Tilray and Aphria Merger Date Nears, Don’t Ignore the Arbitrage

APHA and TLRY stock have fallen off their highs. As the Tilray and Aphria merger date nears, is there still a merger arbitrage?

April 5 2021, Published 8:28 a.m. ET

In 2020, Tilray (TLRY) and Aphria (APHA) announced their merger where Aphria would merge with Tilray. On April 14, Aphria will host a special meeting for shareholders to approve the merger. Tilray has scheduled its shareholder meeting for April 16. As the Tilray and Aphria merger date nears, is there still merger arbitrage?

When Tilray and Aphria announced the merger in December 2020, they forecast that the merged entity would become the largest marijuana company globally. However, in the first quarter of 2021, Curaleaf announced the acquisition of EMMAC Life Sciences, which would help it maintain the top position in the marijuana industry. While Tilray's and Aphria’s status as the world’s largest marijuana company will be challenged by Curaleaf, the merger still has sizeable synergies and benefits.

Tilray and Aphria shareholders have to approve the merger.

In the release, Tilray and Aphria said that they have received the required regulatory approvals for the merger. As I noted previously, given the fragmented nature of the marijuana industry, regulatory approvals shouldn't have been a problem. For the Tilray and Aphria merger to be complete, the two companies need approval from shareholders.

Usually, shareholders tend to go with management’s decision. There isn't anything to suggest that Tilray and Aphria shareholders will vote against the transaction. Both of the stocks rallied after the merger announcement, which was a stamp of approval from the markets.

Tilray and Aphria merger synergies

In the release announcing the shareholder meeting to approve the merger, Tilray and Aphria highlighted the benefits of the deal. These include:

- Higher footprint and scale

- International operations

- Increased presence in the U.S. and Canadian adult-use market

- Pre-tax financial synergies of $78 million within 24 months of the merger

Simply put, the Aphria and Tilray merger has significant synergies. Most importantly, consolidation might be the name of the game in the marijuana industry where most players are posting losses. Through mergers and acquisitions, marijuana companies can improve their unit cost dynamics.

In all likelihood, Aphria and Tilray shareholders will approve the merger. After the merger, the combined entity would trade under the ticker symbol “TLRY.” Aphria shareholders would get 0.8381 Tilray shares for each Aphria share that they hold.

Merger arbitrage in the Tilray and Aphria merger

Tilray stock was targeted by the Reddit group WallStreetBets. The rally, driven by the short squeeze, led to a sharp rise in TLRY stock, while there wasn’t a commensurate rise in APHA stock. This created a big arbitrage opportunity for investors.

APHA versus TLRY price action in 2021

Since then, TLRY stock has fallen sharply and is now down over 66 percent from its 52-week highs. While the merger arbitrage opportunity has come down, we still see some arbitrage.

Based on the closing prices on April 1, Aphria stock closed at 0.811x of what Tilray stock closed at. Ideally, the ratio should be 0.8381x. The arbitrage opportunity has gradually come down, which was expected.

After the deal is approved and the merger happens, Aphria shareholders would get 0.8381 Tilray shares for every APHA stock that they hold. The merger ratio isn't changing and there's still some merger arbitrage.

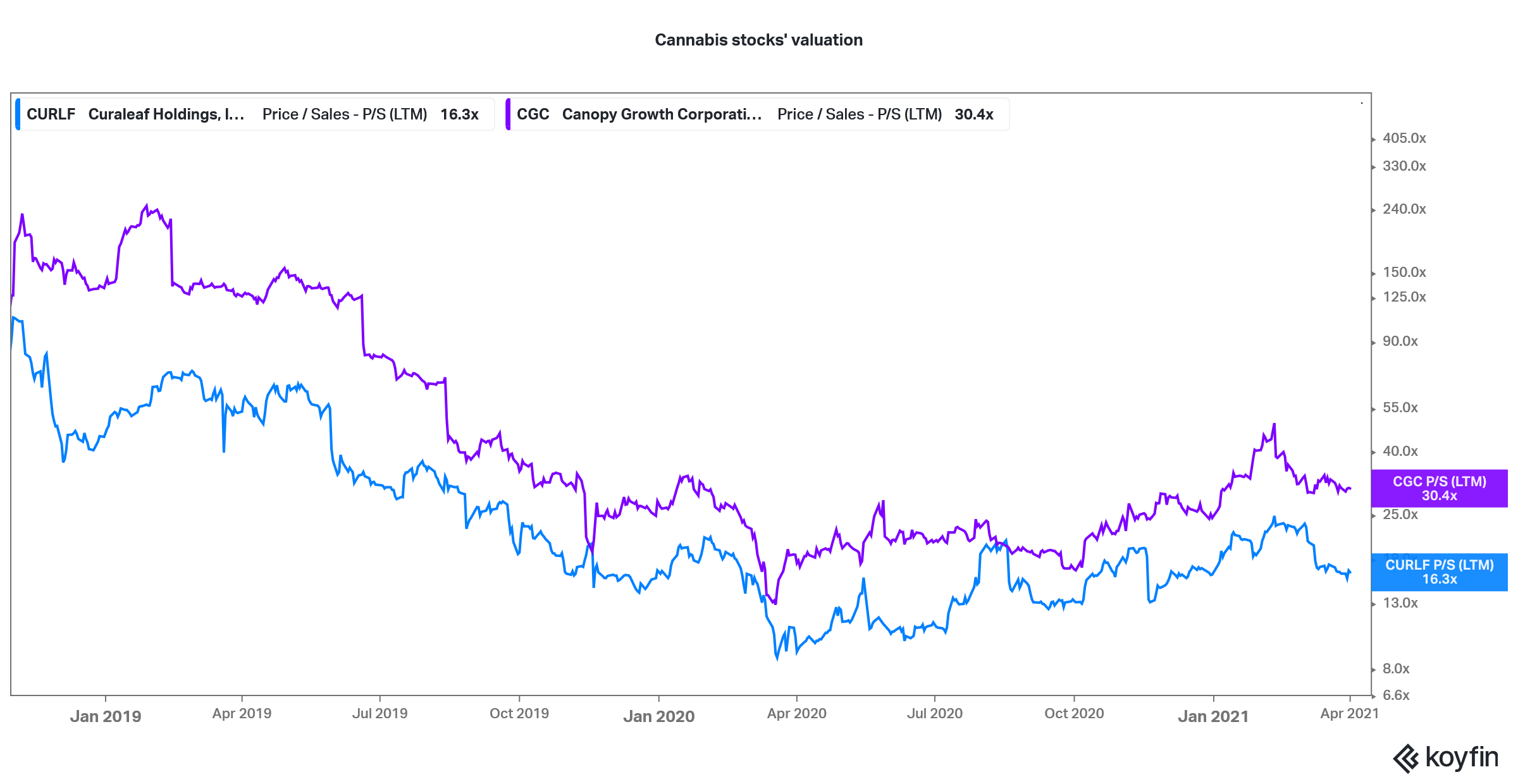

Cannabis stocks' valuation

Forecast for Aphria and Tilray stocks

Even as a standalone company, Aphria seems to offer a better value proposition than Tilray. From the merger arbitrage opportunity perspective also, APHA stock looks better placed. Investors can buy APHA stock and expect to gain from the short-term merger arbitrage. In the long term, the combined entity looks like a good way to play the marijuana industry.

The valuations for both Tilray and Aphria have come down. The merged entity would have a market capitalization of $9.6 billion based on current prices. The two companies generated combined revenues of $655 million in the trailing 12 months, which would mean an LTM price-to-sales multiple of 14.6x.

In comparison, Curaleaf trades at an LTM price-to-sales multiple of 16.3x, while Canopy Growth trades at an LTM price-to-sales multiple of 30.4x. Overall, with lower relative valuations and the expected synergies, Aphria looks like a good stock to buy and play both the arbitrage and the marijuana story.