Discover Financial Services

Latest Discover Financial Services News and Updates

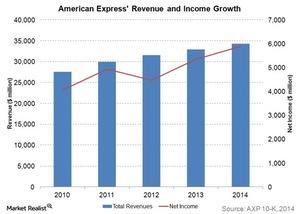

American Express: Opportunities Abound in a Challenging Market

Co-branding relationships are an important part of the American Express business model. The costs of renewing and extending these relationships is increasing.

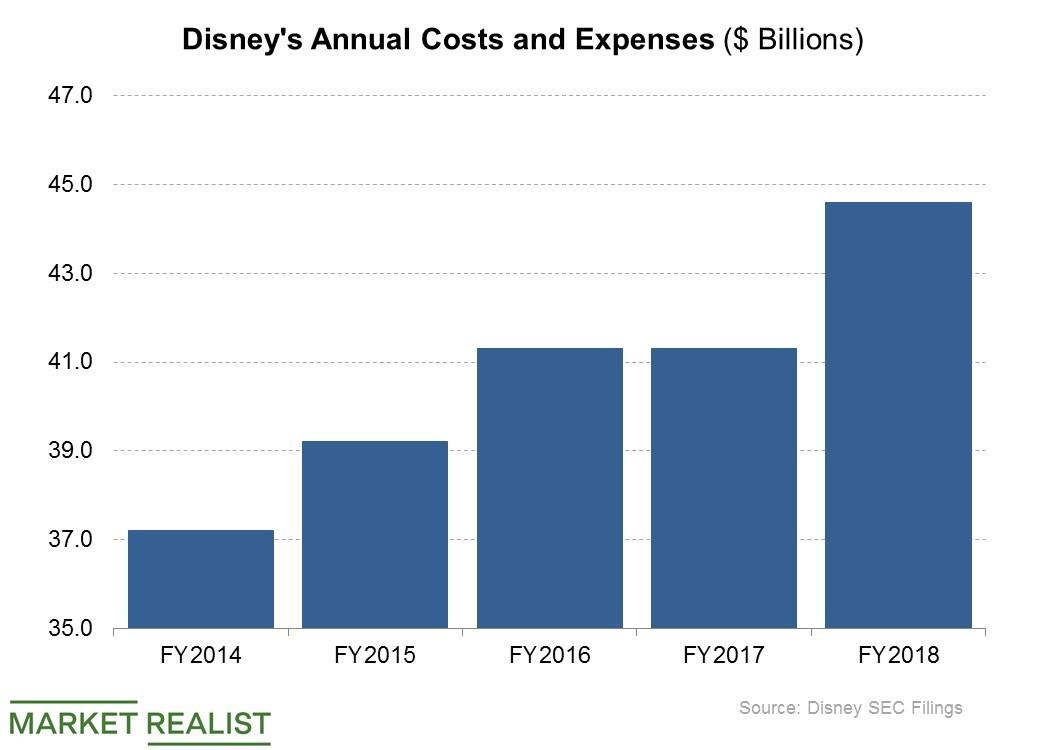

Why Disney Is Spending $25 Million per Year on Staff Education

The Walt Disney Company is among those large American companies that have launched back-to-school programs for their employees.

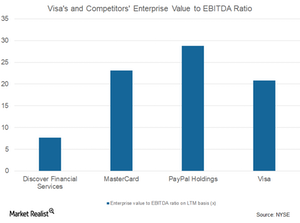

Analyzing Visa’s Assets and Liabilities

As of September 30, 2016, Visa (V) has reported a total asset balance of $64.03 billion. As of June 30, 2017, the company managed to report a total asset balance of $64.00 billion.

American Express to Ride on Partnerships, Digitization

American Express (or Amex) (AXP) has entered into digital partnerships with Airbnb, Facebook (FB), and Uber in order to offset the revenue loss from Costco (COST).

Will Payment Processors Keep Seeing the US Dollar Impact in 2017?

Payment processors are now seeing improved performances on increased spending, new technologies, expansion into global markets, and the stable US dollar.

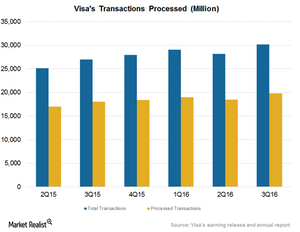

International Use to Boost Visa’s Fiscal 4Q16 Processed Transactions

Visa (V) reported total transactions of $30.2 billion in fiscal 3Q16, compared to $27 billion in fiscal 3Q15—a growth of 11.8% year-over-year.

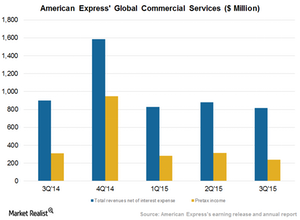

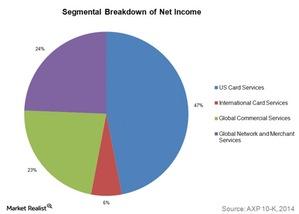

American Express Is Focusing on Its Global Commercial Services

American Express’s Global Commercial Services’ total revenues net of interest expense fell by 9% to $817 million in 3Q15, forming 10% of its total revenues.

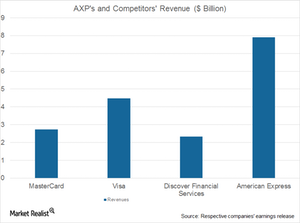

What investors should know about Discover Financial Services

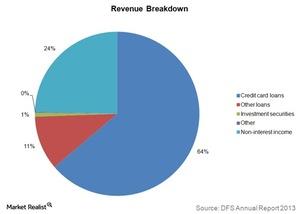

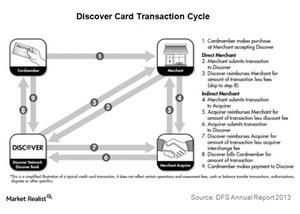

Discover Financial Services (DFS) is a direct bank and electronic payment services company in the US. It offers an array of banking products.

Analyzing Discover Financial’s business segments

Discover Financial Services (DFS) has two operating segments: Direct Banking and Payment Services. Payment Services is comparatively small.

American Express and Its Four Operating Segments

Of the four American Express segments, the Global Network and Merchant Services segment has shown the highest growth over the last two years.

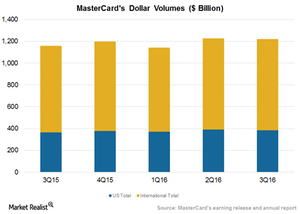

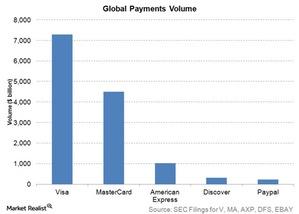

MasterCard Operates in an Intensely Competitive Payments Industry

Cash and checks constitute ~85% of the retail payment transactions worldwide. However, electronic payment methods are increasingly replacing cash and check payments globally.

MasterCard Does Not Look Overvalued Compared to Historical Levels

MasterCard focuses on growth in its core business of credit, debit, prepaid offerings, and processed transactions. It seeks to diversify its customer base, including smaller merchants and consumers who still use cash and checks.