What You Should Know About Morgan Stanley's "High Conviction" Stocks

Morgan Stanley analysts have done a study and named their high conviction global stocks. The list leans heavily toward banking and metals.

April 23 2021, Published 11:30 a.m. ET

International stocks can be a great way for investors to get more exposure to the global economic recovery from the pandemic shocks. You can start by looking at the latest Morgan Stanley "high conviction" global stocks list.

When the bank adds a stock to its high conviction list, investors better pay attention. The label is reserved for stocks that the bank’s analysts have researched well and believe have potential to deliver outstanding returns for investors.

Morgan Stanley "high conviction" stock list

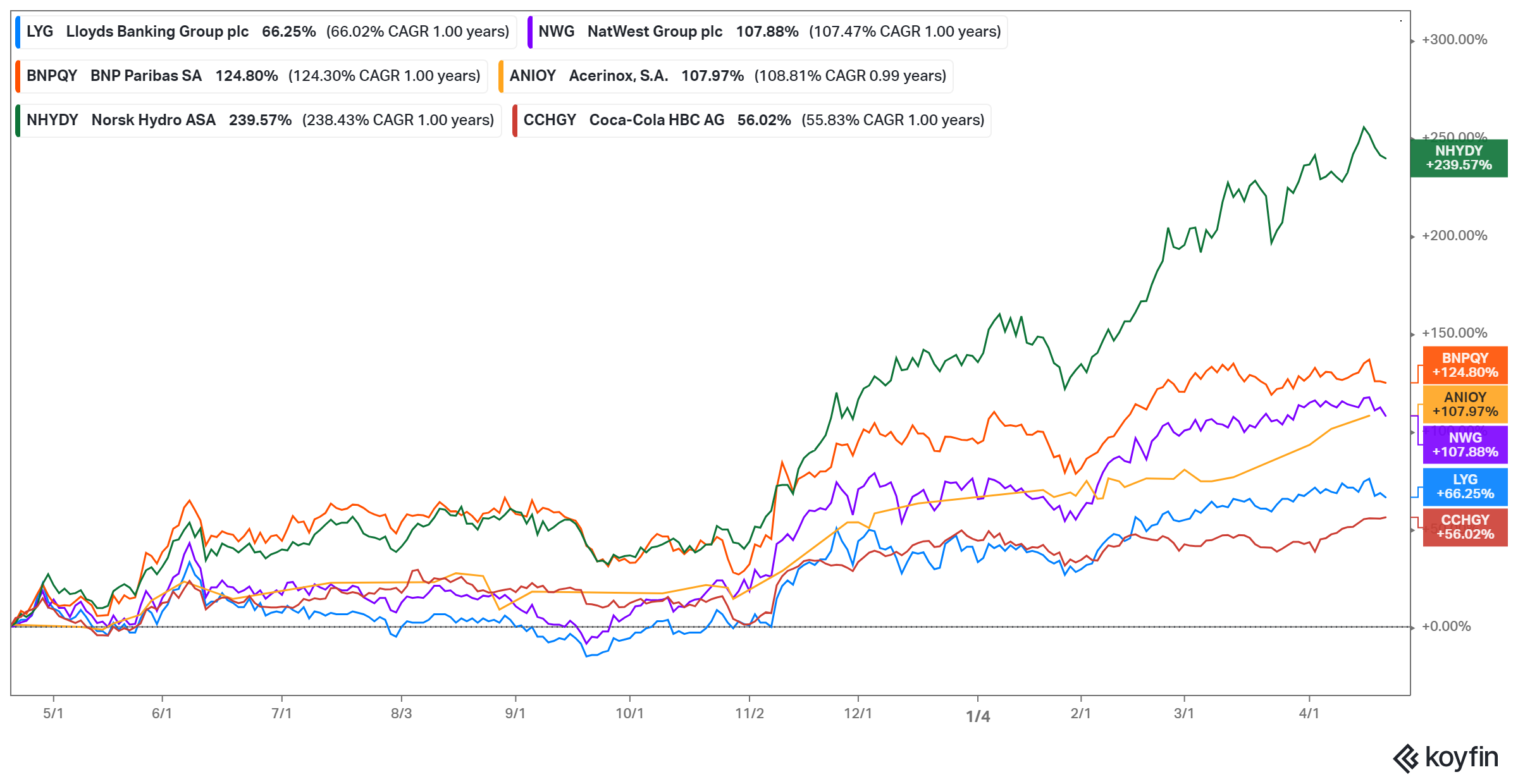

Morgan Stanley’s latest international "high conviction" stock list features companies in Europe. The list draws mostly from banking and metals industries. Here’s the bank’s best European stock picks:

- Lloyds (LYG)

- Natwest (NWG)

- BNP Paribas (BNPQY)

- Norsk Hydro (NHYDY)

- Acerinox (ANIOY)

- Coca-Cola Hellenic (CCHGY)

What you need to know about the latest Morgan Stanley "high conviction" international stocks:

Lloyds is a bank group that controls more than 20 percent of the British mortgage market. It reports first quarter earnings on April 28 and Morgan Stanley analysts expect it to deliver strong results. The analysts expect Lloyds to continue doing well because of high mortgage demand. LYG stock has gained 66 percent in the past year.

Natwest is another bank with a big presence in the British mortgage lending market. Morgan Stanley is excited about it because of the booming mortgage market in the country as well as its plans to grow its market share. Natwest reports earnings on April 29. The stock has gained 108 percent in the past year.

BNP Paribas, based in France, has a resilient business model and should outperform Eurozone banks, according to Morgan Stanley analysts. BNP Paribas reports earnings on April 30. The stock has 125 percent in the past year.

Norsk Hydro is a Norwegian metals company. It reports earnings on April 27 and Morgan Stanley expects it to provide upbeat second quarter outlook. The bank also like the company’s efforts to reduce its carbon footprint. NHYDY stock has climbed 240 percent in the past year.

Spain-based Acerinox produces steel. Morgan Stanley likes it for its improving margins, strong pricing power, and high demand for stainless steel. The analysts further cite the steel company’s superior dividend yield. It reports earnings on May 11. ANIOY stock has risen 108 percent in the past year.

Coca-Cola Hellenic is one of the largest international bottlers of the world's most famous soda. Its 2020 results were strong. It should continue to deliver impressive results as it expands in markets like Russia and Nigeria. It reports earnings on May 12. CCHGY stock has gained 56 percent in the past year.

What are the best international stocks from Asia to invest in now?

Morgan Stanley has covered Europe for its best international stock picks. But you can also find good stocks in Asia. Some of the stocks from China, Japan, and South Korea you might want to buy now are:

- Alibaba (BABA)

- Tencent (TCEHY)

- Nio (NIO)

- Baidu (BIDU)

- SoftBank (SFTBY)

- Nintendo (NTDOY)

- Coupang (CPNG)

- LG Chem (LGCLF)

- SK Hynix (HXSCL)

Which stocks to buy before earnings?

Looking across the board, semiconductor, electric vehicle, fintech, and crypto are some of the industries you can find good stocks to buy before and after earnings. The world is facing a semiconductor chip supply problem that is holding back many industries. For example, many automakers have stopped production for a lack of chips.

Some of the best stocks to play the global chip shortage are:

- Intel (INTC) Micron (MU)

- Applied Materials (AMAT)

- Qualcomm (QCOM)

- NXP Semiconductor (NXPI)

- Lam Research (LRCX)

The world is counting on electric vehicles to combat climate change by reducing carbon emissions in the transport sector. The Biden administration is strongly behind EVs. From Europe to China, other global governments are supporting of the industry.

Some of the best EV stocks to buy now are:

- Tesla (TSLA)

- General Motors (GM)

- Ford Motor (F)

- Quantumscape (QS)

- Lucid Motors (CCIV)

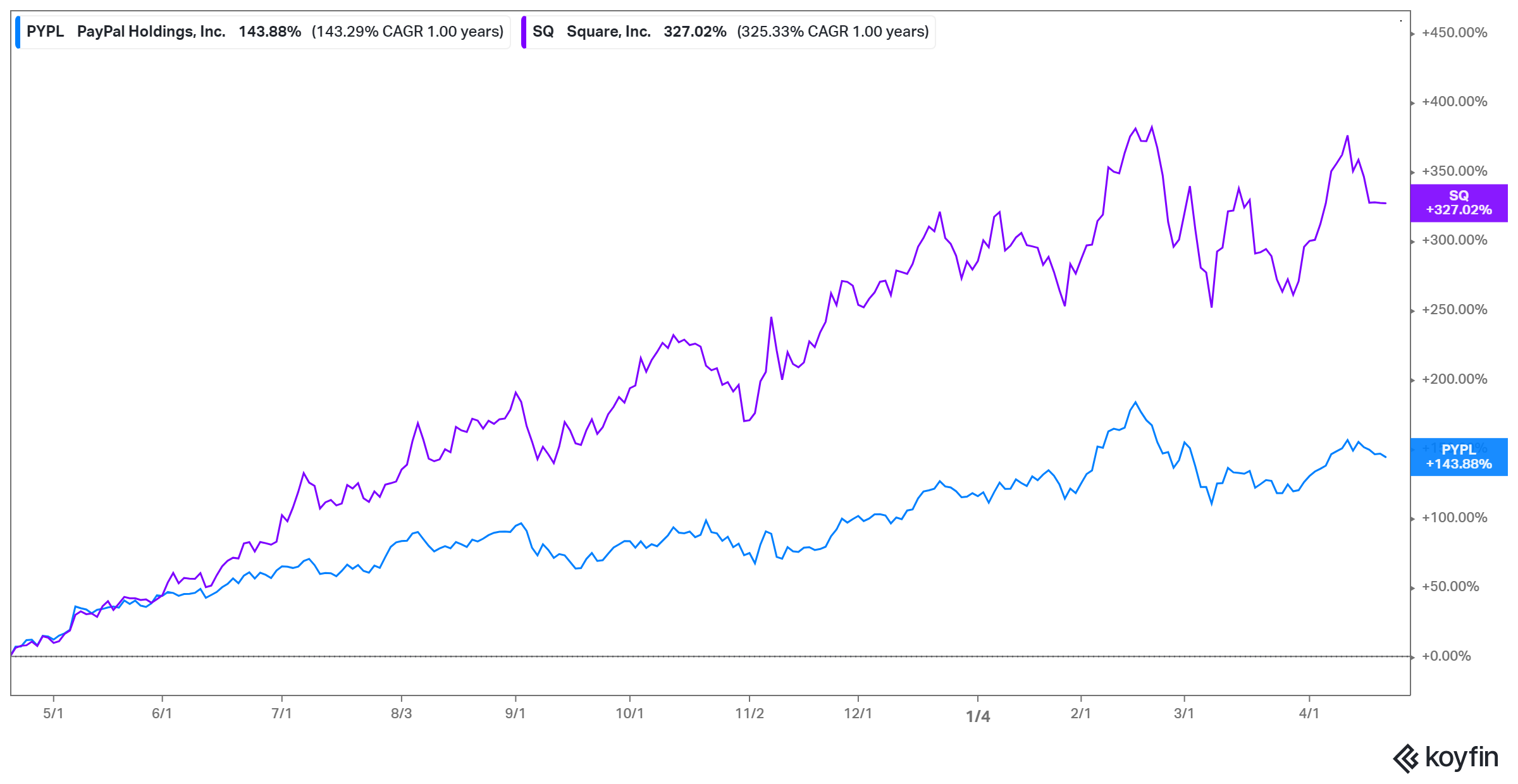

The rise of ecommerce and online investing are driving uptake of fintech services. Some of the best fintech stocks to consider now are:

- PayPal (PYPL)

- Square (SQ)

- Paysafe (PSFE)

Bitcoin has inspired the rise of thousands of cryptocurrencies from more established altcoins like ether to meme-driven coins like dogecoin. Some of the best stocks to invest in for crypto exposure are:

- Coinbase (COIN)

- Riot Blockchain (RIOT)

- Marathon Digital (MARA)

- Bit Digital (BTBT)

Finally, Morgan Stanley’s "high conviction" stock list indicates that there are many areas and industries where investors can find good opportunities outside the U.S. market.