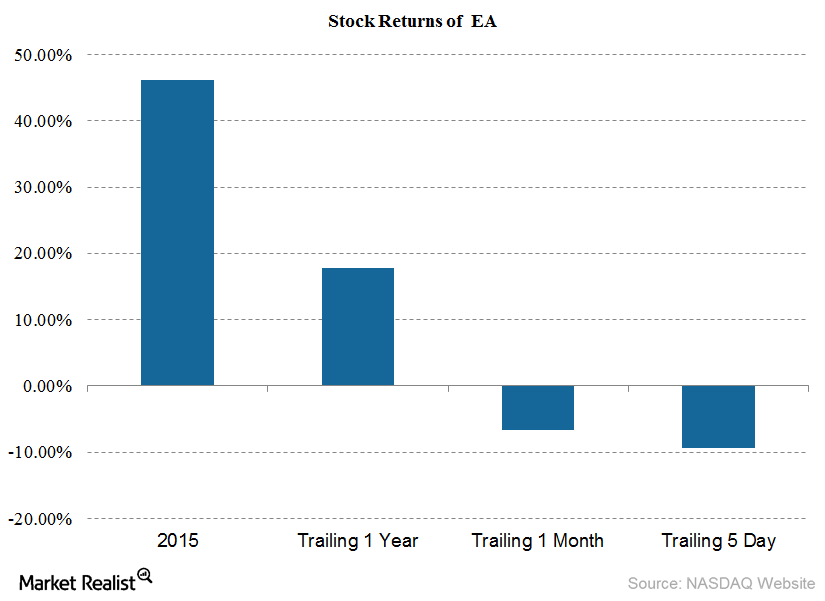

Electronic Arts (EA) generated investor returns of 17.8% in the trailing 12 months and -6.6% in the trailing one month

Should You Invest in Electronic Arts?

Along with its move toward the digital space, console upgrades are the reason Electronic Arts stock returned 66% to shareholders in 2013 and 105% in 2014.