Toronto-Dominion Bank

Latest Toronto-Dominion Bank News and Updates

TD Acquires First Horizon for $13.4B — What Will Happen to FHN Stock?

TD is buying fellow banking corporation First Horizon in a multi-billion-dollar deal. Here’s what to know about the merger plus what will happen to FHN stock.

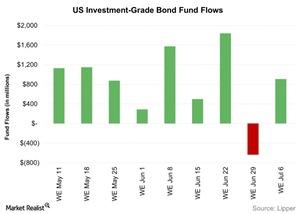

Investment-Grade Bond Funds Saw Inflows Last Week

Flows into investment-grade bond funds were positive last week. Investment-grade bond funds saw net inflows of $907.1 million during the week ending July 6.

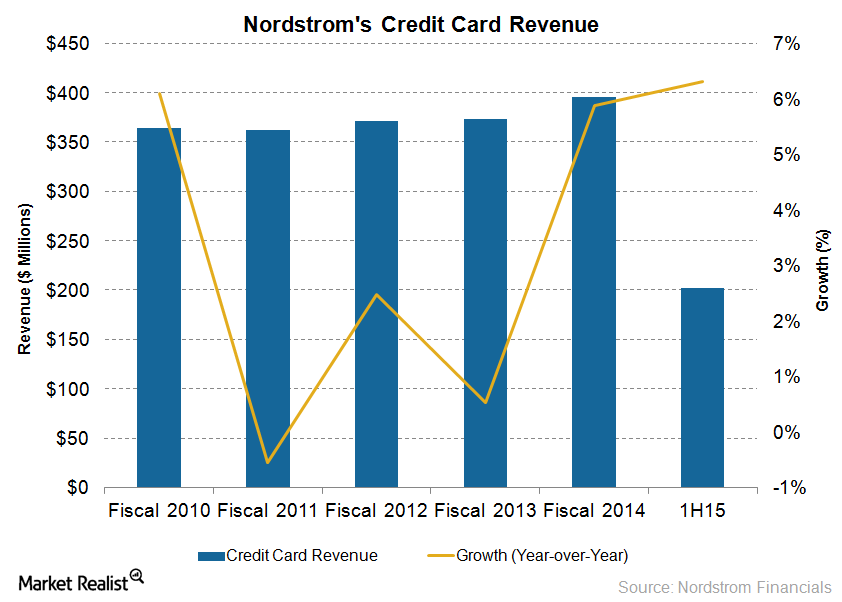

Nordstrom Completes Sale of Credit Card Portfolio to TD Bank

On October 1, Nordstrom (JWN) announced the completion of the sale of its credit card portfolio to Toronto-Dominion Bank (TD), also known as TD Bank.

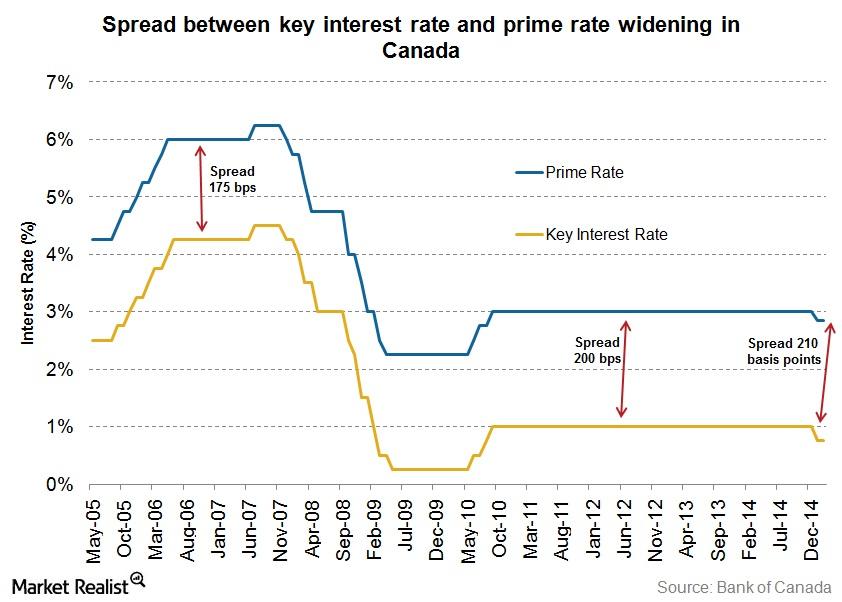

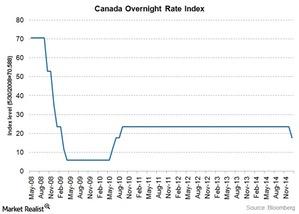

The widening spread in the Canadian prime and key interest rates

The “Big Six Banks” in Canada have only reduced their prime rates by 15 basis points. So the spread between the prime and key interest rates is now 0.1%.

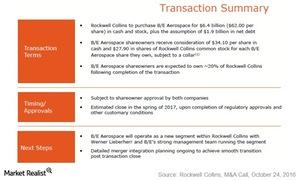

Rockwell Collins Acquires B/E Aerospace in a Deal-Making Weekend

On October 23, Rockwell Collins (COL) announced that it intends to acquire B/E Aerospace (BEAV) for a total consideration of $8.3 billion. Within Rockwell Collins, B/E Aerospace will operate as its new Aircraft Interior Systems segment.

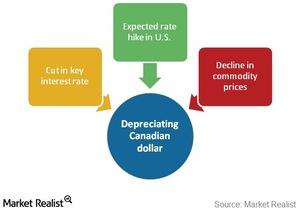

3 key factors affecting Canadian currency depreciation

The availability of easy money leads to currency depreciation, which benefits exporters, but is counterproductive for importers.

Economic essentials: The key interest rate and the prime rate

The key interest rate and the prime rate are central to the Canadian financial system. They key interest drives lending rates at the big banks.

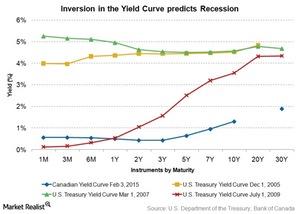

Could Canada’s inverted sovereign yield curve mean recession?

Canada’s inverted sovereign yield curve could be an indication of an upcoming recession. US yields exhibited similar curves prior to the 2008 recession.

Key challenges facing the Canadian economy

One of the challenges facing the Canadian economy is a lack diversification. More than 70% of the TSX Composite Index is made up of only three sectors.