First Trust Water ETF

Latest First Trust Water ETF News and Updates

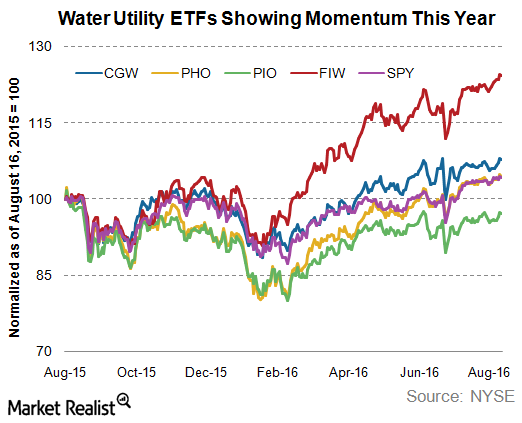

Why Do Water ETFs Yield More Than Water Utilities?

Water utility ETFs (exchange-traded funds) yield roughly 100–150 basis points more than what water utility holding companies yield.

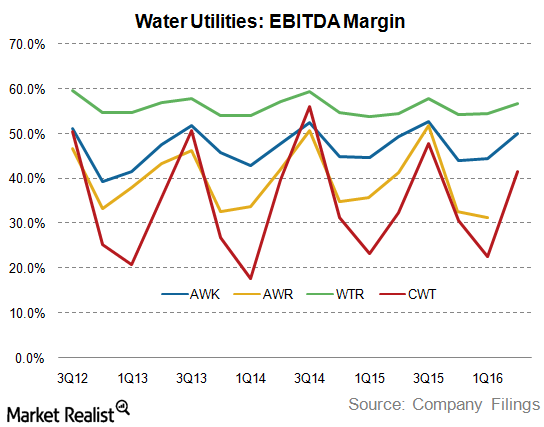

Behind the Earnings of US Water Utilities in 2016

US water utilities have experienced a cyclical but flat earnings growth pattern in the past couple of years.

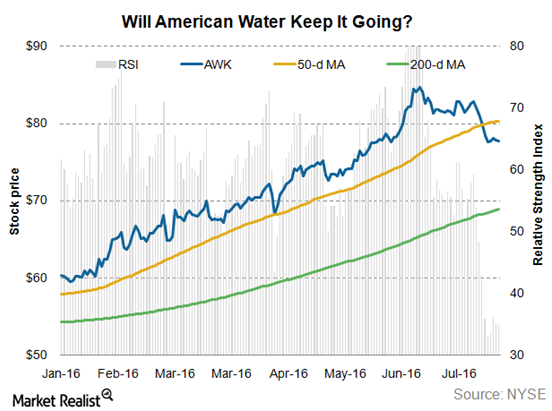

What’s ahead for American Water Works Stock?

American Water Works’ investors are likely concerned by the fact that the stock has corrected by ~12% since July 2016. But it has rallied by ~40% YTD.

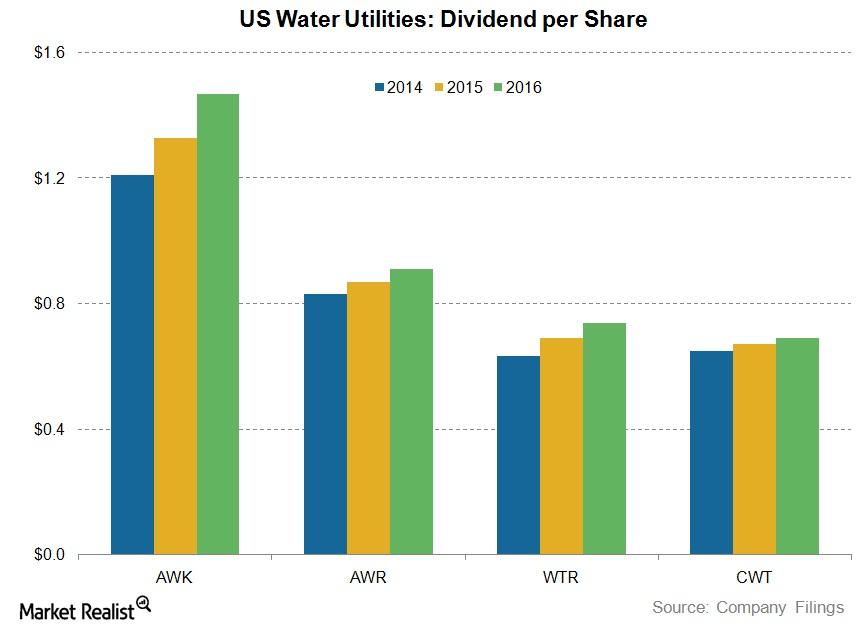

Inside Water Utilities’ Historical Dividends and Growth

US water utilities have distributed fair dividends for the past few years American Water Works’ dividend growth during the past five years stands at 10%.

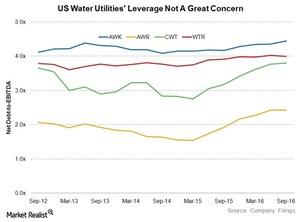

How Is American Water Works’ Leverage Compared to Peers?

Water utilities depend heavily on debt financing due to their capital projects for the longer term, and so company leverages can be useful for investors.

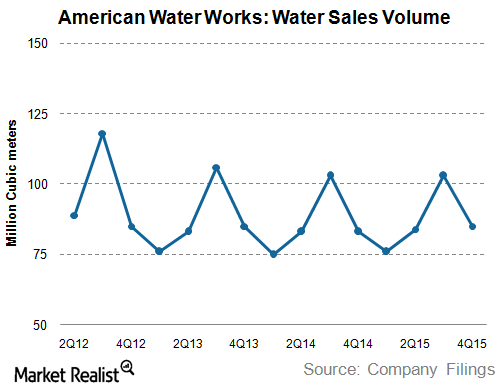

How Are American Water Works’ Sales Volumes Trending?

American Water Works (AWK) witnessed a sharp decline in its water sales volumes after 2010 despite a population increase and economic growth.