Ligand Pharmaceuticals Inc

Latest Ligand Pharmaceuticals Inc News and Updates

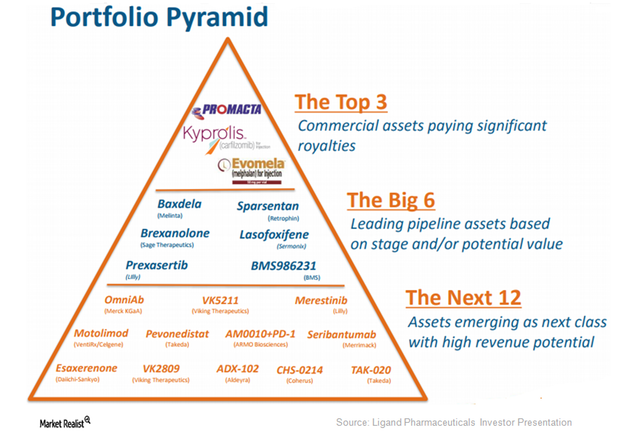

Ligand Pharmaceuticals Focuses on Increasing Returns for Shareholders

Ligand Pharmaceuticals has developed a product portfolio that spans more than 700 patents offering varying degrees of protection to the assets.

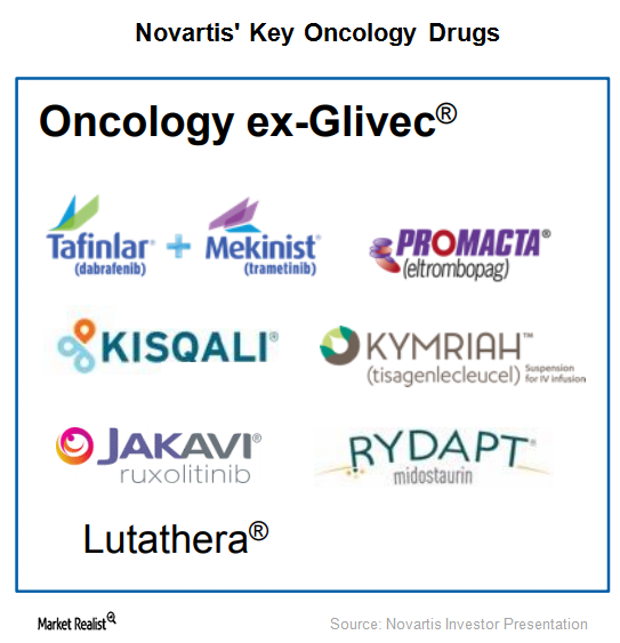

Promacta and Jakavi May Boost Novartis’s Oncology Segment Revenues

Jakavi reported sales of $228.0 million in 4Q17, which is a year-over-year rise of 33.0% on a constant currency basis.

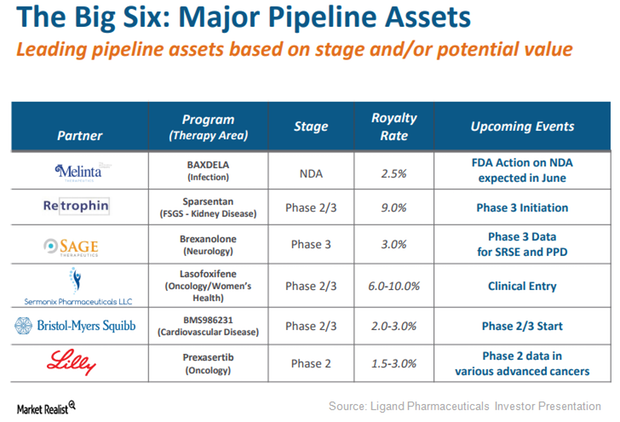

Captisol-Enabled Prexasertib May Be Major Growth Driver for Ligand

Eli Lilly’s (LLY) Captisol-enabled drug Prexasertib is currently being evaluated in multiple oncology indications such as head and neck cancer, small-cell lung cancer (or SCLC), and advanced metastatic cancer.

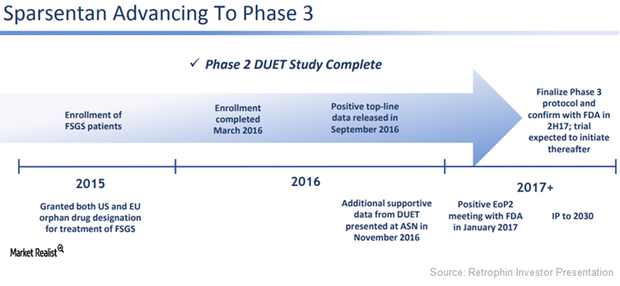

Sparsentan May Be Solid Near-Term Growth Driver for Ligand

With Sparsentan, Retrophin and Ligand Pharmaceuticals could become major nephrology players similar to peers such as Amgen (AMGN), AstraZeneca (AZN), and Bristol-Myers Squibb (BMY).

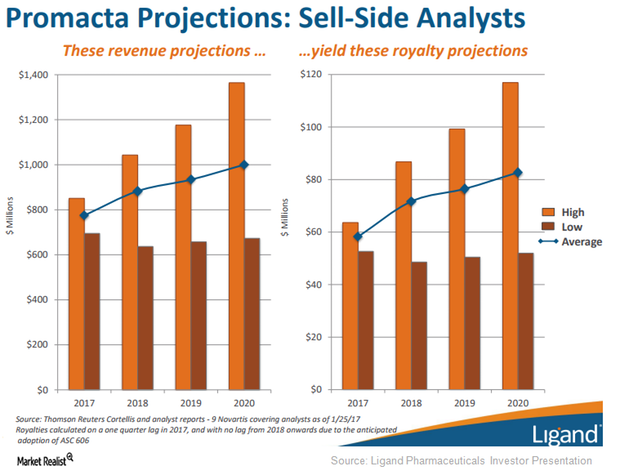

Ligand Pharmaceuticals Projects Higher Average Royalty Rate for Promacta

Ligand Pharmaceuticals (LGND) receives royalties from Novartis on Promacta’s sales according to a tiered annual payment structure.

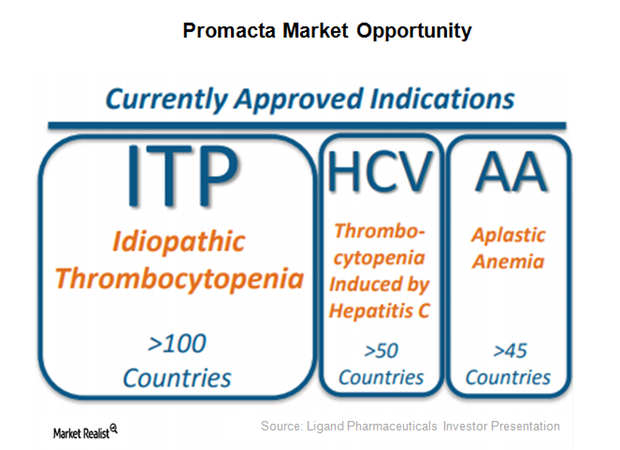

Promacta: A Major Growth Driver for Ligand Pharmaceuticals in 2017

Promacta was discovered by Ligand Pharmaceuticals (LGND) and GlaxoSmithKline (GSK) as a part of their thrombopoietin (or TPO) receptor agonist research collaboration.

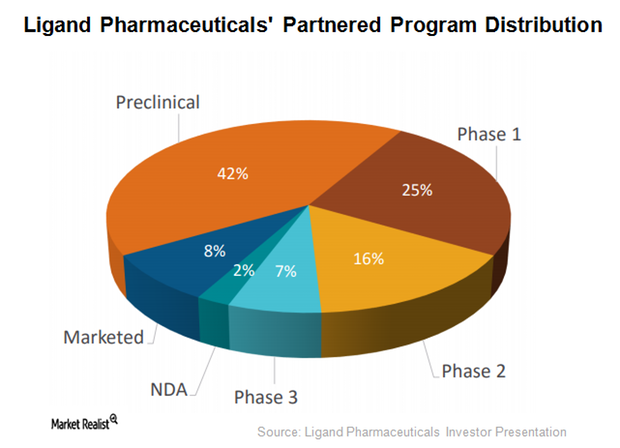

Fully Funded Partnerships May Drive Growth for Ligand Pharmaceuticals

Ligand Pharmaceuticals (LGND) expects its licensees to invest ~$2.0 billion for advancing more than 155 partnered research and development programs in 2017.

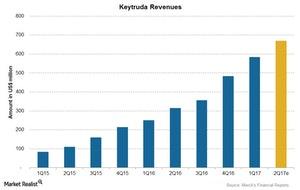

How Did Keytruda Perform in 1Q17?

Merck (MRK) launched Keytruda in 4Q14 and reported global sales of $584 million for 1Q17. As a result, the company reported ~134% growth in revenues compared to $249 million in 1Q16.

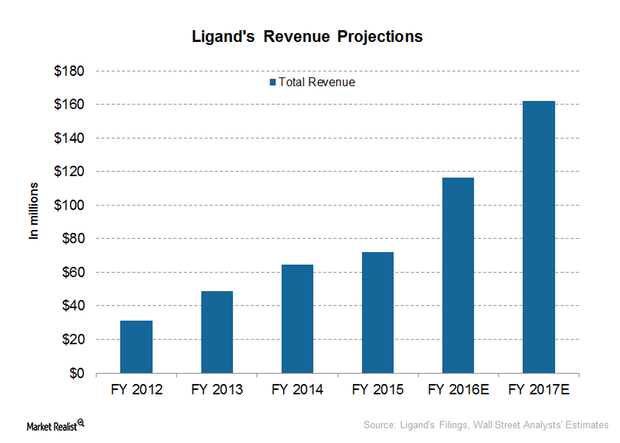

What Is Ligand Pharmaceuticals’s Expected Revenue Growth in 2016?

Ligand Pharmaceuticals (LGND) is a high-growth company with a comparatively low-risk business model. It earns most of its revenue from royalty and license fees.