5 Reasons to Buy U.S. Steel (X) Stock Now Before Q2 Earnings

There are multiples reasons why U.S. Steel (X) looks like a good buy now ahead of its earnings release for the second quarter of 2021 including tepid valuations.

July 20 2021, Published 8:45 a.m. ET

U.S. Steel Corporation (X) stock fell 1.8 percent on July 19 amid the bloodbath in markets. Now, it's down 28 percent from its 52-week highs and is in the bear market territory. The company is set to report its earnings for the second quarter of 2021 later in July. Should you buy X stock now before the earnings release?

All of the metals and mining stocks have come off their 2021 highs amid inflation concerns. The metal and mining industry is very cyclical in nature and there are fears that the commodity cycle has peaked. Some of the metals, especially copper, have come off their highs, which triggered a sell-off in copper miners like Freeport-McMoRan.

U.S. Steel's earnings estimates for Q2 2021

U.S. Steel is scheduled to release its earnings for the second quarter of 2021 on July 29 and will hold the earnings call the next day. The analysts polled by TIKR expect U.S. Steel to report revenues of $4.56 billion in the quarter—an YoY increase of 118 percent. The company’s adjusted EBITDA is expected to rise multifold over the period to $1.21 billion. U.S. steel companies have been posting record profits amid the surge in steel prices.

U.S. Steel gave guidance of an adjusted EBITDA of nearly $1.2 billion. The company said that its adjusted diluted EPS is expected to be $3.08 during the period.

Should you buy X stock now?

There are multiples reasons why X looks like a good buy now ahead of the second-quarter earnings release, including:

- A high possibility of a second-quarter earnings beat

- Transformation in U.S. steel

- Strengthening balance sheet

- Strong outlook for the U.S. steel industry

- Tepid valuations for X stock

Will U.S. Steel post an earnings beat?

U.S. Steel’s earnings estimates are in line with the company’s guidance, which has historically been conservative. Looking at the metal pricing environment, X could end up posting better-than-expected earnings in the quarter. While the earnings beat can be a short-term price driver, there are several long-term drivers for X stock.

First, U.S. Steel is transforming its legacy business and is pivoting towards EAFs, which have a variable cost structure. This would especially help the company in the steel industry downcycle. Also, the company is launching new products that will help it regain some of the market share. U.S. Steel is investing to modernize its aging plants. The investments will likely drive a structural improvement in its earnings.

X is also working on strengthening its balance sheet. In June, the company announced the redemption of its $718 million aggregate principal amount of its 2025 senior notes. The company has more deaveraging opportunities amid the current upcycle.

U.S. steel industry’s forecast looks positive

The medium-term forecast for the U.S. steel industry looks positive. The underlying demand is strong, while supply chain inventories are still low. Also, the rise in energy prices is positive for X’s Tubular Segment as it supplies to the industry. X expects its Tubular operations to post a near break-even EBITDA in the second quarter. Also, President Biden’s infrastructure plans will help support steel demand.

X stock looks undervalued

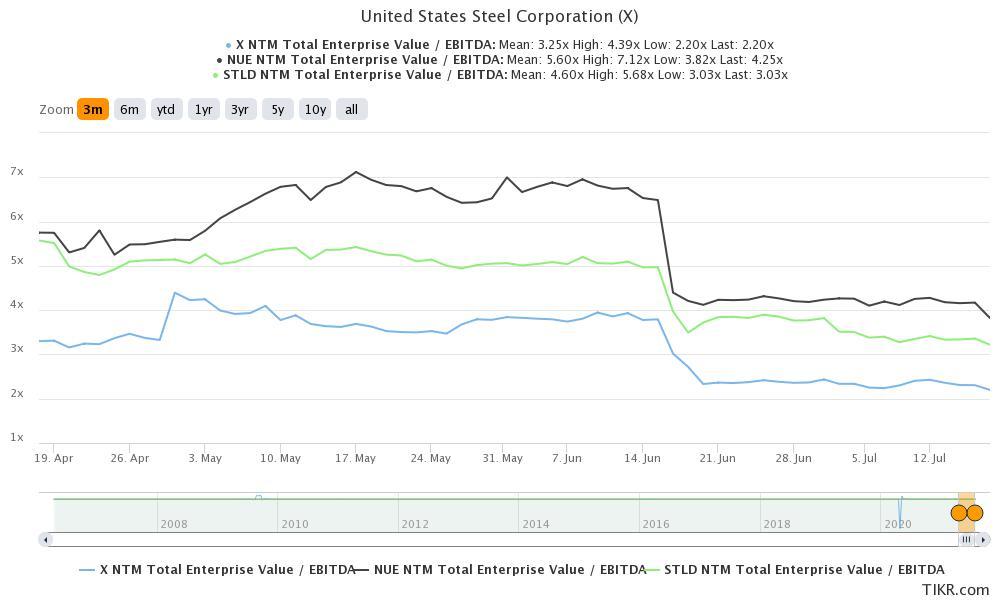

X stock looks undervalued

X trades at an NTM EV-to-EBITDA multiple of just 2.2x, which looks undervalued. Looking at the company’s strengthening balance sheet and the pivot towards EAFs, its valuation multiples should see a structural rerating. The stock has historically traded at a discount to EAF peers like Nucor.

X stock price forecast

X has a median target price of $32.50, which is a premium of more than 51 percent over the current prices. The forecast for X stock looks positive considering the steel industry upcycle and the company’s transformation. While X stock is in a bear market, the time looks ripe to turn bullish on this beaten-down steel name.