Latest Tilray and Aphria Merger News: Is It a Done Deal?

Tilray has delayed the merger vote with Aphria. What's happening with the TLRY and APHA merger? Is the merger a done deal?

April 19 2021, Published 9:21 a.m. ET

In December 2020, Tilray (TLRY) and Aphria (APHA) announced a merger that would create the world’s largest marijuana company. Last week, Aphria stockholders approved the deal overwhelmingly. However, the meeting of Tilray stockholders was postponed. What’s happening with the Tilray and Aphria merger? Why is it delayed and has it been confirmed?

Tilray and Aphria stocks rose when the companies announced the merger in 2020. The stocks continued to rise in 2021 after the Senate runoff. However, since then, both TLRY and APHA have fallen sharply amid the sell-off in marijuana stocks.

Tilray and Aphria merger details

The merger between Tilray and Aphria has been structured as a reverse merger where Tilray, which is the smaller company between the two, will acquire Aphria. Aphria stockholders will get 0.8381 Tilray shares for each APHA share that they hold.

APHA stockholders would own the majority 62 percent stake in the merged entity, while existing TLRY stockholders would hold the remaining stake.

Aphria CEO Irwin D. Simon would lead the new company in a dual role as CEO and chairman, while Tilray CEO Brendan Kennedy would be a director on the board. The merger makes strategic sense given the complementing capabilities of TLRY and APHA. Also, there are financial synergies involved. Finally, consolidation is a welcome step in the marijuana industry.

Tilray and Aphria merger hasn't been confirmed

The Tilray and Aphria merger has received regulatory approvals and APHA stockholders have also confirmed the merger. However, for the merger to be confirmed, it would have to be approved by TLRY stockholders.

TLRY and APHA merger got delayed

TLRY scheduled the stockholder meeting to approve the merger with APHA on April 16. However, the company moved the meeting to April 30. Interestingly, it also amended the bylaws and said that the quorum requirement for the stockholder meeting would be one-third of the voting power. Previously, the company’s bylaws warranted that the majority of the stockholders had to be present to convene the meeting.

Is the Tilray and Aphria merger a done deal?

The delayed merger vote and the new quorum requirements have raised concerns. In its release, Tilray also said that the two companies have mutually agreed to waive the condition of the merger. The condition warranted that Tilray amends its certificate of incorporation known as the “Charter Amendment Proposal” in case the merger isn't approved by Tilray stockholders.

Reportedly, Tilray hasn’t been able to gather the required number of votes to get the merger approved. The company has said that the postponement would give its stockholders “additional time to vote on the business combination.” Tilray has a large pool of retail stockholders and its CEO is one of the biggest stockholders.

Buying TLRY or APHA stock

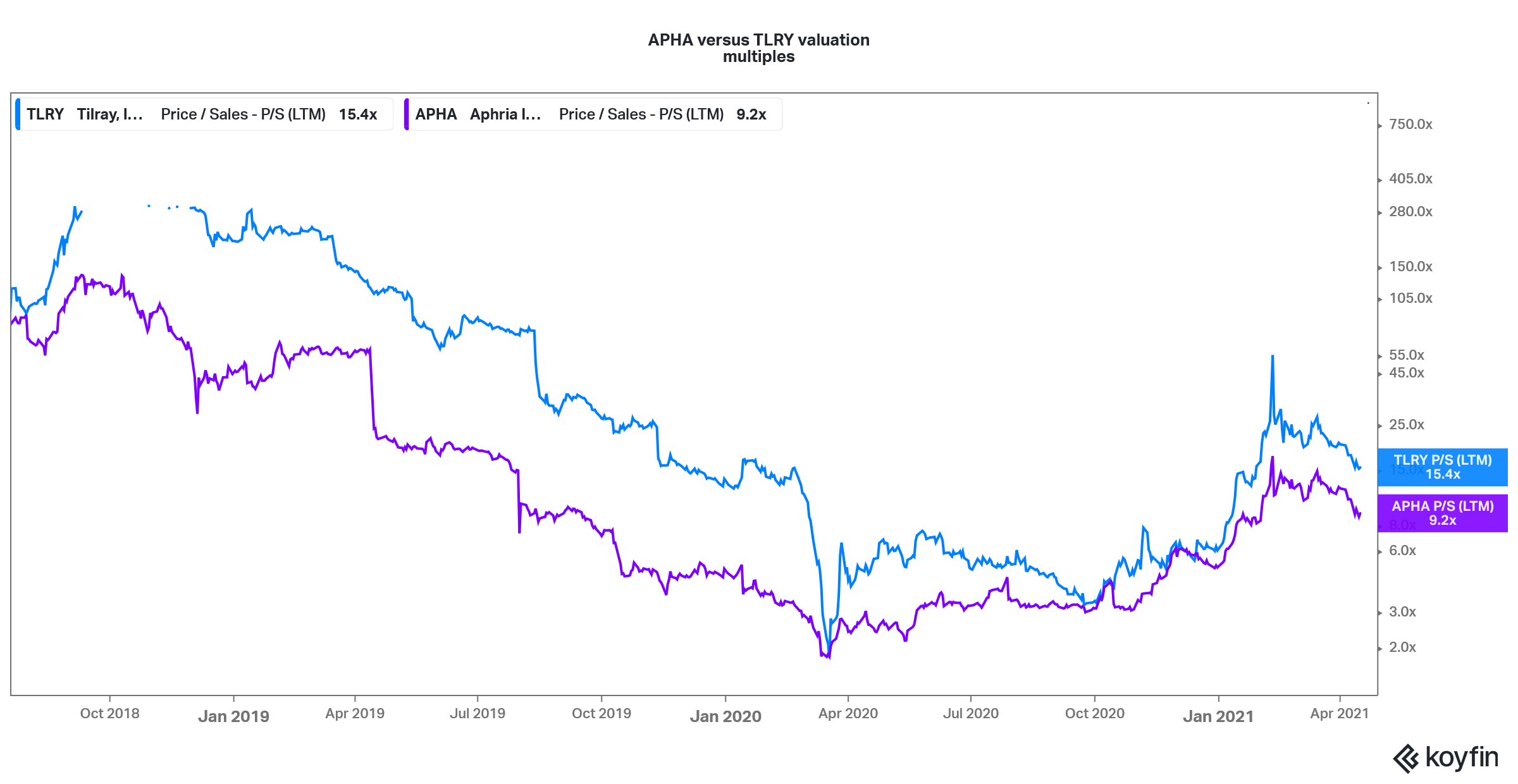

As I noted previously, as a standalone company, APHA looks better placed compared to TLRY given its better financials and lower comparative valuation. Incidentally, there was a massive merger arbitrage in the TLRY and APHA merger.

Tilray versus Aphria NTM PS multiple

However, the arbitrage opportunity has since come down greatly. Based on April 16 closing prices, APHA trades at 0.822x of what TLRY trades at, which is similar to the merger ratio. As I had noted previously, the massive arbitrage wasn't sustainable. TLRY was trading at almost twice what it should have based on the merger ratio.

The steep fall in TLRY stock from the peaks ensured that the arbitrage evaporated. Now, all eyes will be on the TLRY stockholder meeting later this month when the company takes up the merger vote.