Natural Resources Partners LP

Latest Natural Resources Partners LP News and Updates

What Could Drive Arch Coal Stock in 2017?

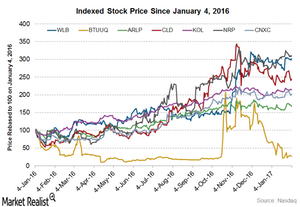

Although the majority of coal (KOL) stocks began 2016 on a weak note, they outperformed the broader market in 2016.

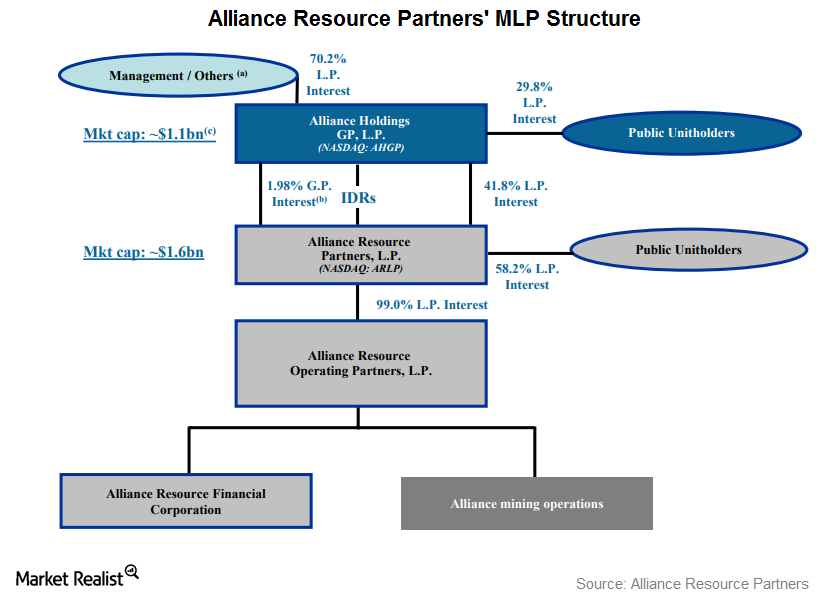

Understanding the Master Limited Partnership Structure of Alliance Resource Partners

As of December 31, 2016, Alliance Resource Partners was being managed by its MGP, which is 100% owned, directly and indirectly, by AGHP.

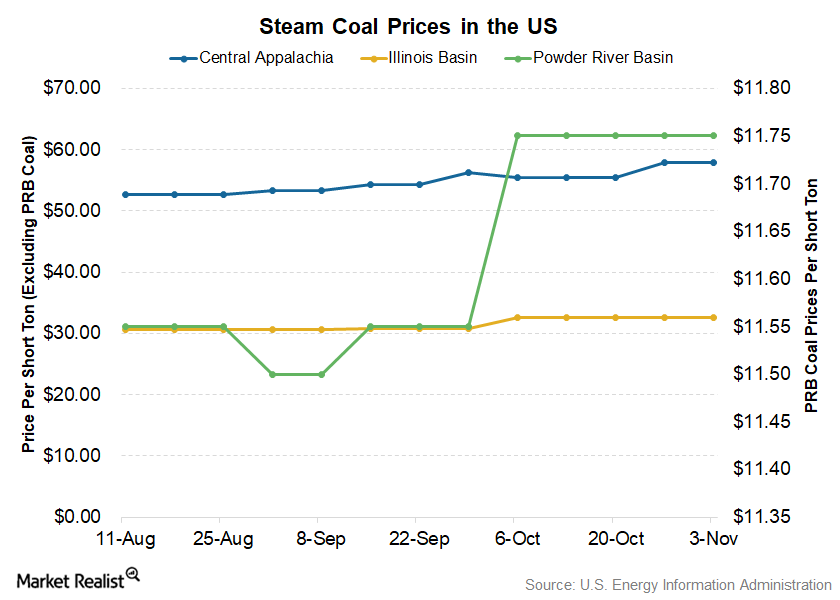

Spot Coal Prices Remained Flat in the Week Ending November 3

Powder River Basin coal settled at $11.75 per short ton, while Illinois Basin spot coal prices closed at $32.60 per short ton.

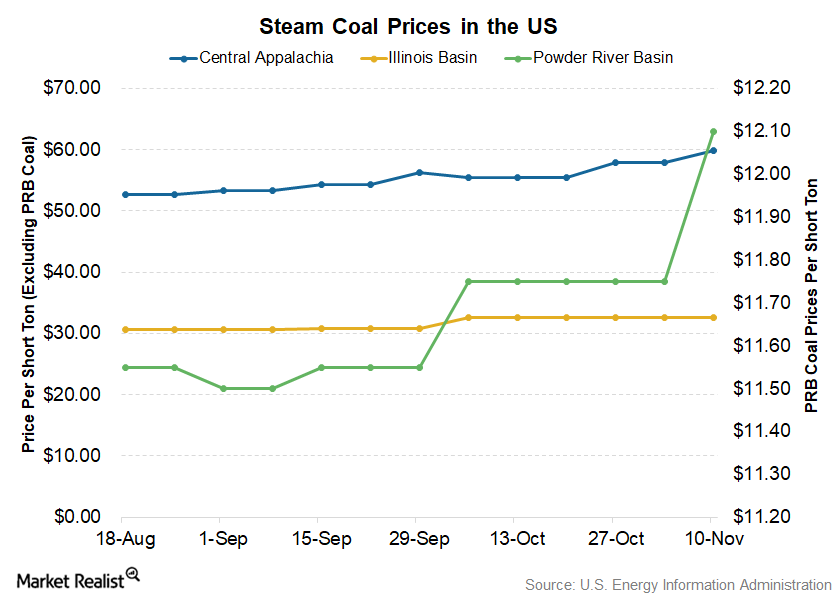

Powder River Basin Coal Spot Prices Recovered Sharply

During the week ended November 10, 2017, PRB coal closed at $12.10 per short ton, which was ~3% higher than $11.75 per short ton that coal maintained for the past five weeks.

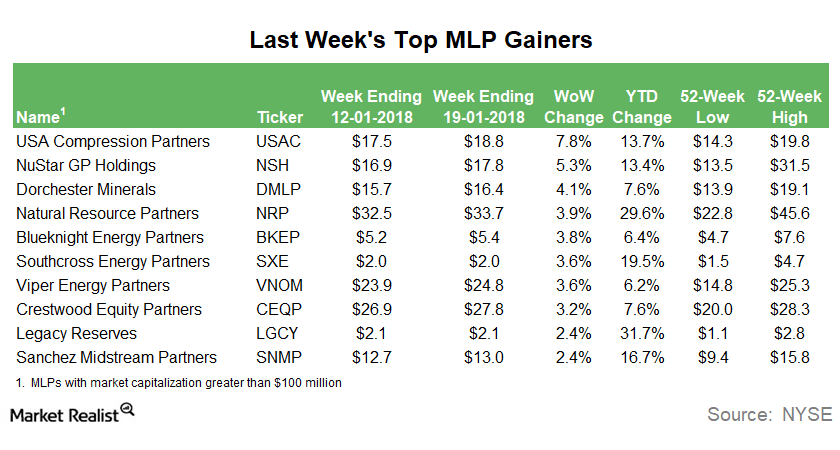

Why USAC Was the Top MLP Last Week

USA Compression Partners (USAC), a midstream MLP involved in natural gas contract compression services, was the top MLP gainer last week with WoW (week-over-week) gains of 7.8%.

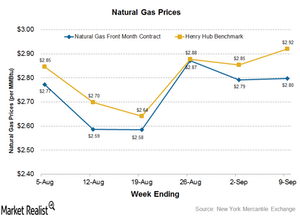

Cleaner Natural Gas Production Continuing to Hurt Coal Miners

Henry Hub benchmark natural gas prices came in at $2.92 per MMBtu for the week ended September 9, 2016, compared to $2.85 per MMBtu for the previous week.

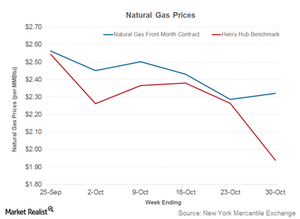

Coal under Pressure as Natural Gas Prices Remain Subdued

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices fall, coal loses market share. It becomes more economical to use natural gas for power generation.

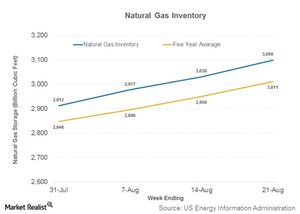

Natural Gas Inventory Figure Puts Pressure on Coal

The EIA’s natural gas inventory report for the week ended August 21 came in at 3,099 billion cubic feet, compared to 3,030 Bcf a week earlier. Natural gas is stored underground to save the fuel for peak demand during the winter.