Church & Dwight Co., Inc.

Latest Church & Dwight Co., Inc. News and Updates

Procter & Gamble Beats Third-Quarter Estimates

Procter & Gamble (PG) posted stronger-than-expected third-quarter results on Tuesday, April 23.

How Much Has Colgate-Palmolive Increased Its Dividend?

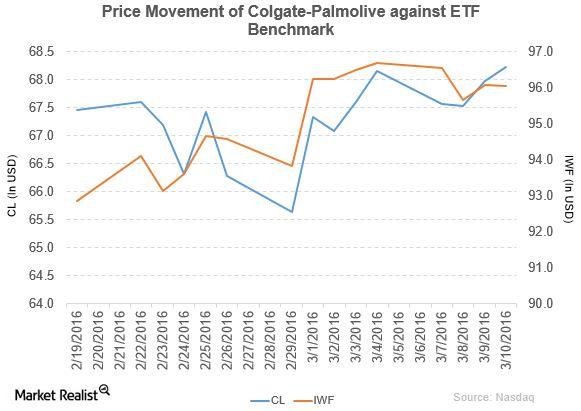

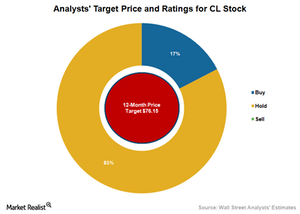

Colgate-Palmolive (CL) has a market capitalization of $60.9 billion. CL rose by 0.37% to close at $68.23 per share as of March 10, 2016.

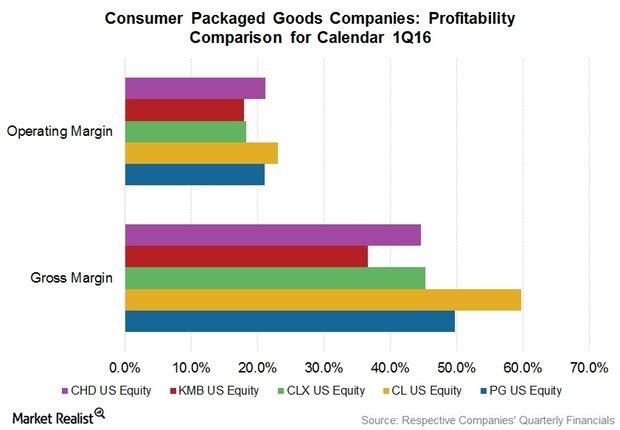

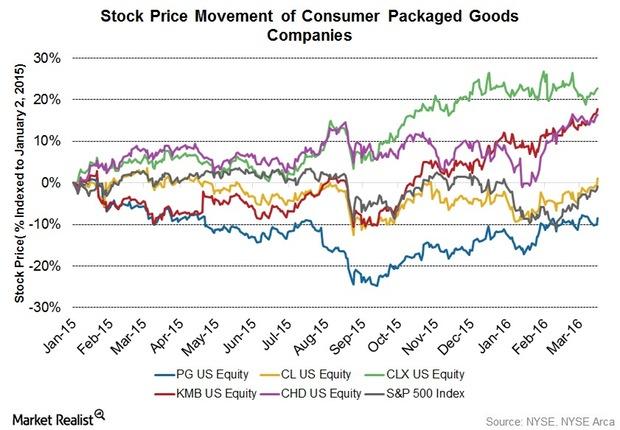

Weak Currencies, but Consumer Packaged Goods Margins Improved

The 1Q16 margins of consumer packaged goods (or CPG) companies sent strong signals. These companies have been investing heavily in innovative products and other growth initiatives.

Why 2019 Wasn’t As Good As 2018 for Church & Dwight Stock

Although Church & Dwight stock is trading in the green, it has lagged its peers and the broader markets. The stock didn’t repeat its 2018 performance.

Procter & Gamble Stock: What’s Fueling the Growth?

Procter & Gamble stock has generated a significant amount of wealth for investors this year. The company boosted shareholders’ returns.

Why Colgate-Palmolive’s Q3 Earnings Failed to Impress

Colgate-Palmolive released its third-quarter earnings results today. The company’s performance was mixed, irking investors.

Procter & Gamble Stock: Valuation Limits Upside

Procter & Gamble stock trades at 24.7x its fiscal 2020 estimated core EPS of $4.85. The stock trades at 23.2x its fiscal 2021 estimated core EPS of $5.17.

Church & Dwight Stock: Valuation Overshadows Growth

Church & Dwight (CHD) stock has risen 9.5% on a YTD (year-to-date) basis as of September 13. However, the stock lags its peers by a wide margin.

Procter & Gamble Stock: What’s behind Its Solid Return?

Procter & Gamble stock benefits from its strong organic sales. On average, the company’s organic sales have increased by 5% in the last four quarters.

Why Clorox Stock Is Underperforming Peers

Clorox stock (CLX) is down about 8% since the company posted its third quarter of fiscal 2019 earnings on May 1.

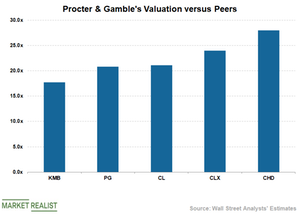

Procter & Gamble’s Valuation Compared to Its Peers

Procter & Gamble (PG) stock trades at 20.8x its estimated fiscal 2019 EPS of $4.41, which doesn’t look attractive.

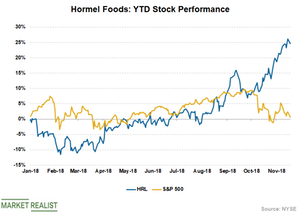

What’s Backing the Uptrend in Hormel Foods Stock?

Hormel Foods (HRL) is another company in the consumer staples industry that has outperformed the broader markets so far this year.

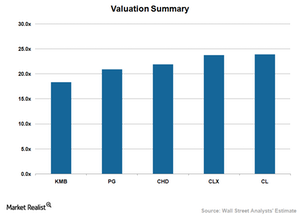

How PG, KMB, CL, CLX, and CHD Compare on Valuation

As of November 24, 2017, Colgate-Palmolive (CL) stock was trading at a forward PE multiple of 24.0x, which is higher than its peers.

What Analysts Recommend for Colgate-Palmolive

The majority of analysts providing recommendations on Colgate-Palmolive (CL) stock maintain a neutral outlook.

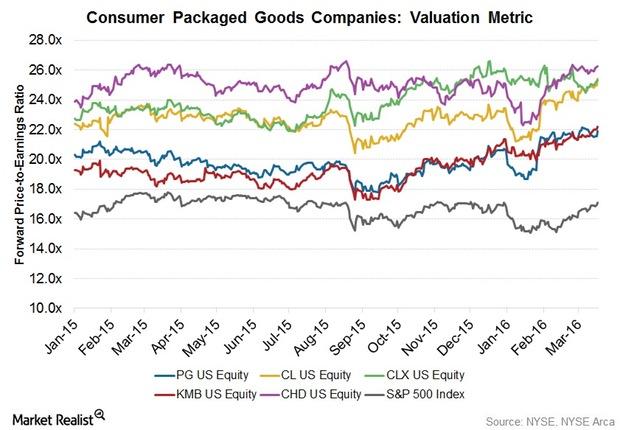

Valuation Multiples Higher for Consumer Packaged Goods in 1Q16

Consumer packaged goods (or CPG) companies are trading at higher valuations compared to the S&P 500 Index (IVV) (SPY) (VOO) and the Dow Jones Industrial Average (DIA).

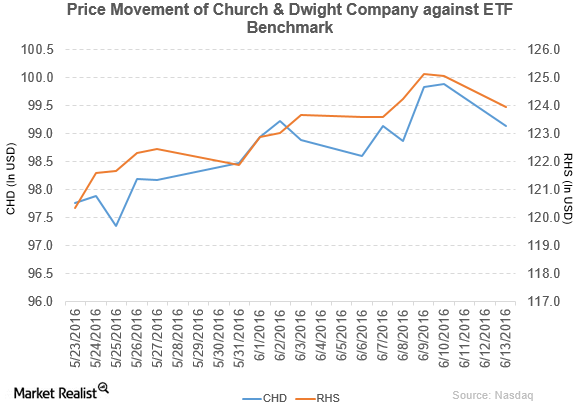

Why Church & Dwight Sold Its Brands to Armaly Brands

Church & Dwight (CHD) has a market cap of $12.7 billion. It fell by 0.74% to close at $99.14 per share on June 13, 2016.

Behind CPG Companies’ High Valuation Multiples in 4Q15

As of March 17, 2016, CPG companies were trading at higher valuations relative to the S&P 500 Index (SPY) and the Dow Jones Industrial Average (DIA).