Mallinckrodt PLC

Latest Mallinckrodt PLC News and Updates

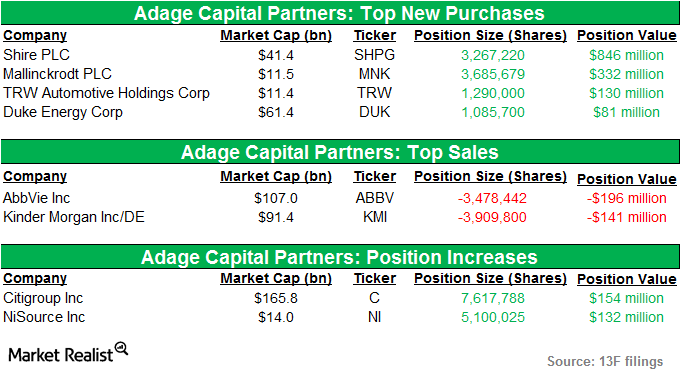

Adage Capital adds a new position in Mallinckrodt

Adage Capital added a new position in Mallinckrodt Plc (MNK) in the third quarter of 2014. The position accounted for 0.82% of the fund’s total portfolio.

Central Nervous System Is Key to Teva’s Specialty Medicines

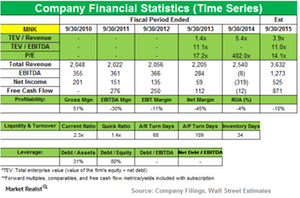

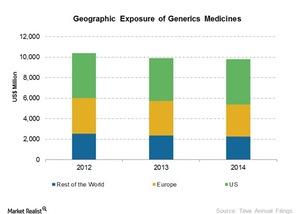

Revenues for Teva’s (TEVA) Specialty Medicines segment grew by 2.1% to $8,560 million in 2014, from $8,388 million in 2013.

A key overview of Adage Capital’s holdings in 3Q14

Adage Capital’s US long portfolio grew from $38.69 billion in 2Q14 to $40.2 billion in 3Q14. The portfolio comprised around 699 stocks.

Baxter International Completes Its Mallinckrodt Assets Buy

Baxter (BAX) announced the completion of its acquisition of Recothrom and Preveleak assets from Mallinckrodt for $185.0 million.

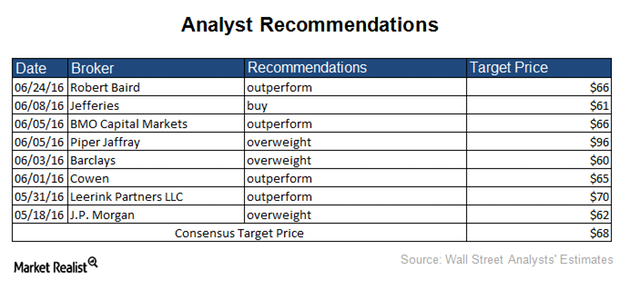

Inside Neurocrine Biosciences’ Analyst Recommendations in 2016

Based on the recommendations of eight brokerage firms, a Bloomberg survey reported that 100% of analysts gave Neurocrine Biosciences “buy” recommendations.

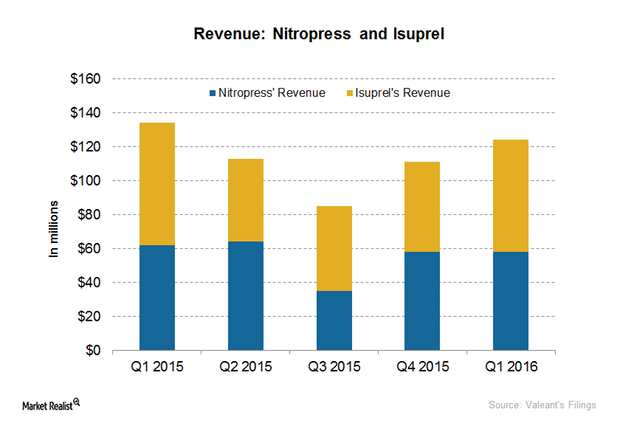

The Facts behind the Valeant Drug Pricing Controversy

Valeant Pharmaceuticals International (VRX) significantly raised the prices of two of its heart drugs—Nitropress and Isuprel—which caused a controversy and an outrage.

What Happened in the Valeant-Philidor Controversy?

Valeant’s (VRX) controversies started with Philidor, a specialty pharmacy company that was accused of altering doctor’s prescriptions so it could sell more of Valeant’s costly drugs.

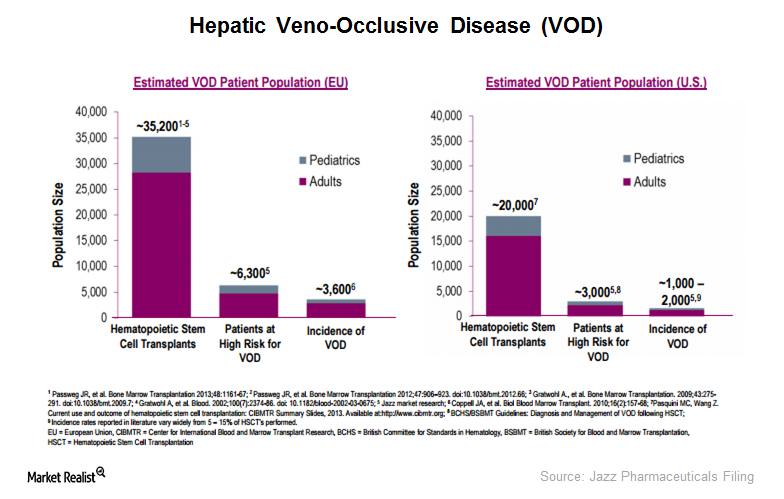

Defitelio: Volume and Pricing Challenges

Jazz Pharmaceuticals’ Defitelio is the first and only approved treatment that increases survival in VOD patients with multi-organ dysfunction (or MOD).

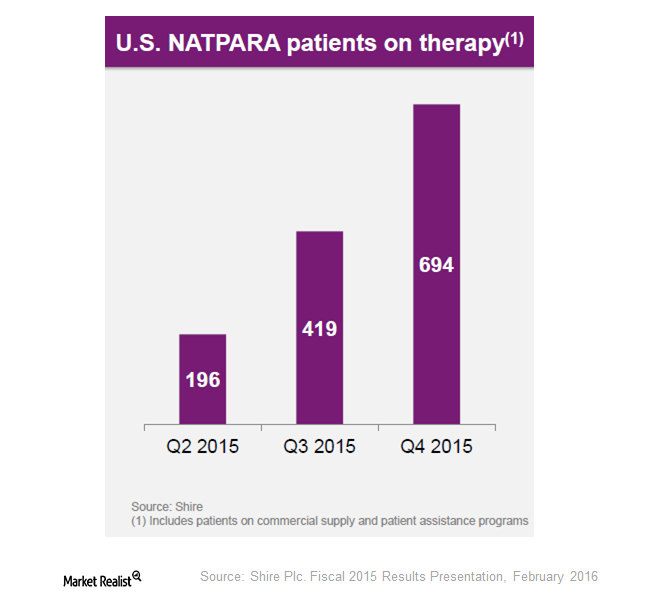

Shire’s Acquisition Gives It Natpara and Gattex

Gattex is the first and only analog of glucagon-like peptide-2 (or GLP-2) indicated for short bowel syndrome. The drug is known as Gattex in the United States and Revestive in Europe.