Why the Party Might Be Over for NIO, TSLA, and Other EV Stocks

EV stocks have fallen in 2021 after the rally in 2020. Should you buy or sell NIO and TSLA stock now amid the crash in EV stocks?

Feb. 26 2021, Published 9:27 a.m. ET

EV (electric vehicle) stocks were strong in 2020. Tesla (TSLA) stock gained 740 percent, while NIO rose over 1,100 percent. Even though 2021 started on a positive note for EV stocks, they have come under pressure over the last month. TSLA and NIO are down 24 percent and 30 percent, respectively, from their 52-week highs. Should you buy or sell NIO stock now amid the crash in EV stocks?

The recent fall in EV stocks could be among the factors behind the plunge in Churchill Capital IV (CCIV) SPAC after it announced a merger with Lucid Motors. The company benchmarked itself against Tesla several times in its presentation, including on the valuation.

Why EV stocks are falling

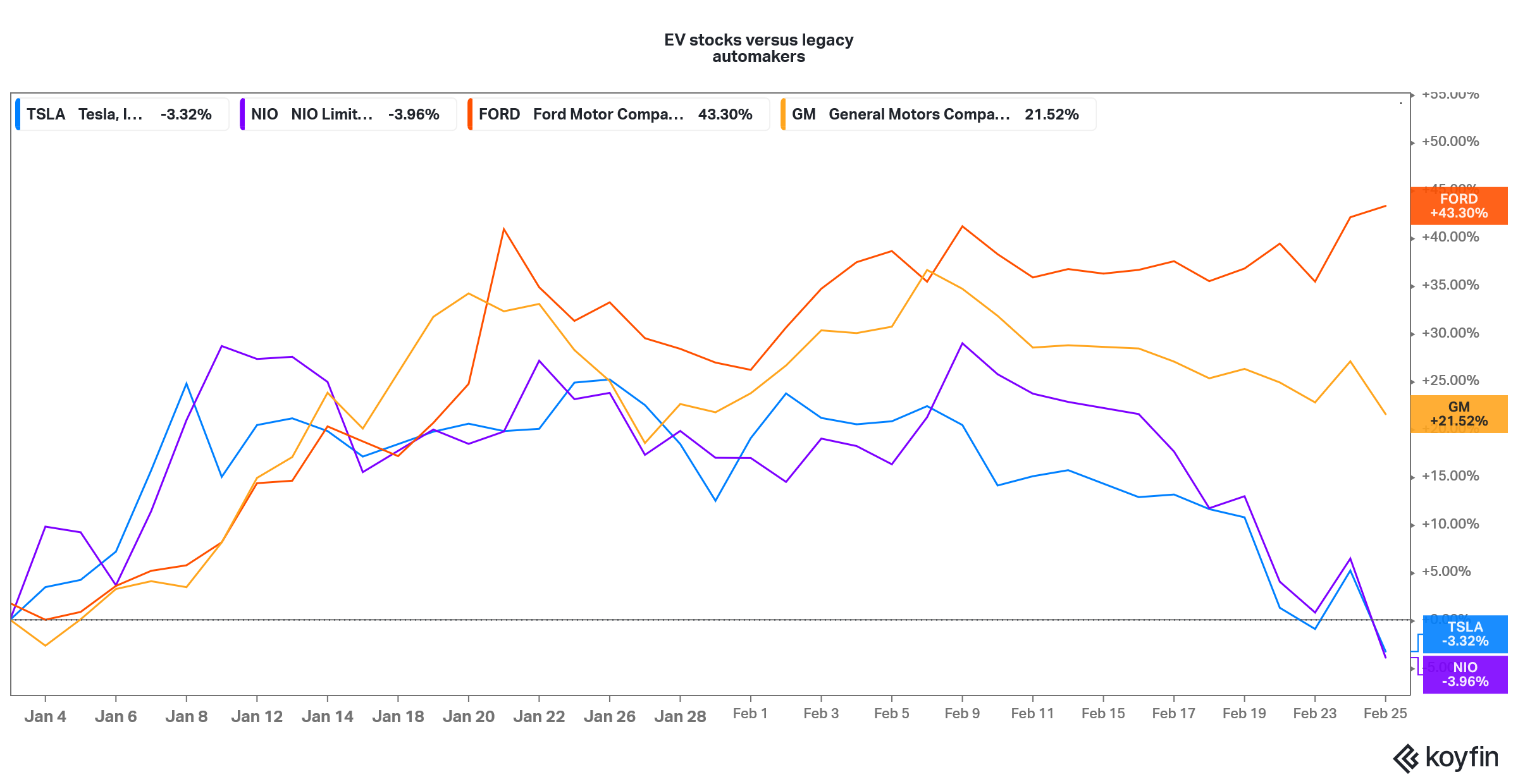

EV stocks rallied sharply in 2020 and were the darling of the markets. Newly listed EV companies were commanding a higher valuation than established automakers like Ford and General Motors. Over the last few months, legacy automakers have also stepped up their EV plans.

Ford and GM have outperformed NIO and TSLA in 2021

General Motors intends to sell only zero-emission vehicles by 2035, while Ford has more than doubled its investment in EV and autonomous driving. The company plans to launch a flurry of all-electric and hybrid models. One of the reasons pure-play EV stocks are falling, while companies like Ford and General Motors have risen, is markets' acknowledgment of their EV plans.

There's bound to be tough competition in the EV space as legacy automakers take on pure-play EV companies, which would lead to pricing pressure. EV companies' profitability has been dismal. Even TSLA’s net profit margins over the last year have been in the vicinity of 1 percent. The profit would turn into a GAAP loss if we exclude the carbon credits.

NIO, TSLA, and other EV stocks were in a bubble

The valuation premium that EV stocks like TSLA and NIO commanded smelled of a bubble. Tesla CEO Elon Musk tried to justify the valuation by pointing to the company’s mobility business that isn't generating much revenue right now.

Based on the core automotive operations alone, you can't justify TSLA’s market capitalization being higher than the combined market capitalization of Toyota Motors, Ford, General Motors, and Volkswagen.

NIO's market capitalization was almost $100 billion at the peak, which was higher than General Motors. NIO turned positive on the gross profit level in 2020 and is delivering fewer than 10,000 cars per month. While the deliveries are growing rapidly, it still isn't possible to justify the valuations considering the increasing competition in the EV industry and tepid valuations of companies like Ford.

NIO and TSLA stocks might still look overvalued

There's little denying that the future of the automotive industry is zero-emission, which would mean both battery-electric cars and cars that run on fuel cell technology. However, even after the recent crash, TSLA and NIO might look overvalued.

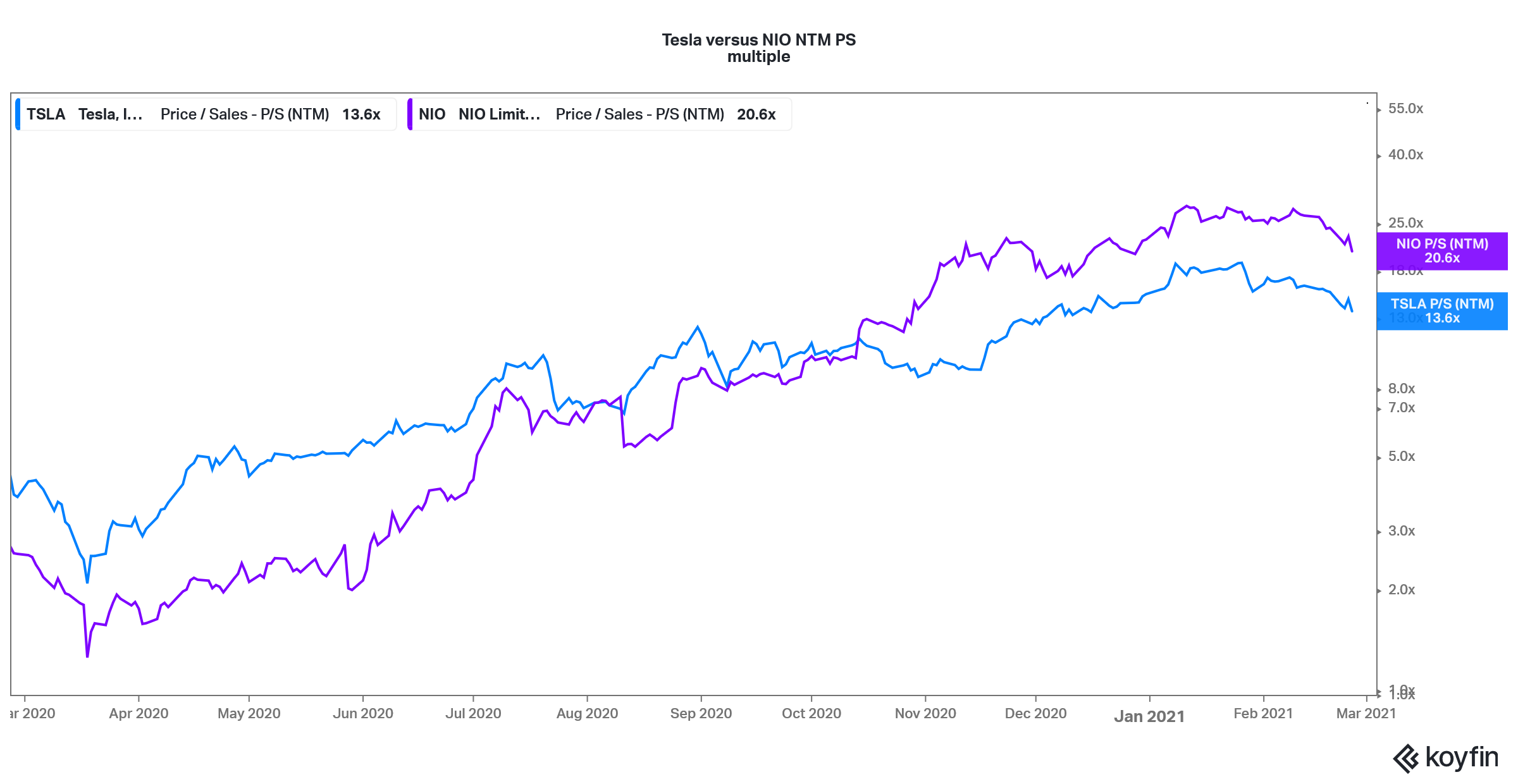

Currently, TSLA stock trades at an NTM price-to-sales multiple of 13.6x. The multiple peaked near 20x in January and has come down. NIO's NTM price-to-sales multiple is 20.6x—down from over 28x in January. Now, while it wouldn't be prudent to only look at NTM numbers considering the sharp growth that both NIO and TSLA are reporting, it gives us some insights into how the markets are valuing them.

Tesla versus NIO valuation based on NTM price-to-sales

To put that in perspective, Ford and General Motors trade an NTM EV-to-sales of less than 1.5x. These companies are also scaling up their EV plans. They aren't exactly dinosaurs waiting for extinction even though the market euphoria towards EV stocks might reflect so.

Bubble might be bursting in NIO stock

Many people have pointed to a bubble in EV stocks including TSLA and NIO. Both of these companies made the most of the surge in their stock price and issued stocks three times in 2020. Visibly short of investment opportunities with its massive cash pile, TSLA poured $1.5 billion into bitcoins. However, that isn't exactly what the company raised money for.

TSLA and NIO stock are trading lower in pre-market trading on Feb. 26. There definitely would be a section of the market that would find immense value in these stocks after the crash. However, for some others, it would signal that the bubble has finally started to burst for EV stocks. I would subscribe to the latter view and expect more downside in TSLA and NIO stock.