First Trust NASDAQ Rising Div Achiev ETF

Latest First Trust NASDAQ Rising Div Achiev ETF News and Updates

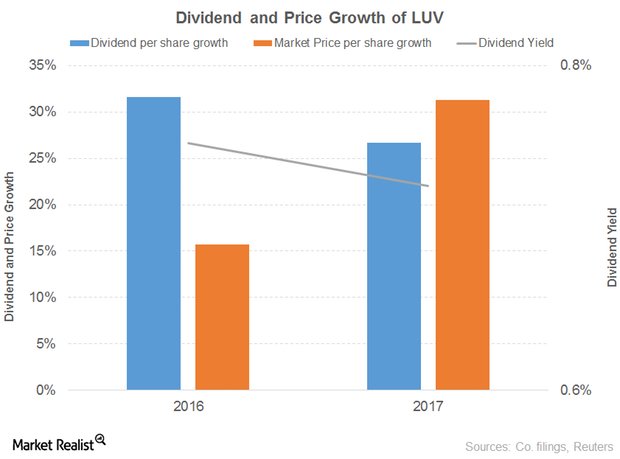

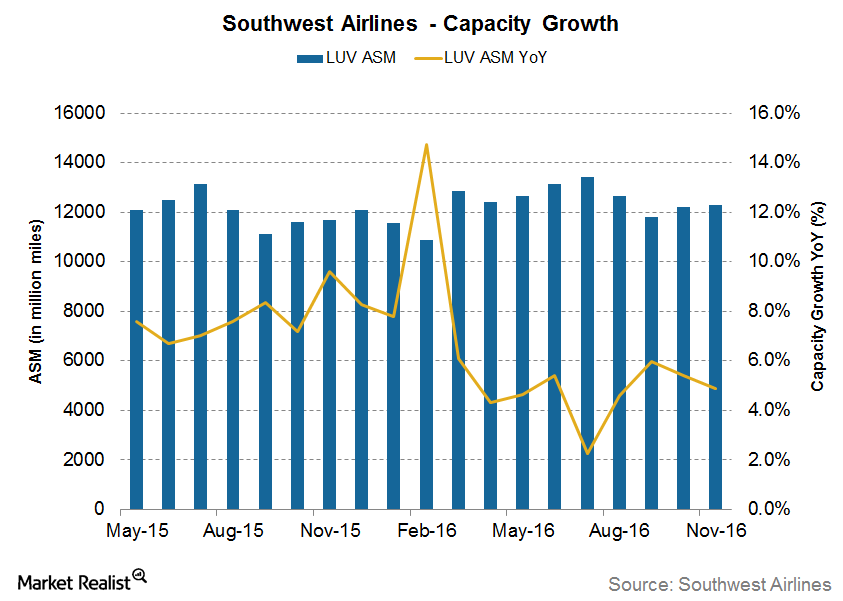

Here’s What Influenced the Outlook for Southwest Airlines

Southwest Airlines’ (LUV) operating revenue grew 3% and 4% in 2016 and 9M17, respectively.

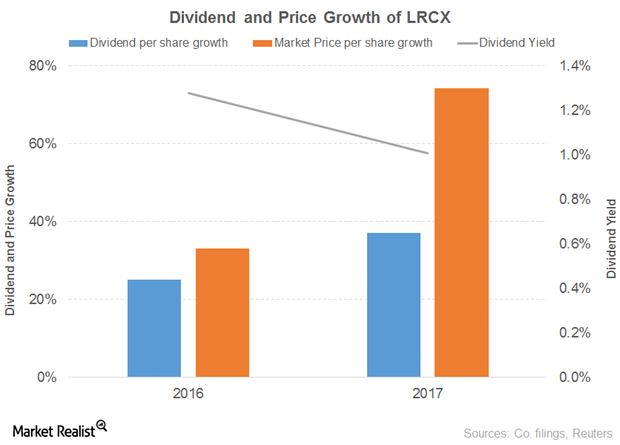

What’s Contributing to Promising Outlook for Lam Research?

Lam Research’s (LRCX) revenue rose 12% and 36% in 2016 and 2017, respectively. It rose 52% in 1Q18.

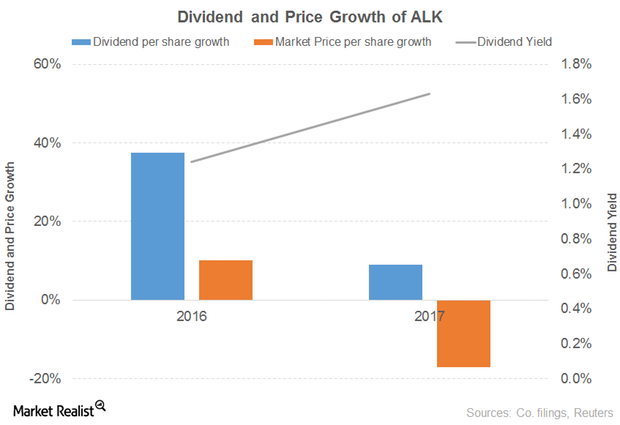

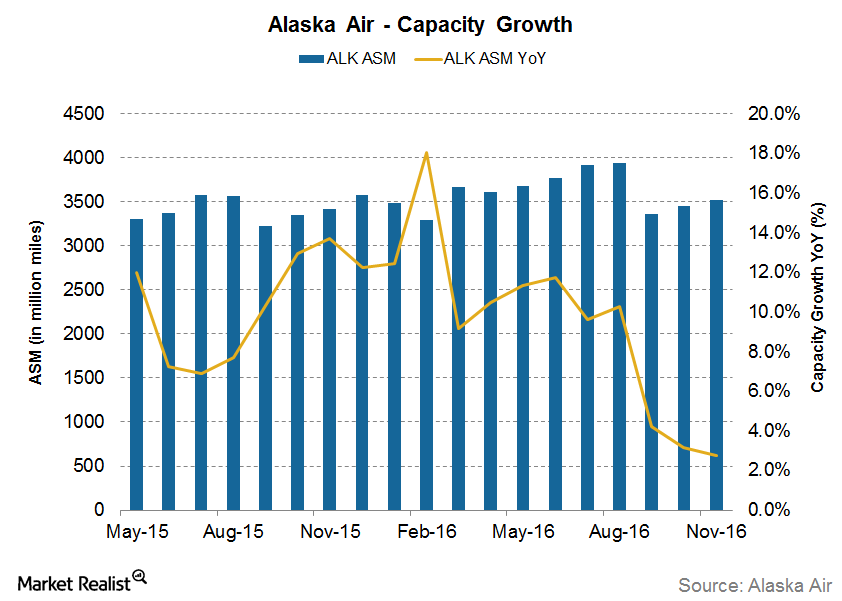

What’s the Outlook for Alaska Air Group?

Alaska Air Group’s (ALK) operating revenue rose 6% and 35% in 2016 and 9M17, respectively.

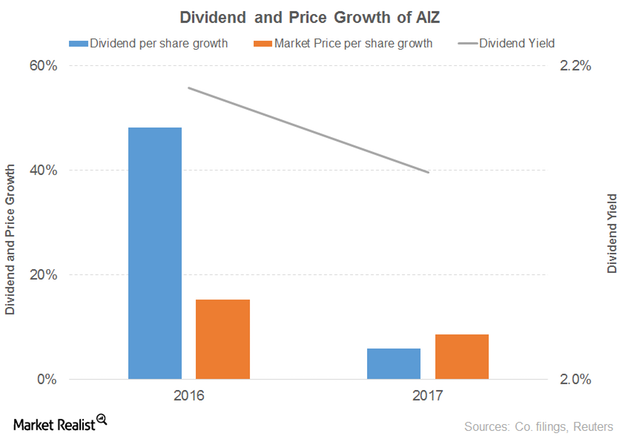

Why Assurant Has a Positive Outlook despite a Weak 2017

Assurant’s (AIZ) revenue fell 27% and 18% in 2016 and 9M17, respectively.

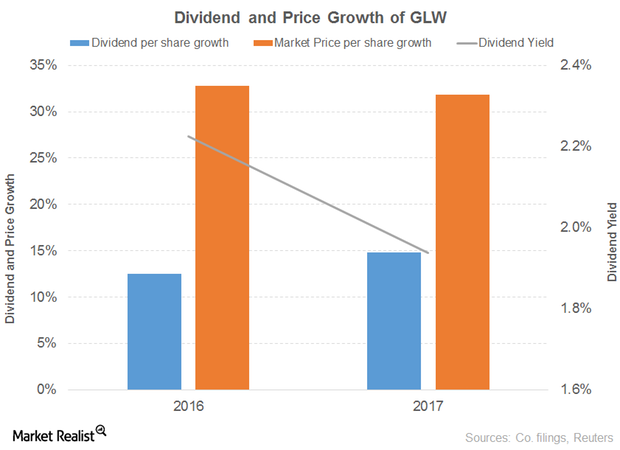

What Are Corning’s Key Growth Drivers?

Corning’s gross margin grew 3% and 9% in 2016 and 9M17, respectively.

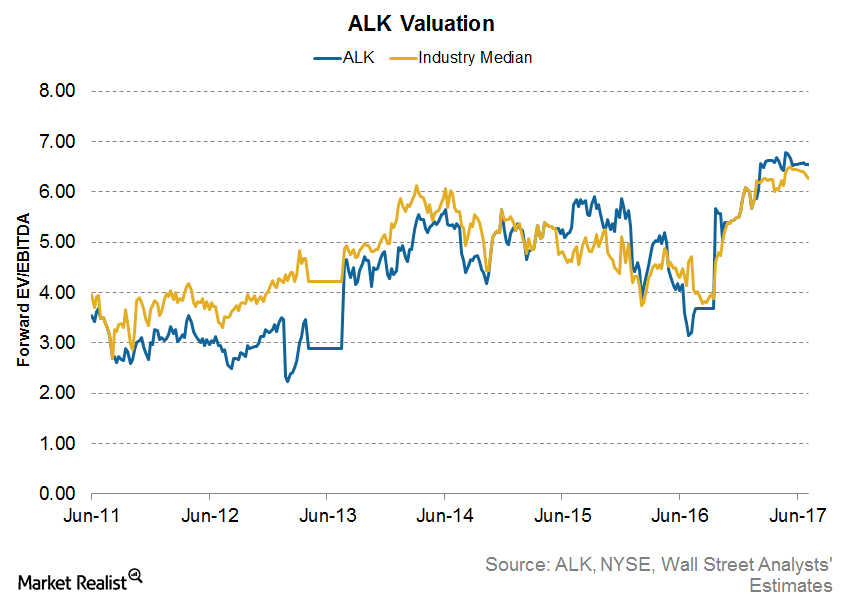

Inside Alaska Air’s Valuation: Cheap Enough?

Alaska Air Group (ALK) is now trading at 6.6x its forward EV-to-EBITDA ratio—one of the highest valuations in the industry.

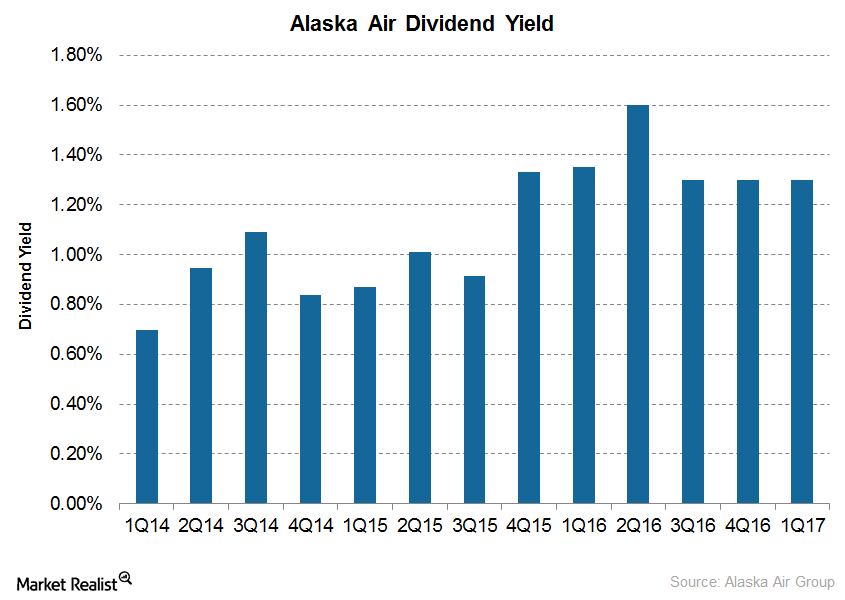

Inside Alaska Air’s Dividend Payout Prospects in 2017

There are only four airlines that currently pay dividends. This is due to the fact that airlines have struggled to stay profitable for a long time now.

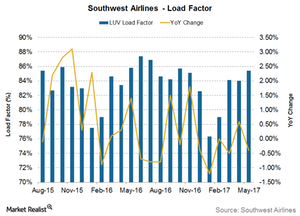

Is LUV on Track to Achieve Its Unit Revenue Guidance?

Because Southwest Airlines’ (LUV) traffic growth lagged its capacity growth in three of the first five months of 2017, its utilization also fell in three of the five months.

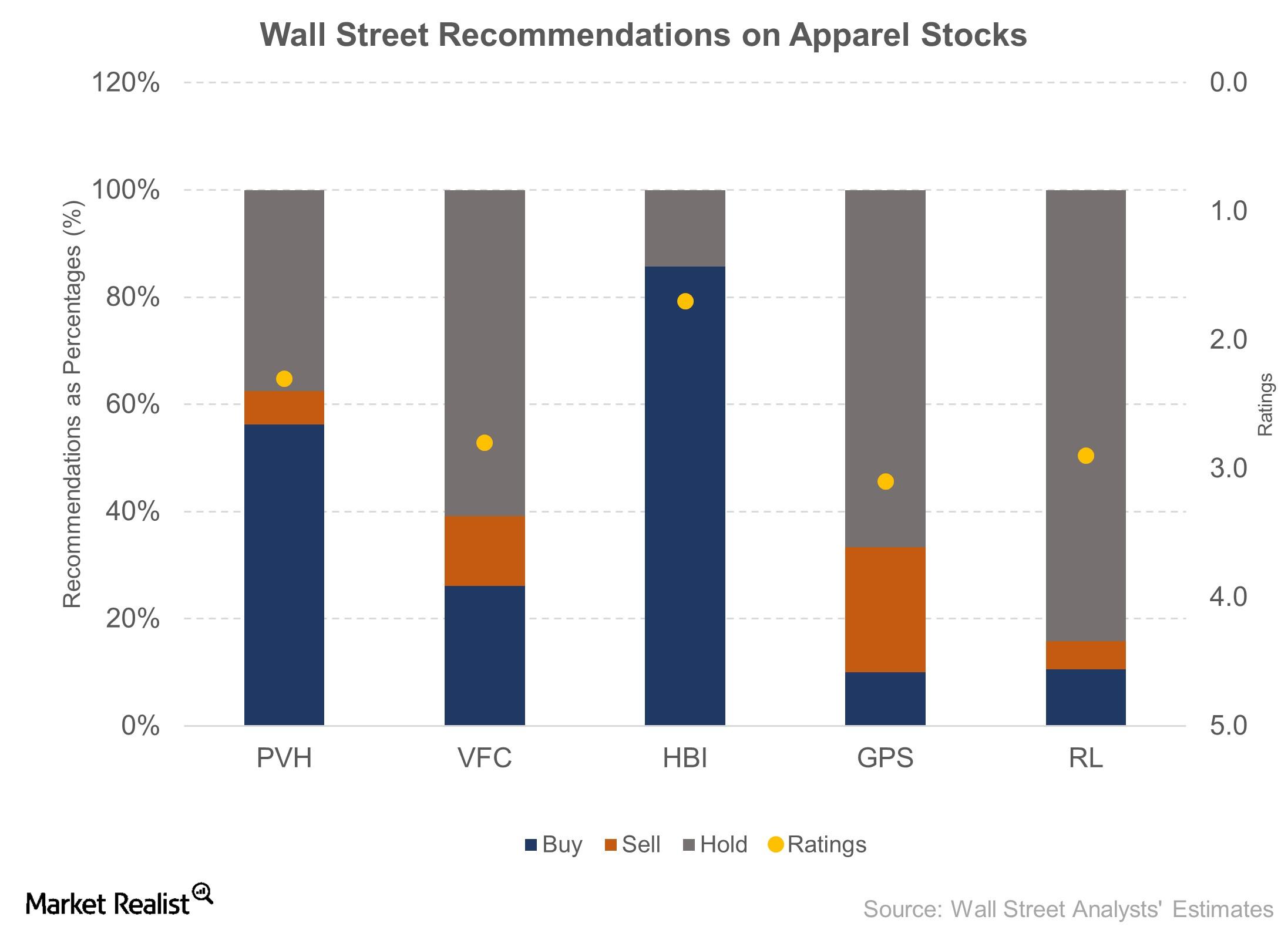

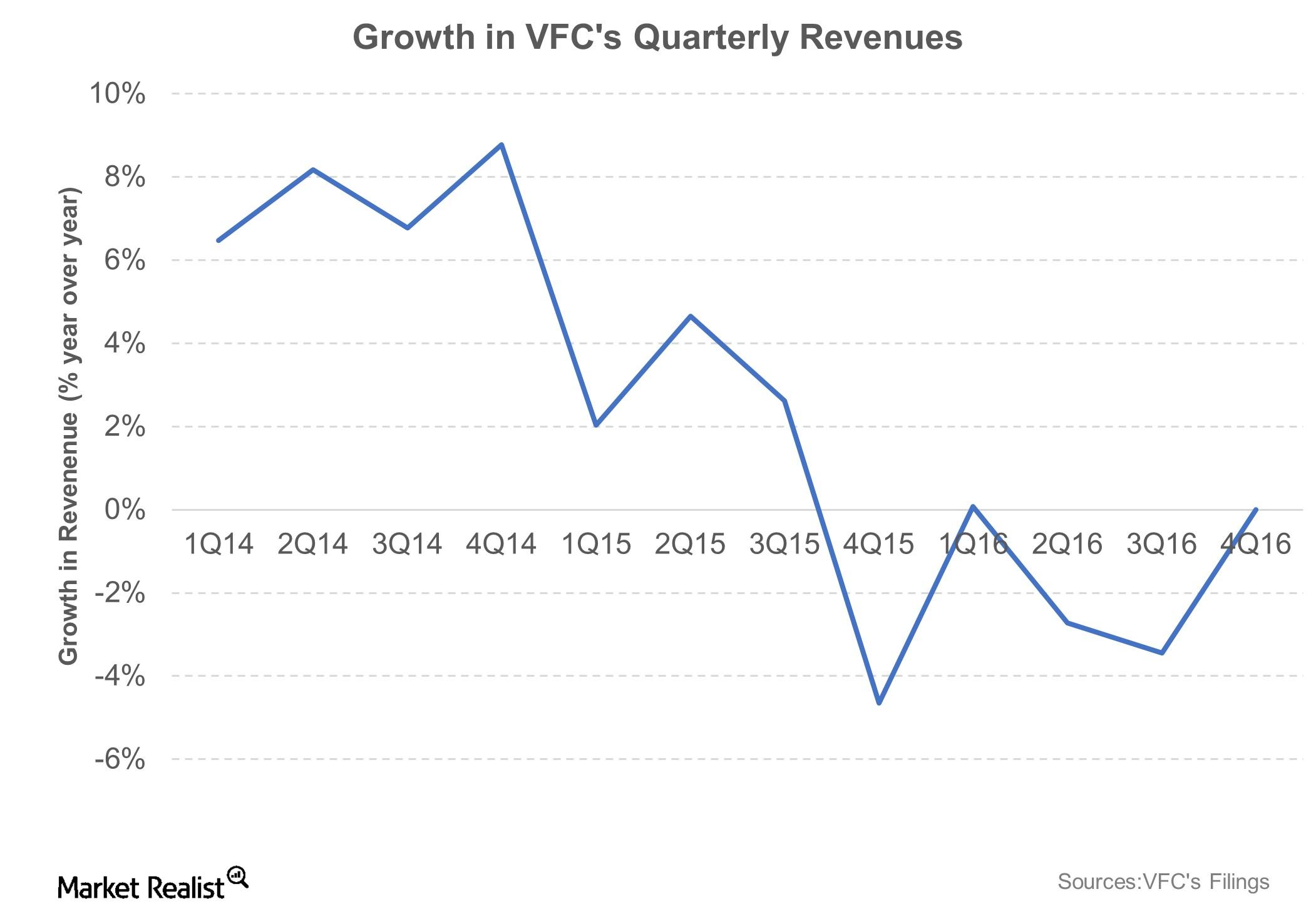

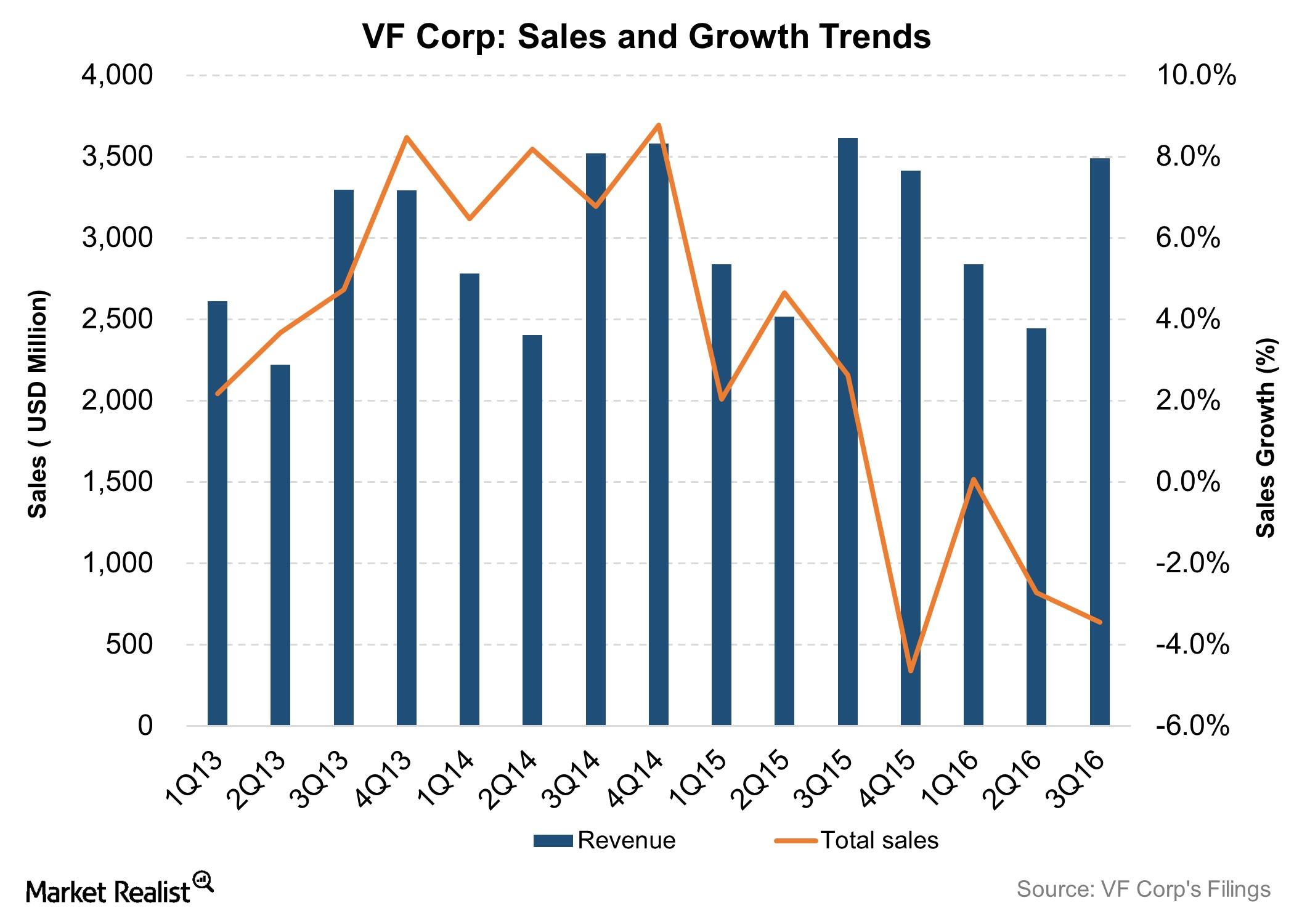

Wall Street Sees a 1% Upside on VFC Stock

VFC is covered by 23 Wall Street analysts who have a neutral view on the company. Plus, 26% of these analysts recommended a “buy,” 61% recommended a “hold,” and 13% recommended a “sell” on the stock.

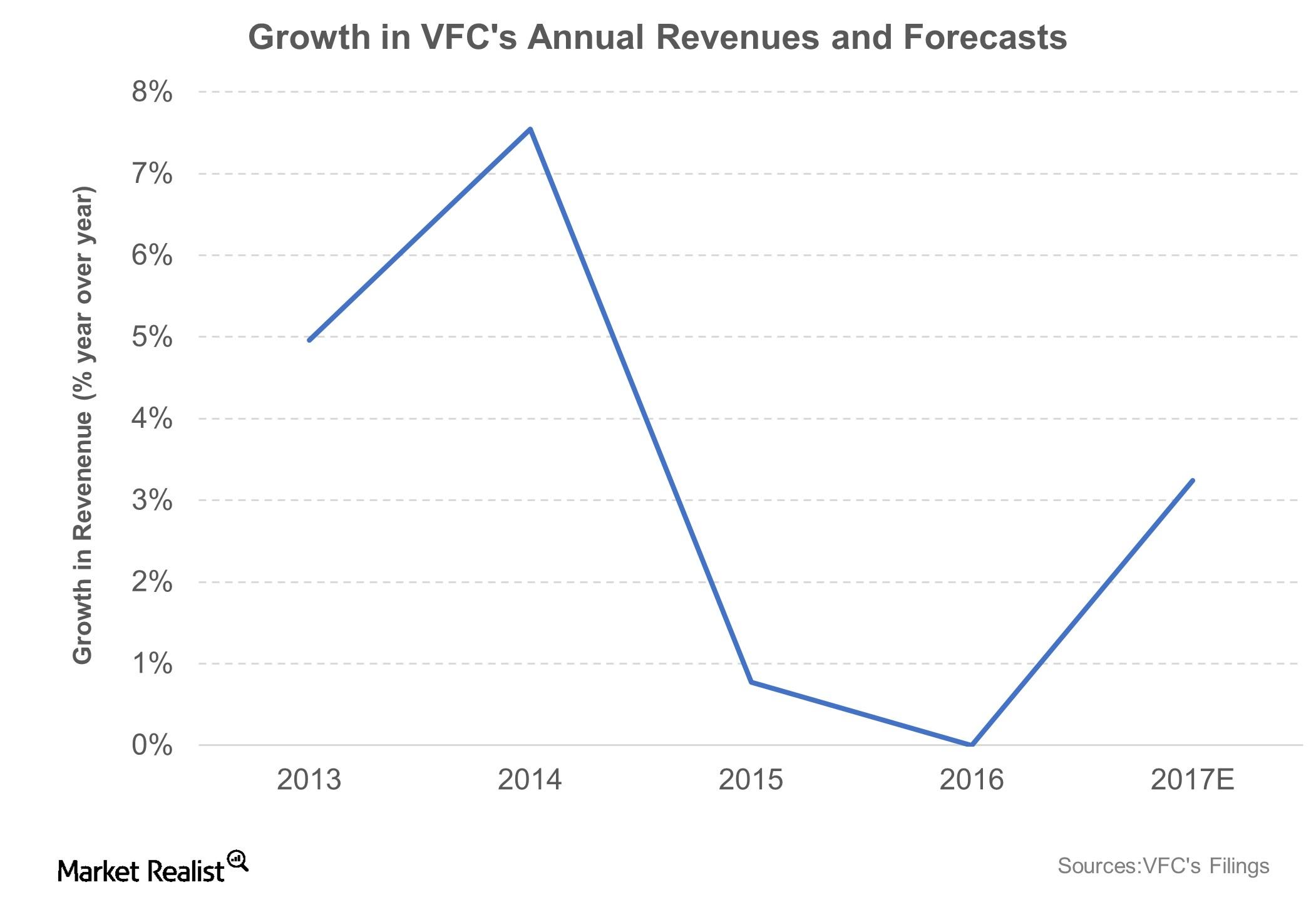

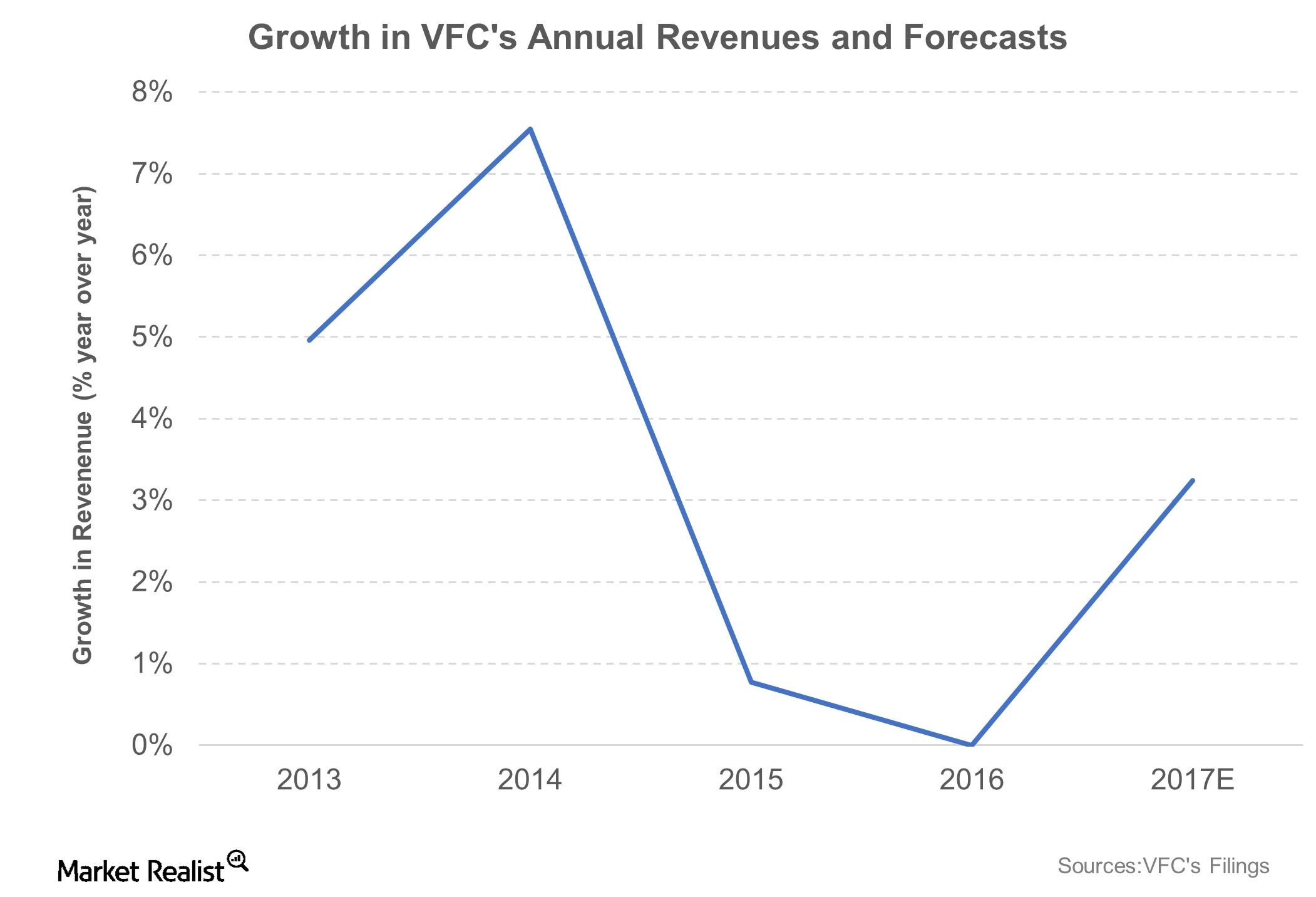

Looking Ahead: What Could Drive VFC in Fiscal 2017?

After reporting flat top-line growth in fiscal 2016, VF Corporation’s (VFC) management is looking for a low single-digit percentage increase in the company’s fiscal 2017 top line.

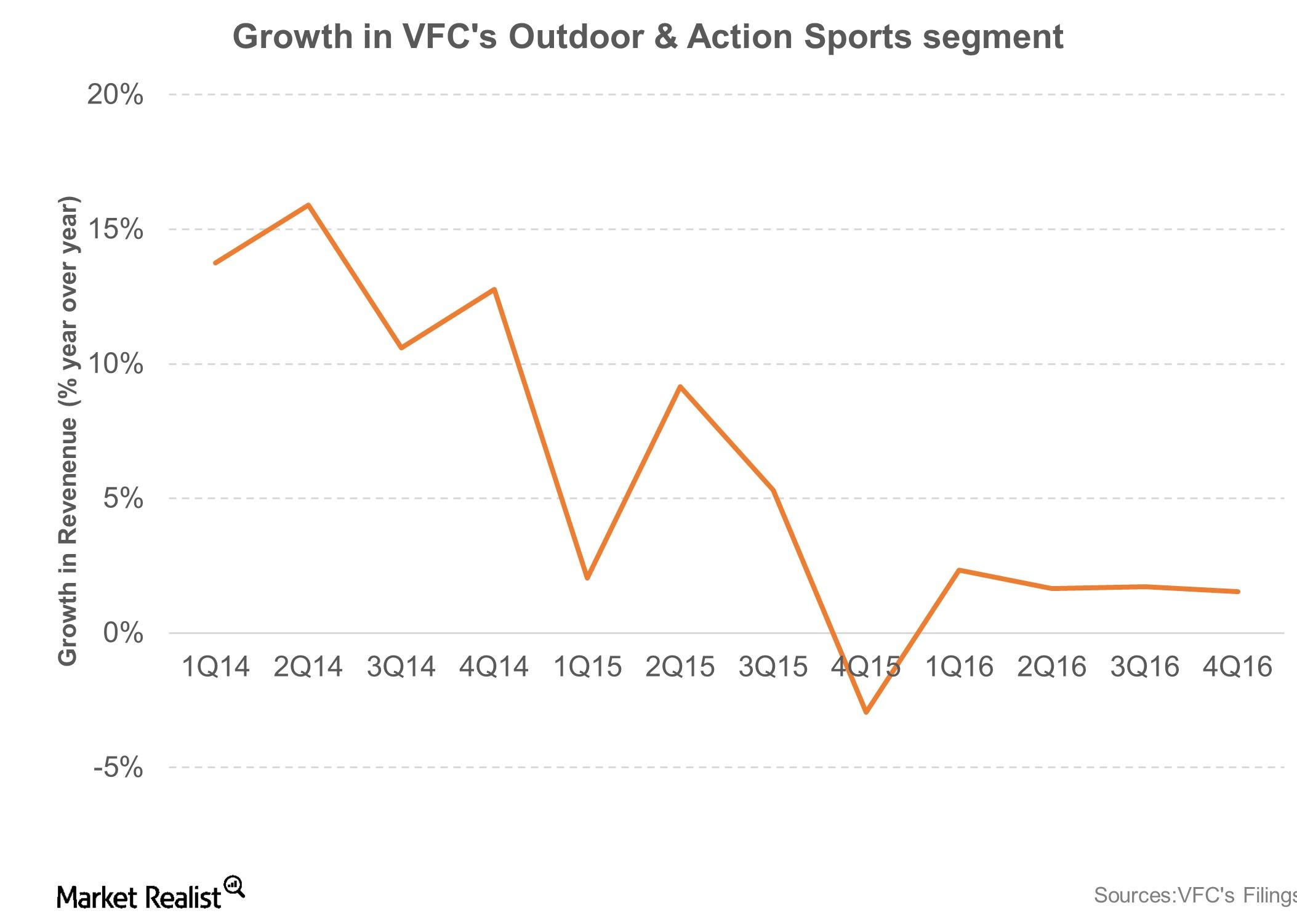

A Quick Look at VFC’s Fiscal 2016 Revenue Drivers

VF Corporation’s (VFC) Outdoor & Action Sports revenues grew 2% in fiscal 2016 to $7.5 billion.

Another Robust Quarter by Vans Boosts VFC’s Fiscal 4Q16 Top Line

Revenues from VFC’s Outdoor and Action Sports segment rose 2% YoY to $2.1 billion, slightly below the company’s expectations.

Key Drivers of VF Corporation’s Top Line in Fiscal 4Q16

VF Corporation’s D2C revenues rose 11% YoY, gaining strength from a mid-teen surge in the Outdoor & Action Sports and a low double-digit rise in Jeanswear.

VFC: Wholesale versus Direct-to-Customer Channel

VFC’s Direct-to-Customer channel is likely to grow more slowly than the company had expected earlier.

Capacity Growth: Is Alaska Air Group Reducing the Pace?

For November 2016, Alaska Air Group’s capacity rose 2.8% YoY (year-over-year). It’s the slowest growth in any month in 2016.

Southwest Airlines: Slowing Capacity Growth in November

For November 2016, Southwest Airlines’ (LUV) capacity grew 4.9% YoY (year-over-year). It’s slower than 5.4% YoY growth the previous month.

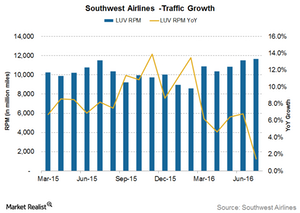

How Traffic Growth Lags behind Capacity at Southwest Airlines

In July 2016, Southwest Airlines’ (LUV) traffic grew by 1.4% YoY, which was slightly lower than its capacity growth of 2.3% YoY.