Xtrackers MSCI Europe Hedged Equity ETF

Latest Xtrackers MSCI Europe Hedged Equity ETF News and Updates

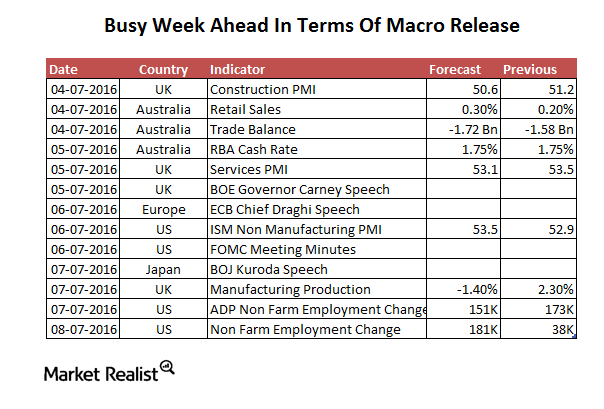

Why Employment Numbers Are this Week’s Center of Attention

Strong non-farm employment required to maintain any rate hike hopes Non-farm employment changes are one of the most important indicators the US Fed considers in deciding on monetary policy. May non-farm employment changes hit a multi-year low, which took away all probabilities of a June hike. Check out the following article for further detail on May’s […]

Structural Issues with the EU Could Lead to Further Referendums

Many European countries want the ability to print their own money and come to their own aid instead of going to the ECB (European Central Bank).

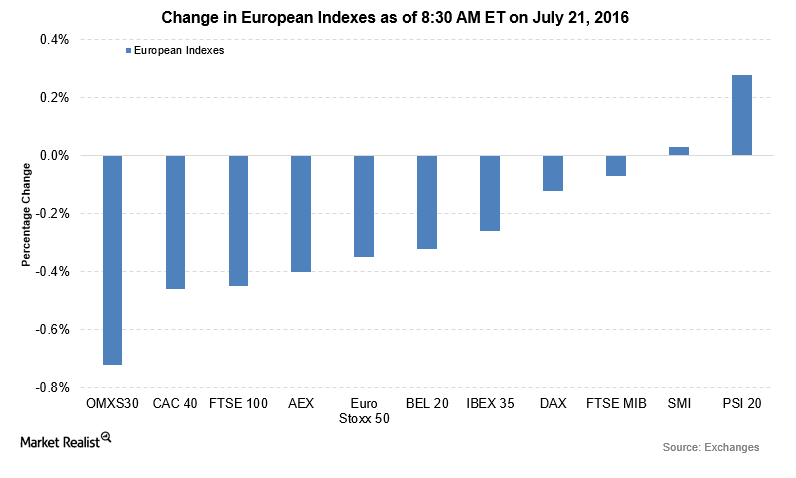

Monetary Policy Statement: Why the ECB Kept Rates Unchanged

The ECB decided to keep the key rates unchanged in the monetary policy review on July 21, 2016. The pound was the major loser among the currencies.

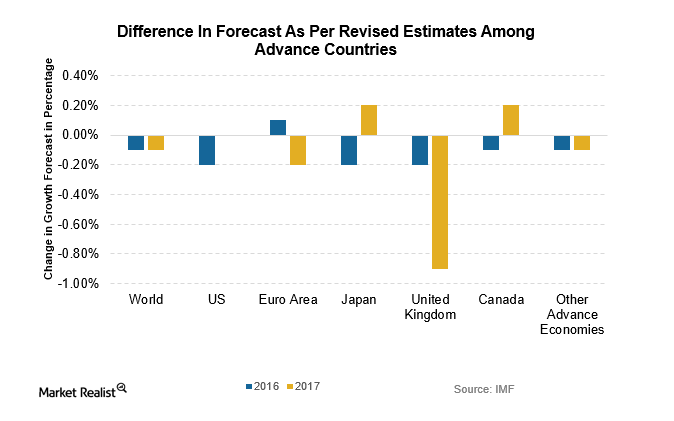

Why Were the United Kingdom’s Growth Forecasts Slashed?

Looking at the change in growth forecasts in advanced economies, the United Kingdom suffered the largest downward revision of estimates.

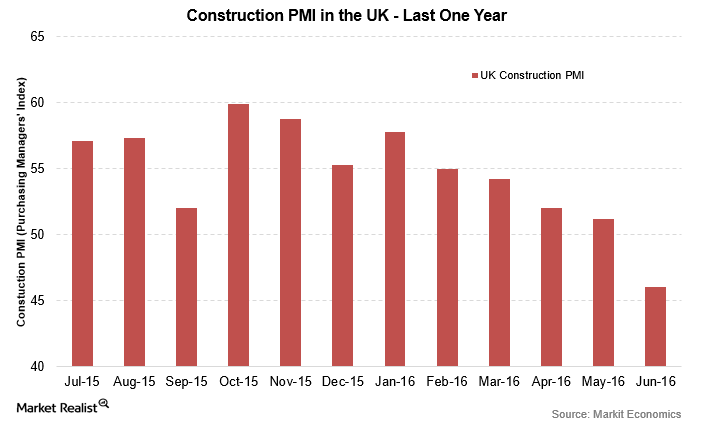

UK Construction PMI Contracts Due to Uncertain Brexit Implications

The United Kingdom’s construction PMI (purchasing managers’ index) came in at 46 for June—compared to 51.2 in the previous month.

Is the Rebound in Global Markets Sustainable?

The SPDR Euro STOXX 50 ETF (FEZ) rose by 2.6%. The United Kingdom’s (FKU) FTSE 100 was among the leaders in European markets. It rose by 2.6%.

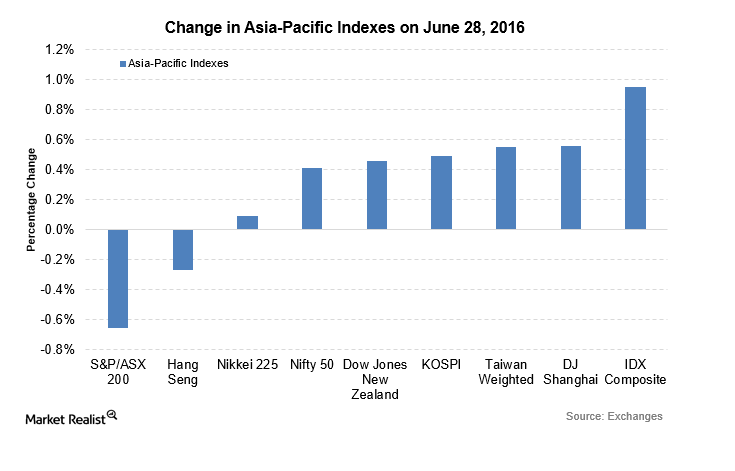

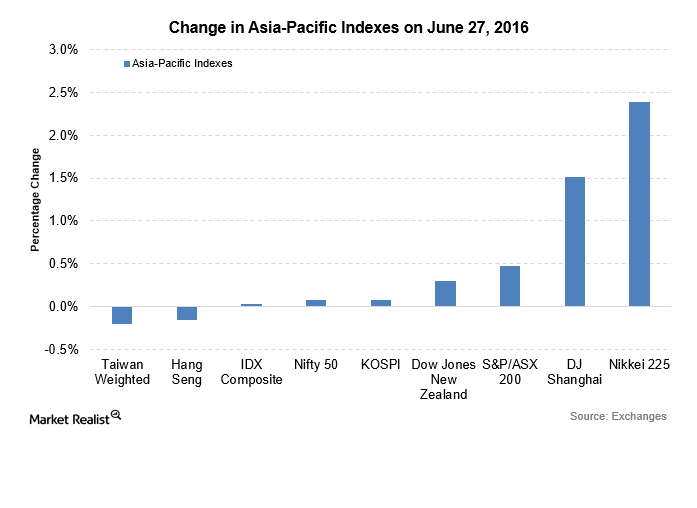

Do Asian Indexes Point to a Recovery in Global Markets?

Critical Asian indexes were trading on a mixed note on June 27 with the Japanese and Chinese indexes leading the gains. The Nikkei 225 posted a significant gain of 2.4%, while the Dow Jones Shanghai Index rose by 1.5%.

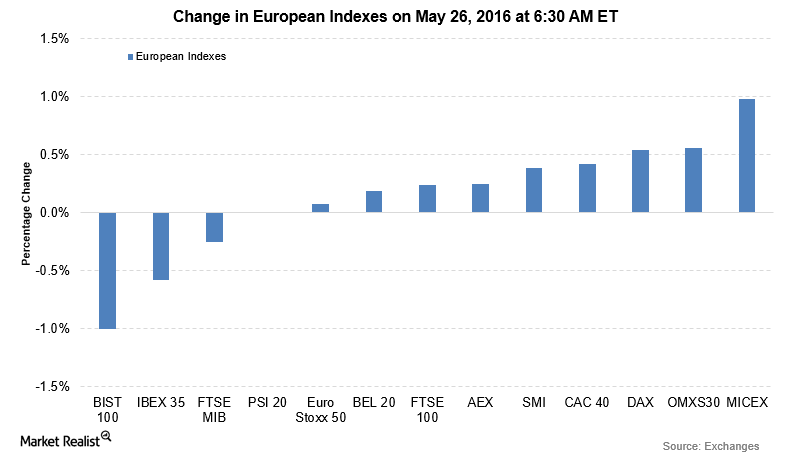

European Market Flat as Investors Await G7 Leaders’ Brexit Views

Major European indexes (DBEU) were trading with caution on May 26, 2016, as they awaited G7 leaders’ views on the Brexit referendum.