Teck Resources Ltd

Latest Teck Resources Ltd News and Updates

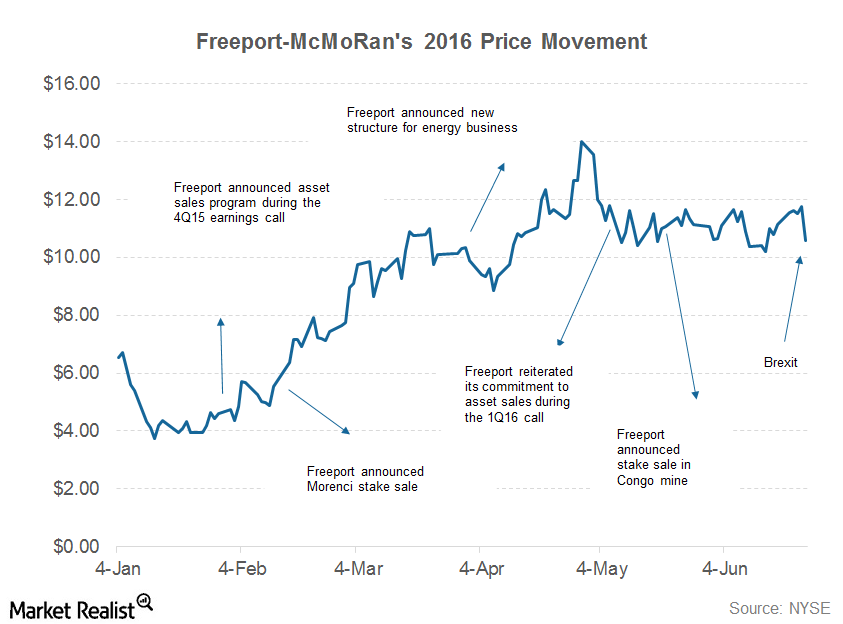

Can Freeport-McMoRan’s 2Q16 Earnings Justify Its Rally?

Freeport-McMoRan (FCX) is expected to release its 2Q16 earnings on July 26. In this series, we’ll explore what Wall Street analysts expect from FCX’s 2Q16 earnings.

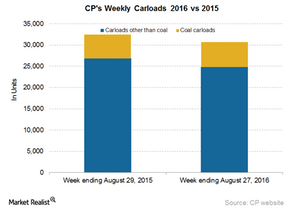

Rising Coal Volumes Not Enough to Stop CP’s Fall in Carloads

Canadian Pacific (CP) registered a fall of 5.2% in total railcars in the week ended August 27, 2016.

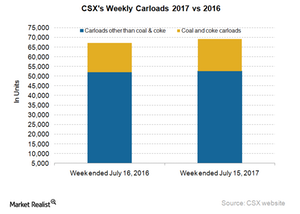

Inside Norfolk Southern’s Freight in Week 28

CSX’s (CSX) overall railcar traffic rose 3.1% in the 28th week of 2017 (ended July 15).

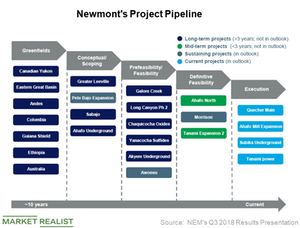

Newmont’s Project Pipeline Remains Strong: What’s the Upside?

Newmont Mining is poised to overtake Barrick Gold as the world’s largest gold producer in 2018.

Copper Industry Gets a Lift in 1H2015

In this series, we’ll discuss recent copper industry indicators. We’ll see how copper prices have done in 2015. We’ll also discuss copper supply trends and demand.

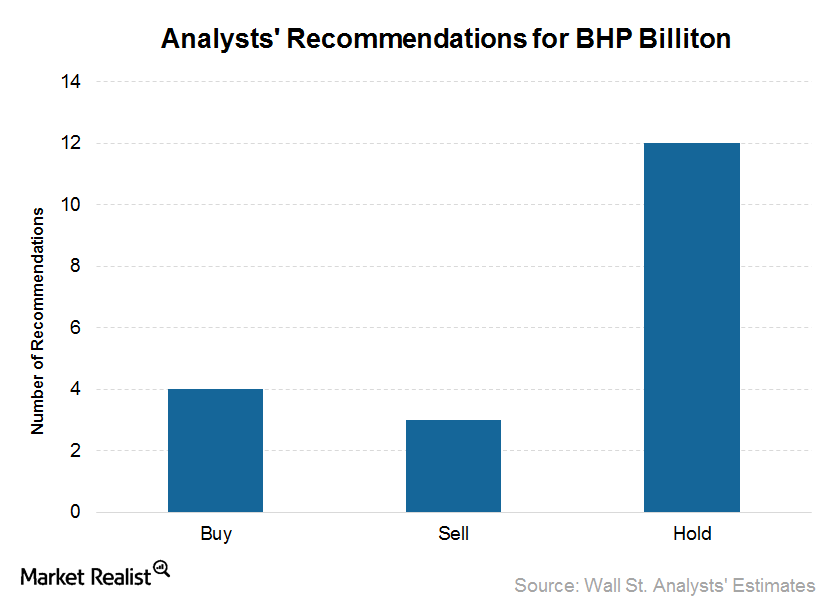

Inside BHP Billiton’s Recent Upgrades and Downgrades

Of the 19 analysts covering BHP Billiton (BHP), four analysts issued “buy” recommendations, while 12 issued “holds,” and three issued “sells.”

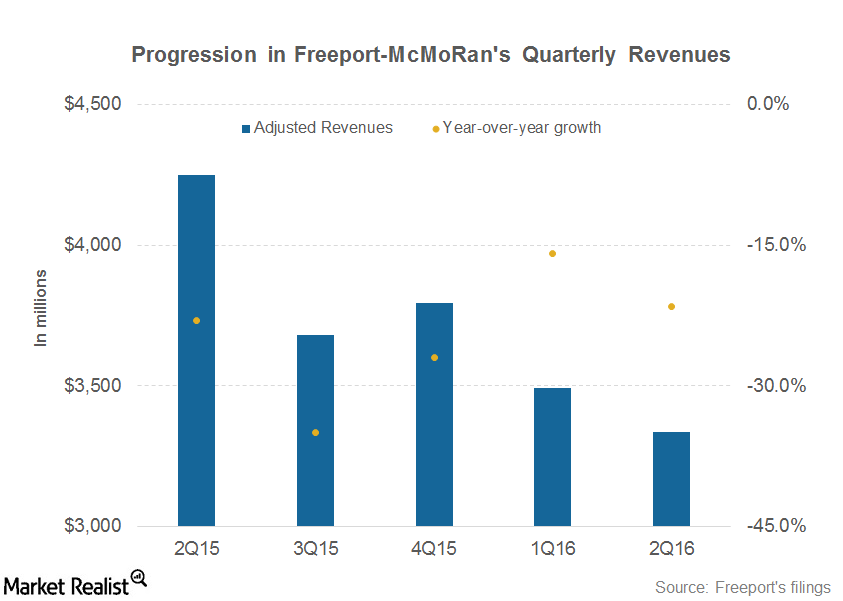

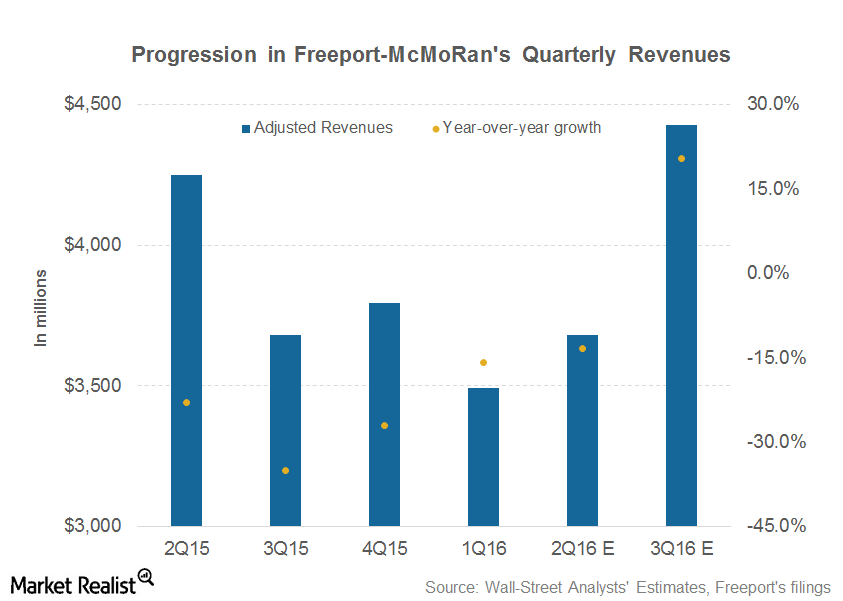

Why Freeport-McMoRan Missed Q2 Revenue Estimates

Freeport-McMoRan (FCX) posted revenues of $3.3 billion in 2Q16. In contrast, Freeport posted revenues of nearly ~$4.2 billion in 2Q15.

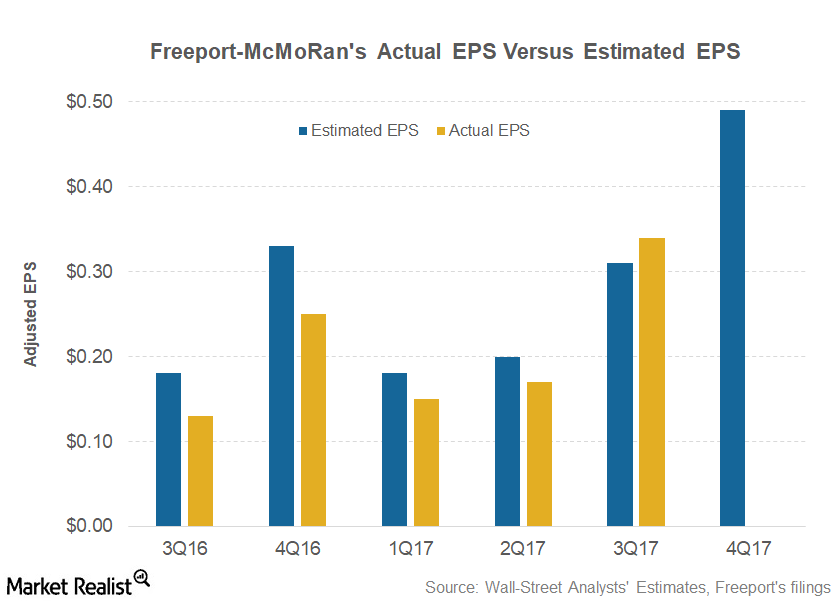

Can Freeport’s 4Q17 Earnings Keep Investor Optimism Alive?

Freeport-McMoRan (FCX), the leading US-based copper miner (XME), is scheduled to release its 4Q17 earnings on January 25.

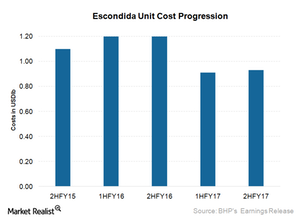

What Could Drive BHP Billiton’s Copper Costs in Fiscal 2018?

BHP Billiton’s (BHP) copper production fell 16.0% in fiscal 2017 to 1.3 million tons.

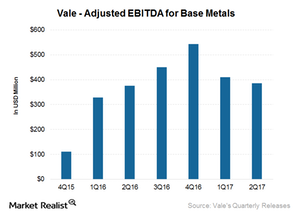

What’s Vale’s Base Metals Outlook?

As we saw in the previous two parts of this series, Vale’s (VALE) iron ore and coal production increased sequentially in 2Q17.

Higher Commodity Prices Impact Glencore’s Business Operations

While trading activities account for more than 70% of Glencore’s consolidated revenues, most of its earnings come from the industrial business.

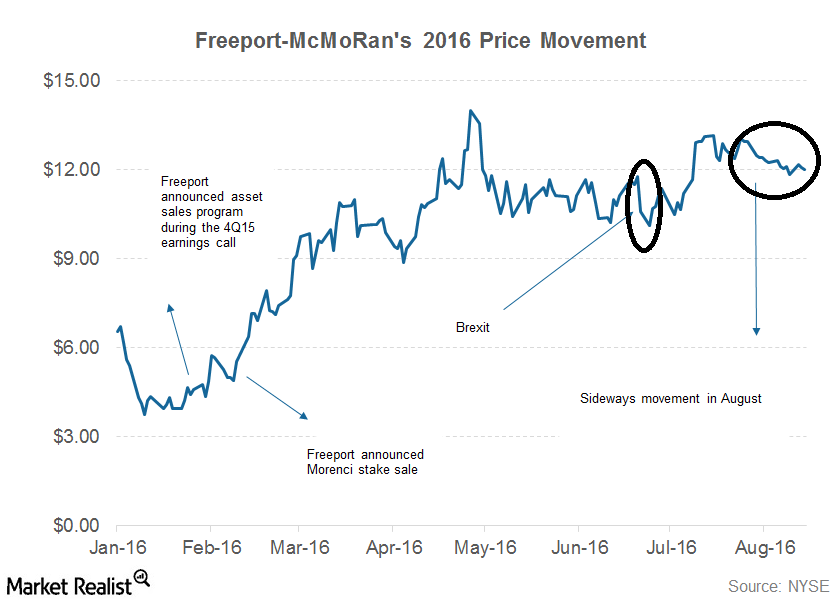

How Do Freeport McMoRan’s Fundamentals Compare to Its Peers?

Freeport-McMoRan (FCX) has been trading largely sideways around the $12 price level for almost a month. August has been a dull month for most companies in the metals and mining space.

Can 2Q16 Mark a Turnaround for Freeport-McMoRan’s Revenues?

Analysts expect Freeport-McMoRan (FCX) to post revenues of ~$3.7 billion in 2Q16 and $4.4 billion in 3Q16.

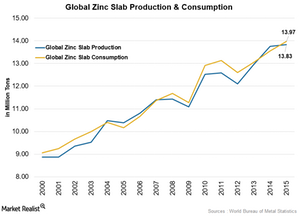

Why Zinc Demand Could Pick Up in 2016–2017

Zinc has gained more than 15% in 2016 so far, outperforming other base metals in the same category.

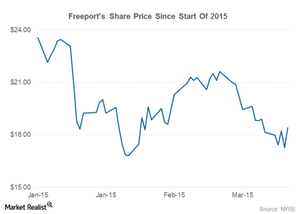

Short-Term Outlook: Freeport-McMoRan, Copper Could Drift Lower

Although copper prices have recovered from sub-$5,000 levels, the worst doesn’t seem to be over for copper or Freeport-McMoRan (FCX).

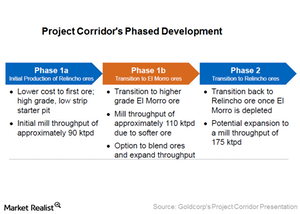

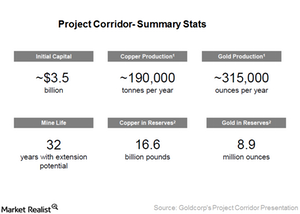

Goldcorp Forms Project Corridor Joint Venture with Teck Resources

The combined project will be a 50:50 joint venture between Goldcorp and Teck with the interim name of Project Corridor.

Goldcorp Acquires New Gold’s 30% Interest in the El Morro Project

On August 27, Goldcorp (GG) announced that it has entered into an agreement with New Gold (NGD) to acquire its 30% interest in the El Morro gold-copper project in Chile.

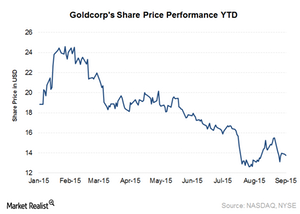

Is the Market Excited about Goldcorp’s Recent Moves?

Goldcorp (GG) announced on August 27 that it has bought the remaining 30% stake of El Morro from New Gold (NGD).

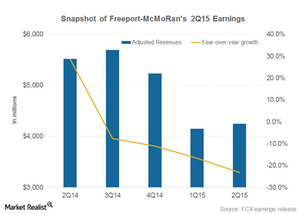

Lower Commodity Prices Take a Toll on Freeport’s 2Q15 Profits

Freeport’s average realized copper prices fell 14% in 2Q15 on a year-over-year basis. Lower commodity prices took a toll on Freeport’s 2Q15 profits.

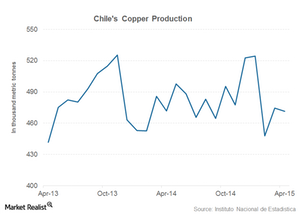

Copper Production in Peru, Chile Falls in First 3 Months of 2015

According to the World Bureau of Metal Statistics, Peru’s refined copper production declined in the first three months of the current year.

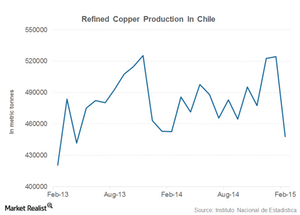

Chilean Refined Copper Production Falls to 2-Year Low

On a year-over-year basis, Chilean refined copper production fell by more than 1%. Incessant rains causing flooding are behind the decline in February’s copper production.

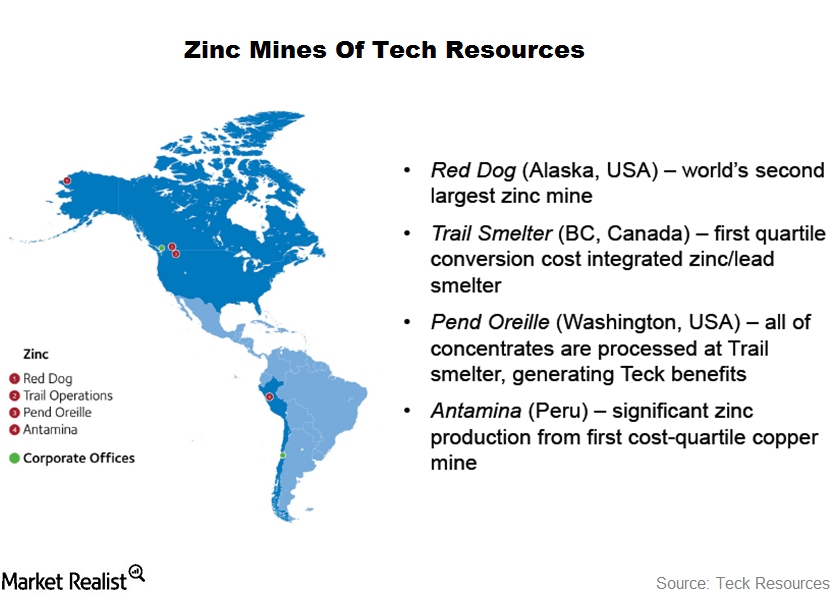

Teck Resources Zinc Operations Focused on Alaska’s Red Dog Mine

In 2014, its zinc operations contributed 31% to revenues and made up 27% of gross profit before depreciation and amortization.

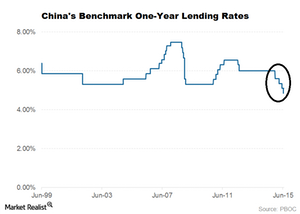

Why Freeport Investors Should Track China’s Automobile Industry

China is the world’s biggest automotive market, where close to 22 million vehicles are sold each year. A mid-sized vehicle has ~50 pounds of copper content.

Copper Prices Hold Steady Amid Commodity Carnage

The trend in copper prices has been clearly uneven this year. Higher copper prices benefit copper producers like Freeport-McMoRan.

Key Indicators Freeport Investors Should Track

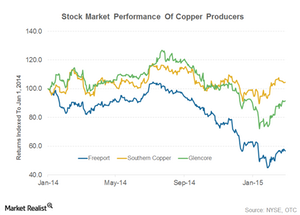

Freeport has lost almost 20% of its market capitalization so far this year, making 2015 a turbulent period for the company.

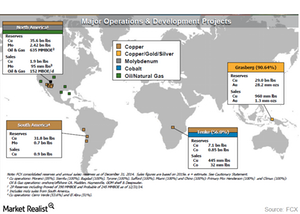

Freeport-McMoRan’s global mining portfolio

Freeport’s global mining portfolio shows that Freeport has major operations in North America, South America, Africa, and Indonesia.

An investor’s guide to Freeport-McMoRan

Freeport-McMoRan (FCX) is a leading natural resources company. It’s among the top copper producers and holds the position of largest molybdenum producer.