Abiomed Inc.

Latest Abiomed Inc. News and Updates

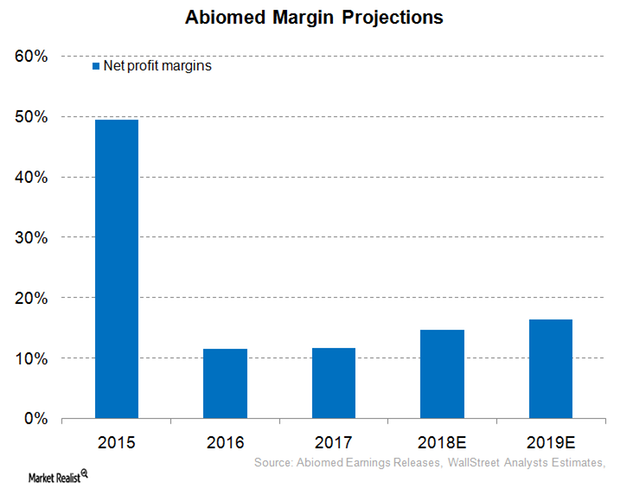

Inside Abiomed’s Profit Margin Expectations for Fiscal 2018

For fiscal 2018 (ended March 31, 2018), Abiomed (ABMD) has projected that its operating margins will be in the range of 22%–24%.

Do Abiomed’s Valuations Look Attractive?

Abiomed’s (ABMD) revenues rose 36% YoY to ~$180 million in fiscal Q1 2019 compared to $133 million in Q1 2018.

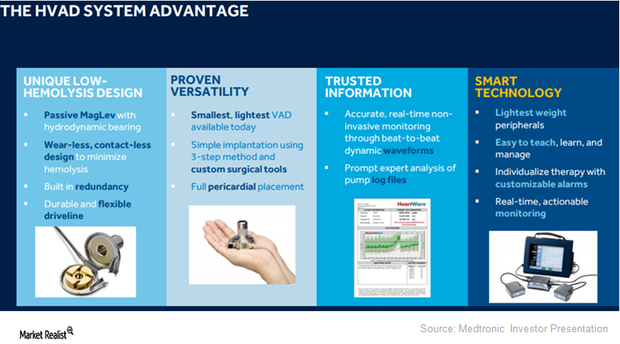

HVAD Expected to Expand Medtronic’s Presence in LVAD Segment

On September 27, 2017, the FDA approved Medtronic’s HVAD (HeartWare ventricular assist device) system as a destination therapy for advanced heart failure patients.

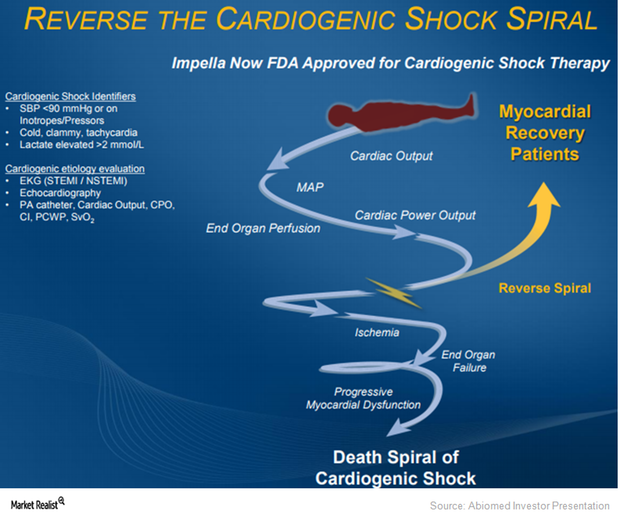

Where Abiomed Plans to Expand Impella CP’s Label

About 40% of patients succumb to heart failure within five years. Abiomed believes that it is reperfusion injuries that cause these problems.

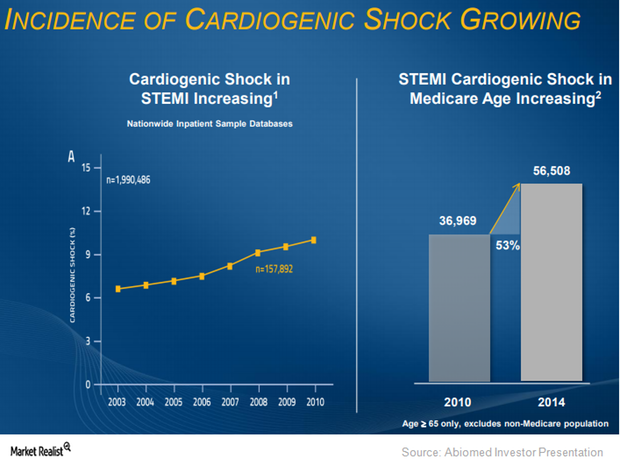

Why Abiomed Expects to Benefit from Impella in Cardiogenic Shock

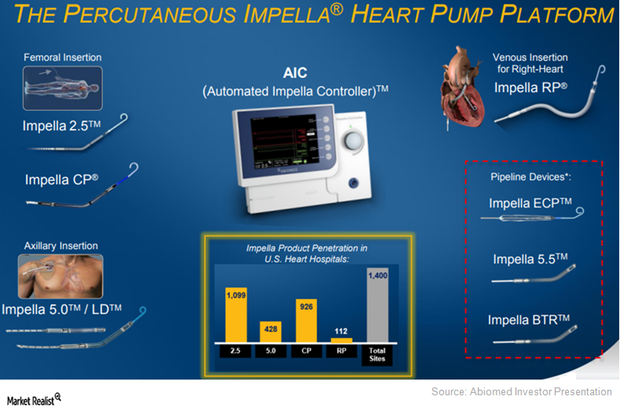

On March 23, 2015, the FDA approved Abiomed’s Impella 2.5 heart pump as a temporary ventricular support device.

Behind Abiomed’s Plans to Create a Greater Awareness of Impella

To target patients across communities, Abiomed (ABMD) has been developing a hub-and-spoke model with hospitals.

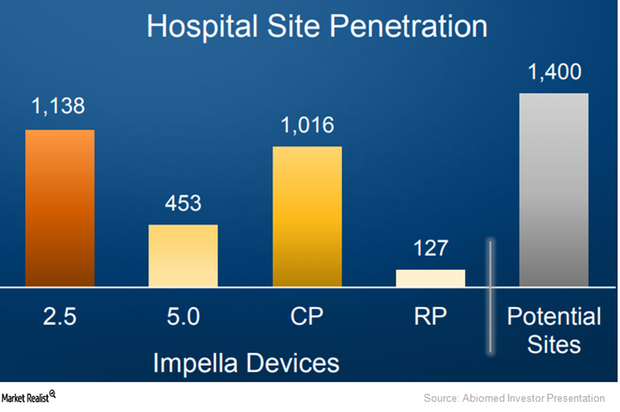

Abiomed Aims to Expand Impella RP’s Penetration Going Forward

In March 2017, Abiomed (ABMD) submitted premarket approval (or PMA) to the FDA for its Impella RP device far ahead of schedule.