Hospira Inc

Latest Hospira Inc News and Updates

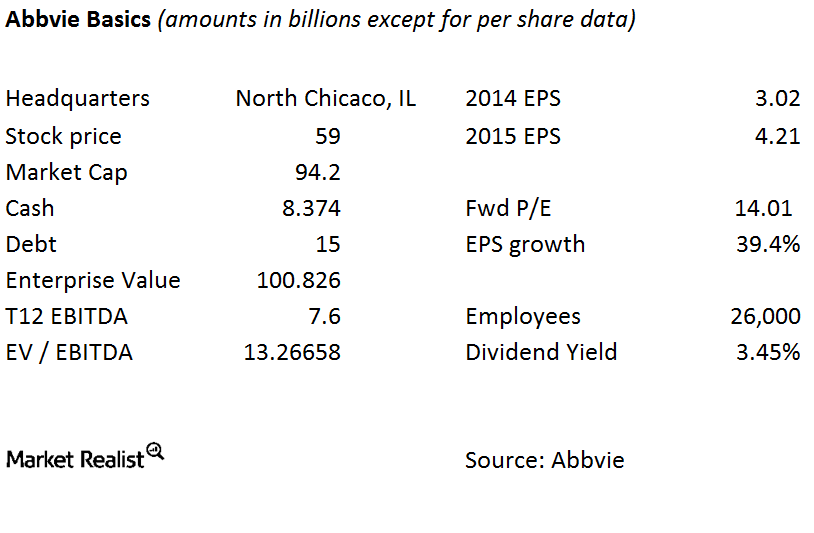

The Pharmacyclics–AbbVie Merger: The Basics of AbbVie

A major reason for the Pharmacyclics–AbbVie merger is to diversify AbbVie away from its reliance on a single product, Humira, and boost its pipeline.

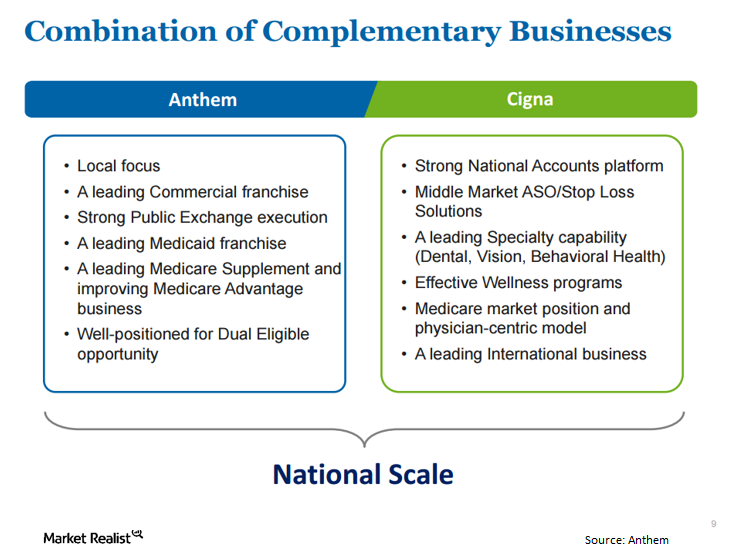

Anthem Files Bear Hug Letter for Cigna on June 21

On June 21, Anthem (ANTM) filed a bear hug letter for Cigna (CI). A bear hug letter is a formal press release in which an acquiring company discloses its interest in a target company.

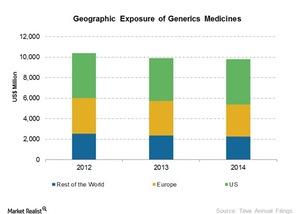

Central Nervous System Is Key to Teva’s Specialty Medicines

Revenues for Teva’s (TEVA) Specialty Medicines segment grew by 2.1% to $8,560 million in 2014, from $8,388 million in 2013.

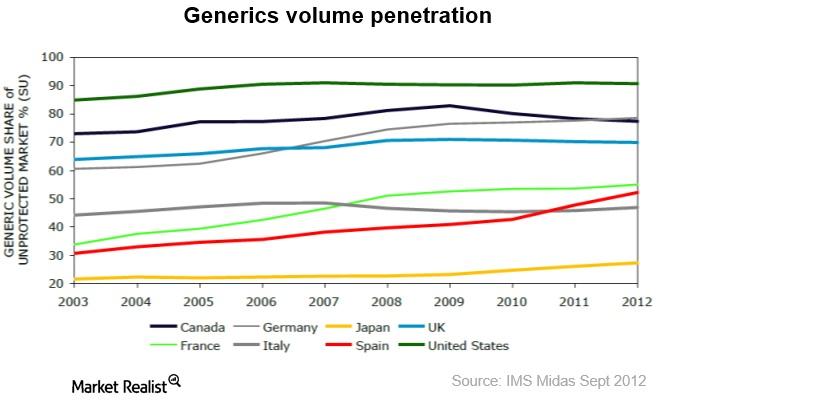

What’s Supporting Continued Growth in the Generics Market?

The global generics market was valued at $168 billion in 2013. From 2013 to 2018, it’s expected to grow at a CAGR of 11% to reach $283 billion.

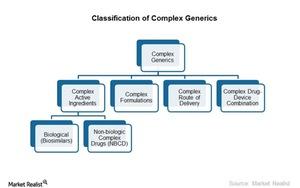

Complex Generics Are Attractive Due to High Margins

Complex generics are large and complex formulations or active ingredients used to treat chronic and life threatening diseases like cancer, Hepatitis C, and HIV.