AutoZone Inc

Latest AutoZone Inc News and Updates

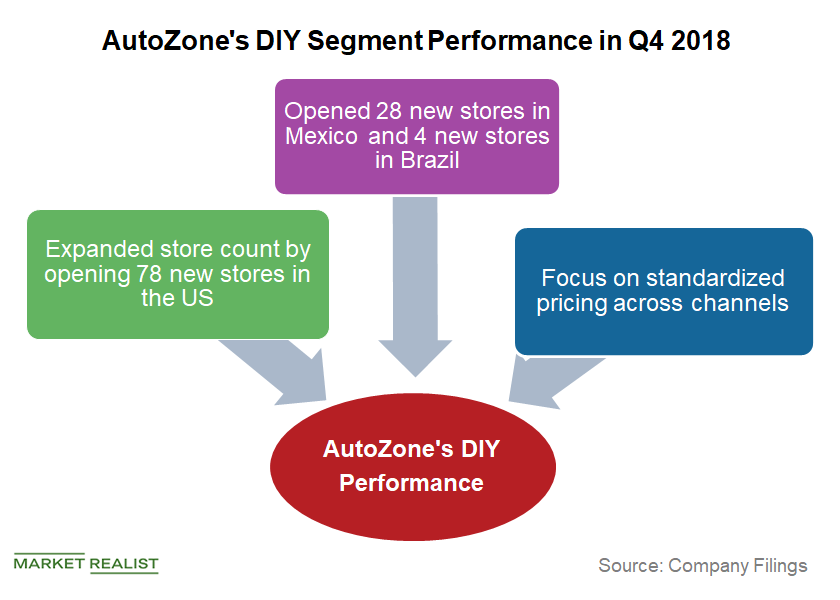

How AutoZone’s DIY Segment Performed in Fiscal Q4 2018

In the second half of fiscal 2018, AutoZone’s management decided to discontinue aggressive promotional discounts for its ship-to-home sales.

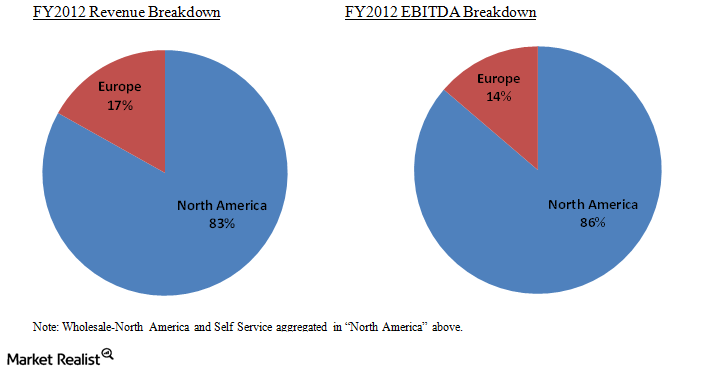

An investor’s must-know guide to LKQ’s 3 operating segments

LKQ is the nation’s largest provider of alternative vehicle collision replacement products and a leading provider of alternative vehicle mechanical replacement products.

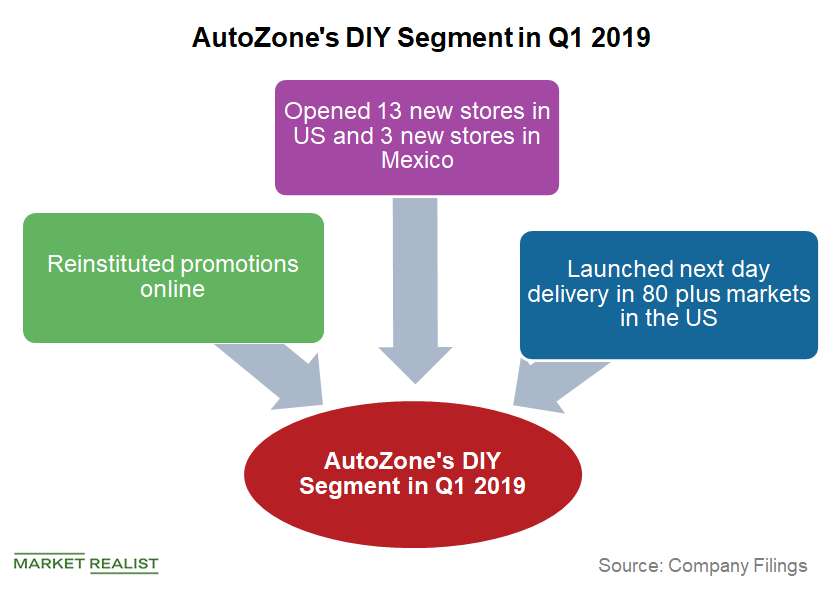

Did AutoZone Resume Its Promotional Strategy in Q1 2019?

AutoZone’s performance is mainly divided into two business segments: DIY (do it yourself), or Retail, and DIFM (do it for me), or Commercial.

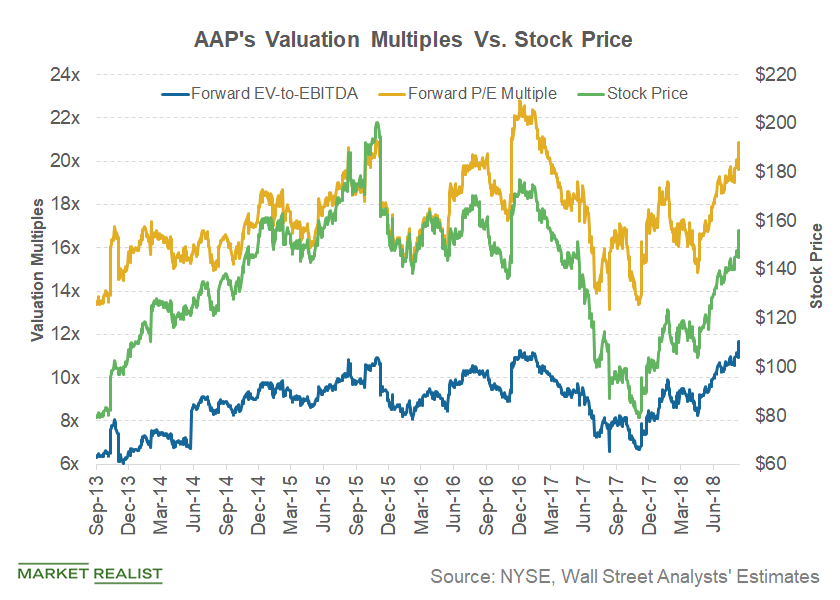

Advance Auto Parts’ Valuation Multiples in Q3 2018

As of August 14, Advance Auto Parts’ forward EV-to-EBITDA multiple was 10.8x. Currently, Advance Auto Parts’ forward PE multiple is 20.8x.

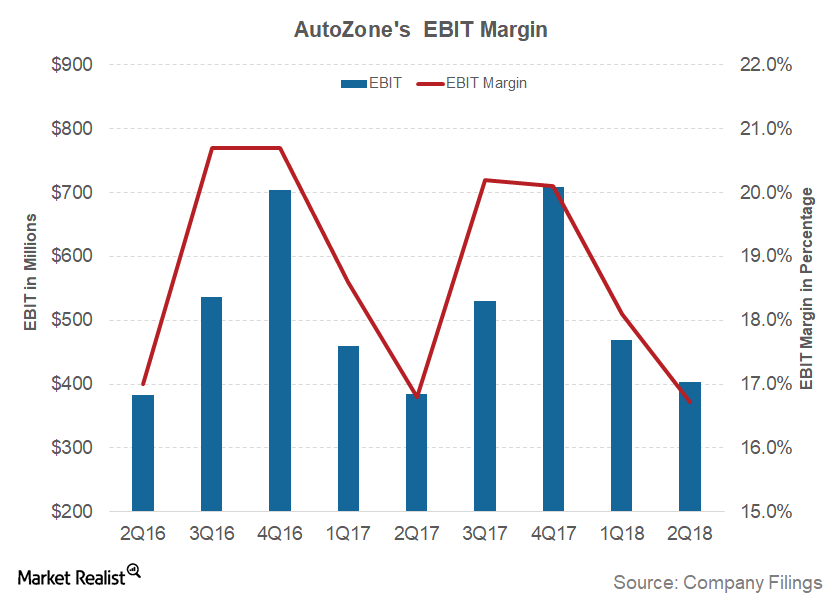

Why AutoZone’s Profit Margin Failed to Impress in Fiscal 2Q18

AutoZone’s 2Q18 earnings Previously, we looked at how AutoZone’s (AZO) key business segments fared in 2Q18. The company’s focus on improving parts availability and the in-store experience continued to drive growth. AZO’s commercial and online retail business traffic grew during the quarter. Let’s find out how these factors affected AutoZone’s profitability in 2Q18. Profit margin in 2Q18 […]

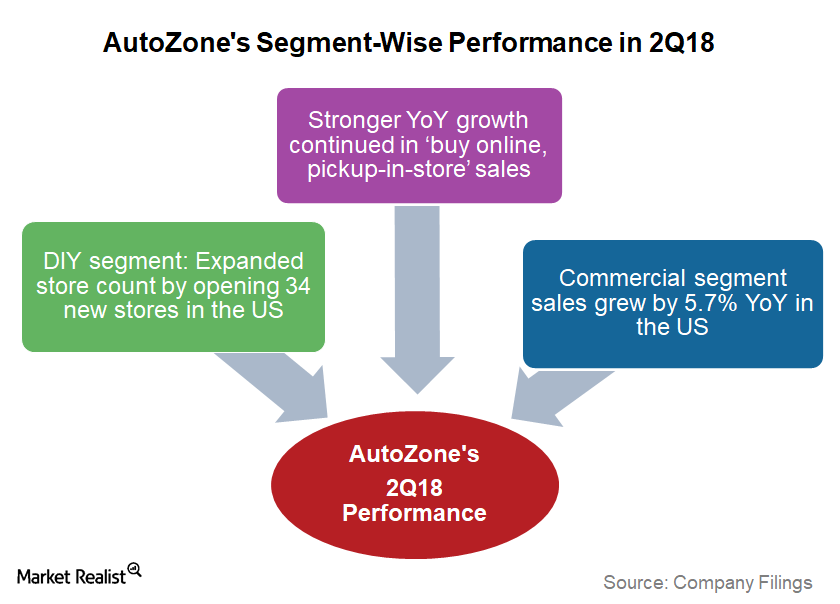

Analyzing AutoZone’s Segment-Wise Performance in 2Q18

AutoZone’s business segments AutoZone’s (AZO) results are divided into two business segments: the DIY (Do-it-yourself) segment and the Commercial or DIFM (Do-it-for-me) segment. The DIY segment, which targets retail customers, yields wider margins than DIFM. Let’s take a look how these business segments performed in 2Q18 and AutoZone’s other key growth priorities. DIY segment in 2Q18 AutoZone’s […]

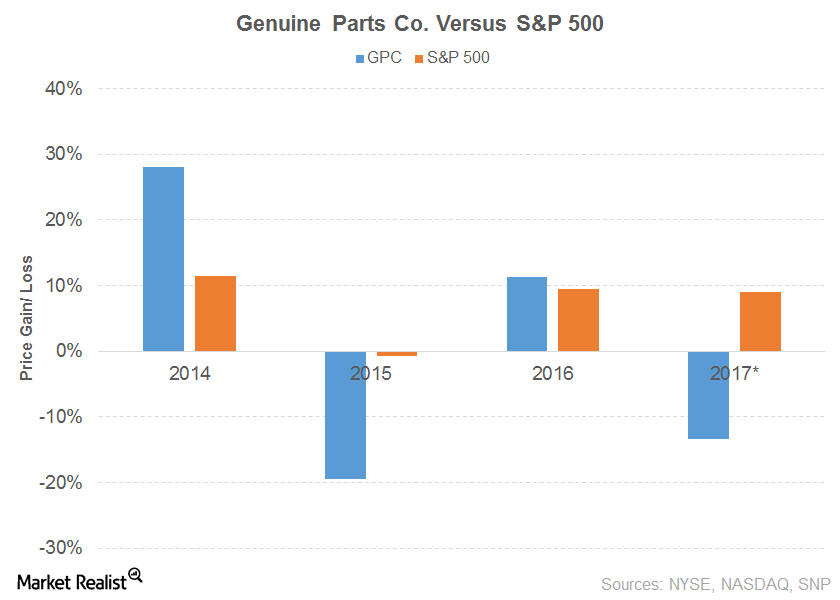

Will Genuine Parts Sustain Its Dividend Yield?

Genuine Parts (GPC) recorded a marginal growth in its 2016 net sales, driven by its Automotive and Office Products segments.

Understanding Tesla Motors’s Product Portfolio

Tesla plans to expand its product portfolio to include the Model-X, which is expected to hit the roads sometime later this year.

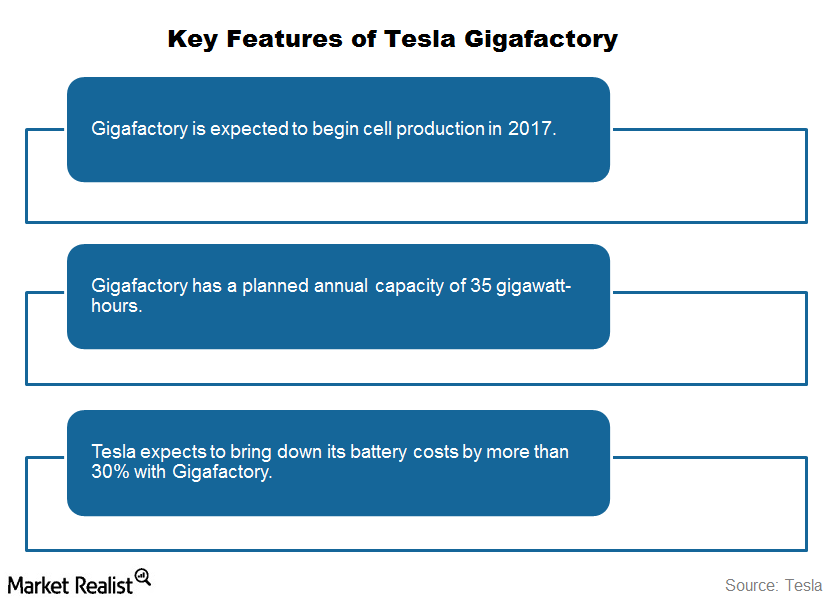

What Is the Strategic Importance of Tesla’s Gigafactory?

By 2020, the Tesla Gigafactory will reach full capacity and produce more lithium ion batteries annually than were produced worldwide in 2013.