Statoil ASA

Latest Statoil ASA News and Updates

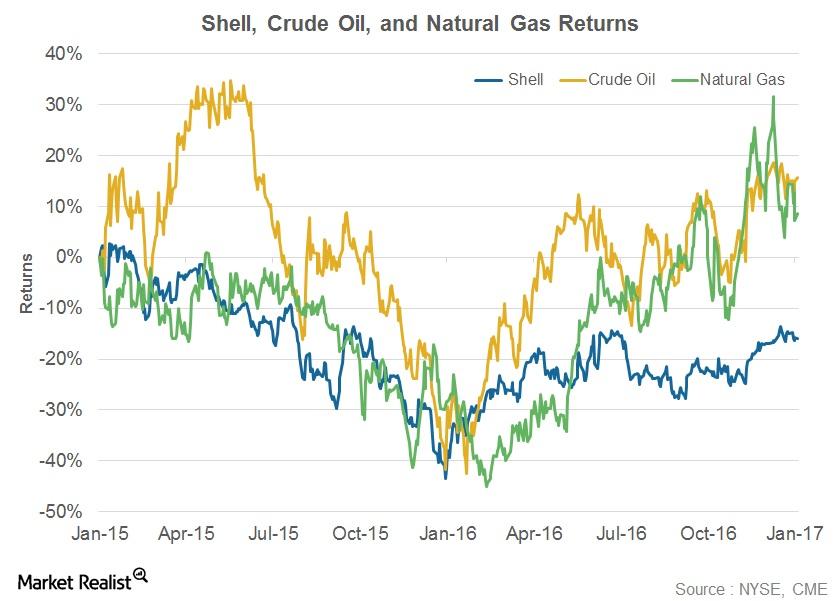

How Has Shell’s Stock Performed ahead of Its 4Q16 Earnings?

On January 20, 2016, Shell began recuperating from the falls it had experienced in the previous year. Shell has risen 49% since January 20, 2016.

Oil Majors Keep New Projects Worth $200 billion on Ice

Wood Mackenzie research shows that the oil majors have deferred more than 45 significant oil and gas projects since the beginning of the crude oil price collapse last year.

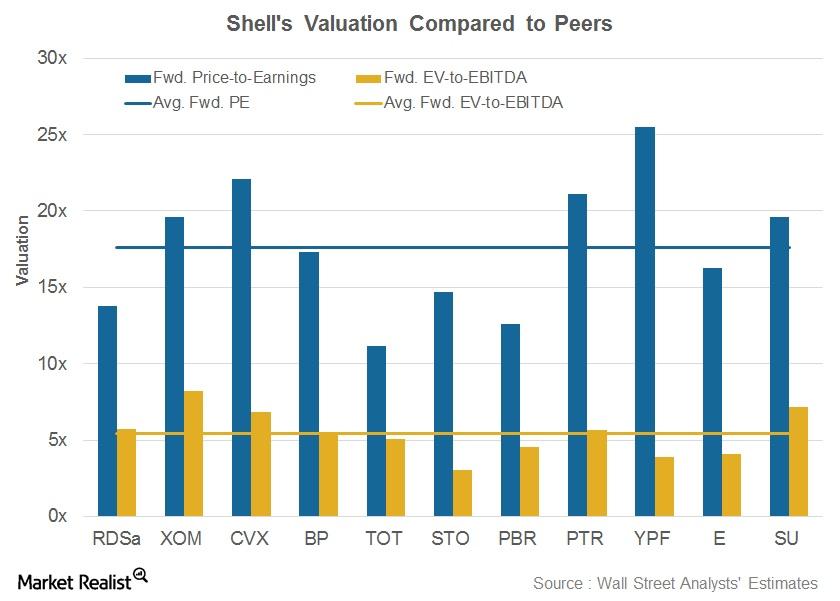

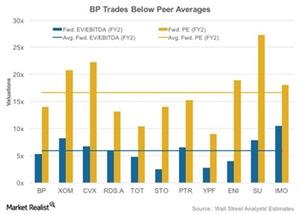

Shell’s Valuation Compared to Its Peers

Shell is trading at a forward PE of 13.8x, below its peer average of 17.6x.

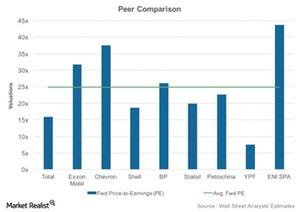

Total’s Forward Valuation: Peer Comparison

In the previous part of this series, we discussed Total’s historical valuation trends. Now we’ll compare its forward valuation with that of its peers.

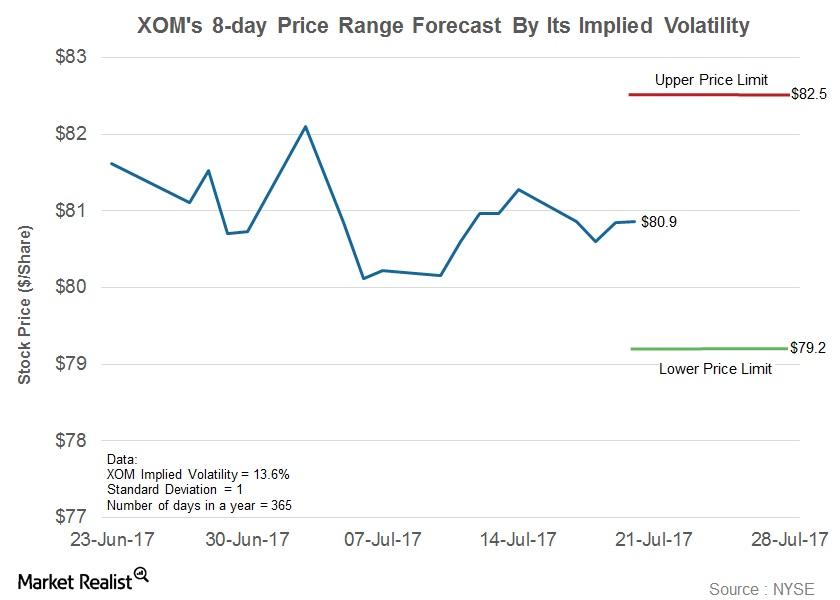

What’s the Forecast for ExxonMobil’s Stock Price?

Implied volatility in ExxonMobil has fallen from 14.9% on April 3, 2017, to 13.6% to date.

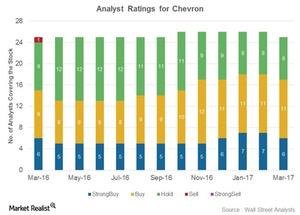

Why Most Analysts Rate Chevron a ‘Buy’

Analyst ratings for Chevron Chevron (CVX) has been rated by 25 analysts. Of the total, 17 analysts have given “buy” or “strong buy” ratings, eight have given “hold” ratings, and none have given “sell” or “strong sell” ratings on the stock. These ratings have improved from March 2016, when Chevron had fewer “buy” ratings, more […]

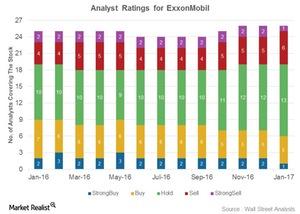

Analysts’ Ratings for ExxonMobil after Its Earnings

Six analysts gave ExxonMobil a “buy” rating, 13 analysts gave it a “hold” rating, and seven analysts gave it a “sell” rating after its 4Q16 earnings.

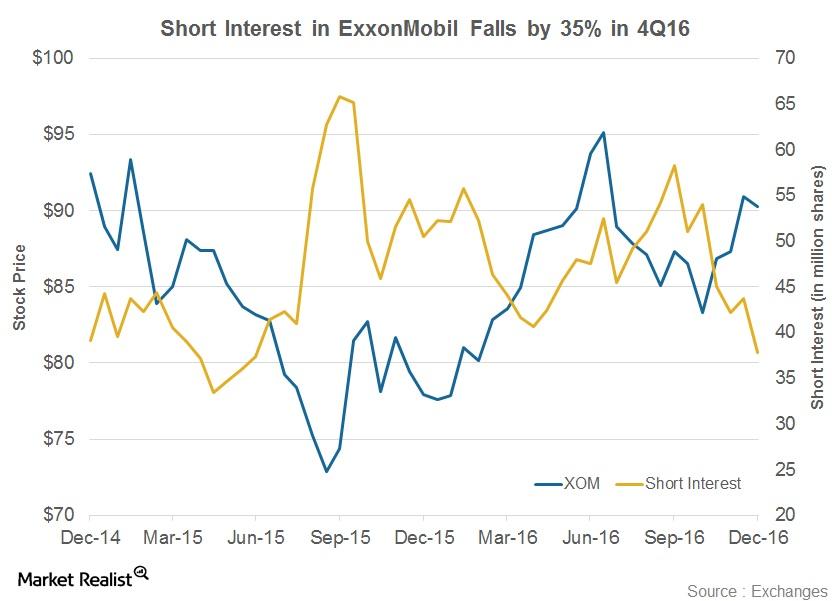

Has Short Interest in ExxonMobil Fallen?

ExxonMobil (XOM) has witnessed a 35% fall in its short interest volumes since September’s end 2016.

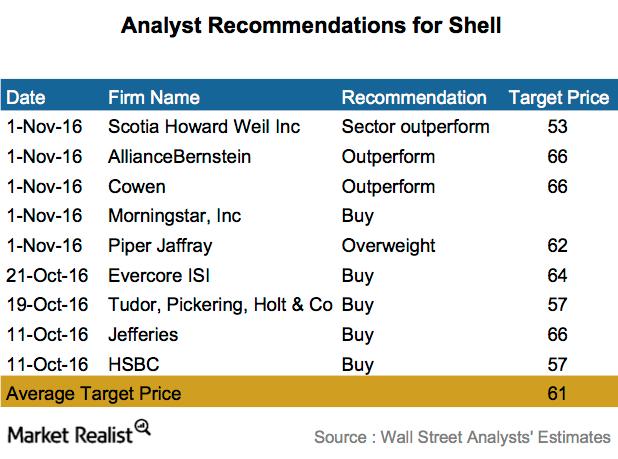

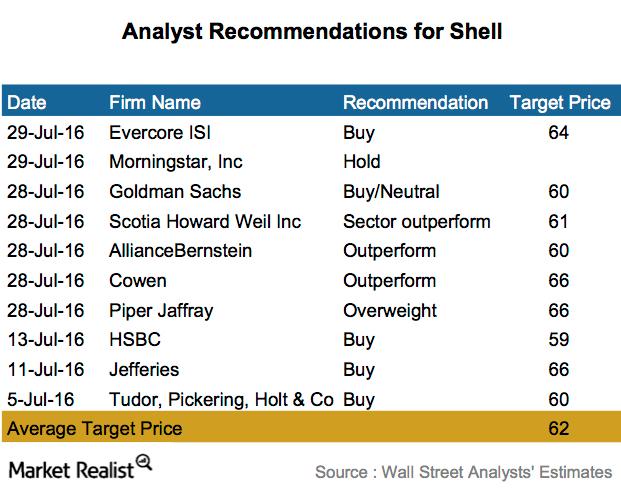

Analysts’ Recommendations for Shell: Most Say ‘Buy’

Shell’s highest and lowest 12-month price targets stand at $66 and $53. It indicates a 27% and 2% rise from its current levels, respectively.Macroeconomic Analysis Statoil Expects Cost Reductions in Offshore Wind

One reason that renewable energy hasn’t caught on in a big way is the cost associated with energy generation.

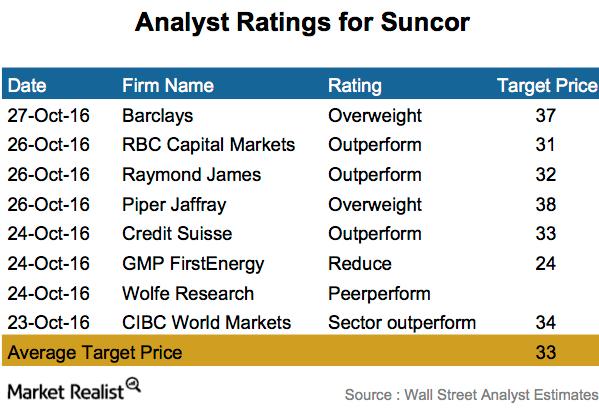

Suncor: How Analysts Are Rating the Stock after Earnings

An analyst survey shows that six out of eight companies surveyed rated Suncor Energy (SU) an “overweight” or “outperform.”

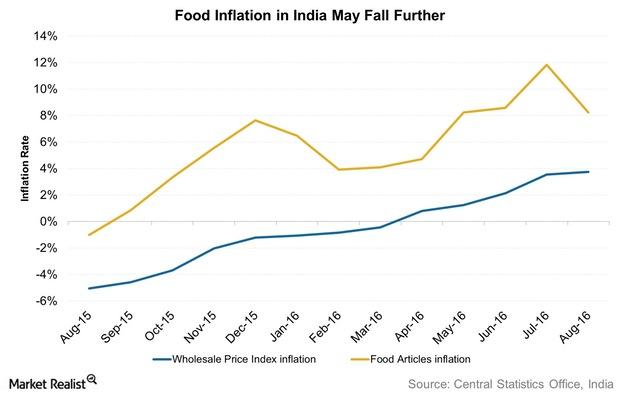

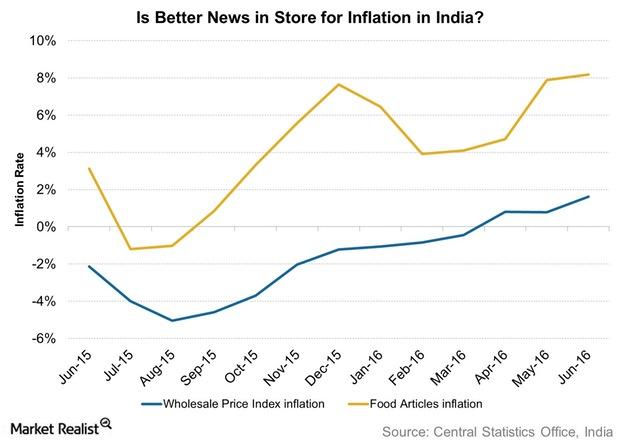

How Does the RBI See Food Inflation Panning out in India?

Components of inflation While food inflation in India has been pushing retail inflation up, fuel inflation (BP) (STO) (RDS.B), another important component, has been subdued. According to the October monetary policy statement issued by the RBI (Reserve Bank of India), “Fuel inflation has moderated steadily through the year so far.” The RBI has also announced […]

BP’s Forward Valuations: A Peer Comparison

In this article, we’ll consider BP’s forward valuations compared to those of its peers. BP’s market cap stands at ~$105 billion.

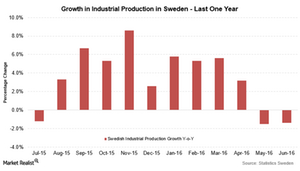

Why Did Swedish Industrial Production Fall?

Swedish industrial production fell by 1.4% in June on an annual basis—compared to a 1.5% drop in the previous month.

What Risks Does the RBI See for Retail Inflation?

The RBI thinks that risks to inflation are “tilted to the upside.” A subsequent rise in inflation could have a negative impact on consumer spending.

Majority of Analysts Rate Shell as a ‘Buy’ Post-2Q16 Earnings

Nine out of the ten companies surveyed rated Royal Dutch Shell (RDS.A) a “buy,” “overweight,” or “outperform.”

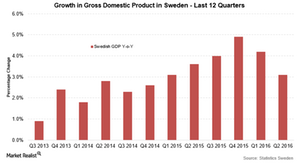

Scandinavian Macroeconomic Data Are below Expectations

Sweden’s economy expanded by 3.1% on an annual basis in 2Q16—compared to 4.2% growth in the previous quarter and below expectations of 3.7% growth.

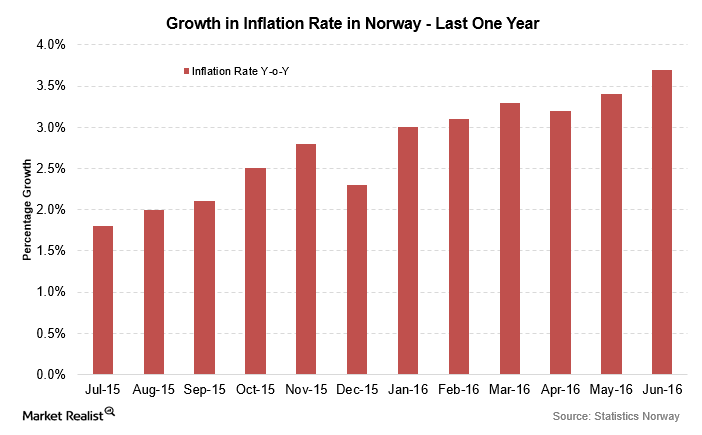

Scandinavian Indexes Rally as Inflation Rises in Norway and Denmark

The Scandinavian indexes were trading on a higher note towards the end of the day on July 11 following higher inflation numbers in Scandinavian countries.

What Does a Fall in Shell’s Short Interest Mean?

Shell has witnessed a 49% fall in its short interest volumes since February 10, 2016. This indicates that the bearish sentiment for the stock is weakening.

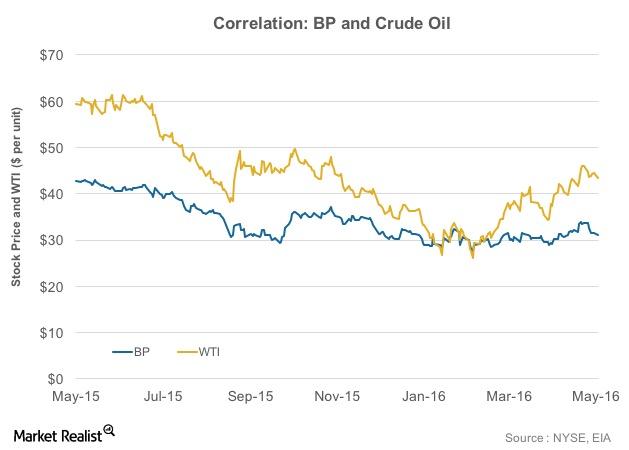

How Do BP’s Stock and Crude Oil Prices Correlate?

To what degree are integrated energy companies such as BP affected by volatility in crude oil prices? This varies from company to company.

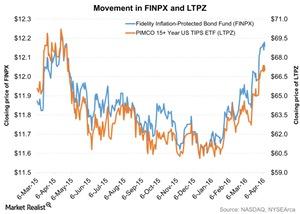

Why TIPS Are an Attractive Investment Option Right Now

Asset managers have warned that costs may rise. They recommend inflation-linked securities such as Treasury inflation-protected securities (or TIPS).