Mastering Afterpay: How to Increase Your Limits and Enjoy More Shopping

Afterpay is a BNPL platform that enables you to buy items with installment payments. Here's how to increase your Afterpay limit.

April 21 2023, Updated 4:47 p.m. ET

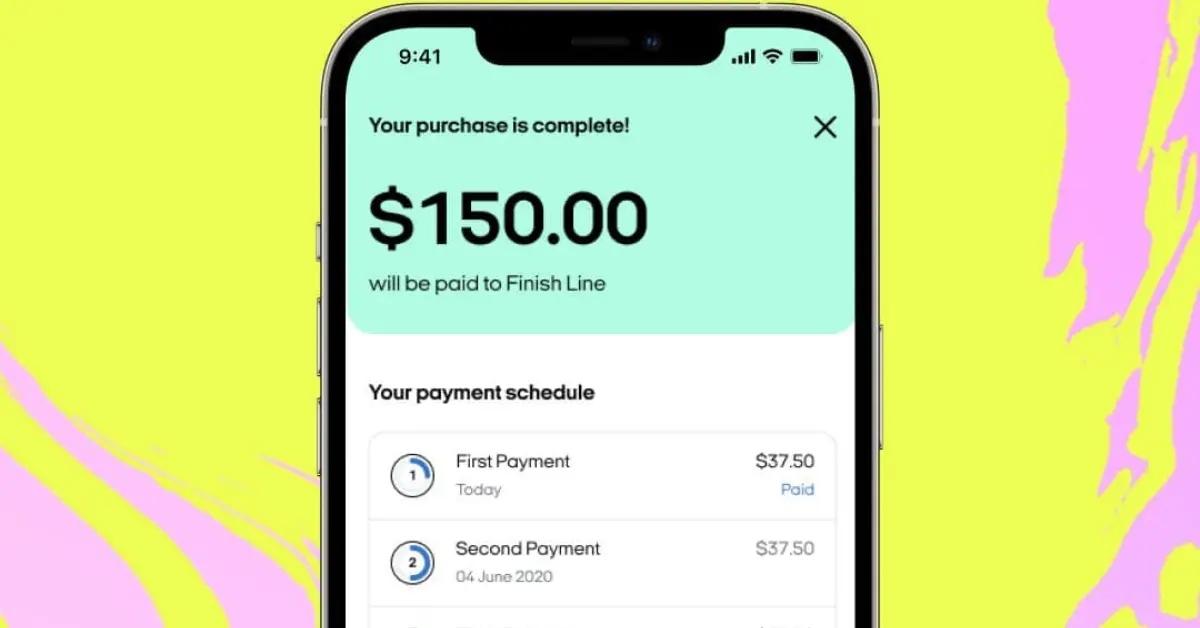

Afterpay is one of the most popular buy-now-pay-later services available. Buy-now-pay-later services enable you to purchase big-ticket items through installment payments for a fixed period of time, usually at zero percent interest.

However, if you're a first-time Afterpay user, the spend amount the company gives you is only $600. But there are steps you can take to increase your Afterpay limit. Keep reading to learn how to increase your Afterpay limit.

How can you increase the Afterpay spend limit?

The pre-approved spend amount that Afterpay grants you increases gradually the longer you use the service and make your payments on time. Payments are required either bi-weekly or monthly.

According to the Afterpay website, the factors that could impact your spending limit include:

How long you’ve used the service

The frequency of your orders

Your payment source

On-time payments

Late payments

How often your orders get declined because you have insufficient funds in the payment source you have on file with Afterpay can have a negative impact on your spending limit.

If you’re an Afterpay user in good standing, you can contact the company and try to negotiate a higher spending limit. The maximum spending limit Afterpay will give you is $3,000.

Does Afterpay increase your credit score?

Afterpay doesn’t report your payments to the three credit bureaus — Experian, Transunion, and Equifax. That means your credit score won’t take a hit if you’re late on your Afterpay payments, but it also means that making your payments on time won’t help increase your credit score.

Afterpay also doesn’t do a credit check when you borrow money, which is good for your credit score. A credit check can negatively impact your credit score.

What happens if you don’t pay Afterpay at all?

If you don’t make your payments, Afterpay could turn your account over to a debt collection agency, which will negatively impact your credit score. Plus, Afterpay will charge you an $8 late fee and up to 25 percent of your order if you stop paying your bills. The company may also freeze your account and prevent you from using the service in the future.

Why did my Afterpay limit decrease?

Afterpay will decrease your spending limits if you miss your payments. If you have difficulty paying your bills because of financial hardship, the company offers several options to help.

For example, if your payment due date is coming up and you’re strapped for cash, you can change your due date through Afterpay’s website or mobile app. Changing your payment date isn’t available if you're a new customer, it's the first or last payment, or your payment is already overdue or due within 24 hours.

If you have a financial hardship that will need more than just moving a single payment date, Afterpay will work with you to get you back on track with your payments. You may be able to negotiate a new payment plan that works better for your current financial situation. Or, you could return your purchase for a refund. If the refund is approved, Afterpay will amend or cancel your payments.