SPDR® S&P Insurance ETF

Latest SPDR® S&P Insurance ETF News and Updates

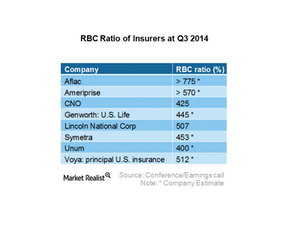

How insurers manage their capital requirements

A company managing higher risk products must maintain a higher level of minimum capital compared to a company with a relatively lower level of risk.

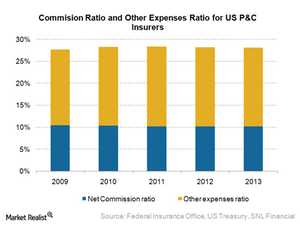

How cost structures and distribution channels impact profit

As customers use Internet-based aggregators to purchase insurance policies, insurers use online sales to interact directly with customers and reduce costs.

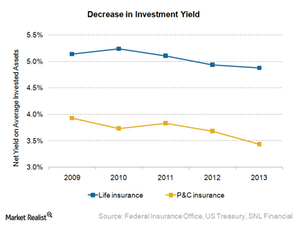

How investment income drives profit

The impact of interest rate movements is lower in the P&C segment, as their products can be repriced annually to keep in line with interest rate movements.

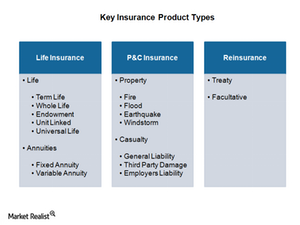

Life insurance, P&C insurance, and reinsurance

P&C products have commoditized characteristics, resulting in sharp competition in the market and business cycles. AIG and ACE are key players in this space.

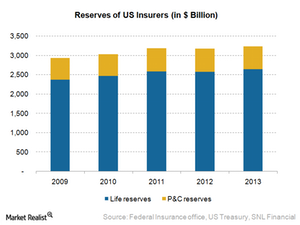

Making sense of an insurer’s liabilities

Policyholder liabilities, or policyholder reserves, represent the future claims that may arise for the pool of policies the insurer writes.

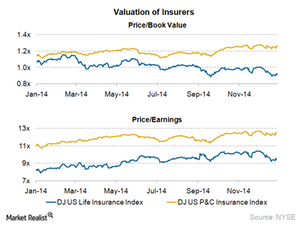

How valuation of insurance companies works

Financial market movements not only impact income from invested assets, but also the value of assets carried at fair value on an insurer’s balance sheet.

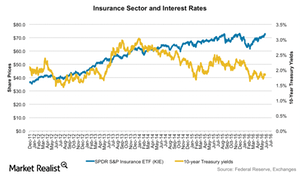

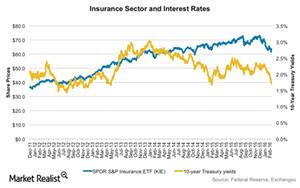

How Does a Rate Hike Impact Insurance Stocks?

Interest rates are a key performance driver for life insurance companies, affecting their margins, hedging costs, and product sales.

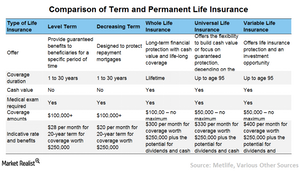

How to Pick a Life Insurance Policy

Term life insurance provides guaranteed benefits to beneficiaries for a specific period of time in case of the sudden death of the insured person.

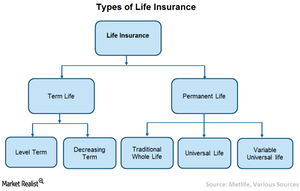

What Are the Different Types of Life Insurance Policies?

Life insurance (PRU) (MET) policies come in various forms that cater to people in different age groups and with different financial goals.

The Effect of an Interest Rate Reversal on Insurance Companies

Interest rates are a key performance driver for life insurance companies. They affect their margins, hedging costs, and product sales.

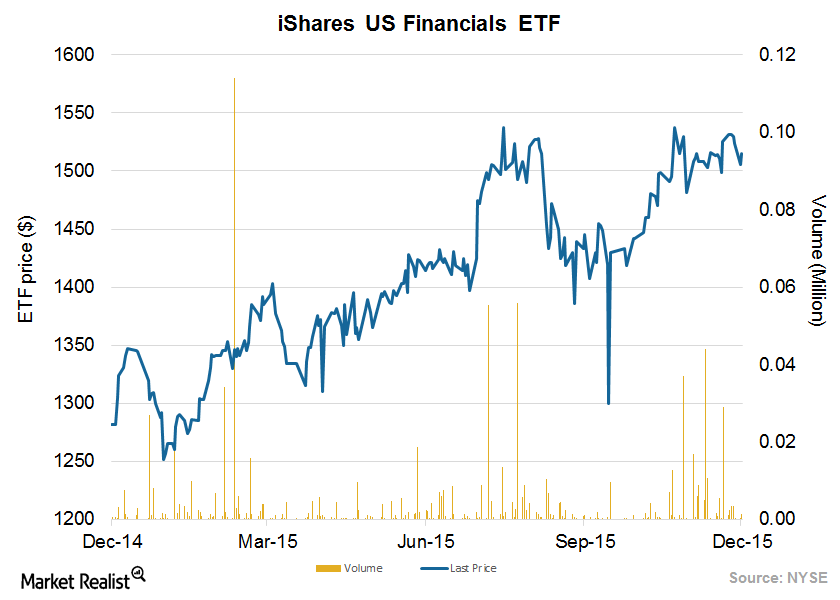

Rising Interest Rates, Banks, and Insurance Companies

Banking stocks are expected to benefit from higher interest rates, but not immediately. Also, rising interest rates would be countered by higher existing liquidity.