Tilray or Aphria: Which Stock Should You Buy Before the Merger?

What’s the TLRY-APHA merger date? Is there still an arbitrage opportunity available before the merger is complete?

March 2 2021, Published 8:51 a.m. ET

On December 16, 2020, Tilray (TLRY) and Aphria (APHA) announced a merger that would create the largest marijuana company globally. Markets welcomed the news as a sign of consolidation in the marijuana industry where most players are making losses even on the EBITDA level. What’s the TLRY-APHA merger date and is there still an arbitrage opportunity available before the merger is complete?

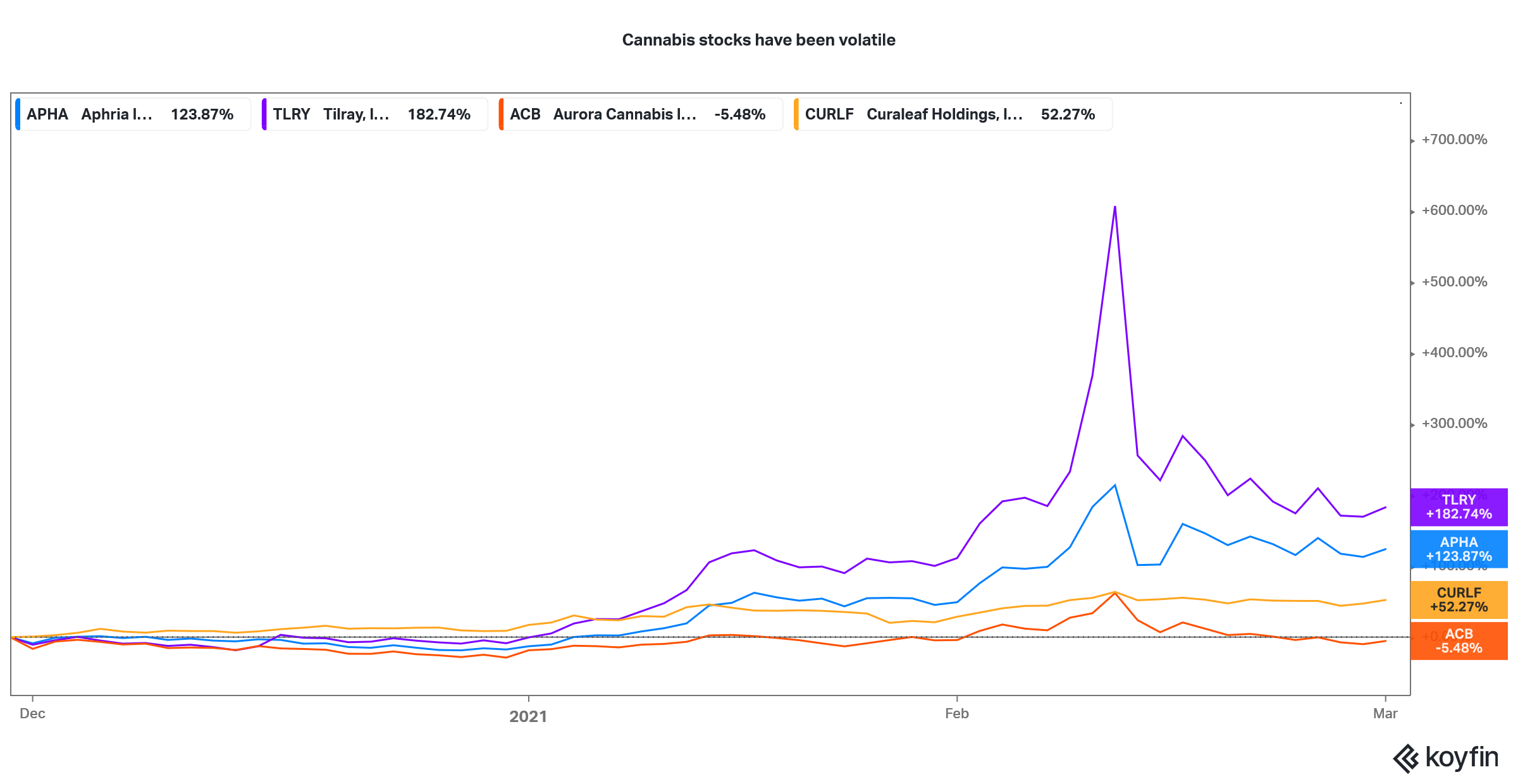

Marijuana stocks have been very volatile over the last few months. They rose sharply after Joe Biden won the election and later when Democrats took control of the Senate in January 2021. Reddit group WallStreetBets also pumped up some marijuana stocks. However, there has been a sell-off since then.

Cannabis stocks' price action

Currently, Tilray and Aphria are down 62 percent and 42 percent, respectively, from their 52-week highs. All of the stocks that were pumped by WallStreetBets have fallen sharply from their peaks. Talking of marijuana stocks, they have started to look very overvalued at their peaks even if we discount all of the positives.

TLRY-APHA merger date

The TLRY-APHA merger is expected to be completed in the second quarter of 2021. The merger would be subject to regulatory approvals. However, given the fragmented nature of the marijuana industry, I don’t see any real regulatory hurdle for the merger.

Does the Aphria and Tilray merger make sense?

The merger between Aphria and Tilray makes perfect sense. No wonder both the stocks rallied after the merger was announced. The merged entity would have diversified global operations. Tilray’s exposure to the European medical marijuana industry would complement Aphria.

Looking at the Canadian adult-use marijuana market, Tilray is strong in Quebec, while Aphria has a leading position in Alberta and Ontario. Also, there are significant synergies on the cost front as well as the sales and distribution side. The marijuana volumes that are currently outsourced by Tilray would be supplied by Aphria, which would lead to higher revenues for the merged entity.

What happens after TLRY and APHA merge?

The merger between TLRY and APHA is a reverse merger where Tilray, which is the smaller company between the two, would acquire APHA. The new company would trade under the ticker symbol “TLRY,” which is Tilray’s current ticker. As for APHA stockholders, they will get 0.8381 Tilray shares for each Aphria share that they hold.

Merger arbitrage in the TLRY-APHA deal

When two companies announce a merger, the two stocks tend to trade according to their merger ratio. A deviation in stock prices can lead to merger arbitrage. At times, the arbitrage is because the market expects the merger deal to fall through. Also, in SPACs, there can be significant arbitrage between the common stock and the warrants.

On March 1, APHA stock closed at $18.76, while TLRY stock closed at $25.56. Looking at the ratio, APHA's stock price was 0.734x of TLRY’s stock price. According to the merger ratio, APHA stock should trade at 0.8381x of TLRY’s stock price.

The merger arbitrage has come down heavily over the last few weeks. In the middle of February, APHA stock was trading at around 0.41x what TLRY was trading at. It was a juicy merger arbitrage opportunity that has since come down.

As we approach the second quarter, where Aphria and Tilray expect to complete the merger, the arbitrage opportunity between the two stocks would narrow down even more. Eventually, on the merger date, APHA stocks would get converted to TLRY stocks based on the merger ratio.

How to play the arbitrage in the Tilray-Aphria merger.

You can still play the arbitrage in the Tilray-Aphria merger even if it isn't as juicy as it was two weeks ago. You can go short on Tilray stock and long on Aphria stock to benefit from the merger arbitrage. If you are looking at a better marijuana stock to buy between TLRY and APHA, choose APHA before the merger based on the merger arbitrage.