ON Semiconductor Is a Good Value Stock to Buy and Bet on Turnaround

ON Semiconductor (ON) looks like a good value stock to buy and bet on the global chip shortage as well as the company's turnaround efforts.

May 10 2021, Published 8:32 a.m. ET

ON Semiconductor (ON) stock is up 150 percent over the last year. While semiconductor stocks have looked strong amid the global chip shortage, markets have rerated ON stock after a management reshuffle and the company’s turnaround plans. Even after the sharp rise over the last year, ON still looks like a good value stock to buy now.

There has been a worsening global chip shortage. While many industries have been impacted by the shortage, the global automotive industry has been impacted the most. Leading automakers have had to shut plants. Ford has been hit particularly hard and America’s second-largest automotive company expects to lose half of its second-quarter of 2021 production due to the chip shortage.

ON stock is a play on the automotive industry and electric vehicles.

It's important to understand the automotive industry’s woes before discussing the outlook for ON stock. ON Semiconductor recorded revenues of $515 million from the automotive end market in the first quarter of 2021. It was a record for the company and accounted for 35 percent of its revenues in the quarter.

ON Semiconductor secured design wins from global EV (electric vehicle) OEMs in the first quarter of 2021. The contracts would drive ON Semiconductor's growth in the coming years. While EV stocks trade at exorbitant valuations, some of the parts suppliers including ON Semiconductor trades at attractive valuations.

Is ON Semiconductor a good value stock to buy?

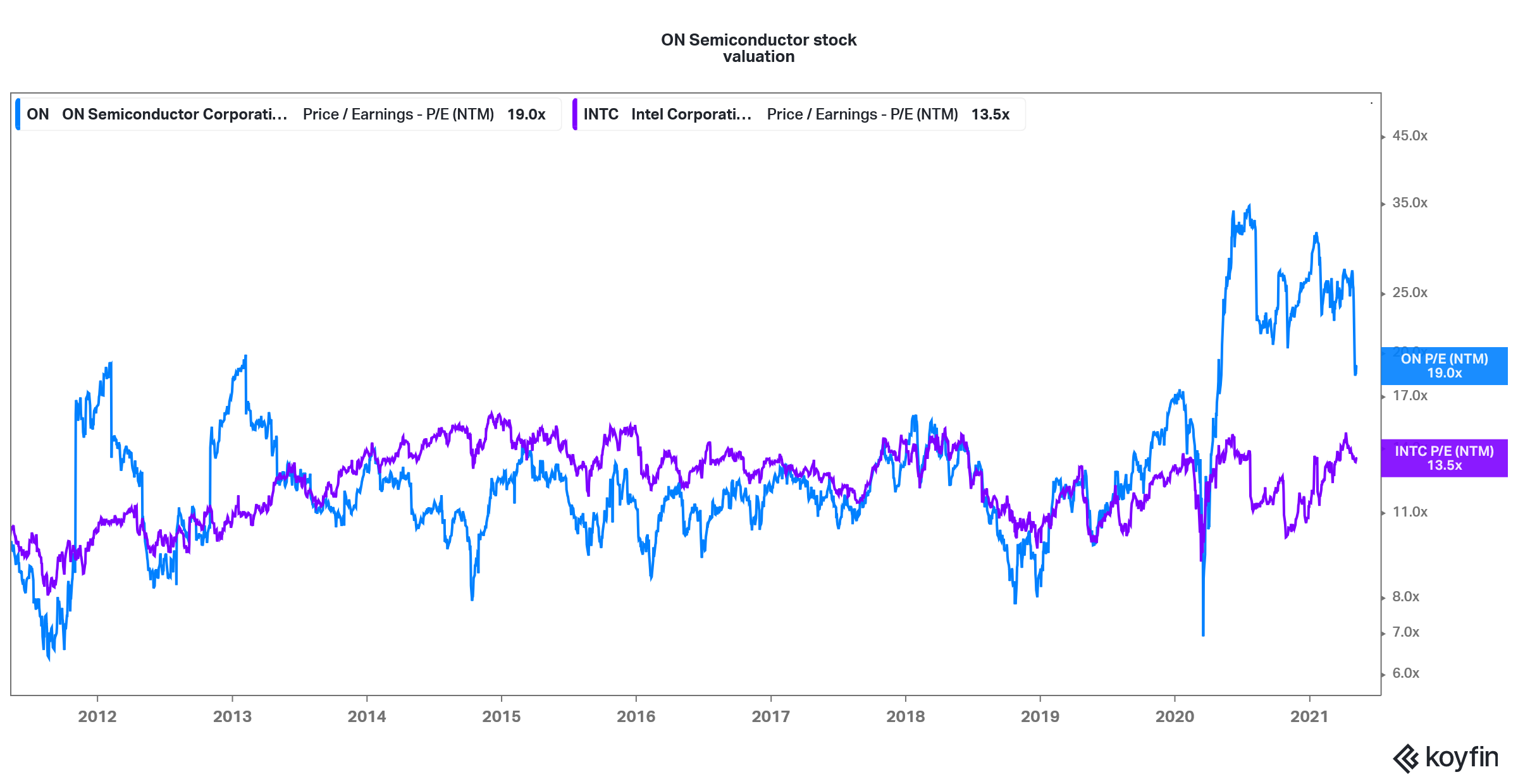

ON Semiconductor trades at an NTM (next-12 month) PE multiple of 18.0x, which is higher than what it has traded historically. Also, we see a divergence in its comparative valuation with Intel. While ON has seen an expansion of trading multiples, it still looks like a good value stock to buy considering its PEG ratio, which stands at 0.7x.

ON Semiconductor versus Intel PE multiple

ON Semiconductor is a turnaround play.

ON Semiconductor has seen a valuation multiple rerating amid its turnaround efforts. The company has new management with industry veteran Hassane El-Khoury as the CEO. Thad Trent was also appointed as the new CFO earlier this year. Activist investor Starboard Value announced a stake in ON stock in 2020 and is bullish on the turnaround story.

ON Semiconductor is working to revamp its portfolio and focus on high-margin businesses. It has managed to expand its gross margins, which were lower than many of its peers. The margins are expected to rise more as the company pushes through with the turnaround plan.

ON Semiconductor's target price

Wall Street is taking note of ON Semiconductor's turnaround plans. In March, BofA analyst Vivek Arya double upgraded the stock from underperform to buy and increased his target price to $48.

Last week, Baird analyst Tristan Gerra also upgraded ON stock to outperform and increased the target price to $48. Gerra is bullish on the stock due to the current chip supercycle and the company’s turnaround plans.

According to the estimates compiled by CNN Business, ON’s median target price of $45 is a premium of more than 16 percent over the current prices. The stock’s highest target price is $55, which is a premium of 42 percent.

Chip shortage

To sum it up, ON Semiconductor looks like a good way to play the chip shortage situation. Also, the company’s turnaround plans make it an attractive play. The stock also gives a proxy exposure to the electric vehicle market.