Post Holdings Inc

Latest Post Holdings Inc News and Updates

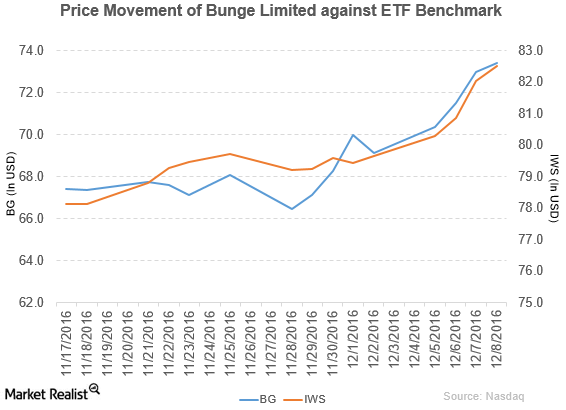

Bunge Limited Has Declared Dividends

Price movement Bunge Limited (BG) has a market cap of $10.4 billion. It rose 0.55% to close at $73.40 per share on December 8, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.9%, 5.4%, and 10.4%, respectively, on the same day. BG is trading 7.8% above its 20-day moving average, 14.4% […]

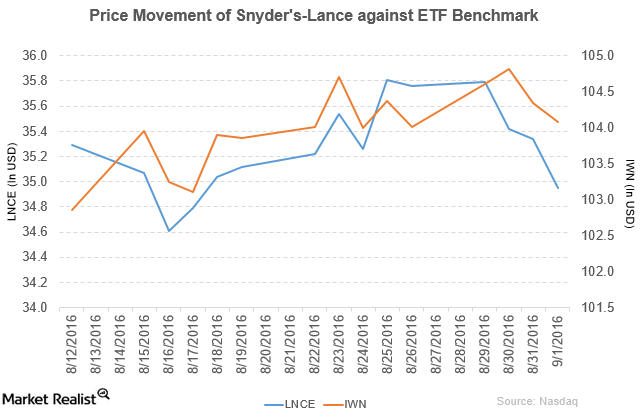

Snyder’s-Lance Acquired Metcalfe’s Skinny to Expand Its Business

Snyder’s-Lance fell by 1.1% to close at $34.95 per share on September 1, 2016. Its weekly, monthly, and YTD price movements were -2.4%, 2.2%, and 3.4%.

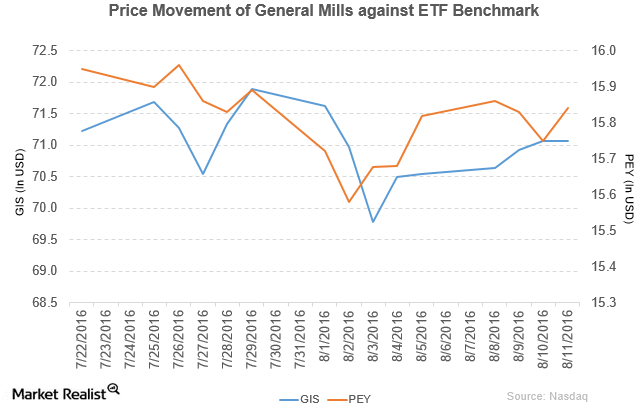

General Mills Rose by Just 0.01% on August 11: Why?

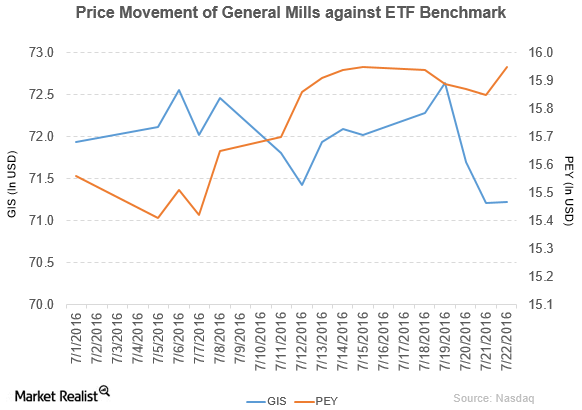

General Mills (GIS) has a market cap of $42.7 billion. It rose by 0.01% to close at $71.07 per share on August 11, 2016.

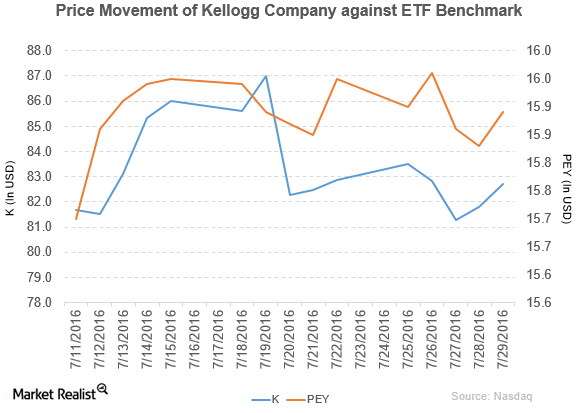

Kellogg Company Has Declared a Quarterly Dividend

Kellogg Company (K) has a market capitalization of $28.8 billion. It rose by 1.1% to close at $82.71 per share on July 29, 2016.

Why Did General Mills Expand the Recall of Its Products?

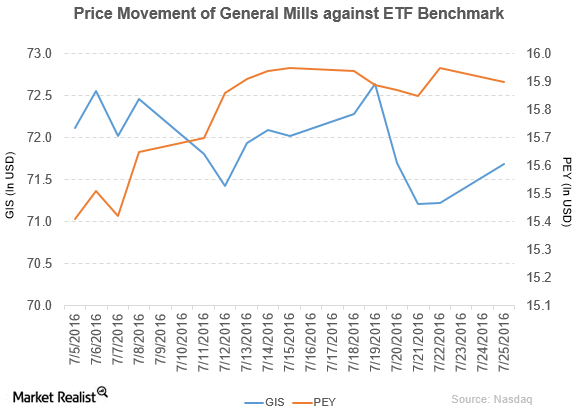

General Mills rose by 0.66% to close at $71.69 per share on July 25. The stock’s weekly, monthly, and YTD price movements were -0.82%, 8.1%, and 27.1%.

How Did Kimberly-Clark Perform in 2Q16?

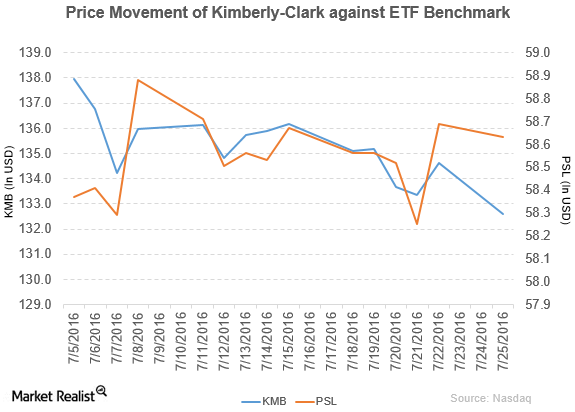

Kimberly-Clark fell by 1.5% to close at $132.59 per share on July 25. The stock’s weekly, monthly, and YTD price movements were -1.9%, -1.0%, and 5.6%.

General Mills Announces Restructuring Plans

General Mills fell by 1.1% to close at $71.22 per share in the third week of July. Its weekly, monthly, and YTD price movements were -1.1%, 8.0%, and 26.2%.

What Drove Down General Mills’ Revenue Growth for Fiscal 4Q16?

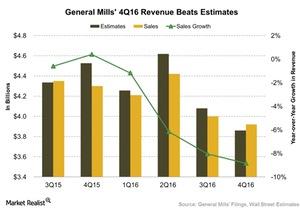

General Mills’ (GIS) net sales for fiscal 4Q16 fell 9% year-over-year. However, they beat analysts’ estimates by 2%.

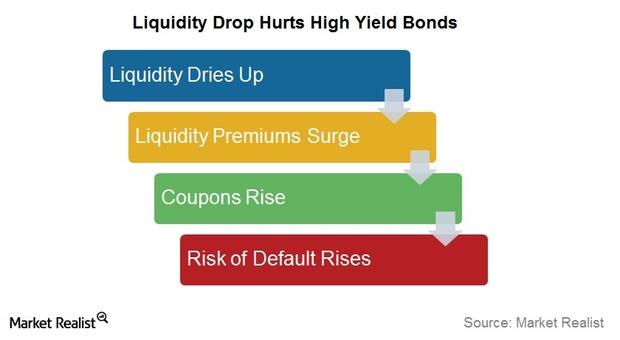

Investors in Junk Bond Mutual Funds Should Worry about Liquidity

If liquidity declines for junk bonds, the liquidity risk premium would rise. This would increase the coupon set on the bond. It will raise the borrowing cost for a company.

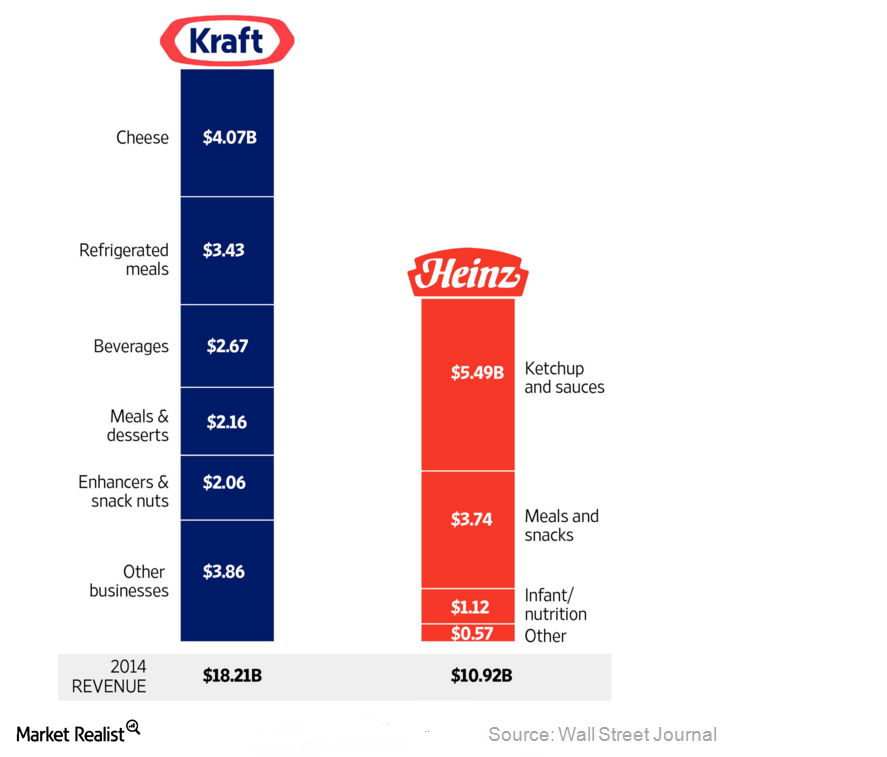

A Key Analysis of the Kraft-Heinz Merger

In early 2015, Berkshire Hathaway and 3G Capital designed the Kraft-Heinz merger by pairing the Kraft Foods Group with H. J. Heinz Company.

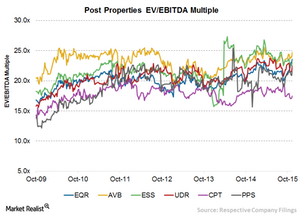

What Post Properties’ Higher-than-Average EV-to-EBITDA Multiple Means

Post Properties’ EV-to-EBITDA ratio is in line with its historical valuation, ranging between 12.2x–25.5x, with a current EV-to-EBITDA ratio of ~21.7x.

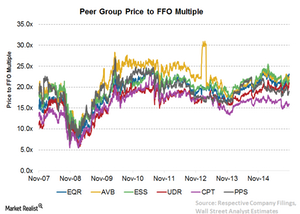

Assessing Post Properties’ Average Price-to-FFO Multiple

Post Properties’ TTM price-to-FFO multiple is in line with its historical valuation at around 18.9x.

A Must-Read Company Overview of Post Properties

Headquartered in Atlanta, Georgia, Post Properties is structured as an REIT and completed its initial public offering in 1993.