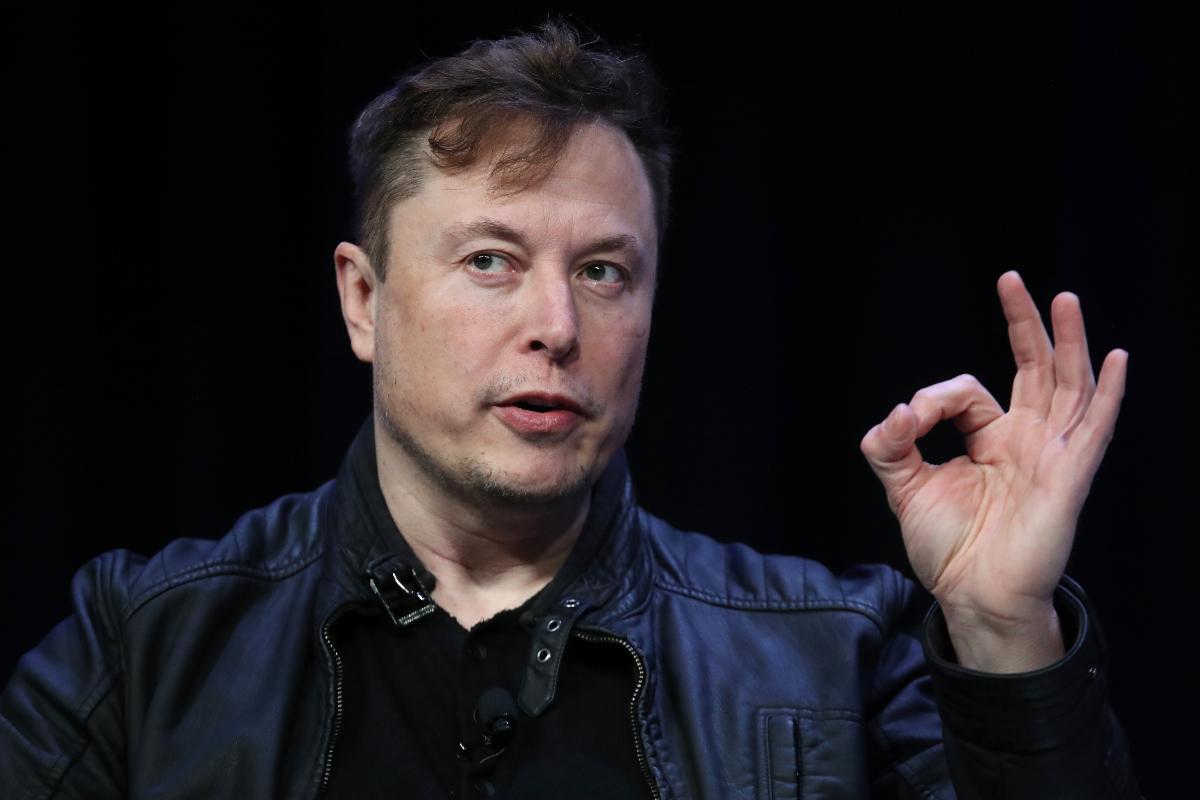

Elon Musk Dumps 7.92 million Tesla Shares Worth $6.88B

Elon Musk has made somewhat of a noticeable trend dumping Tesla stock, here are reasons why he might be doing it. Will he sell more shares?

Aug. 10 2022, Updated 3:06 p.m. ET

In November 2021, Tesla stock skyrocketed and then soon came crashing down after Elon Musk teased the idea that he was going to sell shares of Telsa, 10 percent to be exact. Fast-forward to now, Musk seems to be circling back around to selling Tesla shares. He has offloaded 7.92 million of his shares. Here's what they are worth and why he may have done it.

Musk manages to remain in the news most of the time, if not for his fledgling deal with Twitter, having children, or his estranged father having another child — then it's for Tesla. Once again, Tesla is the topic of discussion. As Musk put more energy into buying Twitter, it appeared that his beloved Tesla was falling by the wayside.

Why is Musk selling Tesla stock?

In November 2021, Musk put out a poll to his followers where he asked them whether or not he should sell stock. It seemed to be in response to growing claims that billionaires like himself are able to bypass taxes through unrealized gains. All of the top billionaires have most of their wealth parked in stocks. Since they rarely sell these stocks, the taxes that they pay are only a tiny fraction of their net worth.

According to CNBC News, Musk sold 7.92 million Tesla shares worth an estimated $6.88 billion. The transaction occurred between Aug. 5 and Aug. 9 as revealed by the SEC filings that CNBC was able to access. Musk's transaction was a surprise given that in April 2022 he tweeted, "No further TSLA sales planned after today."

Elon Musk's Twitter deal may be part of the reason why he is selling TSLA stock.

Musk doesn't get any fixed salary or bonuses from Tesla and all of his compensation is in the form of stock options. It seems though that Musk's funds are tied up in Twitter given that the company decided to sue Musk to guarantee that the deal goes through. Tesla investors on Twitter asked Musk if he was done selling for now and Musk had quite the response.

Musk said, "Yes. In the (hopefully unlikely) event that Twitter forces this deal to close and some equity partners don't come through, it is important to avoid an emergency sale of Tesla." Musk was also asked if he would buy Tesla stock again if the deal doesn't close and he said he would.

Capital gains taxes were believed to be a motivating factor in selling TSLA shares in 2021.

President Biden has proposed increasing capital gains taxes. One theory behind Musk selling shares is that he wants to dodge the expected increase in capital gains taxes by selling shares now. Though it appears that his Twitter deal is a motivating factor in buying and offloading Tesla shares, the idea of him trying to continue to avoid paying taxes remains prevalent.

Musk's critics on Twitter suggest that he's simply trying to cover his own end after firing several Tesla employees and criticizing the influx of new IRS auditor employees.

In 2021, Musk claimed that Tesla stock was overvalued.

When Musk first started discussing selling Tesla stock, many people, including Michael Burry, thought that Musk was simply selling shares since he intended to profit from the sharp rise in Tesla stock in 2021. At the time, the speculation was warranted.

Also, Musk started selling Tesla shares around the Rivian IPO. Musk selling shares led to a fall in Tesla as well as other EV stocks. It was speculated that Musk was trying to pull down the IPO of a competitor, given that he had mocked it several times.

Will Musk sell more Tesla shares?

At this point, whether or not Musk will sell more Tesla shares seems to be directly influenced by the direction of his current deal and lawsuit with Twitter.