Alibaba Stock Had a Dream Rally — Will the Gains Sustain?

Alibaba stock has gone up over the last few trading sessions. What’s the forecast for BABA stock and will it go up more in 2022? Let's take a look.

March 23 2022, Published 8:33 a.m. ET

Alibaba (BABA), which has been weak since the fourth quarter of 2020, has seen a significant upwards price action over the last few trading sessions. What’s the forecast for Alibaba stock and will it go up more in 2022?

Alibaba’s troubles started in November 2020 when China blocked the Ant Financial IPO. In general, 2021 was a bad year for U.S.-listed Chinese stocks amid the country’s tech crackdown and the delisting fears in the U.S. Going into 2022, it didn't look any better for BABA as the U.S. released its first list of Chinese companies that might be delisted.

Why has BABA stock been going up?

Several factors are pushing BABA stock higher. First, there has been a recovery in broader markets, which is also aiding the upwards price action of Chinese stocks like BABA.

Second, Chinese state media reported that the country would end its tech crackdown and also support the overseas listing of domestic companies. This was a huge change from the previous stance where the country cracked down on different sectors and also asked DiDi to delist from the U.S. markets.

Recently, Alibaba increased the size of its stock buyback program to $25 billion, which led to a spike in its stock. While several market participants believed that BABA was ridiculously cheap and was a deep value stock, it continued to fall amid China’s crackdown and delisting fears.

Alibaba's stock forecast still looks bullish.

Alibaba’s forecast still looks bullish despite it recovering sharply from the lows. The company leads the e-commerce market in China and its cloud operations have also been growing at a fast pace. While there are genuine concerns about a slowdown in China, Alibaba’s sales should continue to rise by double digits in the medium term.

What's the target price for BABA stock?

According to the analyst estimates compiled by Koyfin, BABA has an average target price of $172.44, which is a premium of almost 50 percent over current prices. Analysts have lowered the stock’s target price over the last year but even now the consensus view is quite bullish on the stock.

Berkshire Hathaway vice chairman Charlie Munger and valuation guru Ashwath Damodaran are among those who are bullish on BABA stock.

Will BABA stock go up more from these levels?

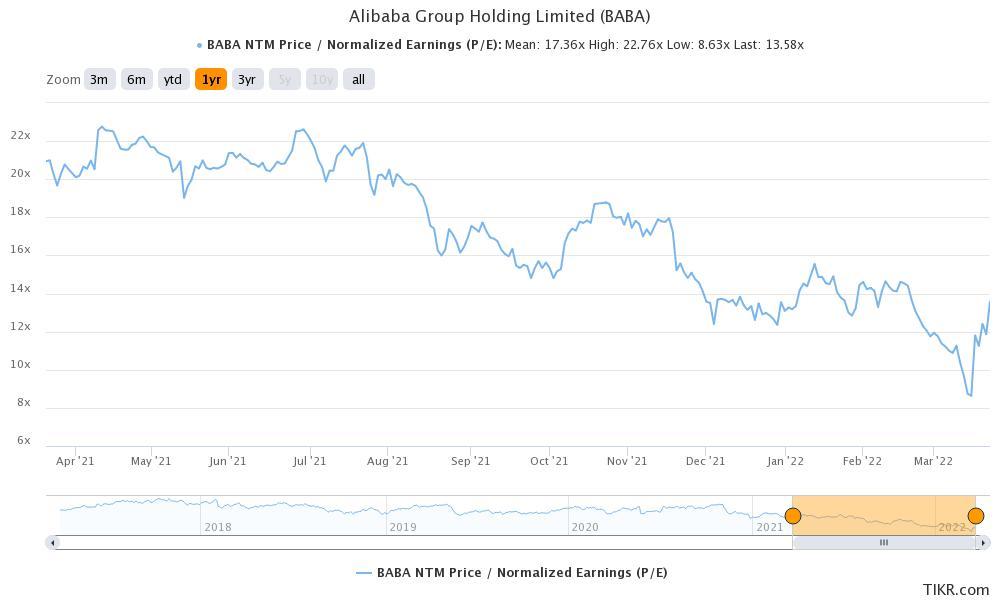

BABA’s NTM PE multiple has now risen to 13.6x. The multiple bottomed at near 9x earlier in March but has since rebounded. Even now, the valuations look reasonable and there's still scope for expansion of Alibaba’s valuation multiples. If BABA’s valuation multiples continue to expand, the stock should also go up.

Is it risky to invest in Alibaba stock?

Investing in stocks is always risky, especially if it’s a foreign company. While market sentiments towards Chinese stocks have improved after the commentary in state media, the country needs to follow up with on-ground action.

Several fund managers, including Cathie Wood of ARK Invest, have lost faith in Chinese stocks after the drama that we saw in 2021. It would take a long time for investors to regain trust in Chinese companies.

China’s slowdown and the negative perception of China as an investment destination have prompted the country to do a rethink its economic policy. While a slowdown in China might otherwise be bad news for companies like Alibaba, it isn't as pessimistic because it would compel the country to support the economy instead of cracking down on emerging sectors of the economy.