SPDR® S&P Regional Banking ETF

Latest SPDR® S&P Regional Banking ETF News and Updates

Financials Financial intermediation, systemic risks, and “too big to fail”

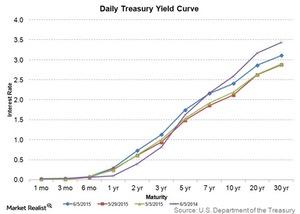

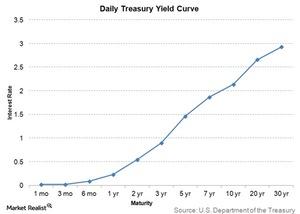

When financial intermediaries allocate funds, they assess the risks and returns that come from various risky claims. Intermediaries help allocate resources and risks throughout the economy. Financial intermediation can result in concentrated risks. The risks increase the financial system’s fragile state. These risks are called systemic risks.Financials Why the yield curve impacts bank profitability

Historically, a flatter yield curve had an adverse impact on the financial institutions’ returns. It lowered their net interest margins. The Fed continues to stress an accommodative monetary policy. The policy and strong overseas demand have kept yields low at the long end of the curve. As a result, the difference between 30-year and five-year Treasury yields fell to 154 basis points on September 5, 2014.Financials Why the banking sector is better, but with room for improvement

Russ explains the good news behind his upgrade of the global financial sector as well as the bad news keeping his sector outlook somewhat subdued.

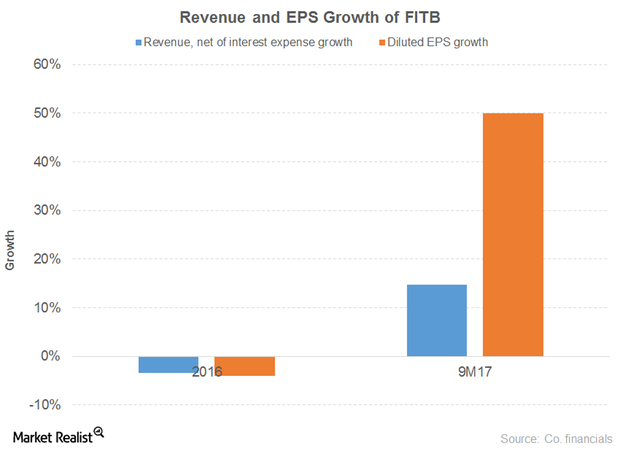

How Fifth Third Bancorp Has Performed Recently

Fifth Third Bancorp has an impressive free cash flow position.

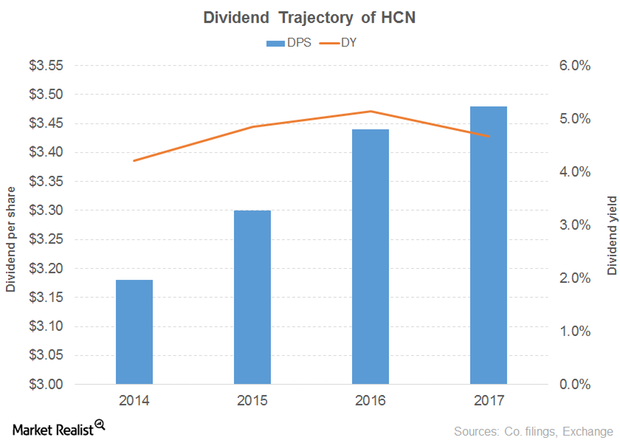

Welltower’s Dividend Yield Falls despite Higher Dividend

Revenue and earnings In this part, we’ll look at Welltower (HCN), a US healthcare REIT. Welltower’s revenue growth slowed from 15% in 2015 to 11% in 2016. The growth was driven by all of its segments, through rental income, resident fees and services, interest income, and other income. Its operating costs and other expenses (including interest expenses) […]

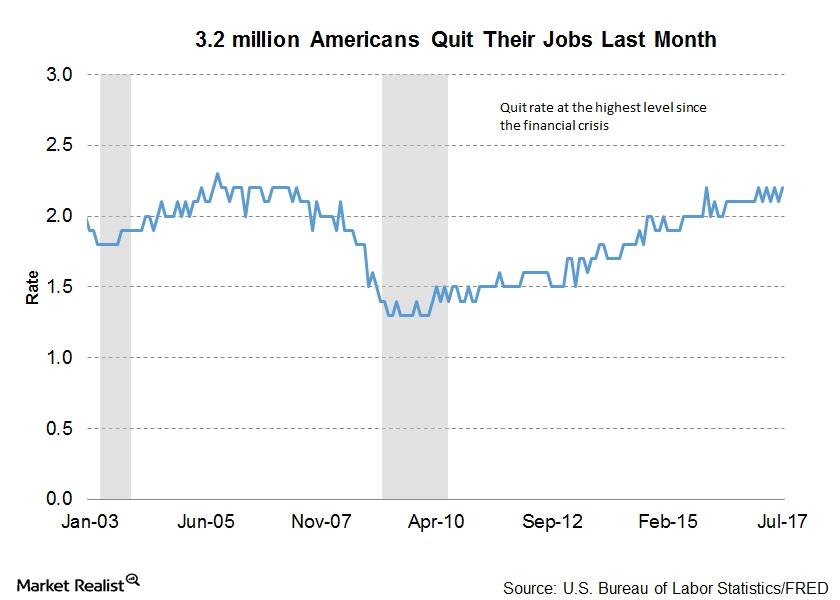

Why Are So Many Americans Quitting Their Jobs?

As per the latest JOLTS report, about 3.2 million Americans quit their jobs voluntarily last month. This is an increase of 0.1 million from the previous month.

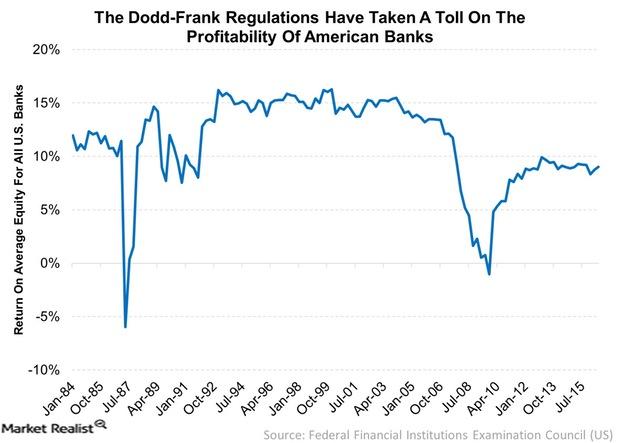

How the Removal of Dodd-Frank Could Affect Banks

While the Dodd-Frank Act was passed to avoid another financial crisis, it has crippled banks’ profitabilities over the years due to higher capital requirements.

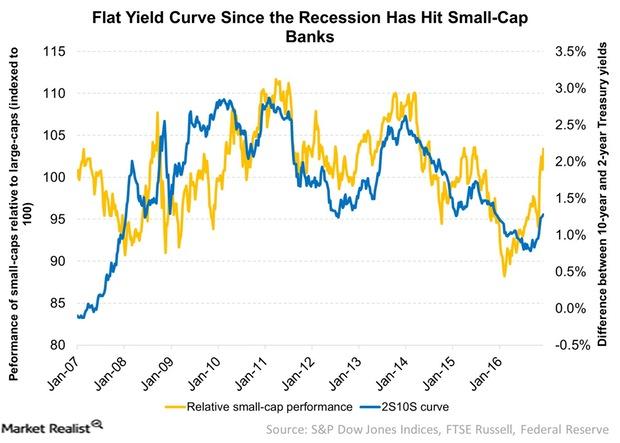

Analyzing How the Yield Curve Impacts Small Caps

Another factor that impacts small-cap stocks’ performance is the yield curve. The yield curve has remained on the flatter side since the recession.

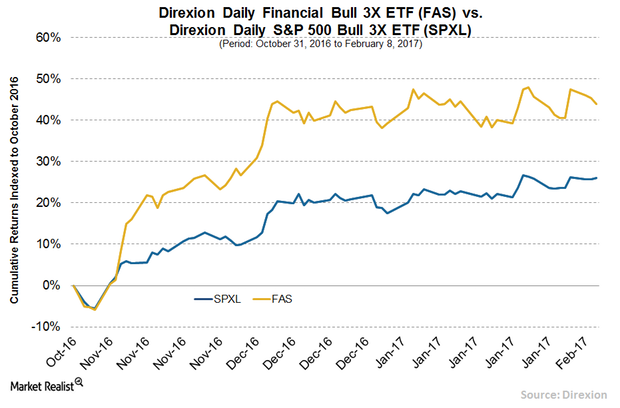

Why Financials Have Soared since Trump’s Election

The dismantling of Dodd-Frank regulations for banks should improve their profitabilities, which explains why their stocks have soared since Trump’s win.

What Can You Expect from Markets in 2016?

While I don’t have a crystal ball, here are three things I believe all investors need to know about returns in 2016.

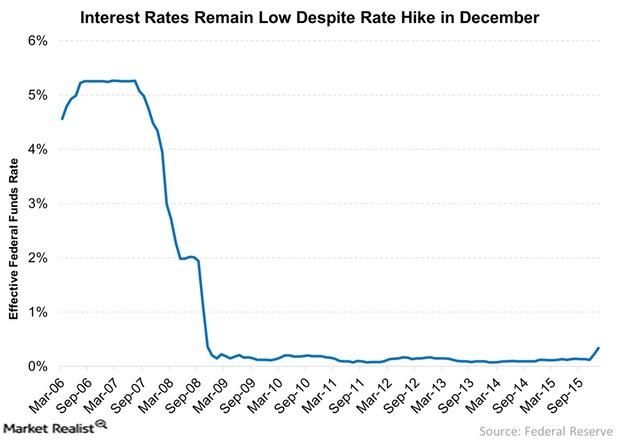

Banks Set to Profit from Steepening Yield Curve

The yield curve has steepened a bit compared to where it was a week or even a month ago. Investors should consider the yield curve slope an indicator of bank performance.

Why Does a Flattened Yield Curve Hurt Banks?

Banks benefit from a steeper yield curve, which allows banks to lend on higher long-term rates and borrow on lower short-term rates. This boosts banks’ margins.

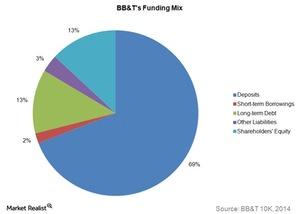

Why BB&T Has Low Funding Costs Compared to Its Peers

Deposits are the cheapest funding source. Since deposits fund a major chunk of BB&T’s assets, the overall funding costs are low.

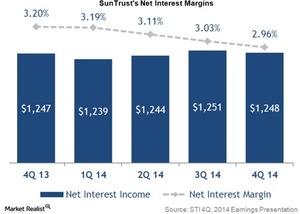

Why SunTrust Has Lower Net Interest Margins

SunTrust Bank’s net interest income in 2014 remained stable compared to 2013 as strong loan growth offset the decline in net interest margin.

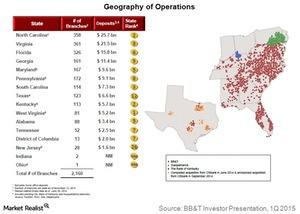

BB&T Corporation Is a Leading Bank in the Southeast Region

BB&T Corporation (BBT) is a financial holding company. It conducts its operations primarily through its bank subsidiary—Branch Bank.