Allstate Corp (The)

Latest Allstate Corp (The) News and Updates

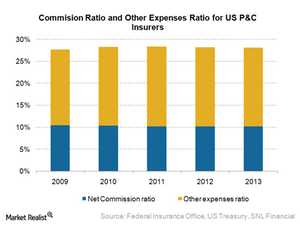

How cost structures and distribution channels impact profit

As customers use Internet-based aggregators to purchase insurance policies, insurers use online sales to interact directly with customers and reduce costs.

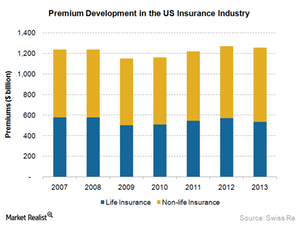

The US insurance industry: Largest in the world

Insurance premiums have grown at a modest pace after a dip in 2009 due to the financial crisis, which the industry was able to navigate.

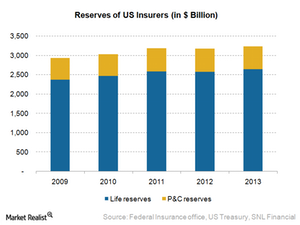

Making sense of an insurer’s liabilities

Policyholder liabilities, or policyholder reserves, represent the future claims that may arise for the pool of policies the insurer writes.

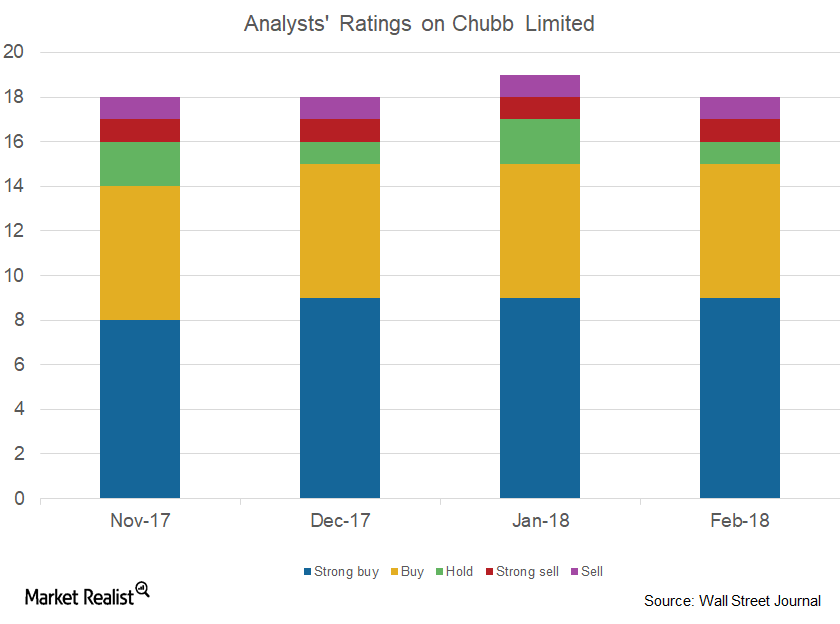

How Analysts Are Rating Chubb

Chubb (CB) is tracked by 18 analysts in February 2018. One analyst has recommended a “sell” for the stock, and one has recommended a “hold.”

How AIG’s Consumer Insurance Division Performed in 3Q17

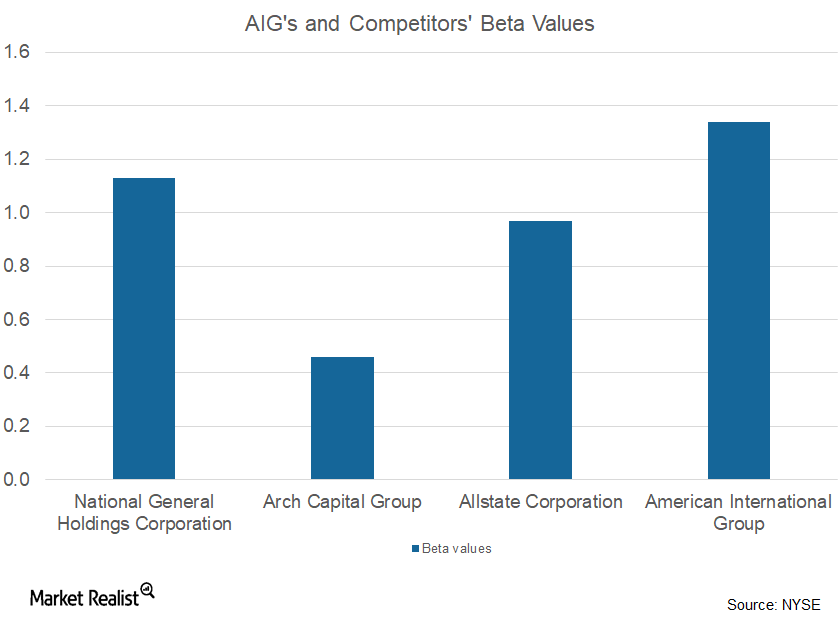

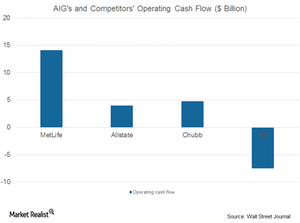

Marginal fall American International Group’s (AIG) consumer insurance division’s total operating revenue fell 1% from $6 billion in 3Q16 to $5.9 billion in 3Q17. The marginal fall was mainly due to lower net investment income and premiums. The division’s premiums fell 2% to $3.2 billion in 3Q17 from $3.3 billion in 3Q16. Whereas AIG has a beta of […]

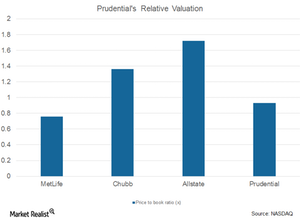

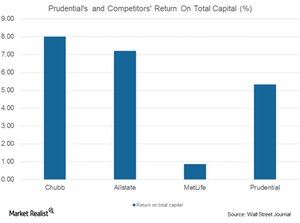

Prudential’s Discounted Valuations in 2Q17

Wall Street analysts recommended a one-year price target of $116.07 per share on Prudential Financial (PRU), reflecting an increase of ~14.1% from the current price.

Understanding Prudential’s Group Insurance and Individual Life Earnings

In 2Q17, on the basis of annualized new business premiums, sales in Prudential’s Individual Life business stood at $153 million, reflecting a marginal decline of ~3.8% year-over-year.

Analyzing AIG’s Life and Personal Insurance Business

AIG’s pretax operating income for personal insurance stood at $330 million in 2Q17. In 2Q16, it stood at $152 million.

Why AIG’s Net Income Fell on a Year-over-Year Basis

AIG is expected to post earnings per share of $1.22 in 3Q17, an ~20.3% decline from its 2Q17 earnings. AIG is expected to report revenues of ~$11.8 billion in 3Q17.

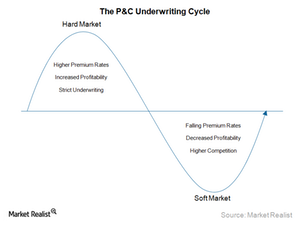

How Underwriting Cycles Impact the Top Line and the Bottom Line

The underwriting cycle moves between hard and soft market conditions, which have different sets of characteristics that determine the profitability of the insurance industry.

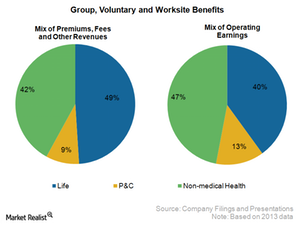

MetLife is a key player in the US group insurance business

MetLife is the market leader in the Large market with ~30% of the market share, while its market share is slightly above 5% in the Middle market.