HSBC Holdings PLC

Latest HSBC Holdings PLC News and Updates

HSBC Bans Bitcoin Proxy MicroStrategy—Here’s Why

One major bank has decided to prevent its clients from buying shares of MicroStrategy, which is one of the top Bitcoin stocks on the market.

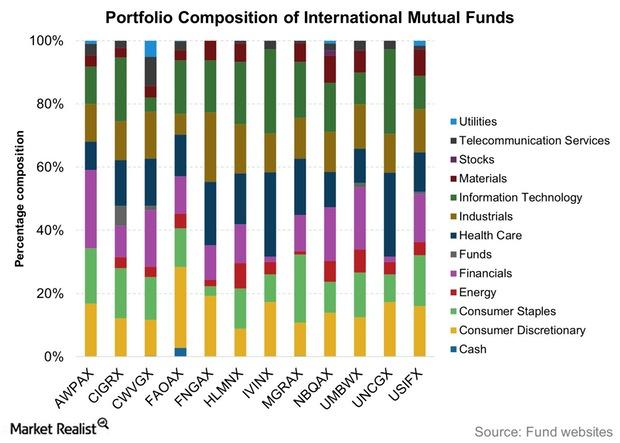

Is It Time to Invest in International Funds?

2016 has mostly been about macro trends, thus presenting a different set of challenges for active fund managers who mostly focus on companies rather than economic and sector trends.

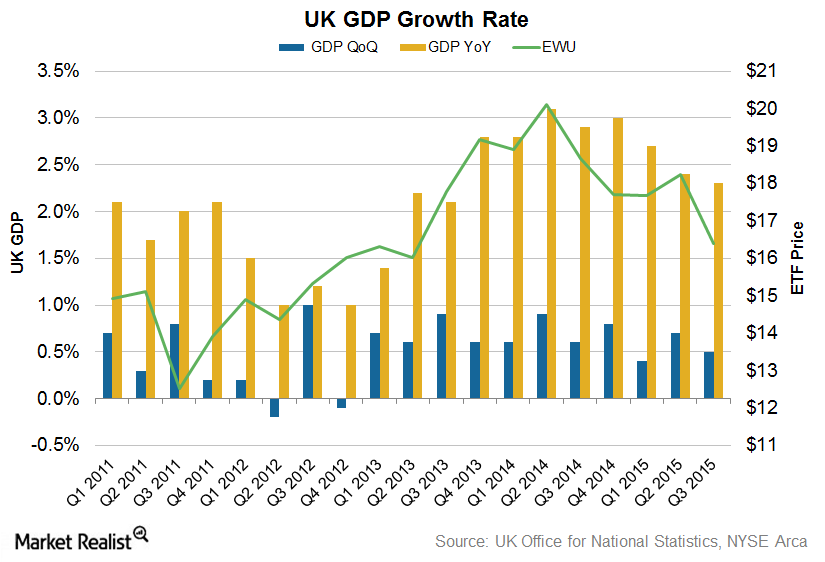

Rise in Household Spending Provided Respite for UK Economic Growth

With household spending gathering pace, it could be an important growth driver for the United Kingdom’s economic growth.

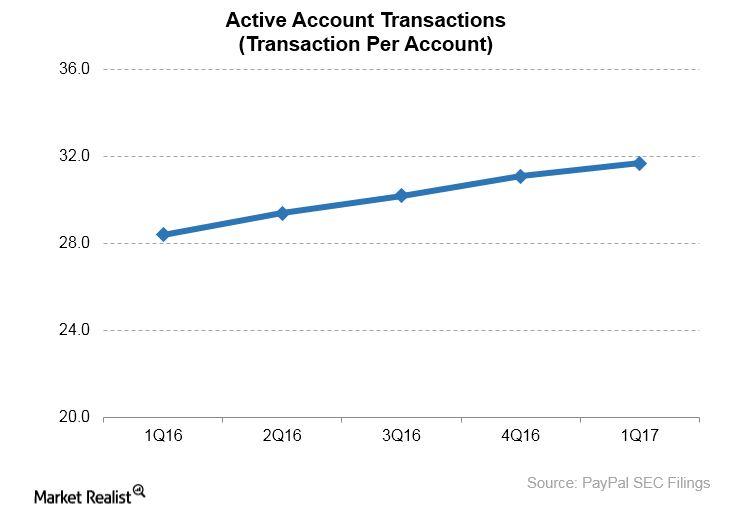

Understanding PayPal’s Choice Transition

PayPal reported that its payment transaction per active account increased 12.0% year-over-year in 1Q17.

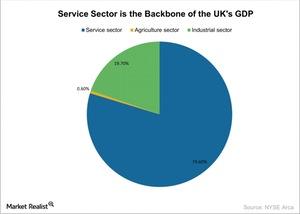

Which Sectors in the UK Will the ‘Brexit’ Decision Affect Most?

The financial sector has contributed heavily to the UK economy. Financial institutions like HSBC and Barclays will face challenges doing business in the EU.

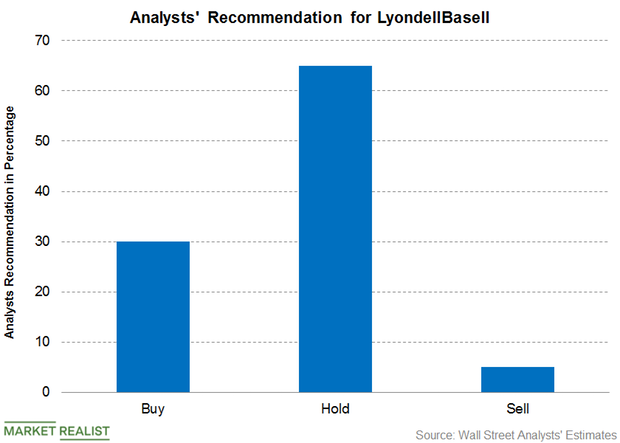

LyondellBasell: Analysts’ Views and Recommendations

For LyondellBasell, 30% of the analysts recommended a “buy,” 65% recommended a “hold,” and 5% recommended a “sell.”

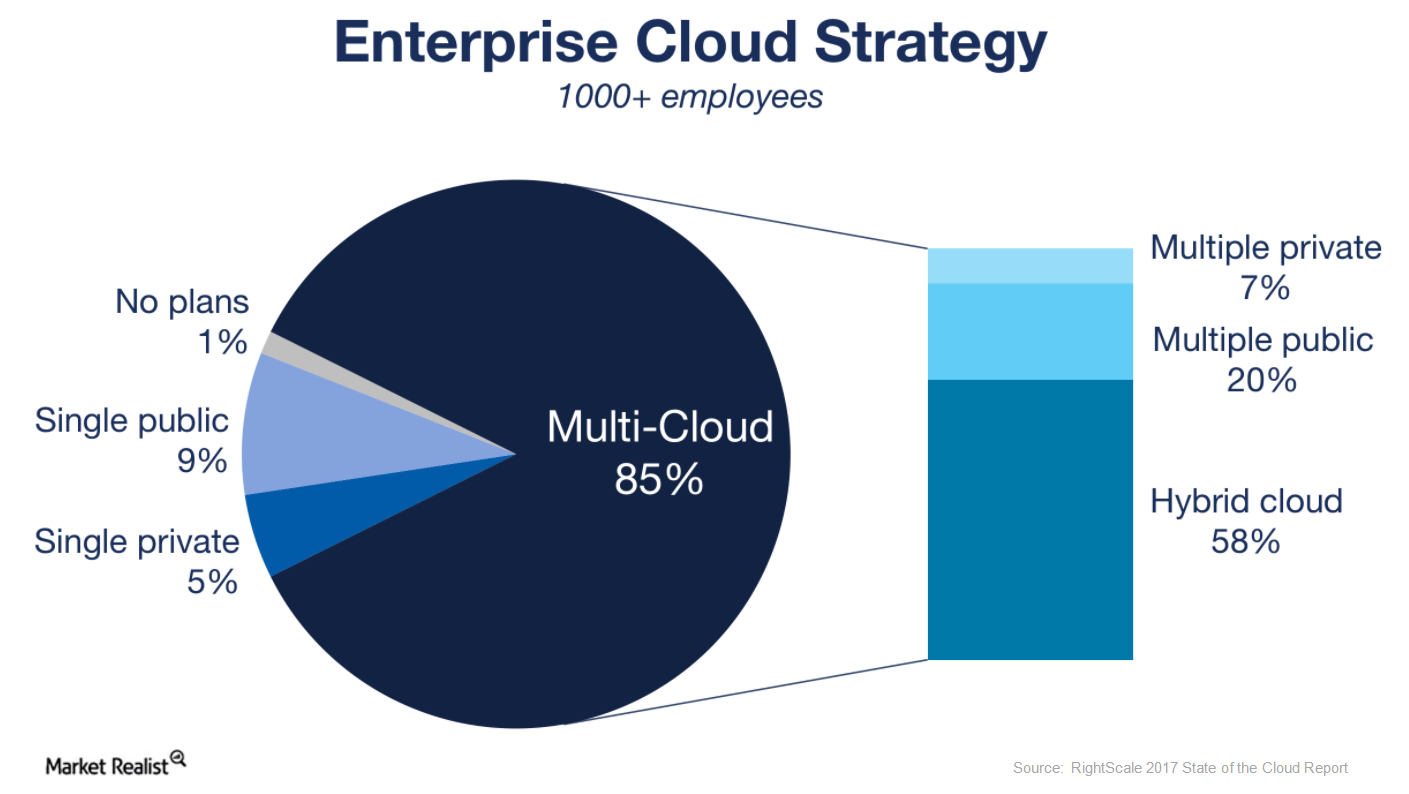

A Look into IBM’s Growth Strategy

Consistent growth in the cloud and mainframe systems enabled IBM to post a lower-than-expected fall in its revenues in 3Q17.

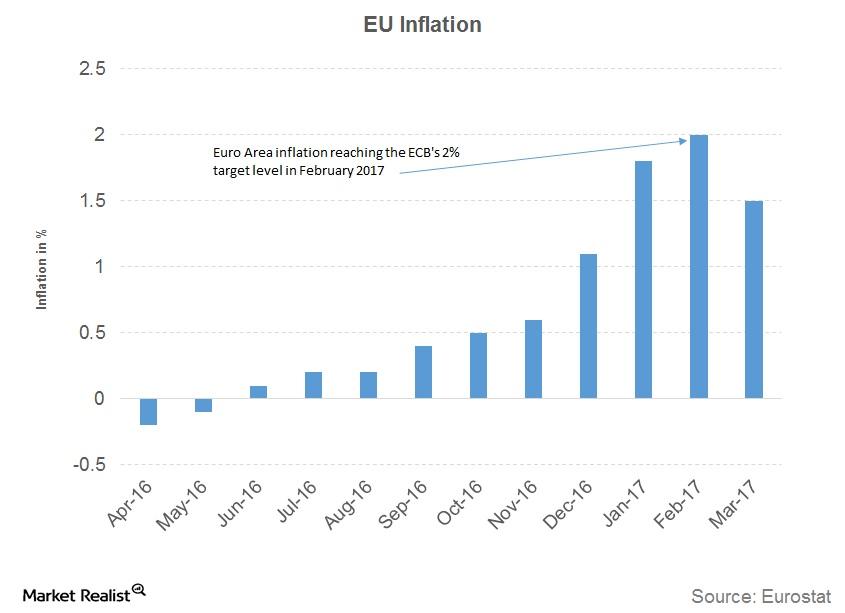

Will the European Central Bank Follow the Fed?

On its own stage across the Atlantic from the US Fed, the ECB (European Central Bank) has had its own quantitative easing program.

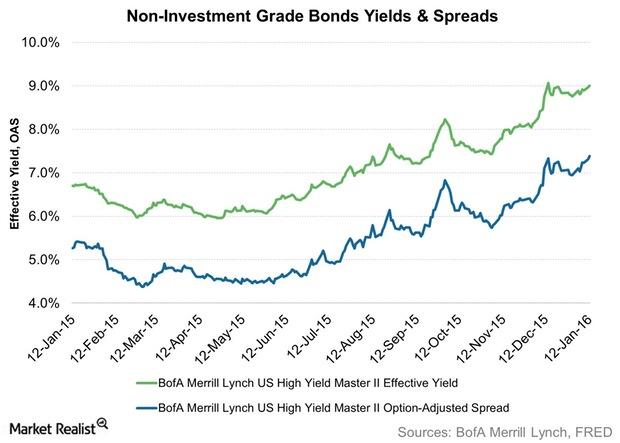

High-Yield Bonds and You in 2016

High-yield bonds, also known as Junk bonds, have an iffy repayment ability, even if they are at the higher end of the junk rating scale.

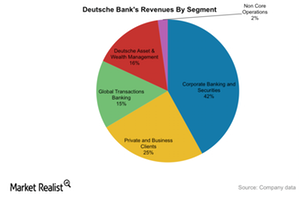

Understanding Deutsche Bank’s Segments

Deutsche Bank operates under five segments. Corporate Banking & Securities contributes 50% to Deutsche Bank’s revenues.

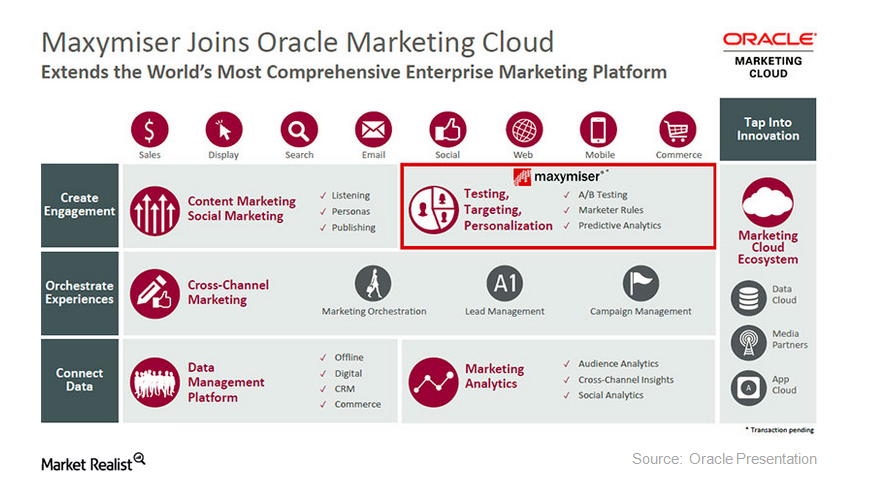

Oracle Made another Marketing Cloud Acquisition: Maxymiser

On August 20, 2015, Oracle (ORCL) announced the acquisition of Maxymiser. The financial details of the deal weren’t disclosed.