Materials Sector Stocks Weigh Market Down, Might Be Time to Buy

The materials sector has been among the worst hit in the market. Is now the time to invest for long-term growth?

Aug. 18 2021, Published 2:03 p.m. ET

Maybe you've heard that stocks in the red are just on sale. This isn't always true (stocks don't always bounce back), but it's often a wise baseline for investing. After all, that's why buying the dip is such a popular strategy. Natural volatility in the market means that buying low can help compound eventual returns. As the materials sector weighs the market down more than any other industry, is now the time to buy?

Here's some insight into the materials sector as the COVID-19 pandemic, inflation, and other factors play into the economy. Is now the time to buy and—if so—which materials sector stocks should you target?

Materials stocks lead U.S. market decline in the short term

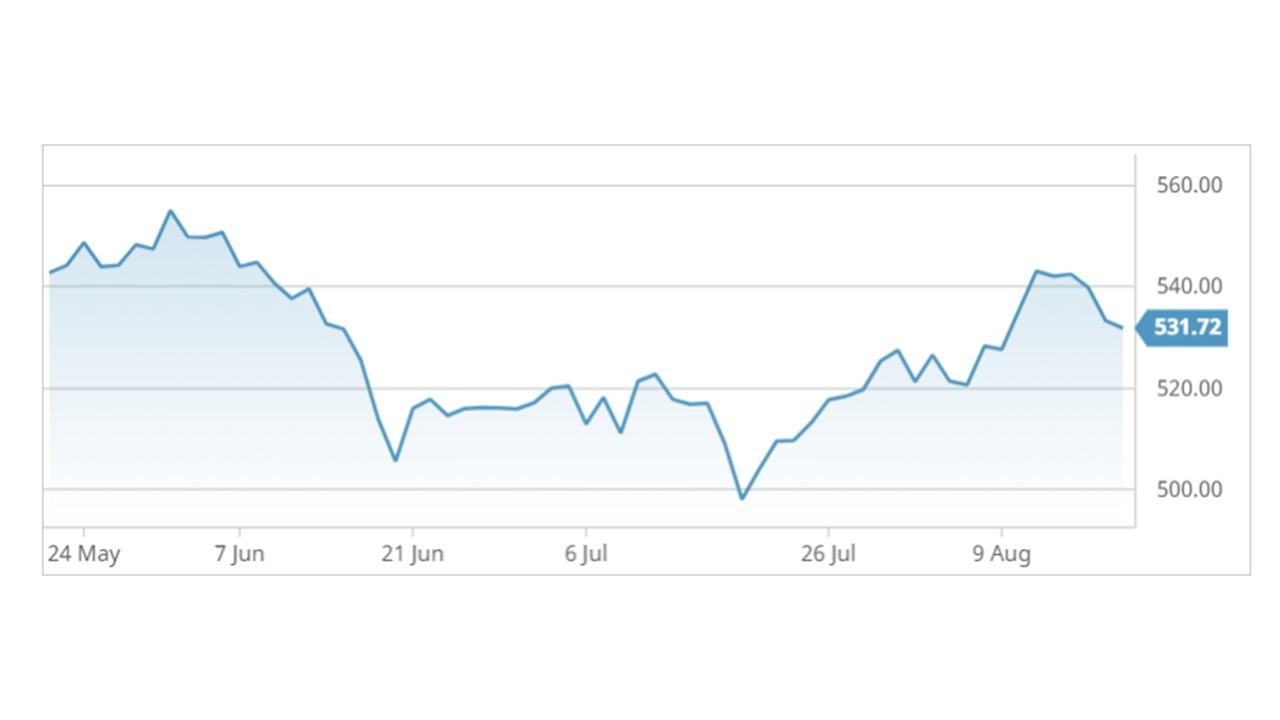

Materials sector stock performance

U.S. stocks across the board are on a downtrend on Aug. 18 with a 0.7 percent drop. Individually, the materials sector is down 1.5 percent for the same period, which is more than twice the overall market rate of decline.

While materials are largely to blame in the short term, the same can't be said from a wider lens. Materials stocks are up 19.8 percent YTD as of market close on Aug. 17.

Is it a smart time to invest in the materials sector?

Determining whether or not to buy the dip in materials means looking at why the sector is struggling. You might also make assumptions about a sector's future behavior based on recent market performance.

The drop in stock value for companies that discover, develop, and process basic materials is based on cyclical demand. The demand for raw materials has been fluctuating with the COVID-19 pandemic, but the sector has grown despite volatility. That's why the stock chart for the materials sector is teeming with ascending triangles YTD.

Supply chain issues (like materials that make semiconductors), targeted inflation (I'm looking at you, lumber), and gaps in the workforce all play a role.

One thing is certain though—materials' demand will return. Based on how tech, housing, and development are looking, that demand will be an upswing.

Materials stocks to consider during the dip

International Paper Company (NYSE:IP) stock is seeing an increased trading volume. The stock has a healthy float with a low short ratio. Also, a 3.45 percent annual dividend yield doesn't hurt. IP is up just 2.53 percent in August but 63.44 percent over the last year, and it's still off its May peak by 8 percent.

The stock for semiconductor materials company Thermo Fisher Scientific Inc. (NYSE:TMO) is poised for future growth as demand heightens. Analysts largely predict a year of returns for the stock, with most suggesting to buy and none suggesting to sell. The dividend ratio is small, but the stock's high value of $551.10 as of Aug. 18 means investors can benefit from the 0.19 percent EPS.

Mosaic Co. (NYSE:MOS) is an agricultural materials company with an affordable share price and a market cap of $11.6 billion. The shares are down in the short term but boast 32.43 percent growth YTD. According to analysts, the average target price for MOS is 25.84 percent higher than its current value.