Flotek Industries Inc

Latest Flotek Industries Inc News and Updates

What Are Schlumberger’s SPM Project Plans?

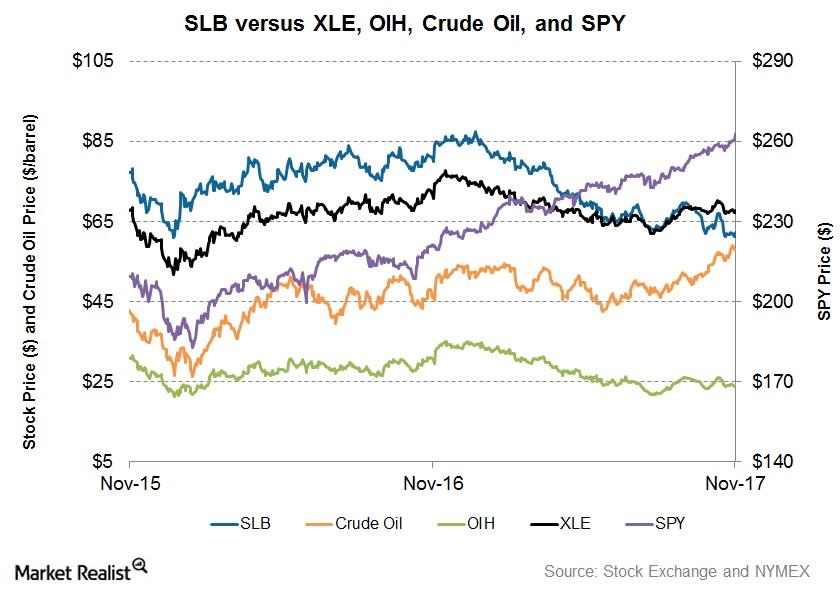

In the past one year, SLB has performed nearly in line with the industry ETF and has hugely underperformed the broader market index.

How Halliburton Has Reacted to Crude Oil Prices

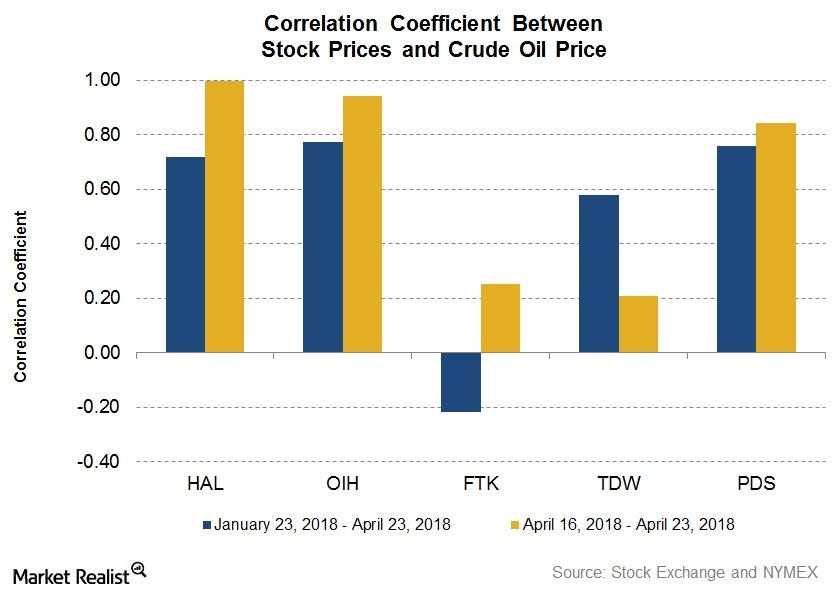

Between April 16 and April 23, Halliburton (HAL) stock’s price correlation with crude oil was 0.99, showing that Halliburton and crude oil prices have been strongly correlated in the past week.

Halliburton Reacts to Changing Crude Oil Prices: Update

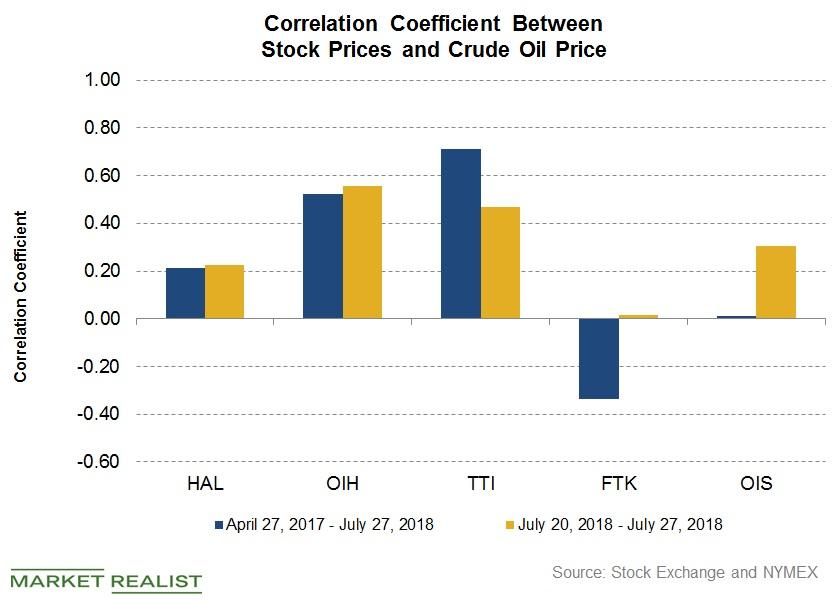

Halliburton’s (HAL) stock price correlation with crude oil on July 20–27 was 0.22—a moderately positive correlation.

Why Schlumberger’s Stock Price Is Bearish

In the past year, Schlumberger’s stock price rose until January 2017. Schlumberger’s revenue fell slowly in the four quarters leading up to 1Q17.

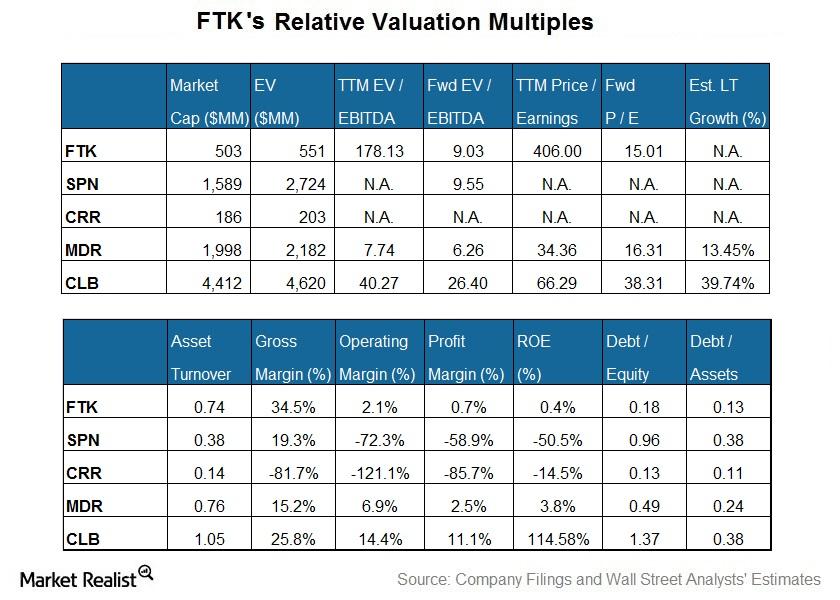

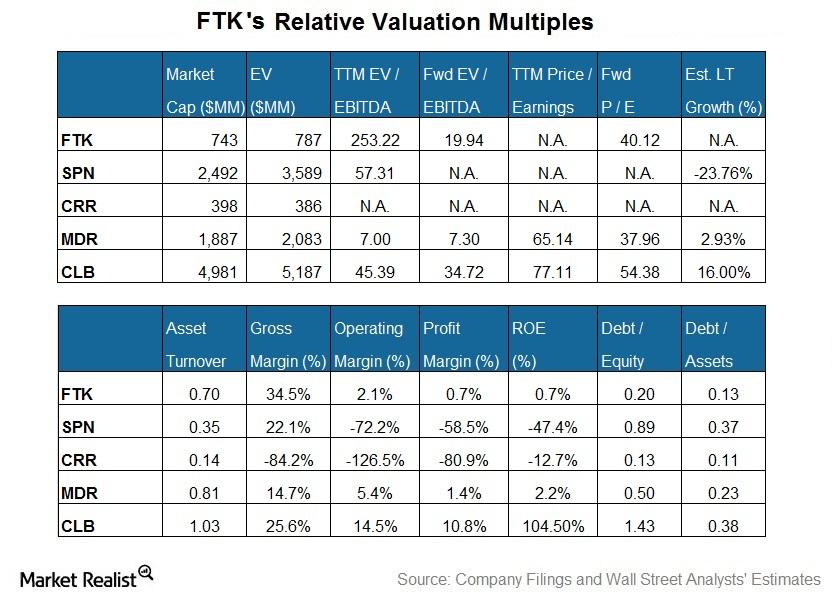

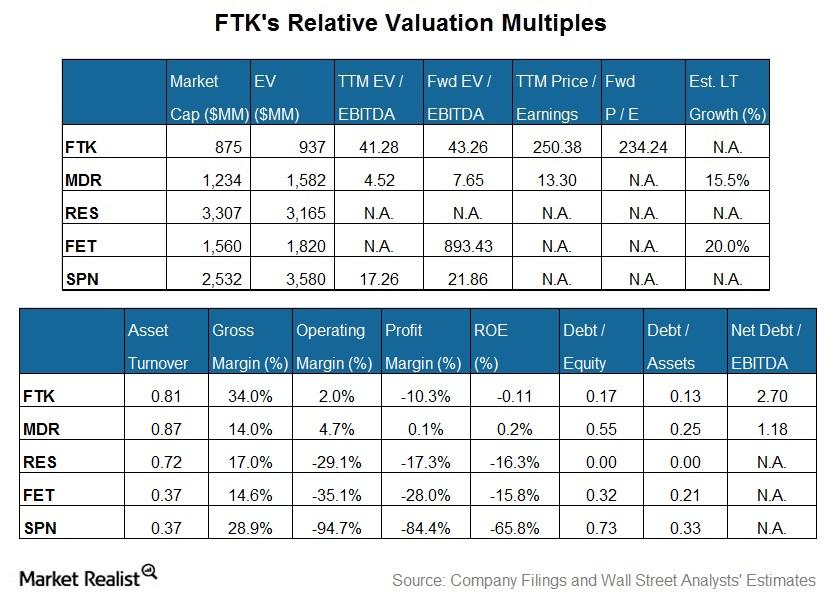

Flotek Industries’ Current Valuation versus Its Peers

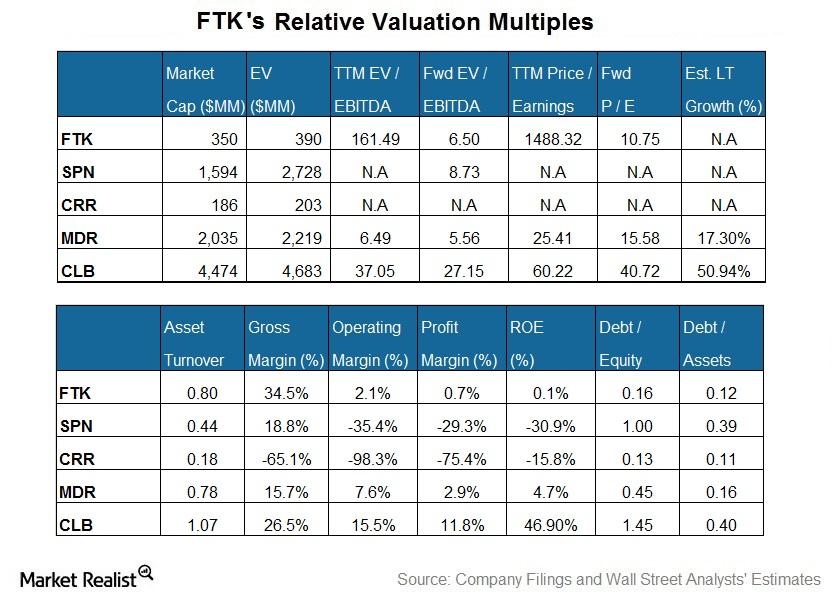

Sell-side analysts expect Flotek’s adjusted EBITDA to rise sharper in the next four quarters compared to its peers.

Ranking OFS Companies by Their Valuation Multiples

Flotek Industries’ (FTK) forward EV-to-EBITDA multiple is at the steepest discount to its current EV-to-EBITDA multiple on March 9, 2018.

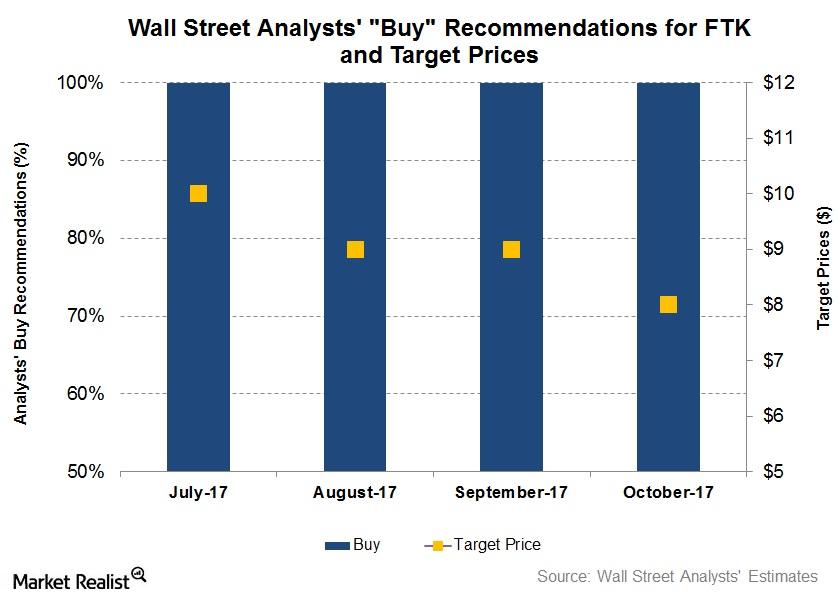

Wall Street’s Forecast for Flotek Industries before Its 3Q17 Earnings

On October 16, 2017, all analysts tracking Flotek Industries rated it as a “buy” or some equivalent.

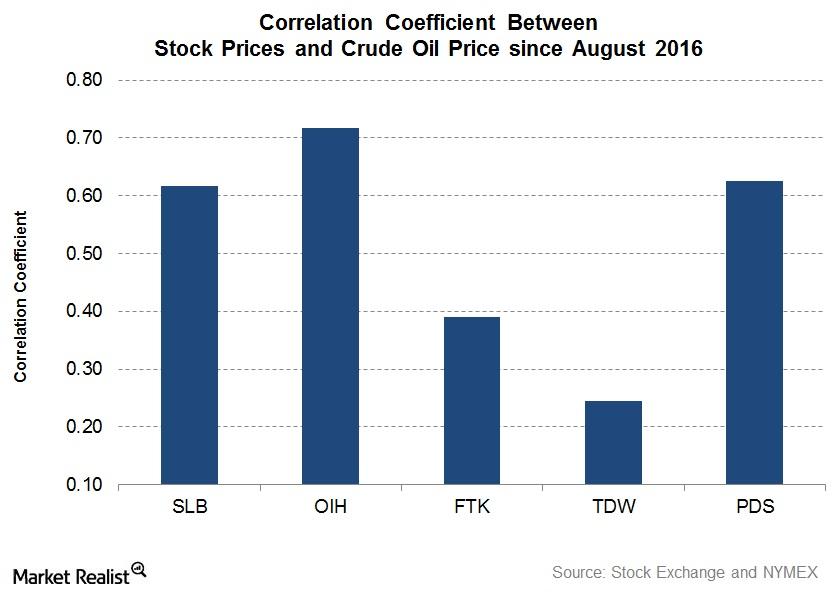

How Schlumberger Correlates with Crude Oil

The correlation coefficient between the West Texas Intermediate (or WTI) crude oil price and Schlumberger’s (SLB) stock price between August 4, 2016, and August 4, 2017, is 0.62.

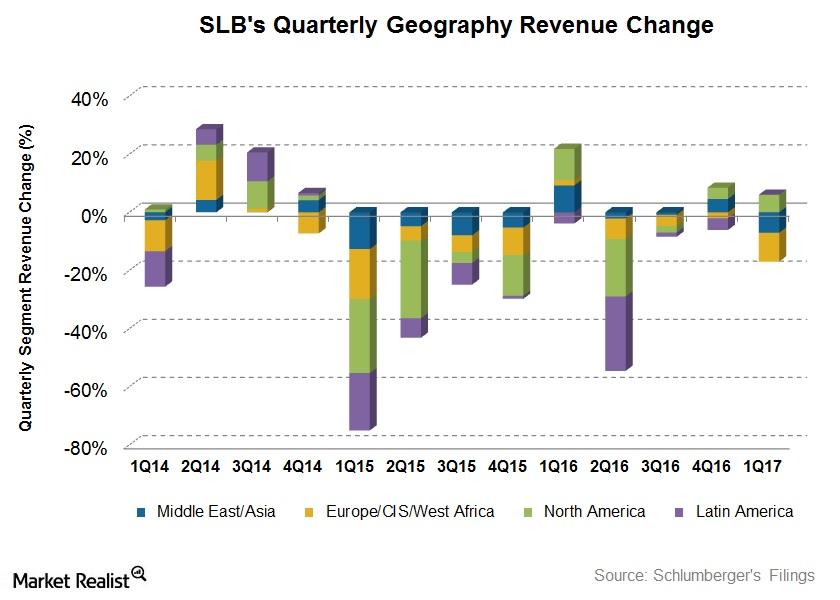

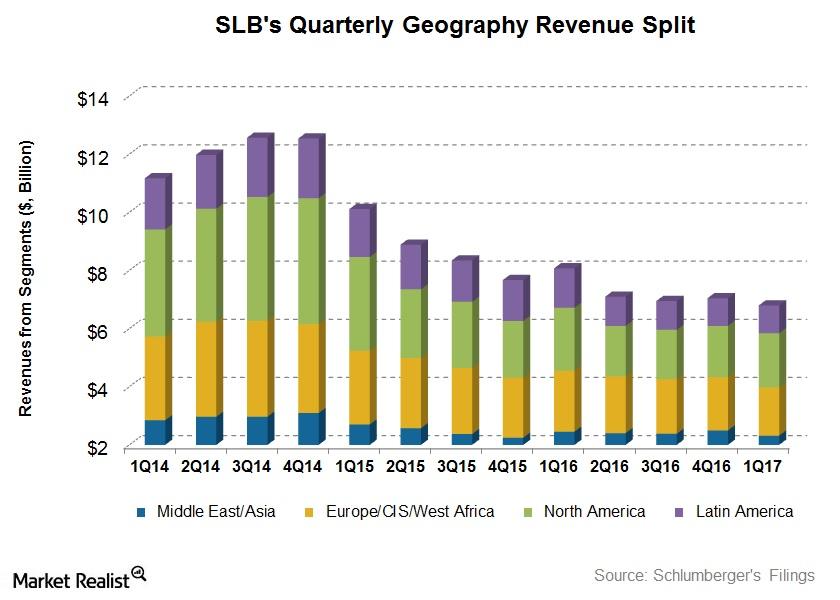

What Drove Schlumberger in 1Q17

Schlumberger’s 1Q17 revenue by geography From 4Q16 to 1Q17, Schlumberger (SLB) witnessed 6% revenue growth in North America, while it saw a steep revenue decline of ~10% in the Europe/CIS[1.Commonwealth of Independent States]/West Africa region. Schlumberger’s revenue from Latin America was resilient in 1Q17, remaining unchanged from 4Q16. Schlumberger accounts for 6.5% of the ProShares […]

Weighing Flotek’s Current Valuation against Peers

Sell-side analysts expect FTK’s adjusted EBITDA to rise more sharply over the next four quarters than those of its peers.

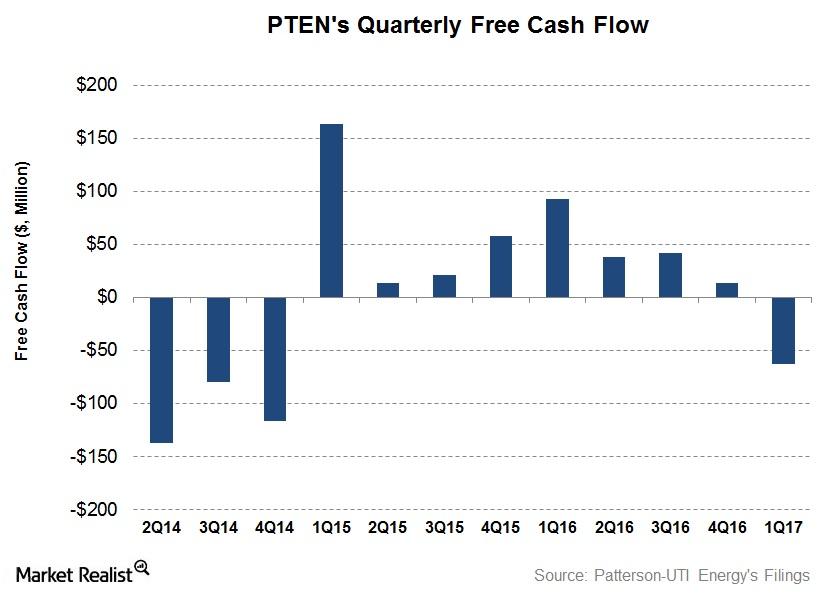

A Look at Patterson-UTI Energy’s Higher 2017 Capex Plan

Patterson-UTI Energy’s capex budget for 2017 is $450.0 million. That’s 275.0% higher than its 2016 capex.

What Were Schlumberger’s Drivers in 1Q17?

Schlumberger’s (SLB) Latin America region witnessed the highest revenue decline (30% fall) in 1Q17—compared to 1Q16.

How Flotek Industries Is Valued versus Peer Stocks

Core Laboratories (CLB) is the largest company by market capitalization among our set of select oilfield services and equipment (or OFS) companies…

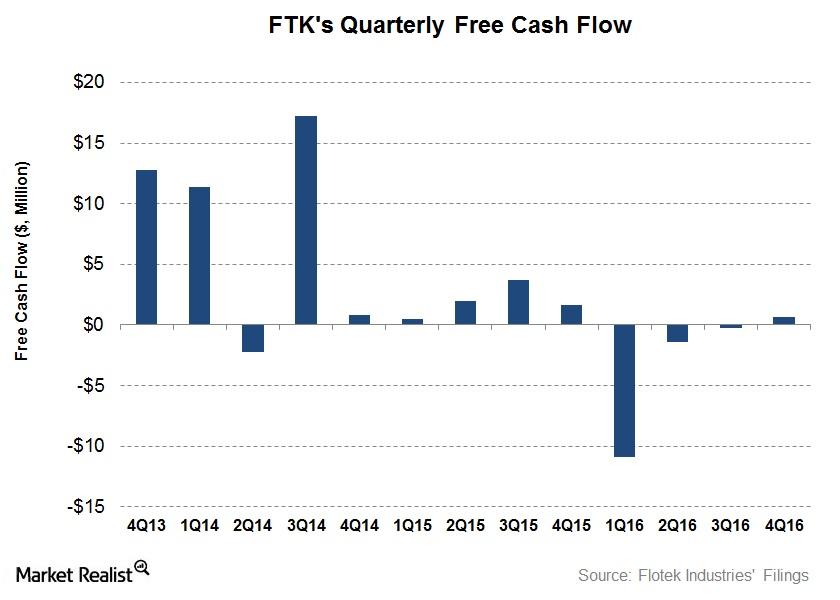

Flotek Industries’ Capex: Impact of a Credit Facility Agreement

In this article, we’ll analyze how Flotek Industries’ (FTK) operating cash flows trended over the past few quarters.

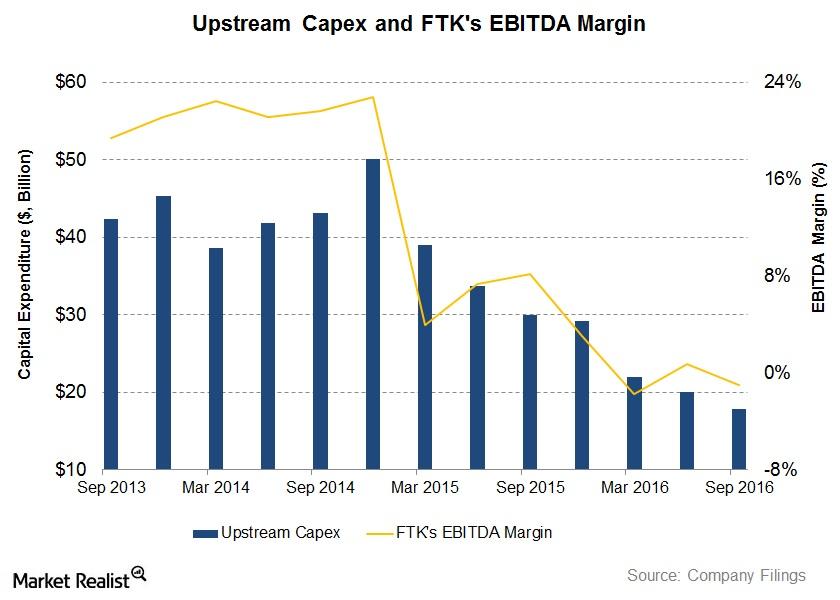

Will Upstream Operators’ Capex Affect Flotek’s 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure as a result of crude oil’s sharp decline.

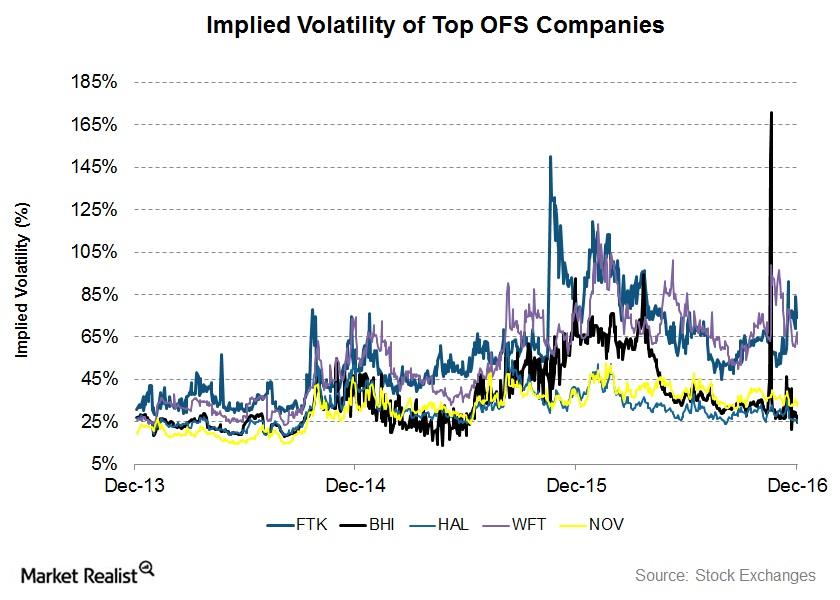

Top Oilfield Service Stocks: Analyzing Implied Volatility

In this article, we’ll compare implied volatility fr the top oilfield services (or OFS) companies, as rated by Wall Street analysts, for 4Q16.

How Is Flotek Industries Currently Valued Compared to Its Peers?

RPC is the largest company by market capitalization among our set of select OFS companies. Flotek Industries is the smallest of the lot.

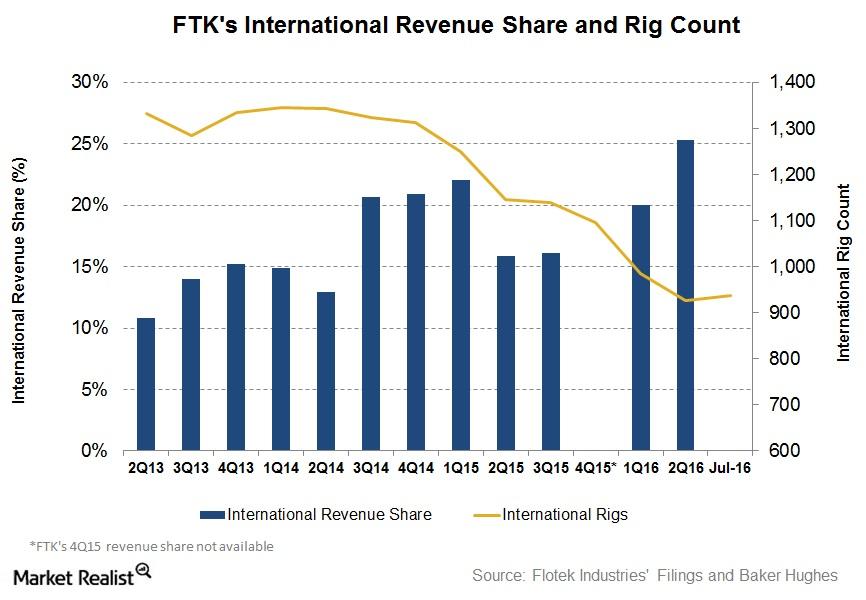

Does the Rig Count Affect Flotek Industries’ International Revenue?

In the past year, Flotek Industries’ (FTK) revenue share generated outside the United States has risen by nearly 10%.