The Underwriters of Rivian's $66 Billion IPO

Rivian, whose IPO is slated for today, is seeking a $70 billion valuation. Underwriters will have the option to buy up to 22.95 million shares.

Nov. 10 2021, Published 10:54 a.m. ET

The long-anticipated Rivian IPO is finally here, with trading of the EV stock expected to begin on Nov. 10, 2021. According to the Rivian IPO agreement, underwriters are being granted a 30-day option to purchase up to 22.95 million more shares at the IPO price, subtracting underwriting discounts and commissions.

Investors wanting to get more involved in the EV (electric vehicle) market will be able to invest in Rivian stock, which has priced its shares at $78 each. The upsized IPO is for 153 million Class A shares.

What the 30-day option means for Rivian IPO underwriters

In May 2021, Rivian announced the underwriters for its potential IPO, which include Goldman Sachs, JPMorgan Chase, and Morgan Stanley. At the time, Bloomberg reported that Rivian could seek a valuation of up to $70 billion. The IPO this week is expected to approach that figure, given the $78 per-share price.

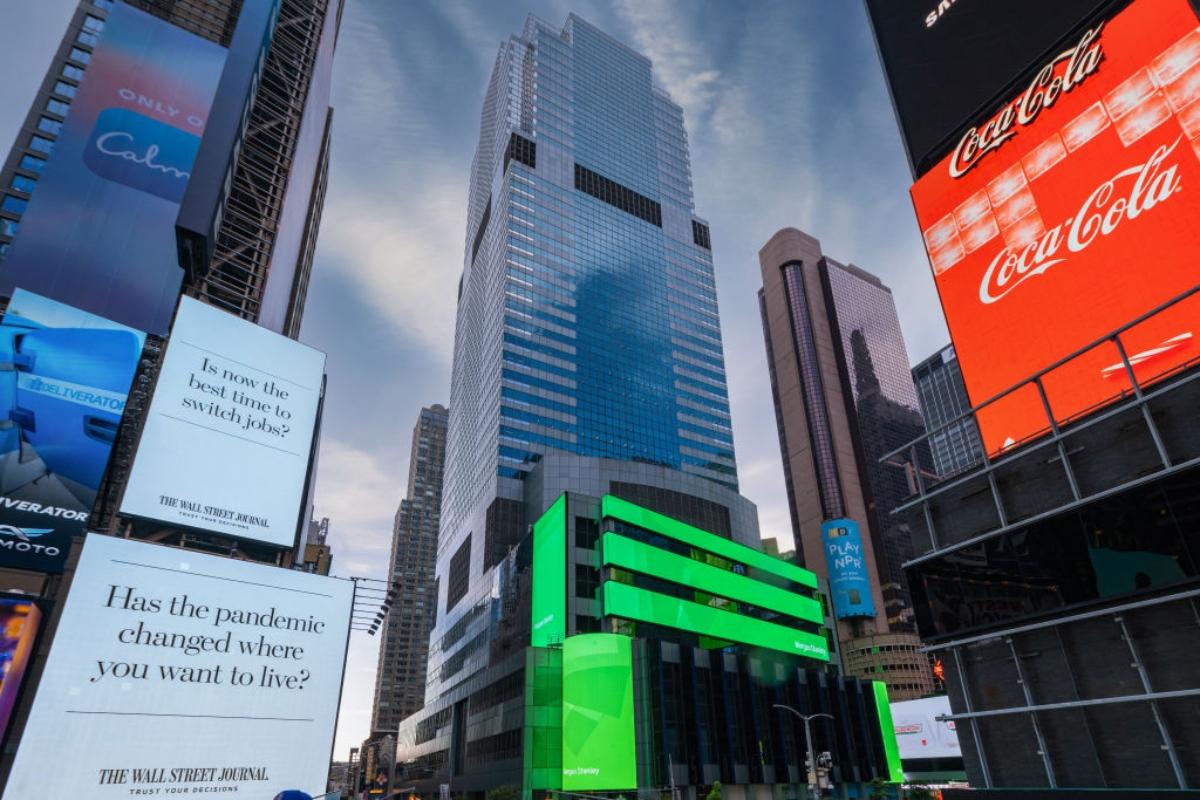

Morgan Stanley's headquarters in New York City. Morgan Stanley is one of Rivian's IPO underwriters.

Additional book-running managers for the Rivian IPO, according to BusinessWire, are Barclays, Deutsche Bank Securities, Allen & Company LLC, BofA Securities, Mizuho Securities, and Wells Fargo Securities.

Rivian will begin trading on the Nasdaq under the stock symbol "RIVN". Although the EV company is still in its early stages and hasn’t delivered a significant number of cars and trucks yet, its IPO valuation of $66.5 billion approaches that of auto giants Ford and General Motors.

Before deducting any discounts and commissions to the IPO underwriters, the gross proceeds of the Rivian IPO are expected to reach about $11.9 billion. This figure also doesn't include underwriters exercising their 30-day option to purchase more shares.

Before the IPO, Rivian raised over $10 billion from investors such as Amazon and Ford. In its early IPO filings, the company stated, “We do not expect to be profitable for the foreseeable future as we invest in our business, build capacity and ramp up operations.”

RJ Scaringe is Rivian's founder and CEO.

What challenges lie ahead for Rivian after its IPO?

Among the challenges Rivian will face, the issue of scaling up auto production to meet customer demand will be a priority. Like Tesla, the company has struggled to meet its delivery deadlines and production goals thus far.

The New York Times reports that by the end of Oct. 2021, Rivian had delivered just 156 of its R1T pickup trucks. Deliveries of the R1S, the company’s SUV, are set to begin in Dec. 2021. Recent financial filings noted that the 55,400 orders for the truck and SUV would likely not be fulfilled until the end of 2023.

Rivian’s third vehicle to be manufactured is a delivery van developed in cooperation with Amazon. The e-commerce company has also ordered 100,000 of these delivery vehicles for its own fleet. Amazon was recently revealed as having a 20 percent stake in the company.

The EV startup’s ability to scale up production enough to meet its delivery promises was one of the issues raised by former Rivian executive Laura Schwab, who has sued the company in a gender-discrimination lawsuit. Rivian claims its Normal, Ill. facility has the capacity to produce 150,000 vehicles annually, according to CNBC.