Crown Holdings Inc

Latest Crown Holdings Inc News and Updates

Bank of America/Merrill Lynch Upgrades Silgan Holdings to a ‘Buy’

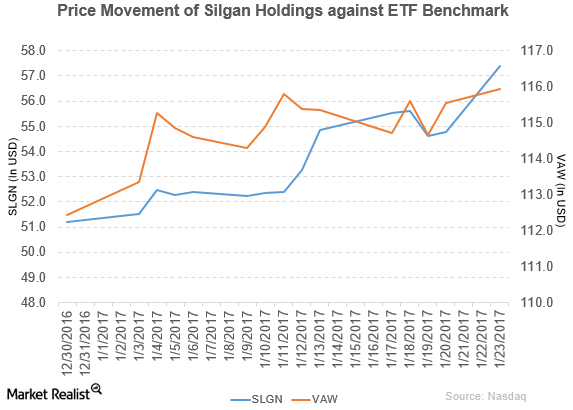

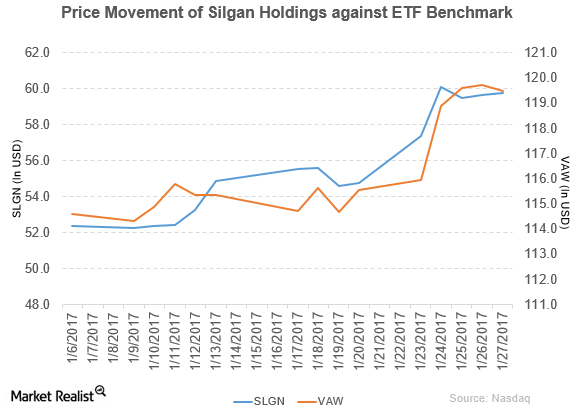

On January 23, 2017, Bank of America/Merrill Lynch upgraded Silgan Holdings’s (SLGN) rating to a “buy” from “underperform.”

What Moody’s Thinks of Silgan Holdings’ Rating

Silgan Holdings (SLGN) rose 9.1% to close at $59.77 per share during the fourth week of January 2017.

Ball Corporation Declared Dividend of $0.13 per Share

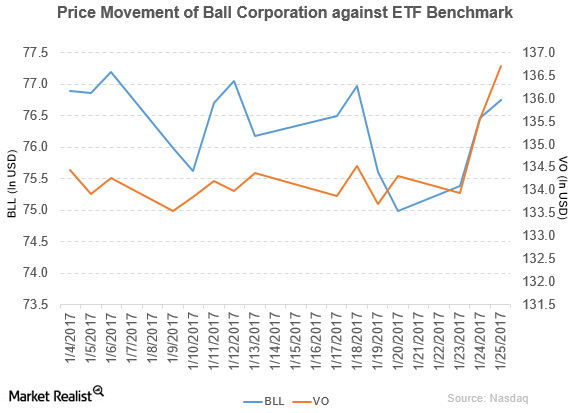

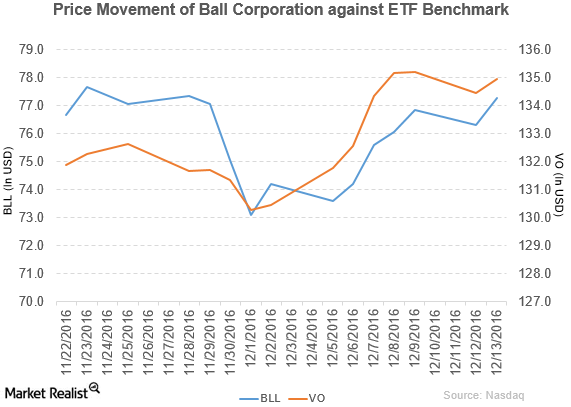

Ball Corporation declared a cash dividend of $0.13 per share on its common stock. It will be paid on March 15 to shareholders of record as of March 1, 2017.

What’s the Latest News on Ball Corporation?

Ball Corporation (BLL) reported 3Q16 net sales of $2.8 billion, a rise of 33.3% compared to net sales of $2.1 billion in 3Q15.

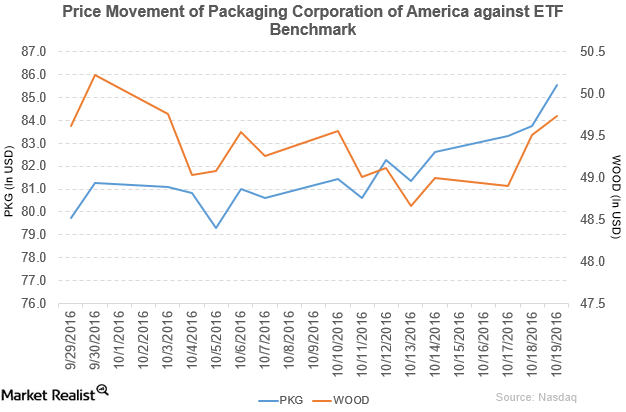

How Has Packaging Corporation of America Performed in 3Q16?

Price movement Packaging Corporation of America (PKG) has a market cap of $8.0 billion. It rose 2.1% to close at $85.54 per share on October 19, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.0%, 7.2%, and 39.3%, respectively, on the same day. PKG is trading 5.1% above its 20-day moving […]

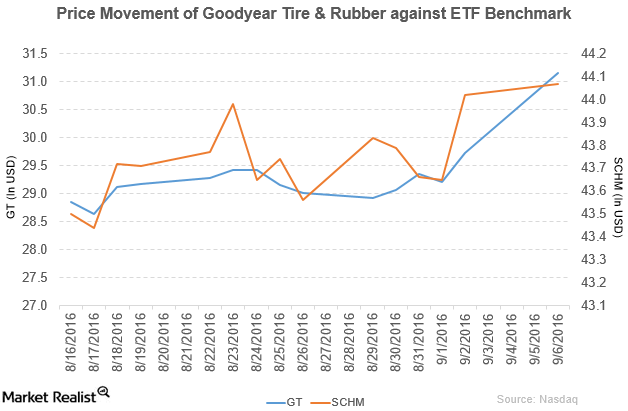

Deutsche Bank Upgrades Goodyear to ‘Buy’

The Goodyear Tire & Rubber Company (GT) has a market cap of $8.2 billion. It rose by 4.8% to close at $31.16 per share on September 6, 2016.

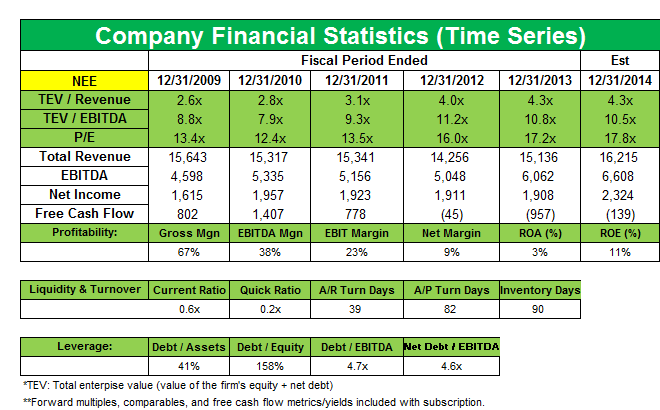

Millennium Management increases its stake in NextEra Energy

Millennium Management increased its stake in renewable energy generator NextEra Energy Inc. (NEE) from 1,789,954 shares to 3,333,627 shares.

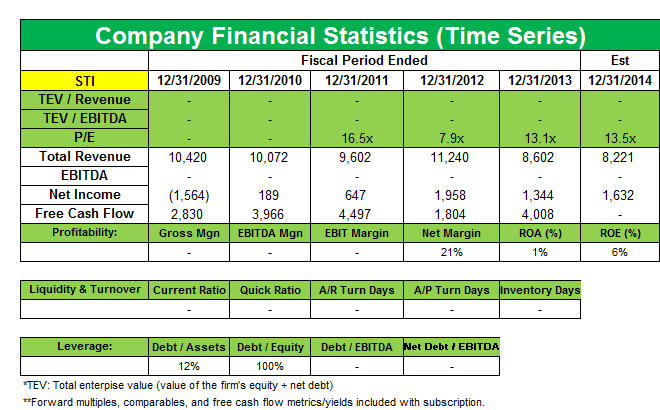

Millennium Management buys a new position in SunTrust Banks

Millennium Management started a new position in SunTrust Banks (STI) that accounts for 0.15% of the fund’s portfolio.