Why You Should Buy the Dip in U.S. Steel Stocks Now

U.S. steel stocks such as X and CLF are up, and Credit Suisse expects the fireworks to continue. The steel supercycle looks here to stay.

Aug. 19 2021, Published 8:28 a.m. ET

U.S. steel stocks are outperforming markets in 2021. While there was a brief sell-off, steel stocks have bounced back. U.S. Steel (X) touched a 52-week high on Aug. 18 and is now up almost 72 percent this year. Cleveland-Cliffs (CLF) is also up 74 percent, and Nucor (NUE) stock is up a whopping 130 percent. Nucor, which is the largest U.S.-based steel producer and the only steel name in the S&P 500, is the prestigious index's second-biggest gainer in 2021.

Meanwhile, Credit Suisse thinks the rally in U.S. steel stocks is far from over. In premarket trading on Aug. 19, the stocks were lower, presenting a buying opportunity.

Credit Suisse on steel stocks

Credit Suisse has been bullish on the steel sector for some time now. In May 2021, it double-upgraded X stock from “underperform” to “outperform” and raised its target price from $15 to $35. It had also raised CLF stock by one notch to “outperform” and assigned it a target price of $24.

In Jul. 2021, Credit Suisse doubled down on its bullish bets on steel stocks and said that it sees more upside in them. Now, the brokerage has issued another bullish note on U.S. steel stocks. It sees the current estimates as very low and finds the stocks' valuation attractive.

Credit Suisse analyst Curt Woodworth raised his HRC (hot roll coil) price forecast to $1,570 per short ton in 2021 and $1,200 per short ton in 2022.

Are steel stocks a good investment now?

We're currently in a steel supercycle. U.S. steel prices are supported by strong demand-supply dynamics, and the infrastructure bill is set to boost U.S. steel demand even more.

There are lingering concerns over the health of the U.S. economy, the Fed's tapering, high commodity prices, and the Biden administration removing Section 232 tariffs. Though these concerns are not totally unfounded, markets are not fully appreciating the once-in-a-lifetime supercycle in commodity prices.

U.S. steel stocks still look like a good investment despite having risen in 2021. Amid the steel supercycle, X and CLF will use their high free cash flow for deleveraging, whereas Nucor will double down on share repurchases. CLF has already said it expects to achieve zero net debt by 2022.

CLF and X are working to lower their debt

Once CLF and X lower their debt, they could see a structural valuation rerating. Historically, both companies have traded at a discount to peers lUE and Steel Dynamics (STLD), largely because of their high financial and operating leverage.

With its pivot towards EAFs (electric arc furnaces), X is also trying to address the high operating leverage associated with blast furnaces. The strengthening energy market is another positive for X stock, and its tubular segment could see a pickup in growth.

The rally in steel stocks is far from over

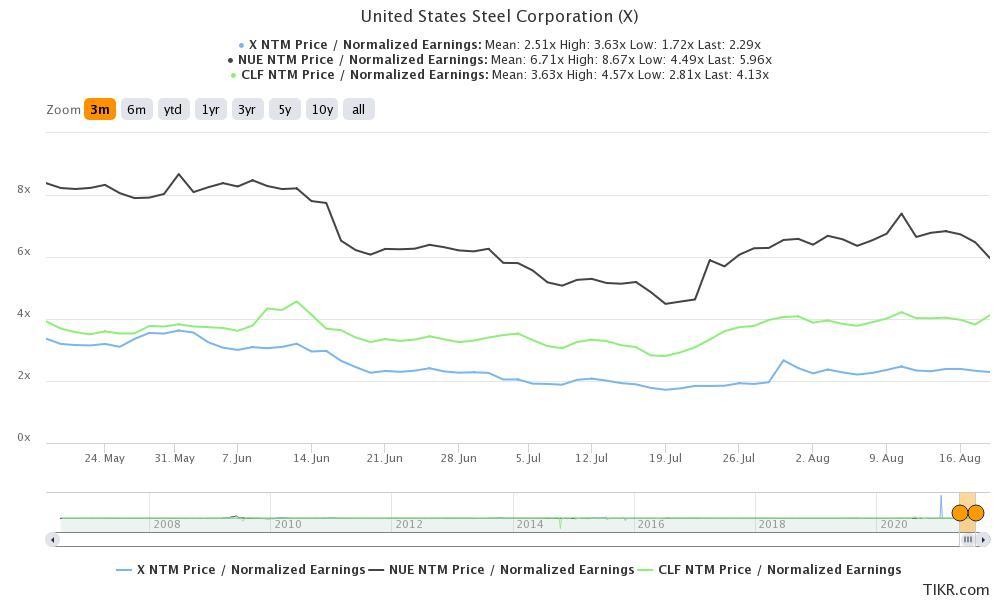

The rally in steel prices is set to continue. X's next-12-month PE multiple is 2.3x, while NUE's and CLF's are 6x and 4.1x, respectively. The valuation multiples look attractive even if U.S. steel prices have peaked.

U.S. steel stocks look undervalued

The biggest risk for U.S. steel companies is the Biden administration waiving Section 232 tariffs without appropriate safeguards. Trump waived tariffs for Canada and Mexico, and some European countries would be pleased with a similar exemption.

Hopefully, the Biden administration will push for safeguards so that imports don’t spike even after more exemptions are granted. Steel is too strong a political constituency to ignore for any administration, and Biden should be mindful of that. Therefore, the dip in U.S. steel stocks looks like a buying opportunity.