Tim Hortons Inc

Latest Tim Hortons Inc News and Updates

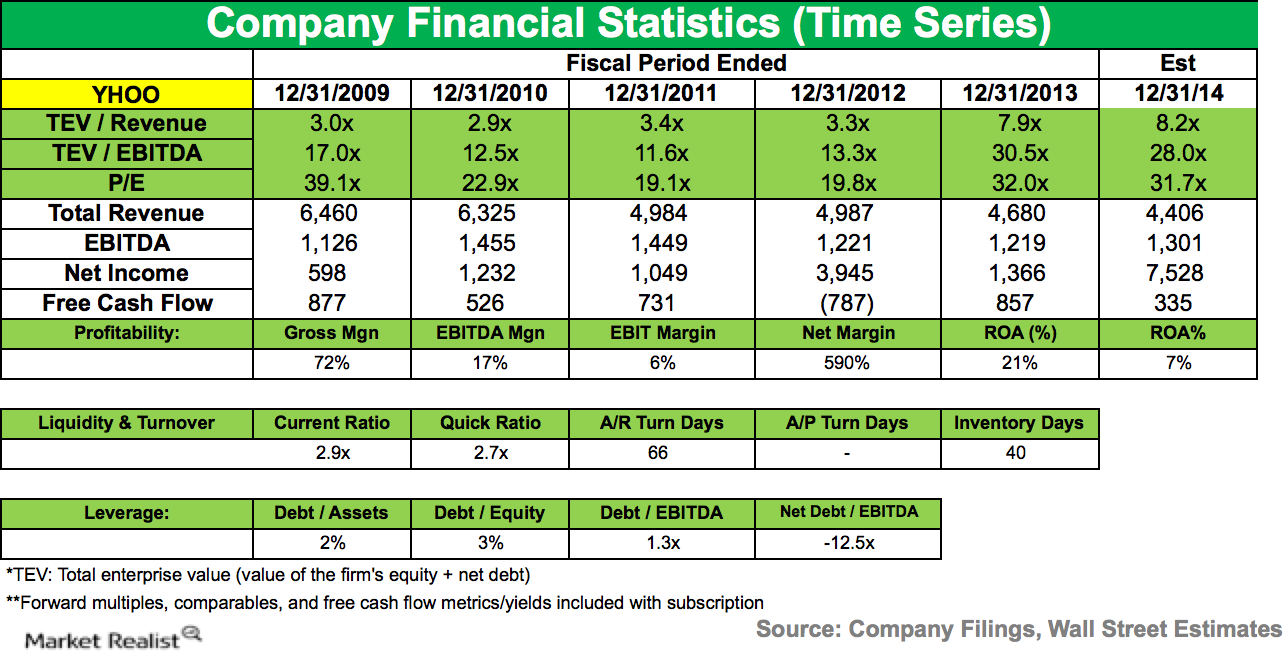

Farallon Capital sells stake in Yahoo!

Farallon Capital Management sold its position in Yahoo! Inc. (YHOO) during the third quarter. The stock accounted for 3.39% of the fund’s total 2Q14 portfolio.Consumer Must-know: Dunkin’s major costs of operations

Dunkin’ Brands Group (DNKN) has three major costs of operations. The costs of operations include general and administrative expenses, cost of products sold, and occupancy expense. Dunkin’s general and administrative expenses accounted for $56 million in the second quarter. This was 30% as a percentage of sales—compared to $62 million, or 34%, as a percentage of sales.Earnings Report Starbucks’ strategy: Aggressive unit growth

Unit growth is a key driver that Starbucks is aggressively pursuing to grow the company’s sales. In the last 12 months, Starbucks has added 1,599 net new restaurants, or 8% growth in units.Consumer Why Tim Hortons introduced a mobile app and loyalty cards

Along with introducing new products like those we discussed in the previous part of this series, Tim Hortons (THI) is also testing different revenue channels and payment methods.Consumer Domino’s management guidance on food costs, capex, and more

Management anticipates the effective tax rate to be in the range of 37% to 38% for the “foreseeable future.” Corporate tax rates in the U.S. are high, and force some companies to move their headquarters to countries offering lower tax rates.

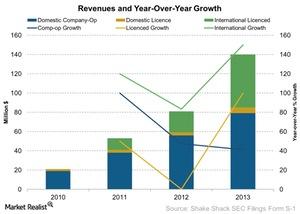

Where Does Shake Shack Get Its Revenue Sources?

Domestic means all of the restaurants in Shake Shack’s domestic market—the US. Revenue from this segment was $78.5 million in 2013.

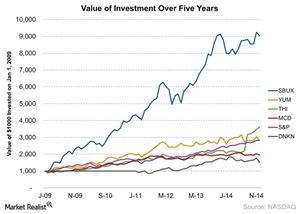

Starbucks’ 5-Year Stock Performance

Now, we’ll discuss SBUX’s stock performance over the past few years. SBUX returned $9,037 on $1,000 invested on January 1, 2009. The fourth quarter earnings announcement is approaching.

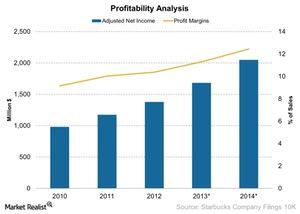

Starbucks’ Net Profit Margins Improve Over 5 Years

SBUX’s net income and net profit margins have been on an uptrend since 2010. At the end of fiscal year 2014, SBUX’s adjusted net income was $2.05 billion.

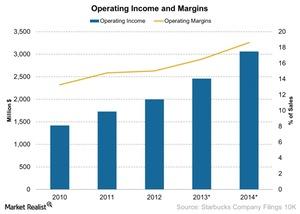

Starbucks’ Operating Profit Margin Increases

At the end of fiscal year 2014, SBUX’s operating income was $3.1 billion. Its operating profit margins increased to 19% in 2014—compared to 17% in 2013.

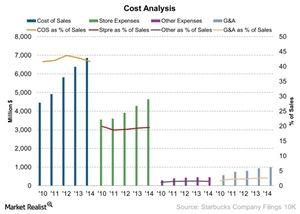

Starbucks’ Key Operating Costs

SBUX wants to grow sales. It’s also important to manage the operating costs. In this part of the series, we’ll take a look at four key operating costs.

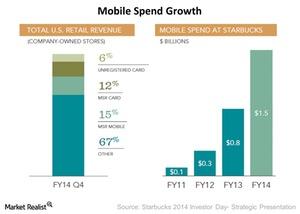

Analyzing Starbucks’ Successful Mobile Ecosystem

Once the card is registered on the Starbucks (SBUX) website, the data is available on other ecosystems—for example, a mobile app. It helps a customer keep track of rewards.

Starbucks Gets Help From Its Rewards Program

One of the ways a customer can become a My Starbucks Rewards member is by using the My Starbucks Rewards card. The card is available at the checkout counter.

A Business Overview Of Starbucks Corporation

Starbucks Corporation (SBUX) is a limited-service café. It operates more than 20,000 restaurants across 65 countries around the world. It employs more than 191,000 people.Company & Industry Overviews Unit growth equally important for restaurants as same-store sales

Restaurants seek revenue growth in a variety of ways, but after exhausting all options, restaurants pursue a unit-growth strategy to capitalize on these opportunities.