PowerShares S&P 500 High Dividend ETF

Latest PowerShares S&P 500 High Dividend ETF News and Updates

What Do Analysts Recommend for Archer Daniels Midland?

Now, ~8% gave Archer Daniels Midland a “buy” rating. No analysts rated it a “sell.” The average target price for the company fell to $36.60 as of April 26.

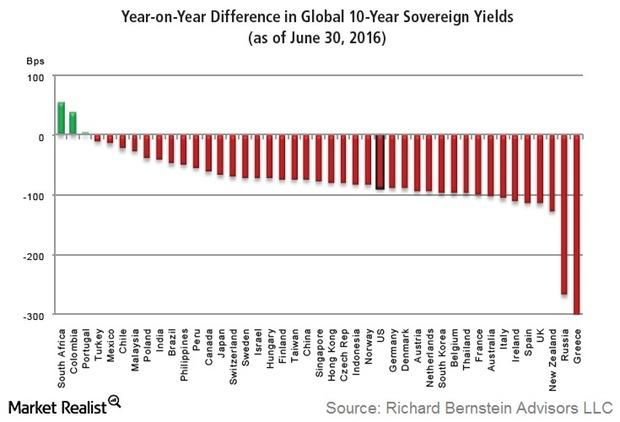

Richard Bernstein: Falling Yields Are Testimony to Risk Aversion

Bernstein asked a rhetorical question: “Could there be anything that suggests extreme risk aversion more than the increasing proportion of global sovereign bonds that have negative yields?”

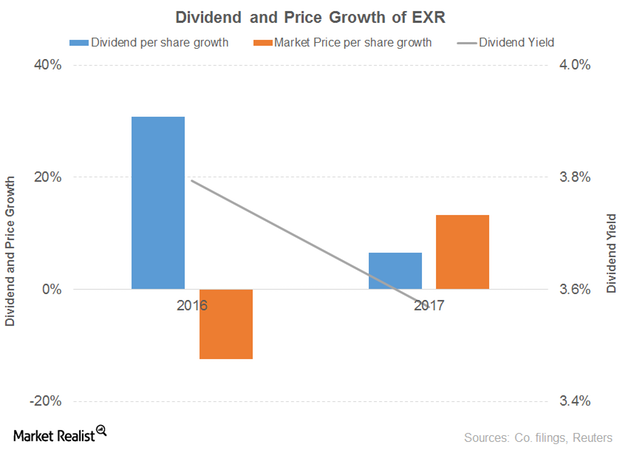

What’s the Outlook for Extra Space Storage?

Extra Space Storage’s (EXR) revenue grew 27% and 13% in 2016 and 9M17, respectively.

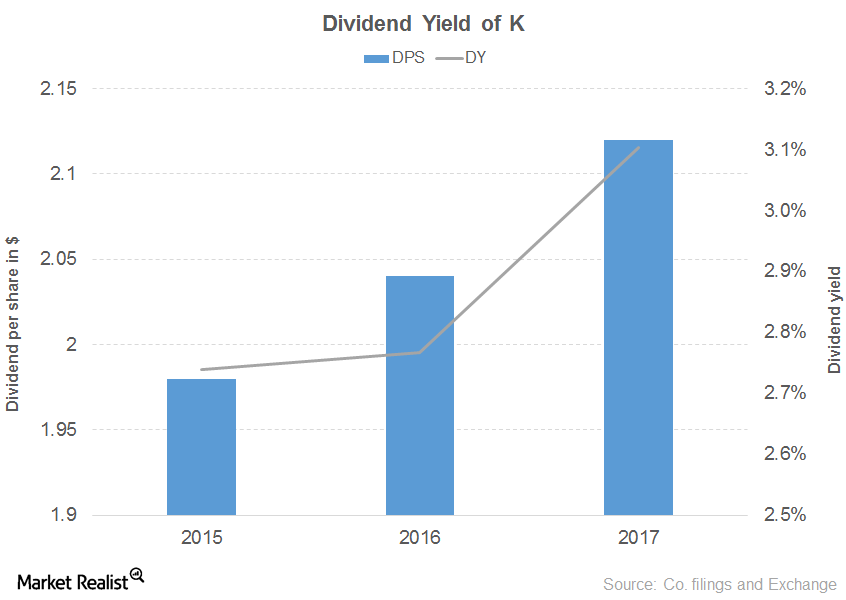

A Look at Kellogg’s Dividend Yield Curve

Kellogg has noted a 3.0% fall in sales for the first half of 2017. The fall is due to a decline in every segment, offset by U.S. Specialty, Latin America, and Asia Pacific.

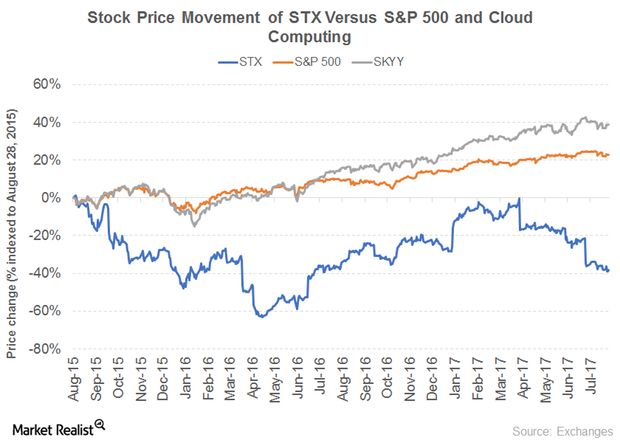

Can Seagate Sustain Its Dividend Yield?

What’s behind Seagate’s dividend yield Seagate Technology (STX) is a data storage technology and solutions provider. The company’s revenue, which has fallen over the years, seems to have recovered in 2017. Its revenue has fallen 3% in 2017, compared with a fall of 19% in 2016 due to intense competition in the data storage market. The company’s […]

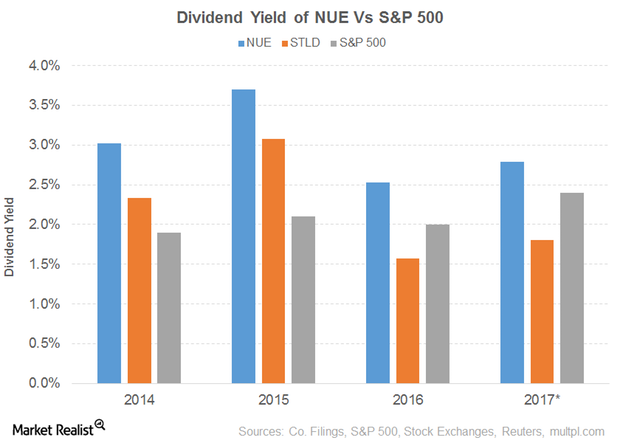

Dividend Yield of Nucor

Nucor’s (NUE) PE ratio of 21.8x is pitted against a sector average of 19.4x. The dividend yield of 1.5% is pitted against a sector average of 1.4%.

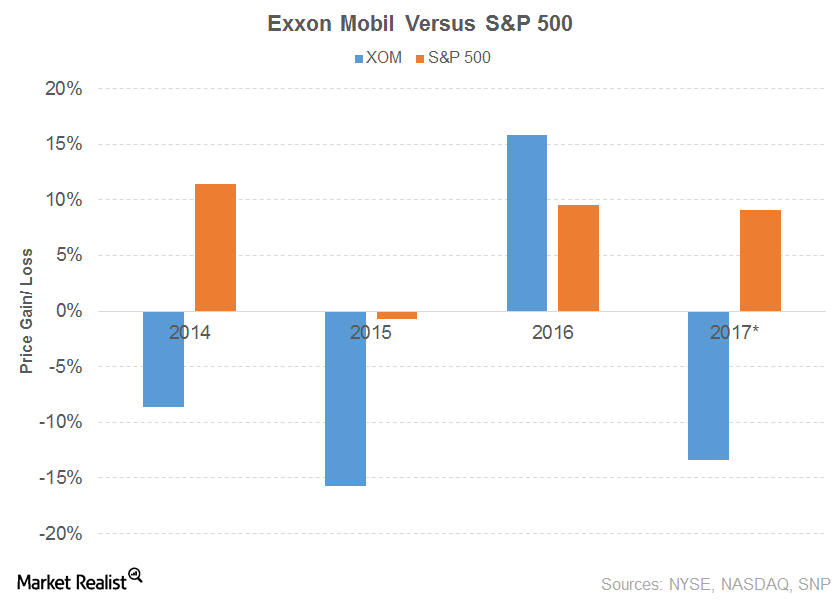

ExxonMobil’s Journey as a Dividend Aristocrat

ExxonMobil’s (XOM) story is similar to Chevron’s. The company’s sales and other operating revenue for 2016 fell 16.0%.

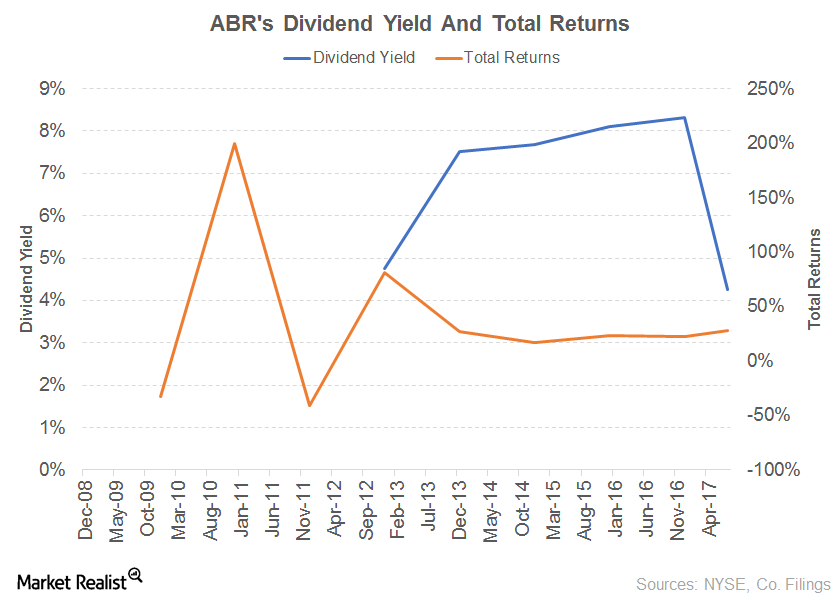

Arbor Realty Trust’s Dividend Growth Prospects

Arbor Realty Trust (ABR) paid 74.1% of its earnings as dividends in 2016 compared to 56.7% in 1Q17.

Dividend Growth for Qualcomm and Crown Castle International

Qualcomm (QCOM) recorded a year-over-year decline in revenues for 2Q17 after growth in the preceding quarter.

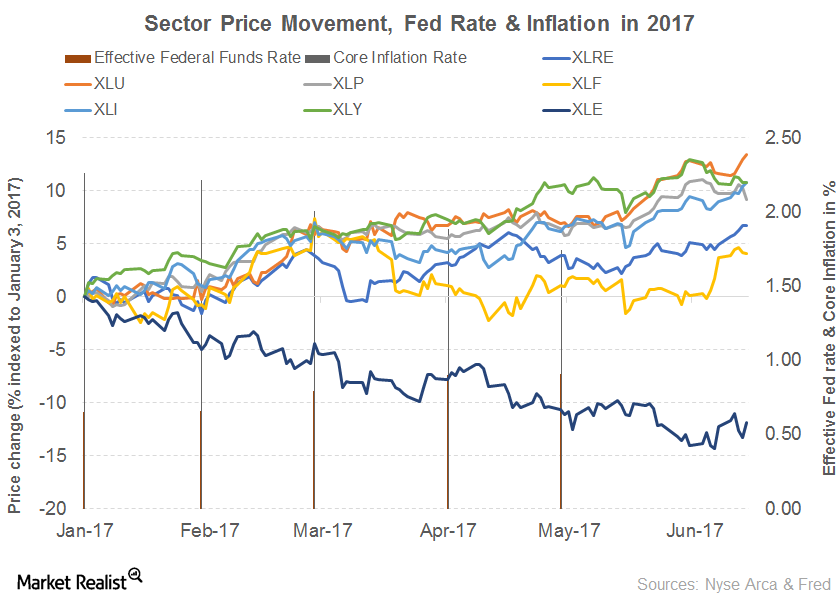

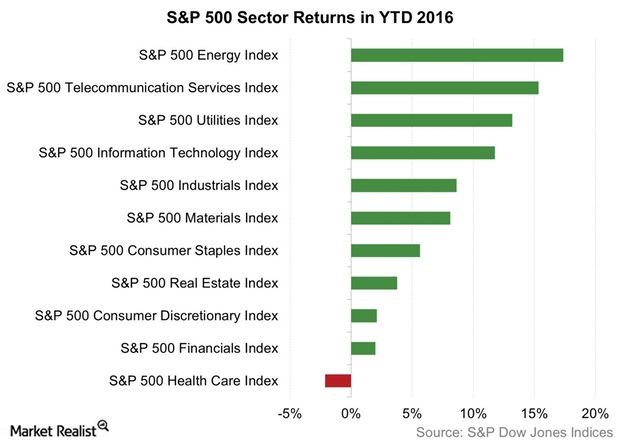

Comparing Growth and Value Stock Sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV).

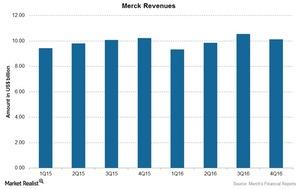

How Merck Performed in 2016

Merck (MRK) reported growth of 1% to $39.8 billion in its 2016 revenues as compared to $39.5 billion in 2015.

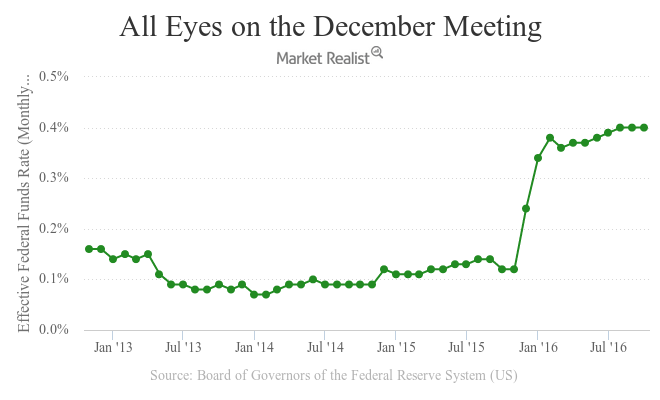

A Pass on a November Hike: It’s Up to December Now

The expected occurred on November 2, 2016, when the FOMC (Federal Open Market Committee) left the federal funds rate unchanged at 0.25%–0.5%.

Richard Bernstein: Don’t Fear the Bear Market

A legitimate bull market In this series, we’ve taken a look at Richard Bernstein’s views on investors’ fear of an impending bear market. In Richard Bernstein Advisors’ October Insights newsletter, he rejects the notion that the current rise in US stocks (SPLV) (OEF) has been brought about only by the Fed’s easy monetary policy. In the […]

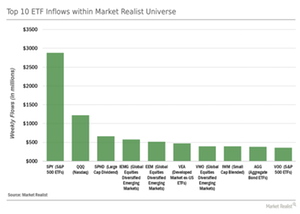

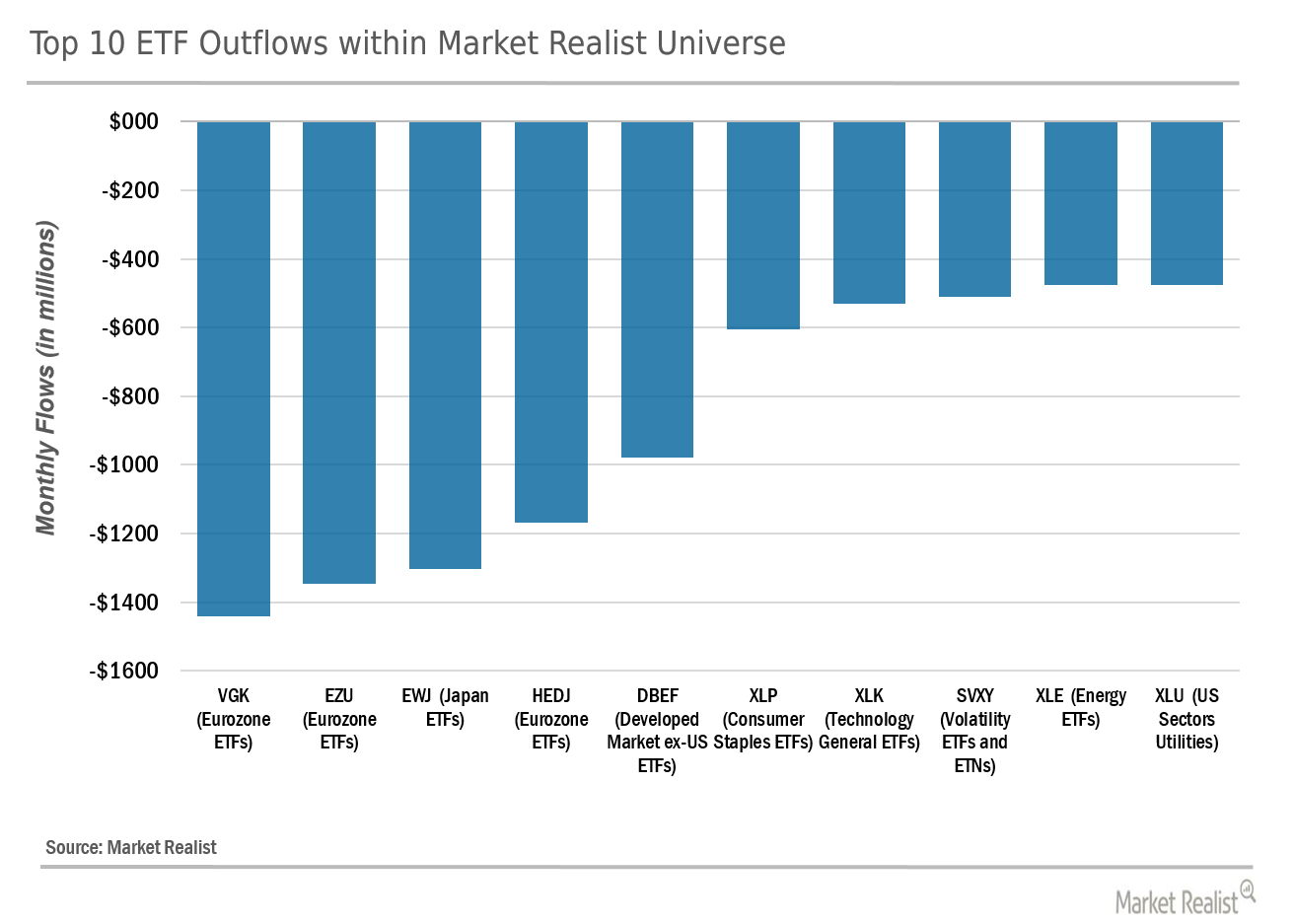

Category Flows: Looking for Yield? Be Picky!

The rise of the actively selective investor becomes more nuanced within the context of our entire ETF universe.

ETF Flows in 30 Seconds: 5 Things That Matter

Last week‘s ETF fund flows showed the beginning of a remarkable shift in investor behavior and asset allocation.

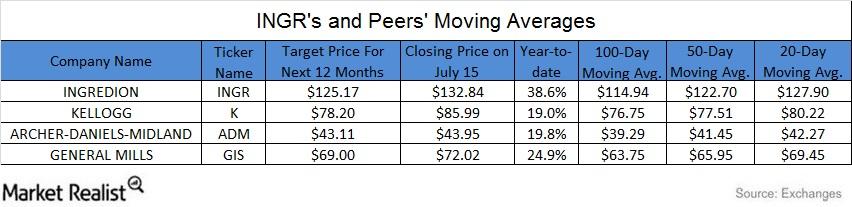

How Does Ingredion Compare to Peers on Key Moving Averages?

On July 15, 2016, Ingredion (INGR) closed at $132.84. It traded 15.6% above its 100-day moving average, 8.3% above its 50-day moving average, and 3.9% above its 20-day moving average.