Nvidia (NVDA) Stock Looks Like a Decent Buy Before the Split

Nvidia has announced a stock split that will be effective in July. Should you buy NVDA stock now before the split or give it a miss?

June 29 2021, Published 11:31 a.m. ET

So far, Nvidia (NVDA) stock has gained almost 46 percent in 2021. It's among the top 30 performers of the S&P 500. The stock was also among the top performers in 2020. The company has announced a stock split that will be effective in July. Should you buy NVDA stock now ahead of the split or give it a miss?

Nvidia stock rose over 5 percent on June 28 and hit its 52-week high of $803.15. The stock was trading lower in early trading on June 29. The stock has been a consistent outperformer even though some of the other chipmakers have sagged.

Nvidia stock split

Nvidia has announced a four-for-one stock split. Every Nvidia stockholder will get three additional shares after the close of market hours on July 19. The stock will start to trade on a split-adjusted basis on July 20. Generally speaking, stock splits don’t have a fundamental impact on the stock since the price falls in accordance with the split.

However, over the last year, companies like Tesla and Apple have resorted to stock splits. Through a split, companies can lower the stock price, which can then propel the trading volumes. Also, a lot of retail investors prefer to buy stocks with a low absolute dollar value.

NVDA stock forecast

According to the estimates compiled by CNN Business, NVDA stock has a median target price of $725, which implies a potential downside of 9.3 percent over the current prices. Among the 41 analysts covering the stock, 34 have a buy or equivalent rating, five have a hold rating, and two have a sell rating.

While most analysts are bullish on Nvidia stock, their target prices haven't kept pace with the steep rise in the stock. Several brokerages have raised the stock’s target price in June. Bank of America is among the most bullish on NVDA stock and raised its target price by $100 to $900. Raymond James also raised NVDA’s target price from $775 to $900. Wells Fargo raised the stock’s target price from $715 to $875.

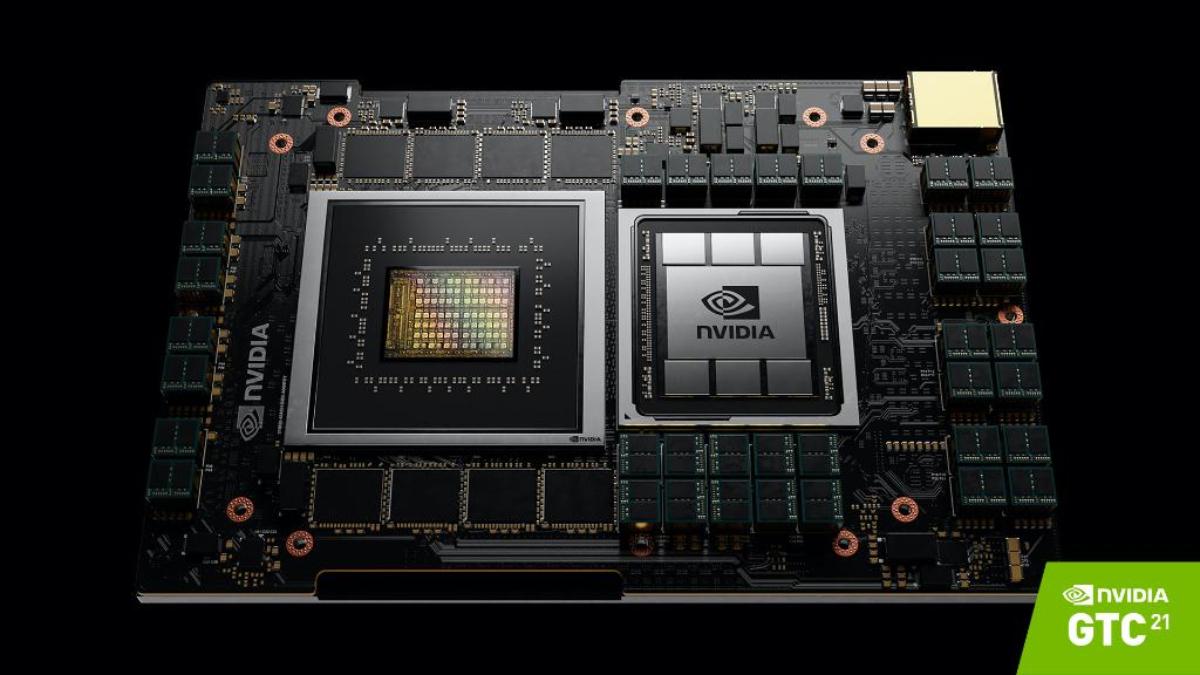

Nvidia-Arm deal

In 2020, Nvidia announced plans to acquire Arm Holdings from SoftBank. However, the deal is being probed due to antitrust concerns by the U.S., U.K., and China. The deal is especially facing troubles in the U.K. where Arm is based.

Although chipmakers including Broadcom have backed the deal, companies like Qualcomm, Google, and Microsoft have opposed the deal. If the Arm deal goes through, it will be a key driver for Nvidia stock.

Should you buy Nvidia stock?

Nvidia stock trades at an NTM PE ratio of 49.5x. The multiple has averaged 47.9x over the last year and ranged between 34.4x and 58.8x. Nvidia stock has seen a valuation rerating over the last year and the current multiples are much higher than the historical average.

Nvidia stock valuation

Nvidia’s revenues are expected to increase 49 percent in this fiscal year, while its adjusted net income is expected to increase 59 percent to almost $10 billion. While the valuation multiples look stretched looking at the historical average, they are justified looking at the high growth and the 5G supercycle.

Nvidia is among the stocks that are benefiting from the increased pace of digitization. Overall, NVDA stock still looks like a decent buy despite surging sharply over the last year.