If Data Is the New Oil, Palantir Might Be the Next Aramco

Palantir stock has come off its highs, but it's getting popular on Reddit groups. The stock's forecast looks positive amid a possible short squeeze.

Aug. 19 2021, Published 11:50 a.m. ET

Palantir is among the most discussed stocks on Reddit group WallStreetBets. Traders on the group successfully triggered a short squeeze in several stocks. However, over the last few months, they haven’t been as successful as they were in the first quarter. What’s the forecast for PLTR stock and can Reddit traders take it to the moon next?

Palantir went public in 2020 through a direct listing. The stock has featured among the top discussions on WallStreetBets previously before making it to the top of the charts this week.

Palantir stock forecast

According to the data from TipRanks, Palantir has an average target price of $23.8, which is a discount of almost 6 percent over the current prices. Analysts don’t have a bullish forecast for PLTR and it has received only one buy rating from the six analysts covering the stock. Two analysts have a hold rating, while three analysts rate it as a sell or some equivalent.

But then, some of the names picked by WallStreetBets were at odds with Wall Street analysts. GameStop (GME) and AMC Entertainment (AMC) are two stocks where Reddit traders saw value while markets saw them as struggling companies.

While Wall Street was too bearish on these stocks, Reddit traders were too optimistic. After the initial spike, both AMC and GME have tumbled even though they still trade above what they should, based on fundamentals.

PLTR stock forecast on Reddit

The forecasts on Reddit groups can be sometimes over the top. There have been instances where traders have talked about a target price of $1,000 for AMC. Coming back to Palantir, WallStreetBets traders are talking about the company’s recently released earnings. While some see the 49 percent revenue growth in the second quarter as impressive, others don’t seem to agree.

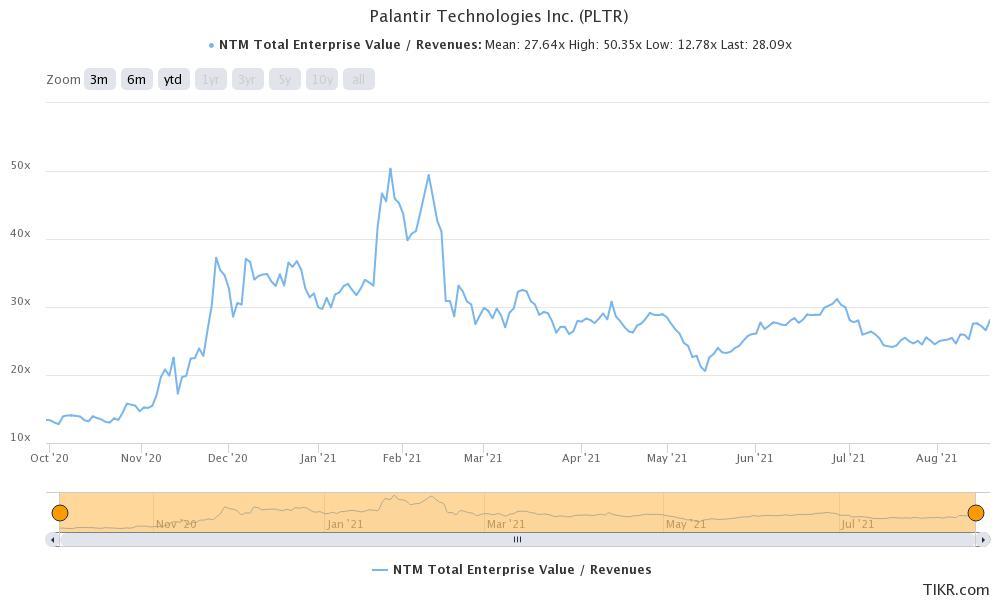

PLTR stock valuation

A member named SoyFuturesTrader termed the revenue growth as “low.” The member talked about the company’s high valuations and said that the revenue growth should be between 100 percent and 200 percent to justify the valuations.

Palantir stock valuation

PLTR stock trades at an NTM EV-to-sales multiple of 28x. Meanwhile, the NTM EV-to-EBITDA is 99.7x. While the valuation multiples might appear high, markets are giving a premium to the stock for the long-term growth potential.

A WallStreetBets member with username namjd72 termed Palantir as a long-term play. Indeed, the stock is a long-term play. Apart from the core analytics business, the company has also been investing the money that it has on its balance sheet. Palantir has invested in PIPE in several SPACs. Recently, it also bought gold bars worth $50 million.

Should you buy Palantir stock?

Palantir stock looks like a good long-term bet. The company has been forging several partnerships, which will help build a long-term revenue stream. The company is also growing its business with governments despite some raising concerns about government partnerships.

Even during the listing time, PLTR was straightforward and said that investors who don’t like the business model were free to not invest in the company.

There's a general consensus that data is the new oil. Given the company's competitive strength in data mining and analytics, PLTR could be the Aramco of the data mining industry in the future. Cathie Wood of ARK Invest, who has built her reputation by identifying disruptors, has also been buying PLTR stock.

Palantir stock short interest

According to the data from Fintel, Palantir had a FINRA short volume ratio of 41.4 percent on Aug.18. The short interest looks high enough to trigger a squeeze. However, the stock would need some positive news flow to trigger a buying spree. With the earnings behind us, the news of a major contract could be the catalyst that could trigger a short squeeze in PLTR stock.