Is There More Upside Left in CLF and U.S. Steel (X) Stock?

Steel stocks have bounced back and Cleveland-Cliffs (CLF) and U.S. Steel (X) look strong this week. Is there more upside left in the stocks?

July 29 2021, Published 9:43 a.m. ET

Steel stocks have bounced back from their lows and Cleveland-Cliffs (CLF) and U.S. Steel Corporation (X) look strong this week. Is there more upside left in these stocks as they approach their 52-week highs?

CLF and X are both integrated companies with steel and iron ore operations. Both of the companies are benefiting from the uptrend in U.S. steel markets and are posting record earnings. While CLF has already released its earnings, X will release its earnings on July 29 and hold the conference call the next day.

X stock forecast

According to the data from CNN Business, X has a median target price of $32.50, which is a premium of 32 percent over the current prices. Meanwhile, seven out of 13 analysts rate it as a hold, four rate it as a buy, and two rate it as a sell.

U.S. Steel's second-quarter earnings

The analysts polled by TIKR expect U.S. Steel to report revenues of $4.56 billion in the second quarter—an YoY increase of 118 percent. The company’s adjusted EBITDA is expected to rise 560 percent over the period to $1.2 billion. The company’s EBITDA is expected to rise more in the second half of 2021 amid higher steel prices.

Markets are underappreciating the strength of U.S. steel markets. While there are fears of a slowdown, the undercurrent is strong even as we head into the seasonally weak second half of the year. X and CLF would use the current supercycle for deleveraging. CLF expects zero net debt by 2022. X might also provide the path for deleveraging in its earnings release.

Is X stock undervalued?

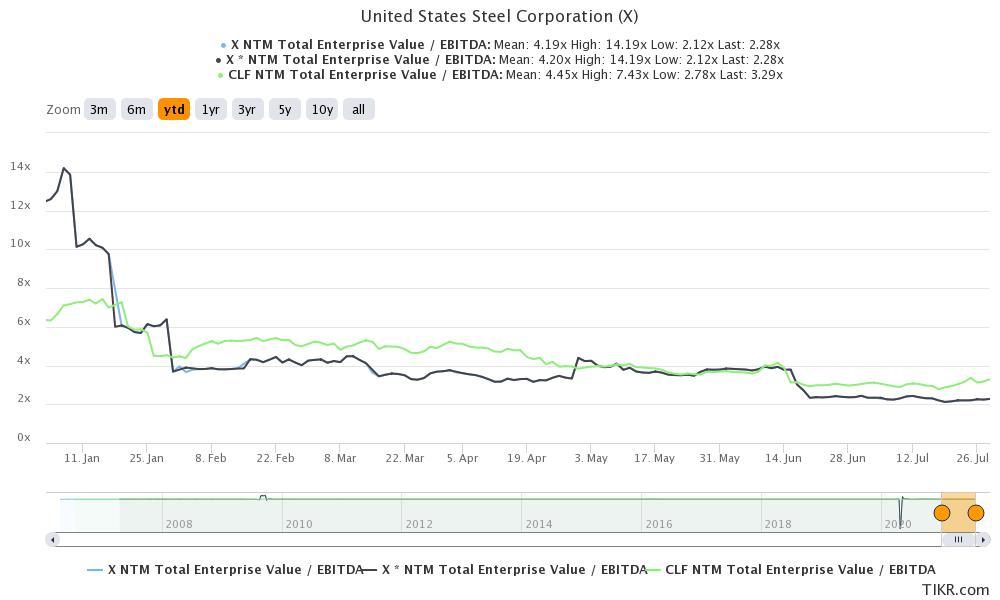

X stock trades at an NTM EV-to-EBITDA multiple of 2.3x, which looks undervalued. Technically, the stock appears to be in an uptrend and has crossed above the 100-day SMA (simple moving average). It's only slightly below the 50-day SMA and a move above the trendline will strengthen the uptrend.

CLF stock forecast

Wall Street analysts seem more bullish on CLF stock compared to X stock. CLF has six buy and four hold ratings. Its median target price of $28 implies an 18.8 percent upside over the next 12 months.

Looking at the valuations, CLF trades at an NTM EV-to-EBITDA multiple of 3.3x, which is higher than X. Looking at the technical indicators, CLF stock has crossed above the 50-day and 100-day SMA, which indicates a technical uptrend.

The outlook for U.S. steel stocks looks positive

The outlook for U.S. steel stocks, including X and CLF, looks positive considering the commodity supercycle. If President Biden’s infrastructure plans take shape, it will boost the demand for metals including steel. Also, most of the steel-consuming end industries including housing and automotive are in an uptrend, which boosts the demand for U.S. steel mills.

Is there more upside in U.S. steel stocks?

There appears to be more upside on the table for U.S. steel stocks despite the massive rise this year. Higher steel prices look here to stay, which is expected to propel steel companies' earnings in the medium term.