As Cathie Wood Knows, Skillz (SKLZ) Stock Is a Bargain

Skillz stock has fallen 60 percent over the last three months. What's the forecast for SKLZ stock, and should you buy it on a dip?

May 6 2021, Published 10:04 a.m. ET

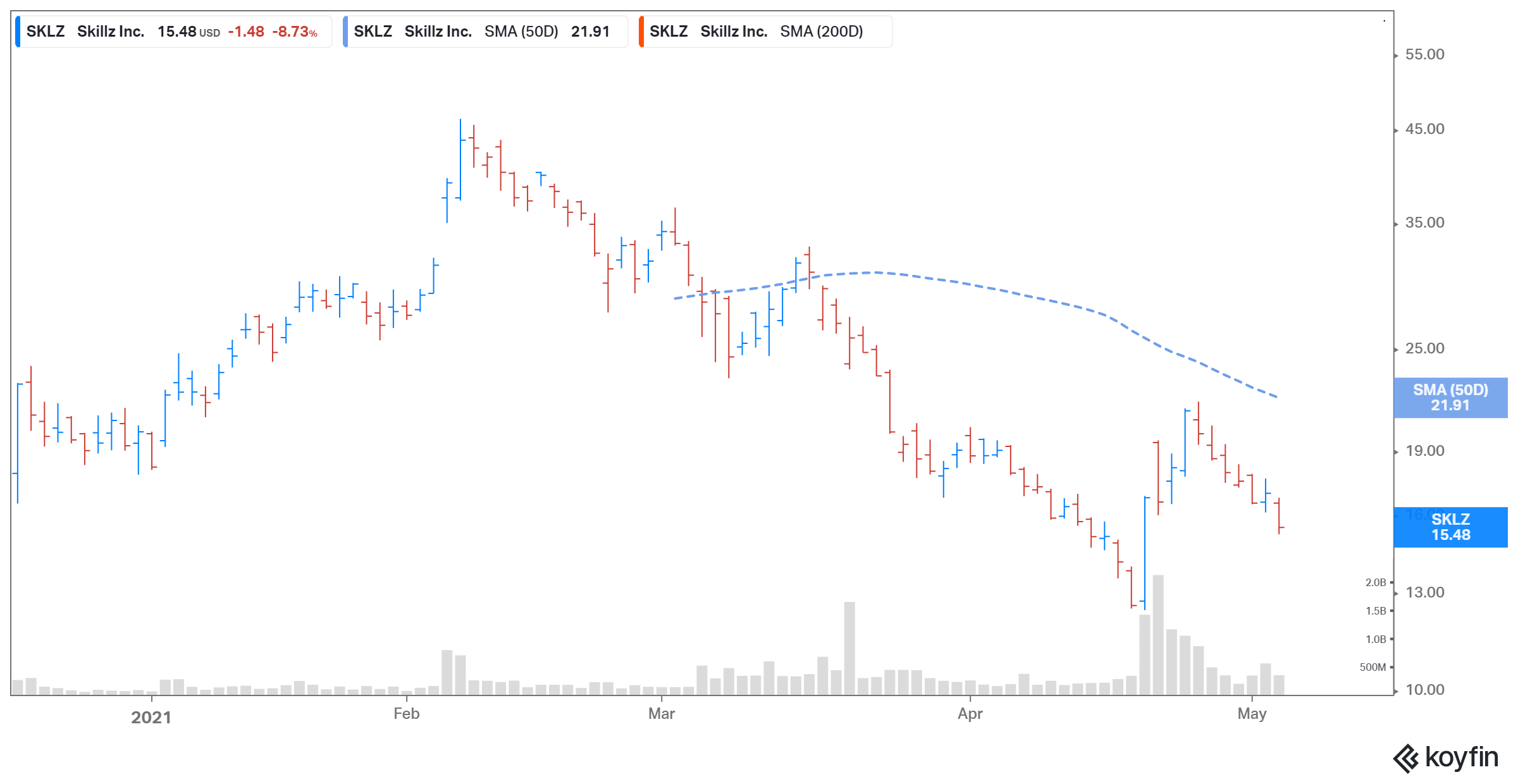

On May 5, Skillz (SKLZ) stock fell more than 8 percent after the company posted its first-quarter earnings results. Investors were disappointed because the mobile video-game platform reported larger-than-expected net losses in the quarter. The stock has fallen 60 percent over the last three months, but has still risen 57 percent over the last year. What's the SKLZ stock forecast, and should you buy it on a dip?

Skillz reported EPS of -$0.15, compared with -$0.06 in the prior-year period. The EPS missed analysts’ average estimate of -$0.10. However, on the positive side, Skillz generated sales of $83.7 million in the first quarter, marking a 92.1 percent rise YoY (year-over-year). The mobile e-sports company beat analysts’ average sales estimate of $78.6 million.

ARK Invest’s Cathie Wood added Skillz stock

Not everyone is selling Skillz stock after the company’s first-quarter earnings report. ARK Investment Management’s CEO Cathie Wood added 3.1 million Skillz shares to her ETFs after the company reported its 21st consecutive quarter of higher sales YoY. Wood's ETFs now own a total of 15.6 million Skillz shares—the ARK Next Generation Internet ETF (ARKW) holds 7.05 million, and the ARK Innovation (ARKK) holds 8.51 million.

Skillz saw its paying monthly active user (MAU) count grow 81 percent YoY to 467,000, which was below analysts' estimate of 469,000 paying MAUs. Skillz posted a record paying user conversion rate of 17 percent, which the company says is eight times better than average in the mobile gaming market.

SKLZ Stock Price

Skillz stock valuation

In Dec. 2020, Skillz went public in a reverse merger deal with Flying Eagle Acquisition SPAC. Flying Eagle valued the gaming platform at $3.5 billion. At its current stock price, Skillz’s market capitalization has ballooned to $6.1 billion.

Is Skillz stock undervalued?

Skillz trades at a next-12-month EV-to-sales multiple of 13.2x, which looks undervalued compared with other gaming stocks. DraftKings (DKNG) and Roblox (RBLX) have multiples of 19.7x and 17.1x, respectively.

The forecast for Skillz stock and Reddit discussion

According to MarketBeat, analysts' average target price is $27.29 for Skillz stock, which is 76.3 percent above its current price. Among the eight analysts tracking Skillz, five recommend “buy,” and three recommend “hold.” None recommend “sell.” Their highest target price of $34 is 120 percent above the stock's current price, while their lowest target price of $17 is 10 percent above. Much of the discussion Reddit insists that there's a huge opportunity in Skillz stock, and that it could become the next Shopify in five years.

Should you buy Skillz stock?

Skillz stock looks like a good investment based on its robust growth outlook. The mobile gaming market is expected to reach $150 billion in 2025, compared with $68 billion in 2019. In 2021, the company expects its total revenue to grow 63 percent YoY to $375 million.

Skillz is also set to benefit from its multi-year deal with the NFL. This agreement should encourage developers to create NFL-themed games, and these could debut on the platform in late 2021 or early 2022.

The best price to buy or sell Skillz stock

Skillz stock looks poised to keep rising with the growing demand for online gaming. Analysts' average price forecast suggests SKLZ stock has significant potential. It looks best to buy at around $15.