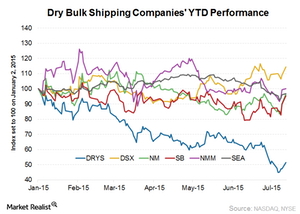

Star Bulk Carriers Corp.

Latest Star Bulk Carriers Corp. News and Updates

What Do Fundamental Bulk Shipping Indicators Say?

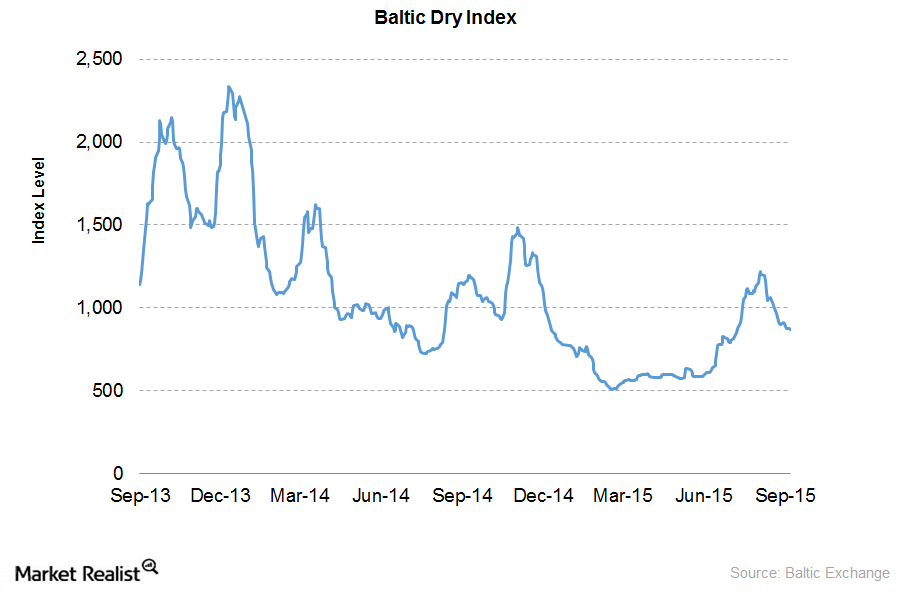

The BDI (Baltic Dry Index) is a leading indicator for the bulk shipping industry. It’s a measure of the cost of shipping major bulk commodities on a number of shipping routes.

Recommendation: Capitalize on dry bulk shipping’s cyclical waves

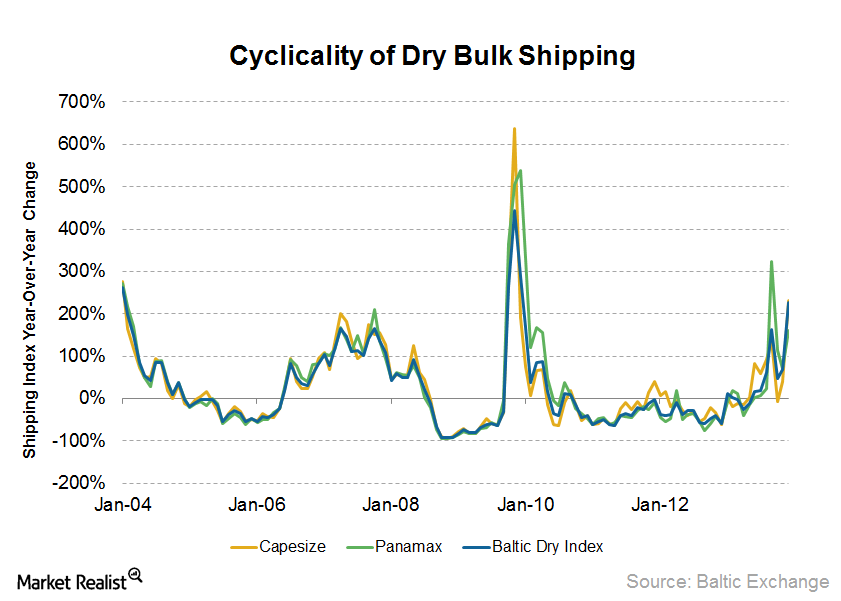

The dry bulk shipping industry is cyclical mainly due to economic or business cycles as well as a long lead time between the placement of orders and the delivery of new vessels.

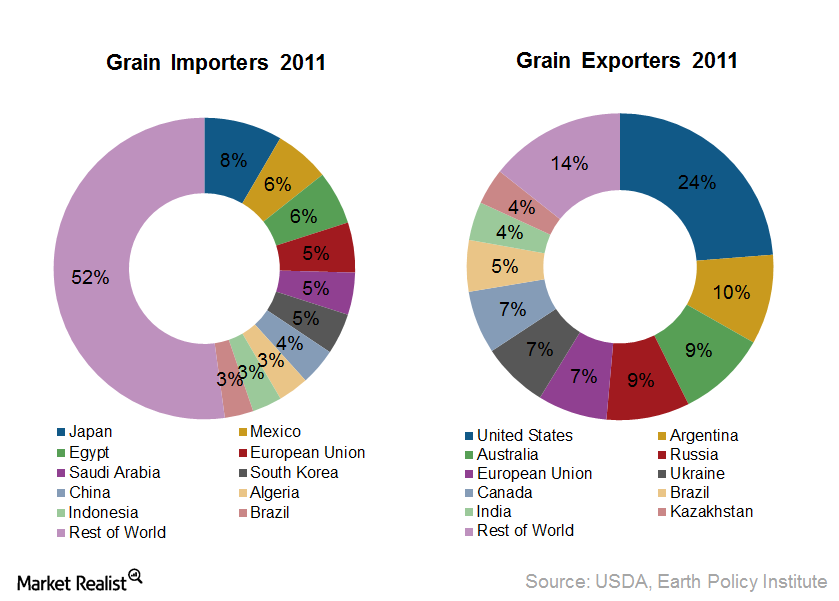

Major importers and exporters of grain and oilseed

Compared to iron ore and coal, the grain and oilseed trade makes up a much smaller part of overall dry bulk shipments—about 10%.

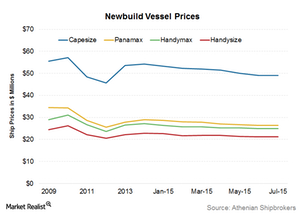

Newbuild Vessel Prices Remained Steady in July

Newbuild vessel prices for all of the ship sizes remained constant in July 2015—compared to June 2015—according to data from Athenian Shipbrokers.

Where Is the Dry Bulk Shipping Industry Headed?

In this series, we’ll discuss some of the important metrics that drive the dry bulk shipping industry. Investors can gain exposure to commodities through the SPDR S&P Metals and Mining ETF (XME).

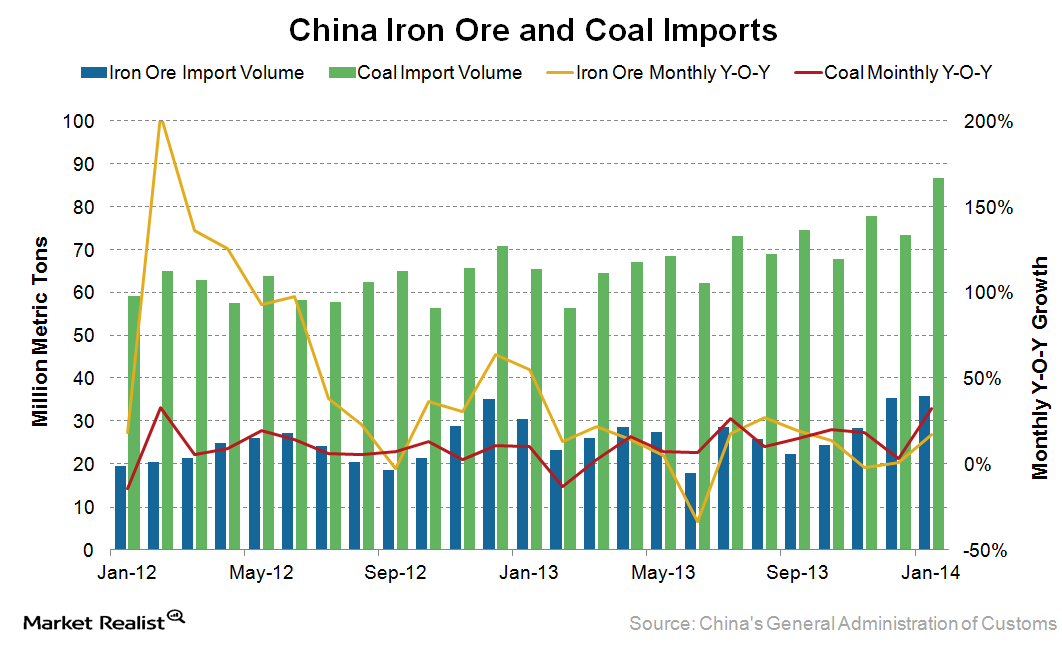

Why China saw high growth in iron ore and coal imports in January

China’s iron ore and coal imports are key factors that drive shipping rates. Iron ore and coal each account for nearly 30% of the world’s dry bulk trade volume.