Uber Stock's Valuation in 2022: Should You Buy the Dip?

While many tech stocks have rebounded from their lows, Uber and rival Lyft have sagged. What’s Uber’s valuation in 2022 and should you buy the dip?

June 2 2022, Published 9:54 a.m. ET

While many tech stocks have rebounded from their lows, Uber and rival Lyft continue to languish near their 52-week lows. Both of these companies went public in 2019 and trade well below their IPO price. While the business has rebounded from the COVID-19 pandemic lows, ride-hailing stocks have looked weak. What’s Uber’s valuation in 2022 and should you buy the dip?

Over the last few years, Uber has been taking several measures to grow its top line while also focusing on the bottom line. It has exited loss-making markets and cash-guzzling businesses to turn sustainably profitable. These measures haven't paid off yet. The slower-than-expected recovery in the ride-hailing business combined with increased driver incentives amid the labor shortage and soaring gas prices had a negative impact on the company.

What's the valuation for Uber stock?

Uber had a market cap of just above $45 billion on June 1. Its enterprise value, which adjusts the cash and debt on the balance sheet and is a better indicator of valuation, was $47.4 billion on that date. However, these numbers don’t tell us much about the company’s valuation and it would be prudent to dig into its financials as well as the business model.

What businesses does Uber own?

Uber runs the ride-hailing mobility business in several markets including North America. It also has Uber Eats, which is its food delivery platform. The company also has a freight business, which eventually posted its first profitable quarter in the first quarter of 2022.

Uber had an autonomous driving and flying taxi business, but it exited the businesses and sold them to Aurora Innovation and Joby Aviation, respectively. It also exited several emerging markets like China and Southeast Asia. While Uber sold the China business to DiDi, Grab “grabbed” its Southeast Asia operations. It also sold the food delivery business in India to Zomato.

After these transactions, Uber took a stake in these companies. Uber is the largest stockholder in Aurora Innovation and DiDi and holds an almost 43 percent stake in the former. It's also the second-largest stockholder of Grab and holds around 14.5 percent stake in the company. Uber is the second-largest stockholder in Zomato.

Uber’s equity investments drive its valuations.

All these companies are now publicly traded and drive Uber's valuations. As growth names tumbled in the first quarter of 2022, Uber booked a pre-tax loss of $5.6 billion in these equity investments. The company has also been hit by DiDi’s forced delisting from the U.S. markets. What was expected to be a value unlocking for Uber turned out to be the opposite.

The fall in these equity investments has also taken a toll on Uber’s valuation in 2022. Grab has the dubious distinction of being the worst-performing listing by a Southeast Asian company in the U.S. It was the largest SPAC deal ever with a valuation of almost $40 billion. Now, the company’s market cap is just around $10 billion.

Uber stock looks undervalued in 2022.

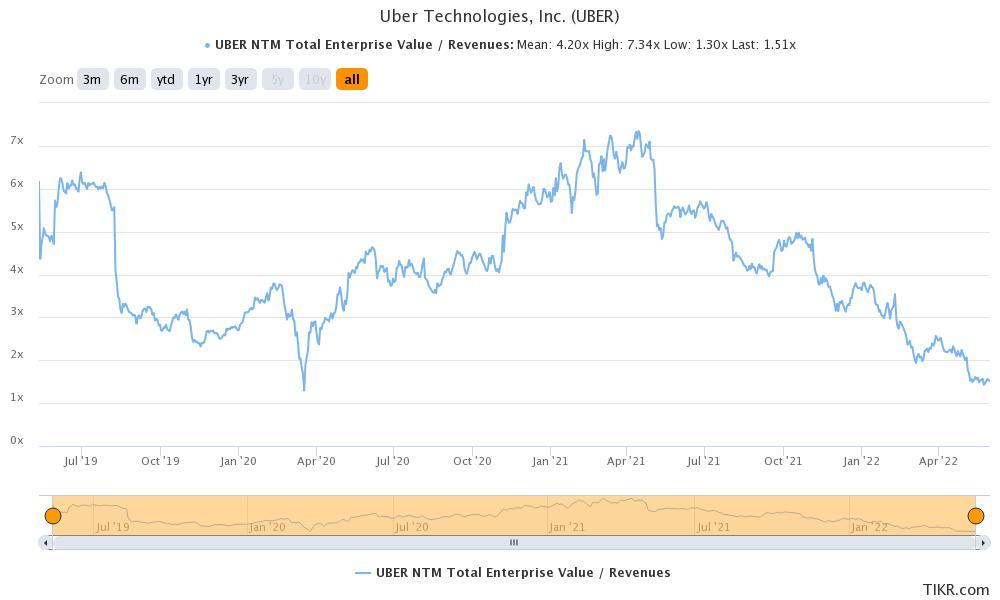

Since Uber is posting losses, we can't value it on traditional valuation metrics like the PE multiple. The stock trades at an NTM EV-to-sales multiple of 1.51x and an NTM EV-to-EBITDA multiple of 26.7x. Uber’s forward EV-to-sales multiples bottomed bear 1.3x in the first half of 2020 as the ride-hailing business came to a literal halt.

Uber’s valuations look reasonable at these levels. While there could be a short-term weakness, Uber looks like a good long-term buy at these depressed valuations. Along with growth in the core ride-hailing and food delivery businesses, Uber’s equity investments would also add value once market sentiments towards growth companies improve.