Does Afterpay Report to Credit Bureaus? Here's the Scoop for Borrowers

Some 'buy-now-pay-later' programs can have a negative effect on your credit score. Does Afterpay report to credit bureaus? What can borrowers expect?

Jan. 3 2022, Published 1:57 p.m. ET

“Buy-now-pay-later” loans can be a great way to finance a large purchase at 0 percent interest. However, some BNPL programs can have a negative impact on your credit score. Does Afterpay report to credit bureaus?

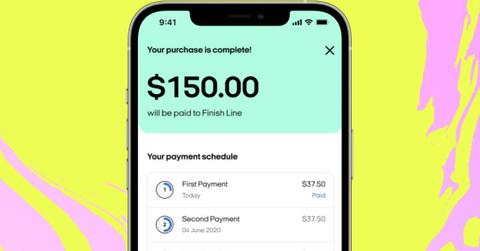

Otherwise known as a point-of-sale loan, a BNPL enables you to purchase something with installment payments for a fixed period of time. The payments are usually due either bi-weekly or monthly. The loans are typically short-term and paid off within three or four months.

Three of the most popular BNPL lenders are Affirm, Klarna, and Afterpay.

Afterpay doesn’t impact your credit score or credit rating.

If you decide to go with a BNPL through Afterpay, then you’re in luck when it comes to your credit. The company doesn’t report late payments to credit bureaus, which can have a negative impact on your credit score.

Afterpay also doesn’t require a credit check for you to borrow money. That's good for your credit score, which usually takes a hit when lenders check your credit before lending you money.

“We don’t believe in preventing people from accessing Afterpay because they may have had an old debt from a long time ago. And we don’t believe that missing a payment with Afterpay should result in a bad credit history,” states the Afterpay website.

If you miss a payment, the company will take other steps, like pausing your account or charging late fees.

“Our main aim is always to help you spend responsibly, and we take a lot of steps to help ensure this,” the Afterpay website states.

Some BNPL lenders report to Experian.

Other BNPL lenders might not be as generous, so you should read their terms and conditions carefully and know the repayment schedule and interest rate before signing anything.

For example, certain loans through Affirm aren’t reported to credit bureaus, but some are. If you miss your payment, your payment history might be reported to the Experian credit bureau, the Affirm website states.

However, Affirm doesn’t report loans that have 0 percent interest and four biweekly payments, the website states. Your loan also won’t be reported to Experian if you were only given one option of a three-month payment term with 0 percent financing.

According to NerdWallet, BNPL lender Klarna doesn’t report on-time payments but it might report your missed payments to the credit bureaus.

Getting a loan from Klarna also shouldn’t impact your credit because the company usually performs a soft credit check before lending you money, the Klarna website states.

BNPL loans can help or hurt your credit.

While not reporting your payment history to a credit bureau can be to your advantage if you miss a payment or two, it won’t help you build your credit if you're good about paying your bills.

“If reported, a missed payment can be noted on your credit report for up to seven years and will negatively impact your credit score,” Rod Griffin, the senior director of education and advocacy at Experian, tells CNBC. “At the same time, if a ‘buy now pay later’ lender reports account information to credit reporting agencies like Experian, and you are managing the debt responsibly, these services can be a helpful way to build credit.”