Goodrich Petroleum Corp

Latest Goodrich Petroleum Corp News and Updates

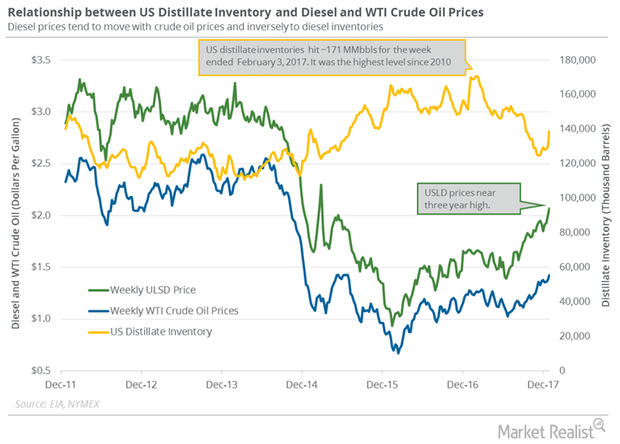

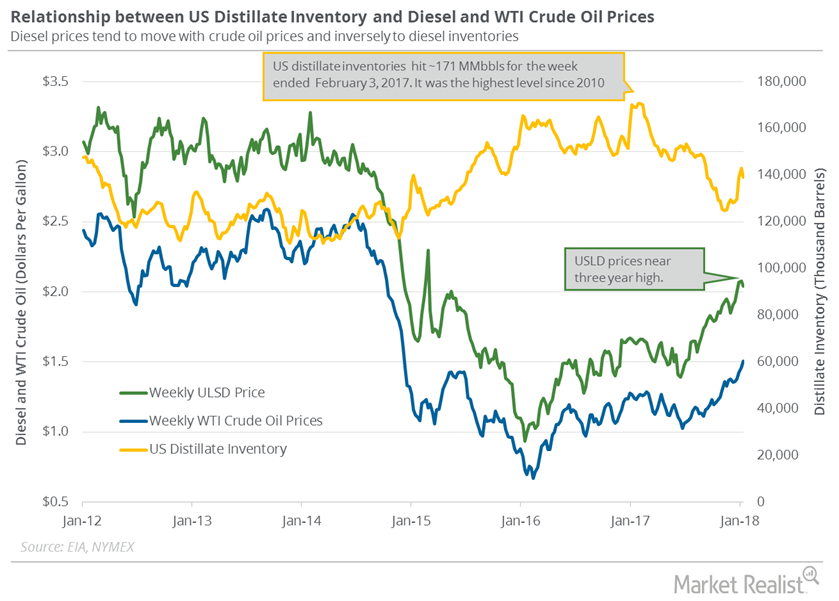

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

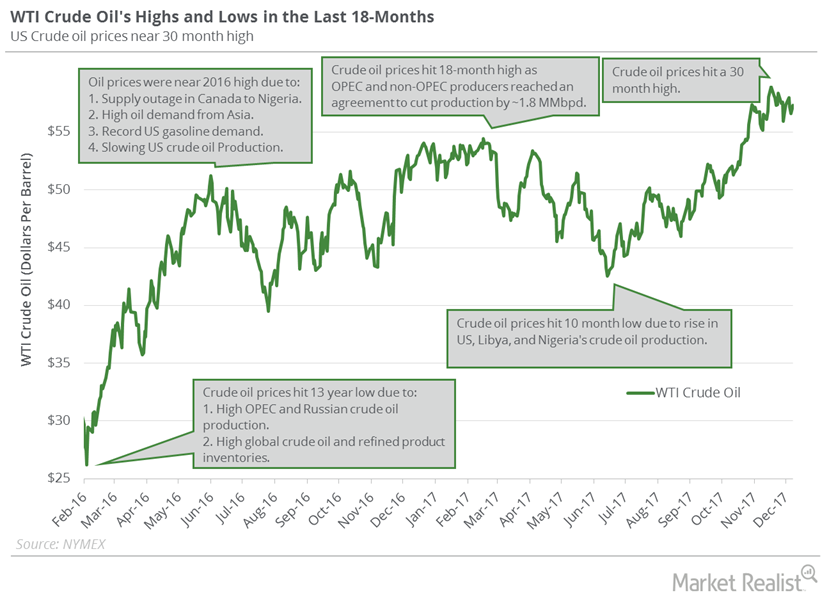

Will US Crude Oil Futures Be Range Bound This Week?

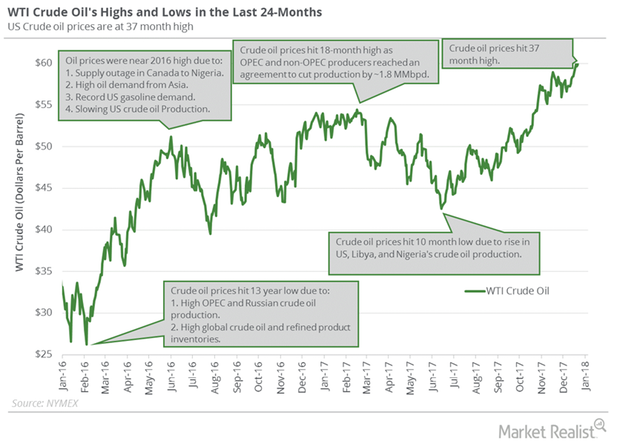

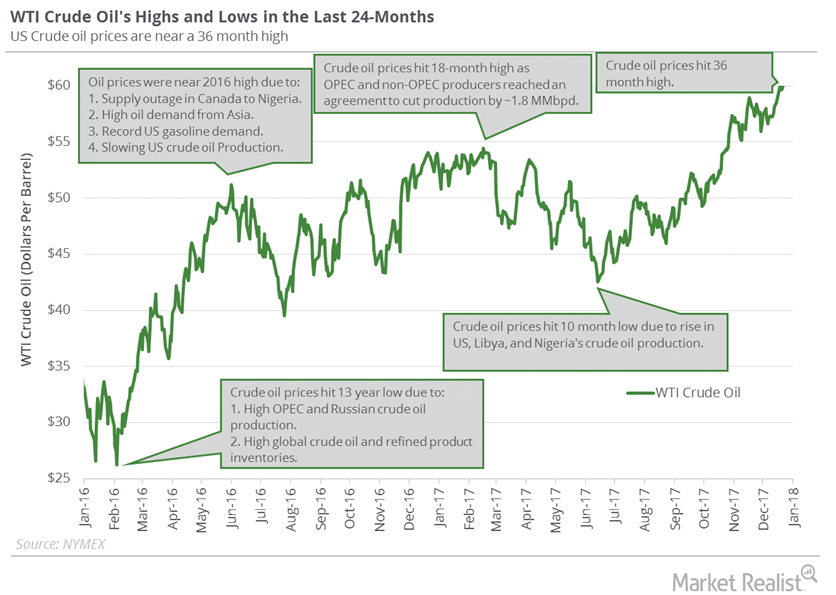

WTI crude oil (USO) futures hit $58.95 per barrel on November 24, 2017—the highest level in nearly three years.

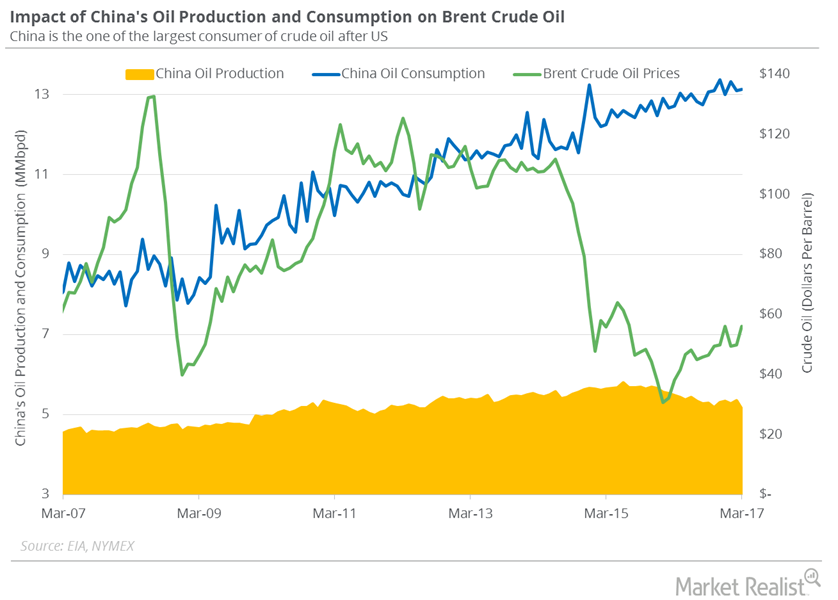

China’s Crude Oil Imports Hit a New Record

China’s General Administration of Customs reported that China’s crude oil imports rose to 9.21 MMbpd (million barrels per day) in March 2017.

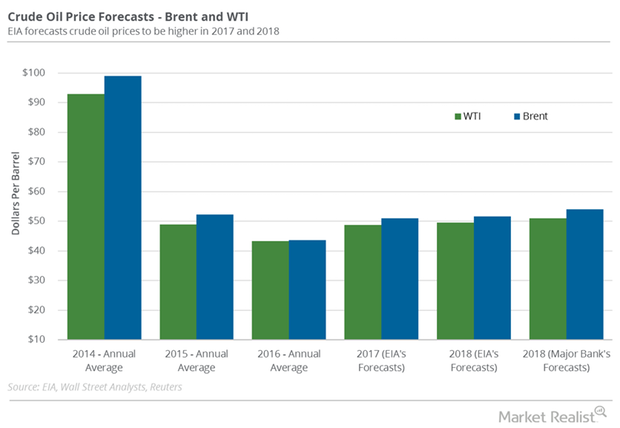

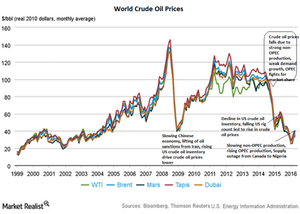

Will Brent and US Crude Oil Prices Rise in 2018?

November US crude oil (DWT)(UWT)(USO) futures are above their 20-day, 50-day, and 100-day moving averages at $49.25, $48.77, and $48.11 per barrel as of September 25.

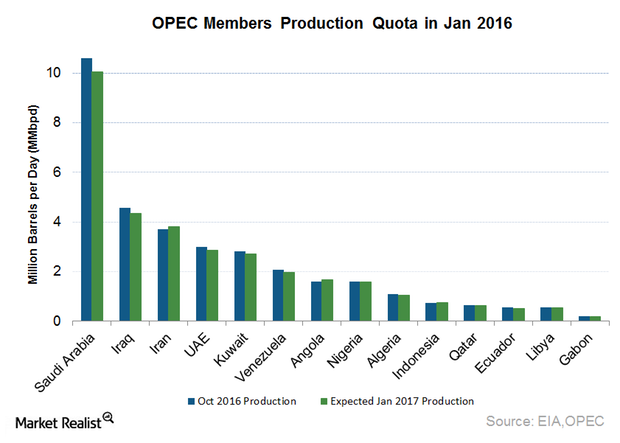

Crude Oil Prices Skyrocket as OPEC Agrees to Cut Production

Crude oil prices hit a one-month high as OPEC reached an agreement to cut production by 1.2 MMbpd in its meeting in Vienna.

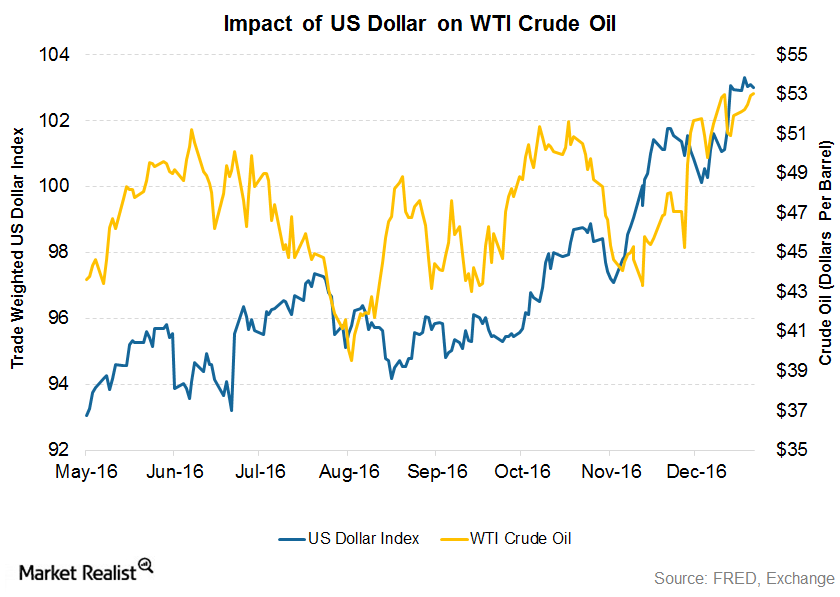

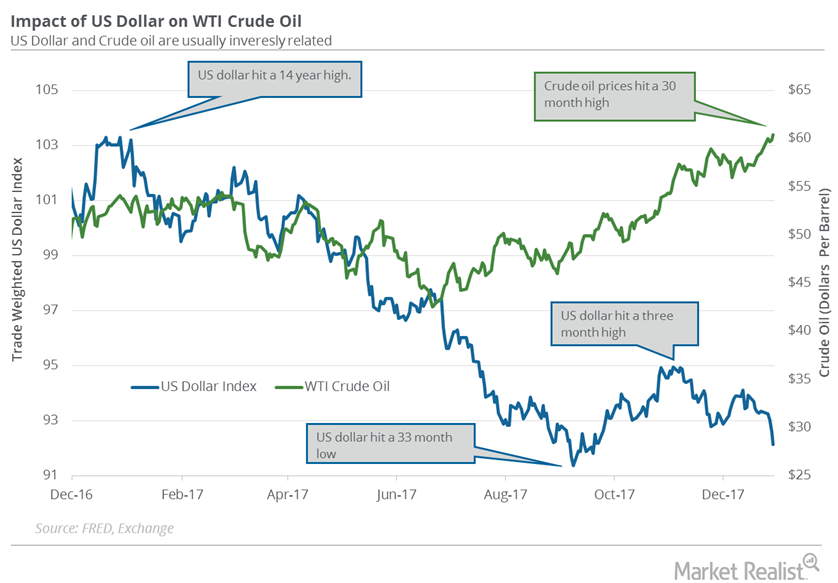

How Will the US Dollar Affect Crude Oil Prices in 2017?

February 2017 WTI (West Texas Intermediate) crude oil (PXI) (ERX) (USL) (ERY) futures contracts rose 0.1% and settled at $53 per barrel on December 23, 2016.

EIA Raises Estimates for US Crude Oil Production in 2018

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 36,000 bpd (barrels per day) to 9,235,000 bpd between March 31 and April 7, 2017.

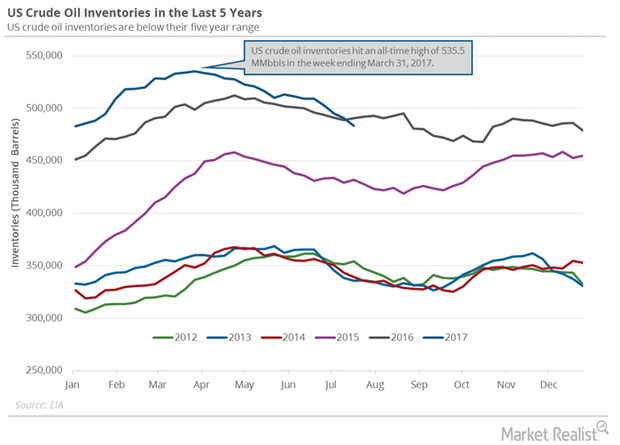

US Crude Oil Inventories Fell below the 5-Year Average

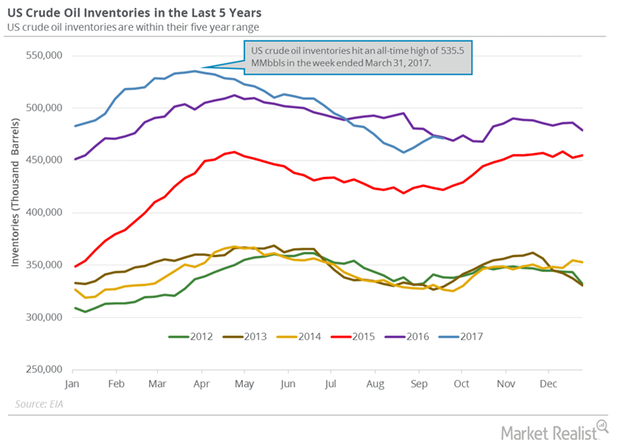

The EIA reported that US crude oil inventories fell by 7.2 MMbbls to 483.4 MMbbls on July 14–21, 2017. Inventories fell below the five-year range.

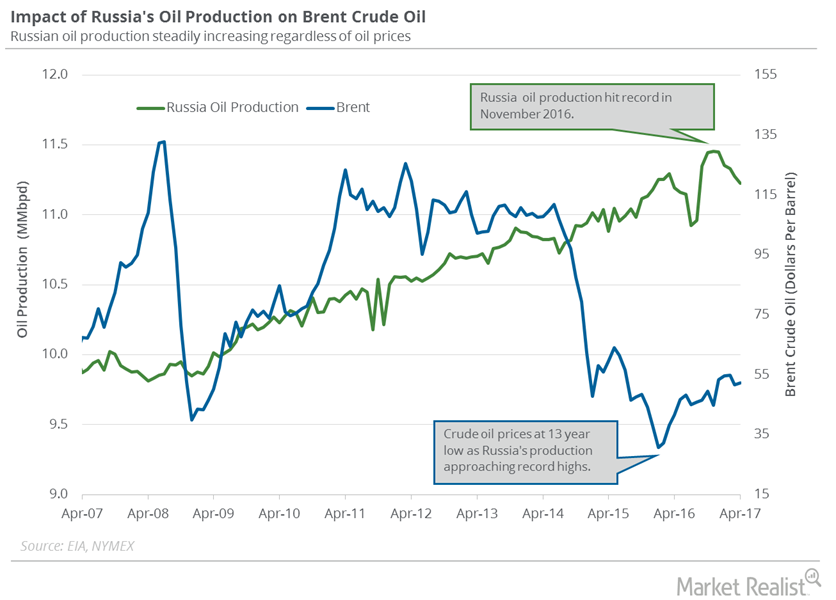

Russia Could Leave OPEC’s Production Cut Deal

Rosneft is Russia’s largest oil producer. On June 1, a Rosneft board member stated that Russia wouldn’t extend the production cut deal beyond March 2018.

Will Crude Oil Futures Rise or Fall This Week?

WTI crude oil (SCO) futures settled at $64.30 per barrel on January 12, 2018—the highest level since December 2014.

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

Crude Oil Futures: Next Important Resistance Level

WTI crude oil (UCO) futures closed at $62.01 per barrel on January 4, 2018—the highest level since December 2014. WTI prices rose ~12.4% in 2017.

Will the US Dollar Help Crude Oil Bulls or Bears in 2018?

The US Dollar Index fell 0.5% to 92.12 on December 29, 2017—the fourth consecutive day of losses. It’s near a three-month low.

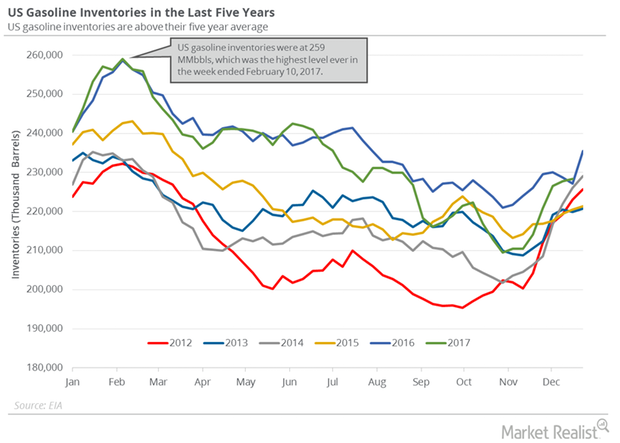

Why Oil Traders Are Tracking US Gasoline Inventories

US gasoline inventories rose by 0.5 MMbbls (million barrels) or 0.3% to 228.3 MMbbls from December 15 to 22, 2017, per the EIA.

Crude Oil Prices: Which Factor Could Change the Trend?

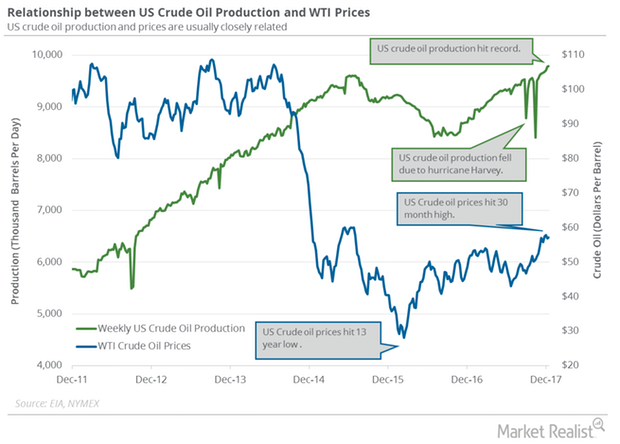

The EIA estimated that US crude oil production rose by 9,000 bpd (barrels per day) to 9,789,000 bpd on December 8–15, 2017.

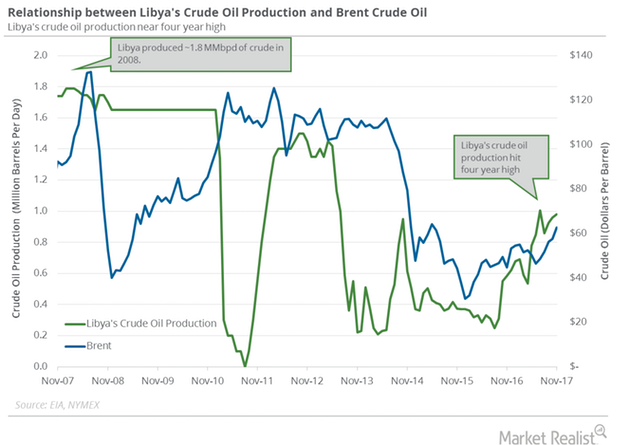

Libya’s Crude Oil Production Is near a 4-Year High

The EIA estimates that Libya’s crude oil production rose by 20,000 bpd (barrels per day) or 2.1% to 980,000 bpd in November 2017.

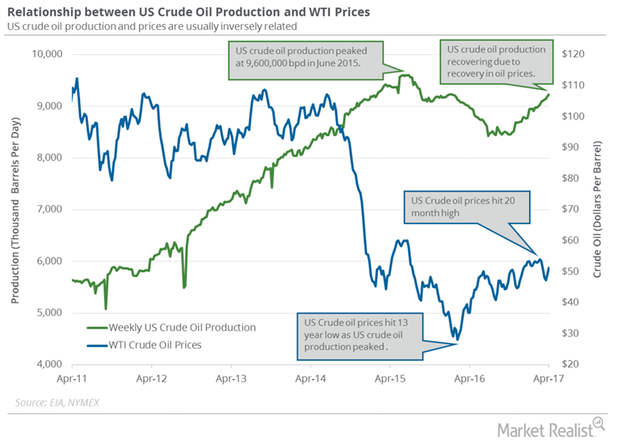

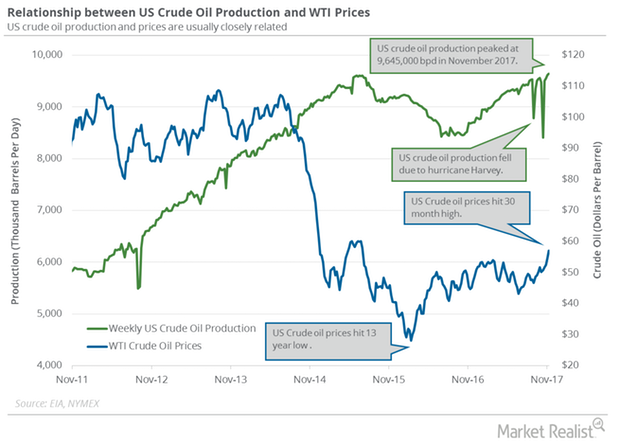

US Crude Oil Production: Bearish Driver for Oil Prices

The EIA estimates that US crude oil production rose by 25,000 bpd (barrels per day) or 0.3% to 9,645,000 bpd on November 3–10, 2017.

How Record US Crude Oil Exports Are Impacting Crude Oil Inventories and Prices

On September 27, the EIA released its weekly report, estimating that US crude oil inventories fell to 470.9 MMbbls from September 15–22, 2017.

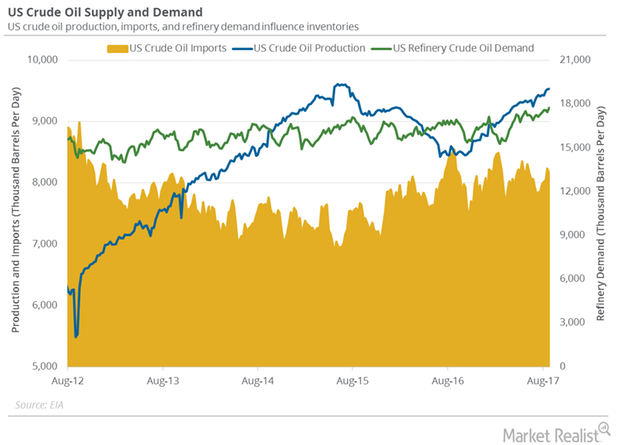

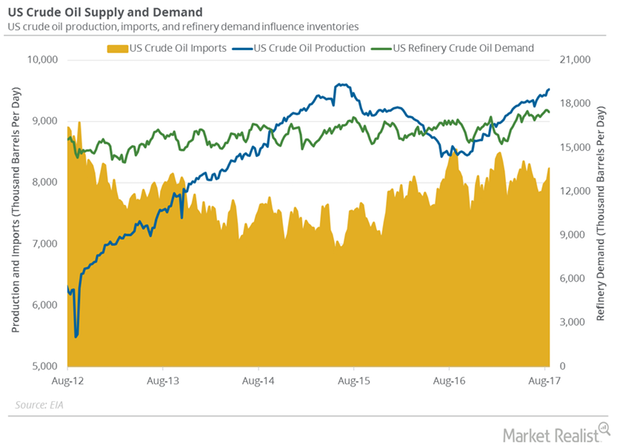

Pre-Hurricane Harvey, US Crude Oil Demand Hit a Record High

US refinery crude oil demand The EIA (U.S. Energy Information Administration) estimates that US refinery crude oil demand rose by 264,000 bpd (barrels per day) to 17,725,000 bpd between August 18 and 25, 2017, reaching the highest level since 1982. Refinery demand rose 1.5% week-over-week and rose 1,110,000 bpd, or 6.6%, year-over-year. High refinery demand is […]

Will US Crude Oil Futures Rise above Key Moving Averages?

Let’s track some important events for oil and gas traders between August 28 and September 1, 2017.

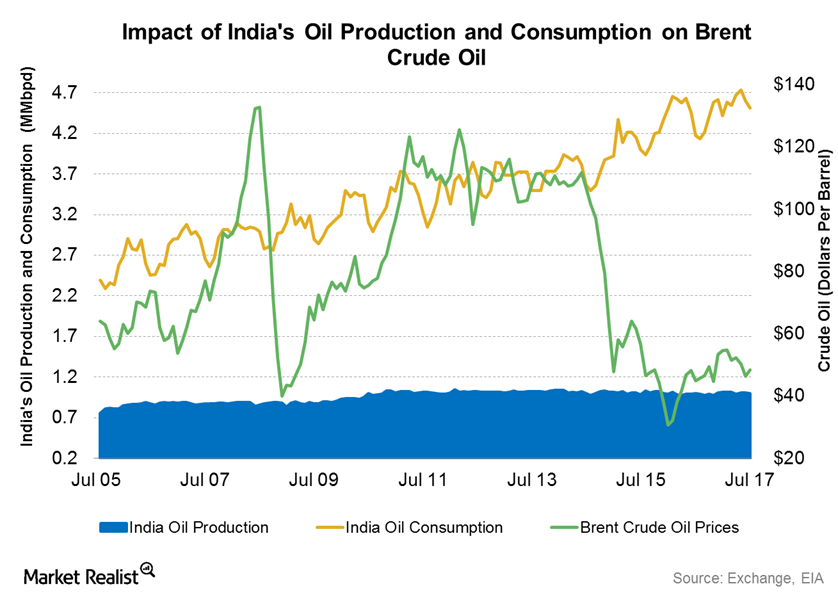

How India’s Crude Oil Imports, Production, Demand Impact Prices

India’s Petroleum Planning and Analysis Cell estimated that the country’s crude oil imports rose 0.60% to 4.2 MMbpd in July 2017 from July 2016.

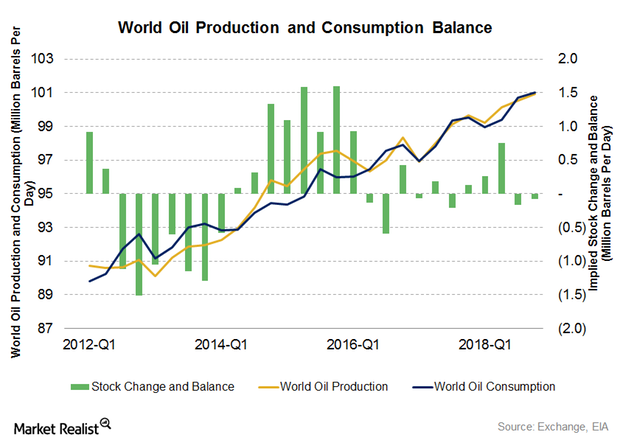

Will Global Oil Consumption Beat Production?

WTI (West Texas Intermediate) crude oil (PXI)(USL)(SCO) futures contracts for September delivery fell 0.1% and were trading at $48.78 per barrel in electronic trading at 2:00 AM EST on August 14, 2017.

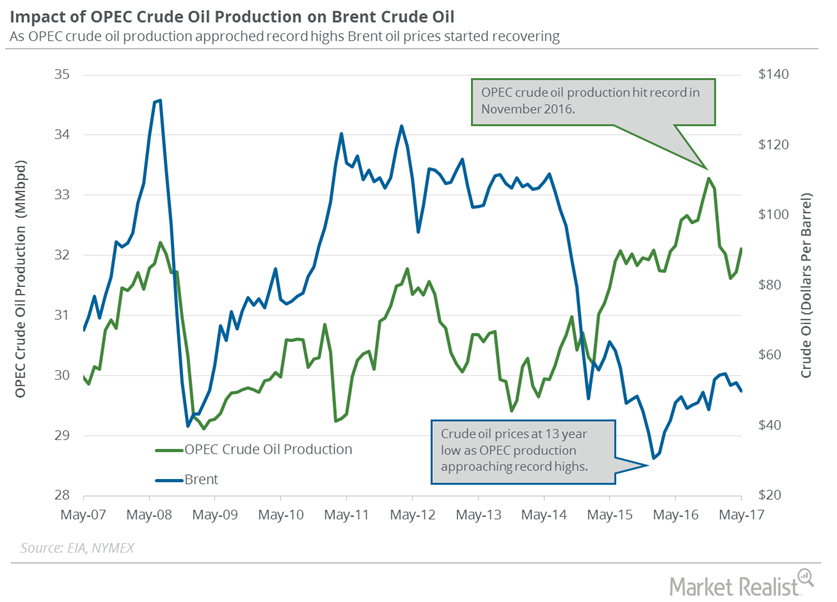

OPEC’s Crude Oil Production Hit a 2017 High

OPEC’s production cut compliance was at 92% in June 2017. Lower compliance from OPEC members and Russia could pressure crude oil prices.

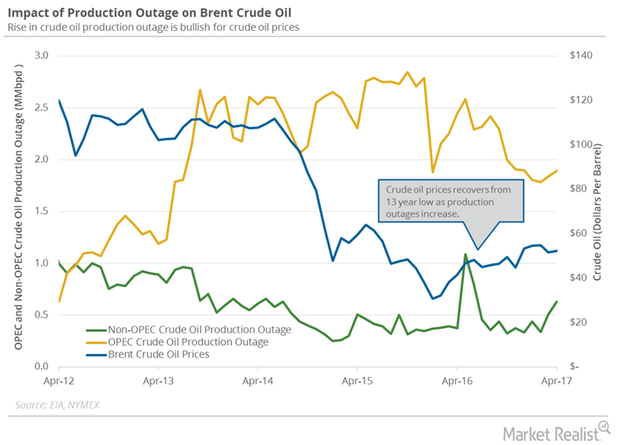

Global Crude Oil Supply Outages Could Help Crude Oil Bulls

The EIA estimated that global crude oil supply outages rose by 181,000 bpd (barrels per day) to 2.52 MMbpd in April 2017—compared to March 2017.

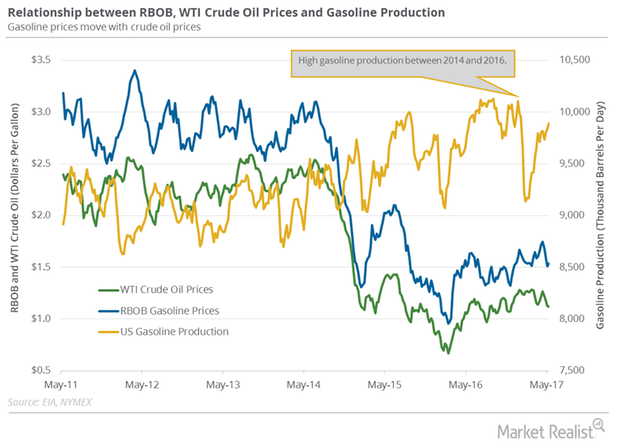

WTI Crude Oil and Gasoline Futures Diverge

US gasoline futures contracts for June delivery fell 0.1% to $1.60 per gallon on May 17, 2017. Prices fell due to a lower fall in US gasoline inventories.

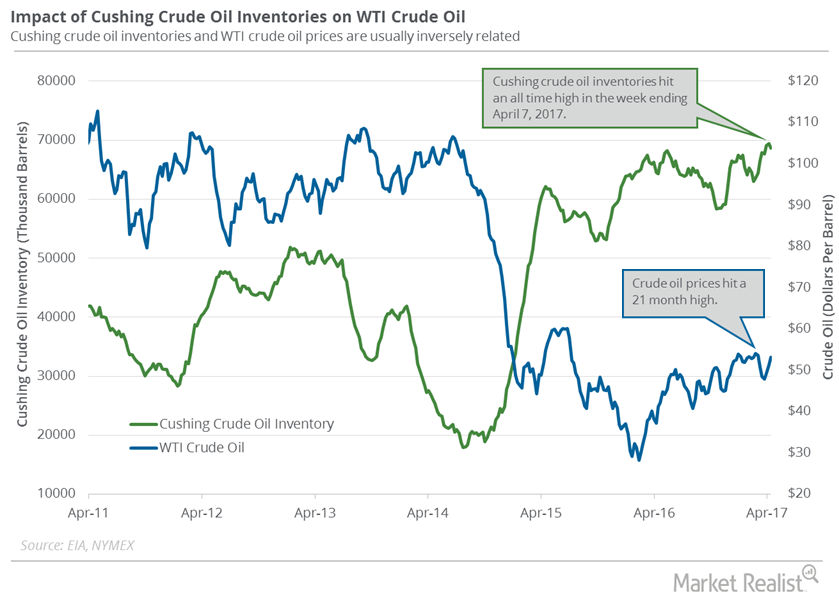

Cushing Crude Oil Inventories Fell from an All-Time High

For the week ending April 14, 2017, the EIA reported that Cushing crude oil inventories fell by 0.8 MMbbls (million barrels) to 68.6 MMbbls.

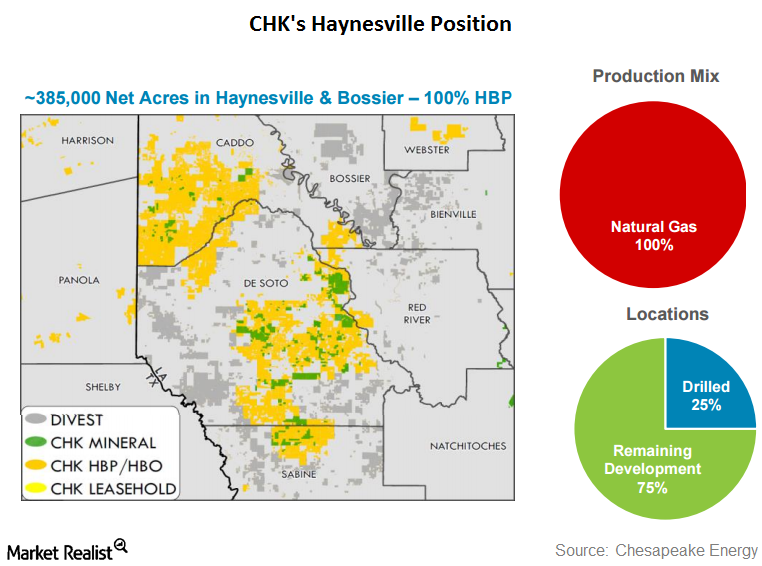

Chesapeake Energy Announces Haynesville Asset Divestiture

Chesapeake Energy (CHK) announced on December 5 that it had agreed to sell 78,000 net acres in Louisiana’s Haynesville Shale for $450 million. The buyer is an undisclosed private player.

Why Did Crude Oil Prices Diverge before OPEC’s Meeting?

July WTI (West Texas Intermediate) crude oil futures contracts trading in NYMEX fell by 0.47% and settled at $49.1 per barrel on Tuesday, May 31, 2016.

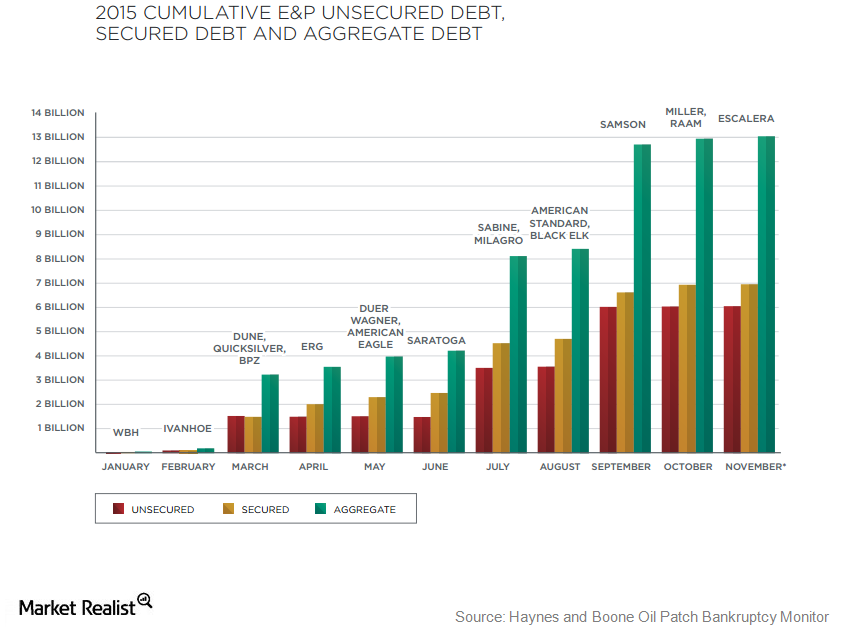

US Oil and Gas Companies’ Debt Exceeds $200 Billion

US oil and gas exploration and production companies are under severe pressure.