Should You Sell Chinese Tech Stocks as the Country Takes a Left Turn?

Chinese stocks have fallen and many fund managers are exiting them. Should you sell Chinese tech stocks now amid the left turn in the country?

Aug. 18 2021, Published 9:26 a.m. ET

Chinese tech stocks have tumbled in 2021, which has led to billions of dollars of losses for U.S. investors. The second quarter 13F filings have revealed that several U.S. hedge funds have trimmed their exposure to Chinese stocks. Should you sell Chinese tech stocks like leading hedge fund managers?

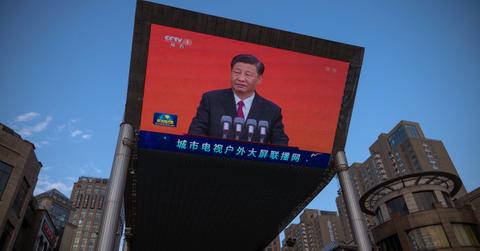

China has taken a hard left turn under the leadership of current president Xi Jinping who’s the strongest leader in the communist country in decades. Over the years, China has gradually opened up and Chinese stocks became an attractive investment for global investors. However, the bullishness is unwinding now.

George Soros and SoftBank sell Chinese stocks

George Soros and SoftBank are among those who have trimmed positions in Chinese stocks. SoftBank has been a major investor in Chinese tech companies and was among the early Alibaba investors. SoftBank suffered massive losses as China went after ride-hailing company DiDi Global just after the IPO.

SoftBank is still the largest shareholder in Alibaba. However, it has lost heavily as BABA stock is now at the lowest level since 2019. The crackdown on Alibaba started last year when China went after the tech giant.

Cathie Wood doesn't own any Chinese stocks now.

Cathie Wood of ARK Invest has sold all of the Chinese stocks that the funds were holding. Alibaba, JD.com, and Tencent were among the Chinese stocks that ARK Invest was holding. The market cap of Chinese tech stocks listed in the U.S. has tumbled.

The churn is also reflecting in the market cap of Chinese companies. Taiwan Semiconductor Manufacturing Company (TSM) is now the most valuable Asian company after overtaking Tencent.

China is taking a hard left turn.

Under the disguise of national security, curbing monopoly, wage disparity, and social cohesion, China has been taking a hard left turn. In the most recent salvo, President Jinping has called for curbs on “excessive” income and wants the wealthy to give back more to society.

While some of the measures could be well-intended, the ultimate aim seems to establish President Jinping’s authority on the country’s social, economic, and political roadmap. Chinese companies only have one option, which is to comply with all of the regulations.

Should you sell Chinese stocks?

The valuation framework for Chinese companies has changed over the last six months. Uncertainty is the one thing that markets dislike the most. The continued crackdown on Chinese companies has led to a lot of uncertainties. It has increased the risk profile of Chinese companies. To make things worse, it isn't possible to price the risk when the Chinese leadership has motives apart from the economic cause.

The risk for Chinese companies also comes from the increased scrutiny in the U.S. While U.S. regulators want Chinese companies to disclose more, China wants them to do the opposite.

Fund managers are shorting Chinese stocks.

The August Bank of America Global Fund Manager survey showed that the respondents see Chinese policy among the top five tail risks for markets. Also, short Chinese stocks were the most crowded trades. Long U.S. tech stocks were cited as the most crowded trade, as it has been for the most part over the last year.

The U.S.-China decoupling has only increased over the last few months. While some of the Chinese stocks might appear very undervalued, they are now cheap for a reason. Unless we see some sanity returning, Chinese stocks could continue to trade at depressed valuations.