What the Tilray and Aphria Merger Means for Investors

The Tilray and Aphria merger has finally been confirmed and will be complete on May 5. What's the forecast for TLRY stock?

May 4 2021, Published 10:08 a.m. ET

Tilray (TLRY) and Aphria (APHA), which announced a merger in December 2020, have received stockholder approval for the transaction. The merger will be completed on May 5. What’s the forecast for TLRY stock after it merges with APHA? Also, what happens after the merger? What changes for the combined company after the merger?

Consolidation is the need of the hour in the marijuana industry. Since most players are making losses, it makes sense to consolidate and benefit from economies of scale. Curaleaf has also announced the acquisition of EMMAC Life Sciences. Penny marijuana stock Sundial Growers is also looking at strategic acquisitions and is even looking to set up a SPAC.

TLRY and APHA merger is finally confirmed.

While Aphria stockholders approved the merger earlier in April, Tilray had to delay the vote. Tilray was reportedly having trouble garnering the votes. It also lowered the quorum requirement for the stockholder meeting. Meanwhile, the good news is that TLRY stockholders have also approved the merger, so it's confirmed.

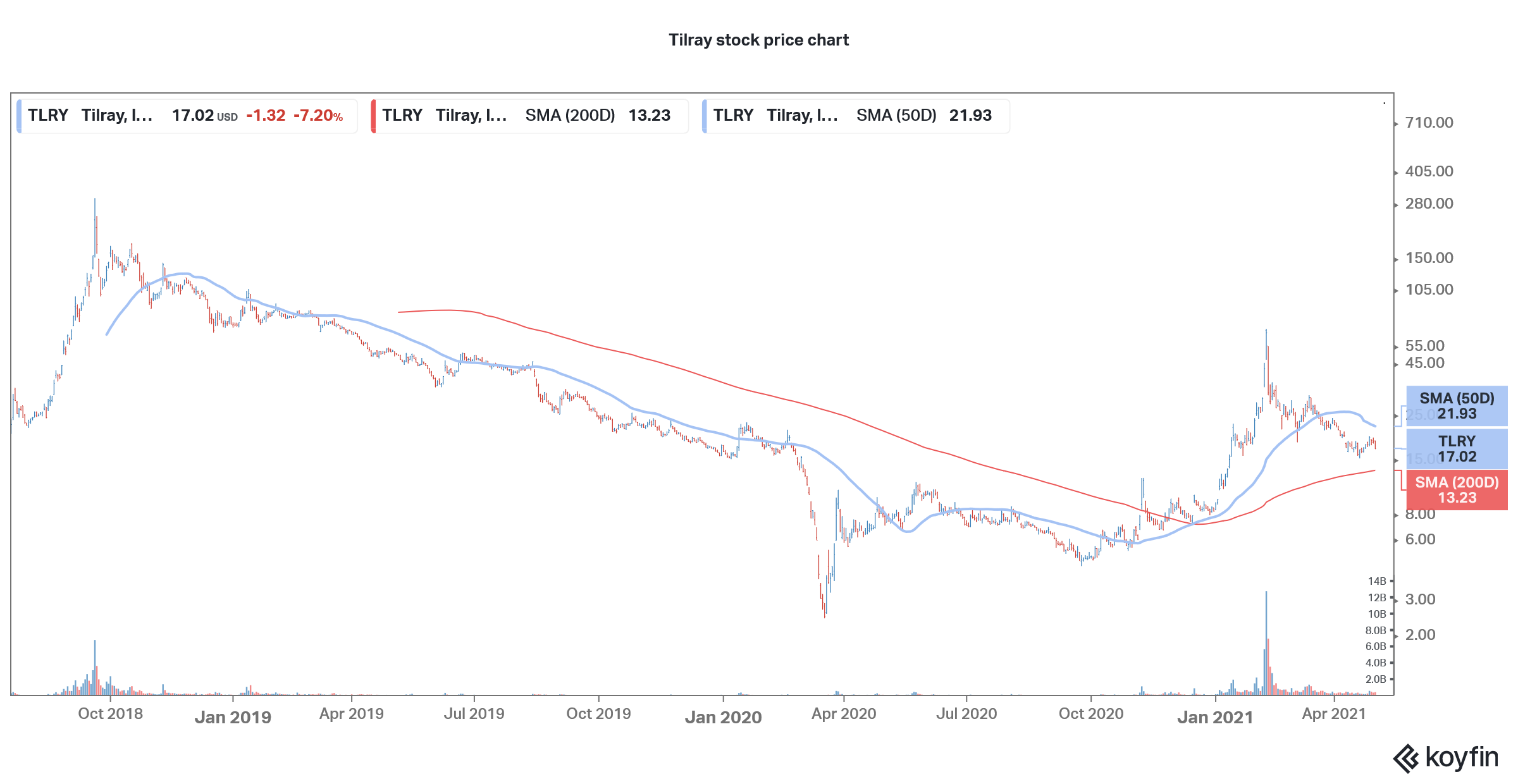

Tilray stock versus key moving averages

What happens after the TLRY and APHA merger?

The new entity would start trading on the Toronto Stock Exchange on May 5 under the ticker symbol “TLRY.” The Nasdaq listed Tilray stock would continue to trade under its “TLRY” ticker symbol as it did before the merger.

If you are an APHA stockholder, your stocks would be converted to TLRY stock. For every Aphria stock that they hold, APHA investors would get 0.8381 TLRY stock. After the merger, APHA stock would cease to trade.

Changes after the Tilray and Aphria merger

There will be more changes after the Tilray and Aphria merger. First, the combined entity will get a new logo that blends the legacy of both the companies. Also, there will be management changes. Aphria CEO Irwin D. Simon will lead the new Tilray in a dual role as CEO and chairman, while Brendan Kennedy, who is the current Tilray CEO, will be a director on the board of the new entity.

Forecast for Tilray stock after the Aphria merger

The forecast for Tilray stock looks positive after the Aphria merger and it looks like a good long-term buy. The combined entity had a combined market capitalization of $7.92 billion based on the closing prices on May 3.

The combined entity posted revenues of $672 million in the last 12 months, which would mean a trailing price-to-sales multiple of 11.8x. The multiples look reasonable considering what peers trade at.

The new Tilray would have better economies of scale and the management is forecasting $81 million of annual pre-tax synergies within 18 months of the merger. Also, it would have the largest global footprint with operations in North America as well as Europe.

Tilray would have access to around 17,000 stores in North America. The company would be a diversified play on the marijuana industry with both medical and adult-use operations. It would be among the prime beneficiaries if the Biden administration moves ahead with federal marijuana legalization.

Marijuana stocks have fallen

Meanwhile, marijuana stocks have fallen sharply from their 2021 highs as the euphoria over federal legalization has tapered down. That said, legalization could be a matter of “when” and not “if.” The fall in marijuana stocks looks like an opportunity to buy some of the quality names including Tilray.