BTC iShares MSCI Europe Financials ETF

Latest BTC iShares MSCI Europe Financials ETF News and Updates

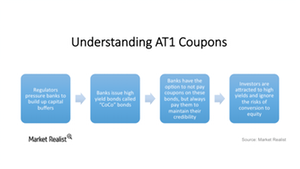

Why Are Deutsche Bank Investors So Concerned About AT1 Coupons?

Shares of Deutsche Bank (DB) have fallen nearly 10% in the last three trading sessions. Efforts to reassure investors about its ability to pay coupons on its AT1 bonds were in vain.

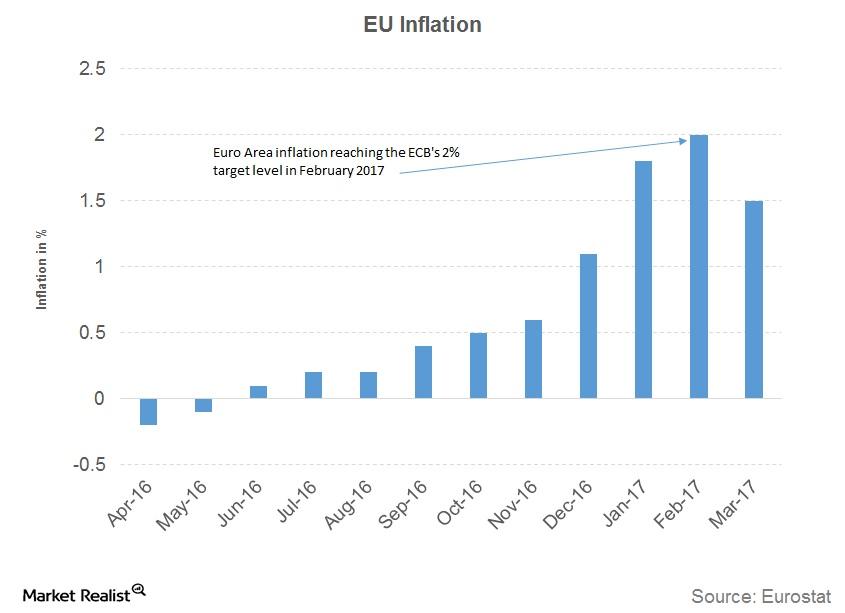

Will the European Central Bank Follow the Fed?

On its own stage across the Atlantic from the US Fed, the ECB (European Central Bank) has had its own quantitative easing program.

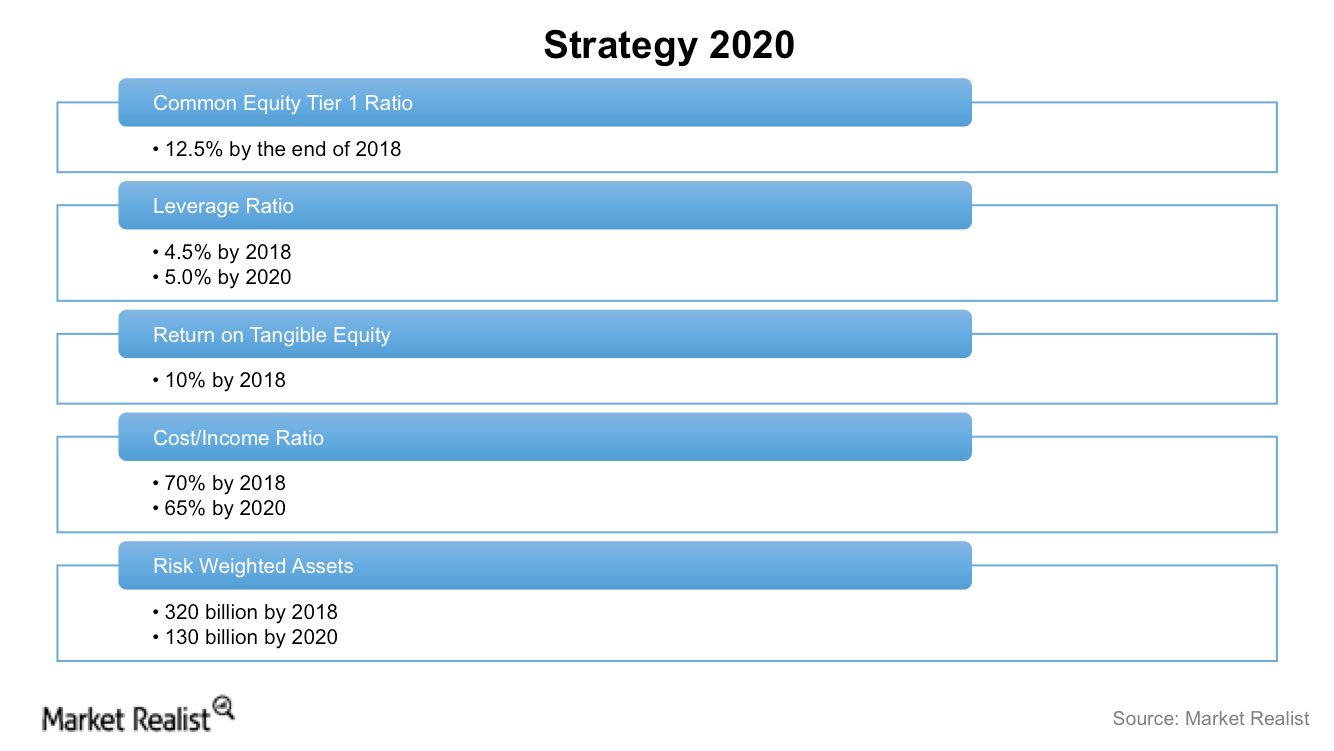

Will Deutsche Bank’s Overhaul Plan Work?

Investors who are concerned about Deutsche Bank’s bankruptcy are looking at CEO John Cryan’s plan to restructure the company’s operations.

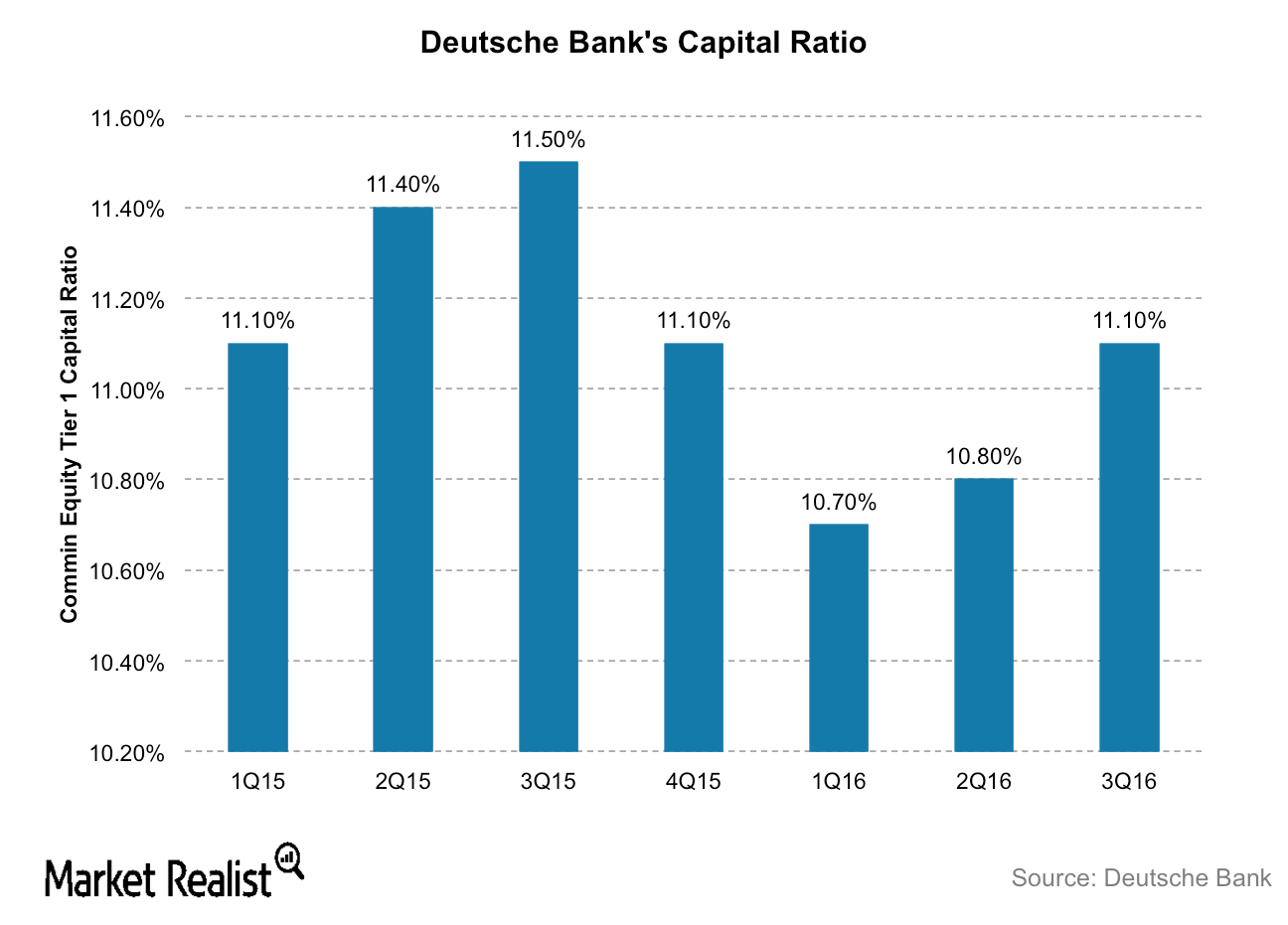

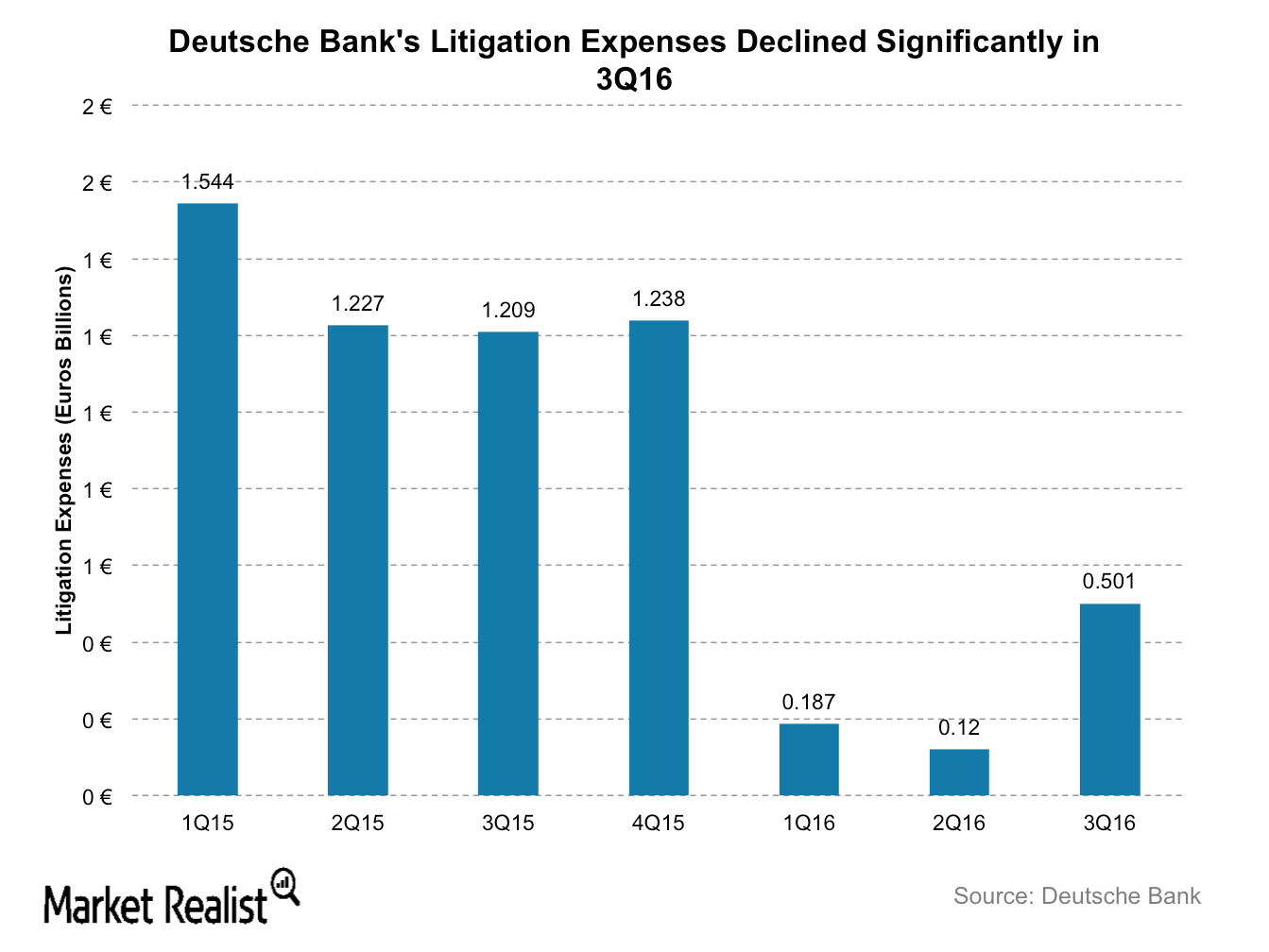

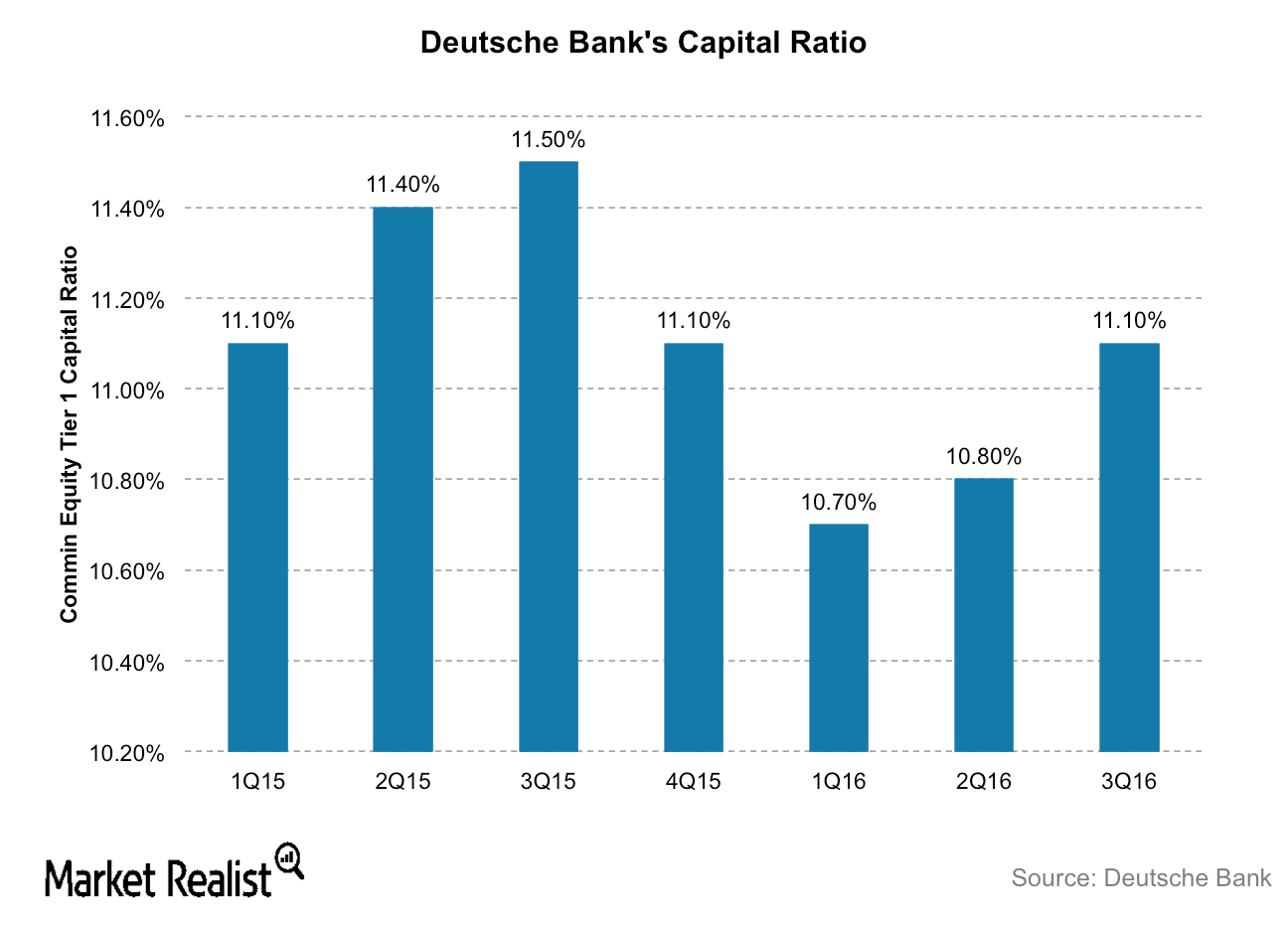

Deutsche Bank: Analyzing Its Capital Levels

Deutsche Bank is proving to be the most dangerous bank to the global economy. It failed the Fed’s 2016 stress tests in June 2016.

Can Trump Save Deutsche Bank from Bankruptcy?

Deutsche Bank could be the biggest beneficiary under Trump, having been on the brink of bankruptcy until its stock spiked nearly 20% after the election.

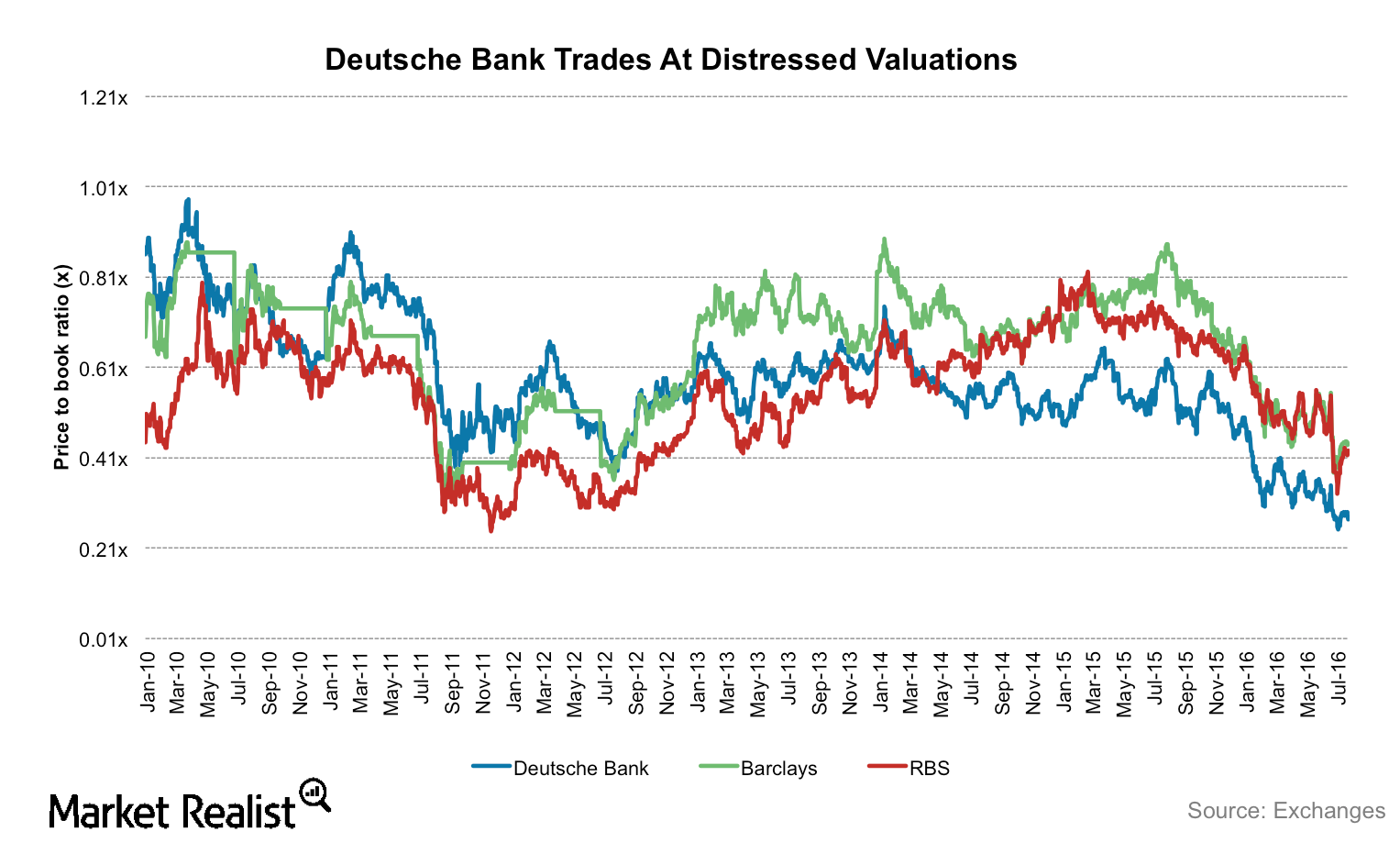

Do Distressed Valuations Offer a Good Chance to Buy Deutsche Bank?

Deutsche Bank’s (DB) shares are currently trading at distressed valuations. The bank’s shares are trading at the steepest discount to its book value, worse than the 2008 financial crisis.

Deutsche Bank’s Capital Levels Struggle to Meet Regulatory Requirements

Deutsche Bank’s stock is down nearly 40% in 2016 so far. Capital reserves are important to restore the confidence of regulators and investors.

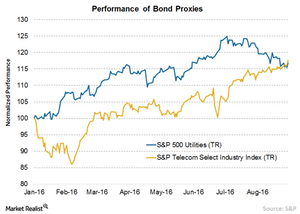

Why Some Popular Positions Become Risky

According to Factset data, around 93% of companies in the utilities (JXI) sector and 80% in the telecom (IXP) sector reported revenues below estimates in the second quarter of 2016.

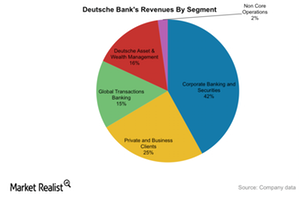

Understanding Deutsche Bank’s Segments

Deutsche Bank operates under five segments. Corporate Banking & Securities contributes 50% to Deutsche Bank’s revenues.

Analyzing US and European Banks’ Leverage Ratios

On average, European banks have higher leverage than US banks. An excess buildup of leverage increases a bank’s exposure to the risk of bankruptcy.